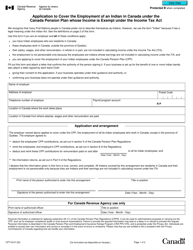

This version of the form is not currently in use and is provided for reference only. Download this version of

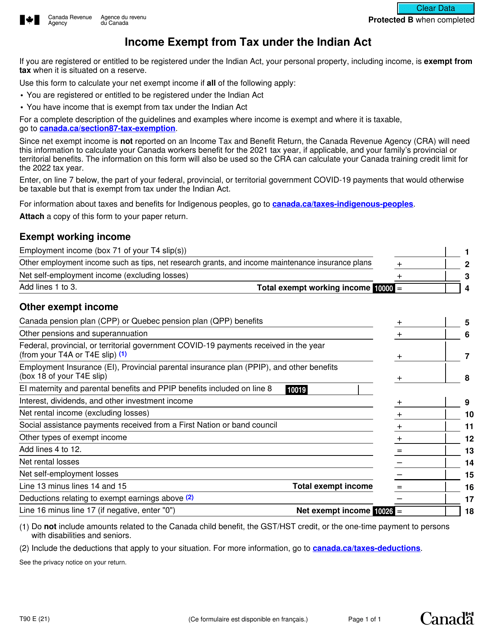

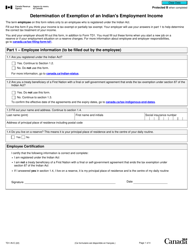

Form T90

for the current year.

Form T90 Income Exempt From Tax Under the Indian Act - Canada

Form T90 is not a recognized form under the Canadian tax system. If you're specifically referring to the Indian Act in Canada, it deals with matters related to the rights and benefits of Indigenous peoples. However, without more context, it is challenging to provide a specific answer regarding Form T90.

FAQ

Q: What is Form T90?

A: Form T90 is a tax form used in Canada.

Q: What does 'Income Exempt From Tax Under the Indian Act' mean?

A: It refers to income earned by individuals who are registered under the Indian Act and are exempt from paying taxes on that income.

Q: Who is eligible to use Form T90?

A: Individuals who are registered under the Indian Act and have income that is exempt from tax can use Form T90.

Q: What is the purpose of Form T90?

A: The purpose of Form T90 is to report income that is exempt from tax under the Indian Act.