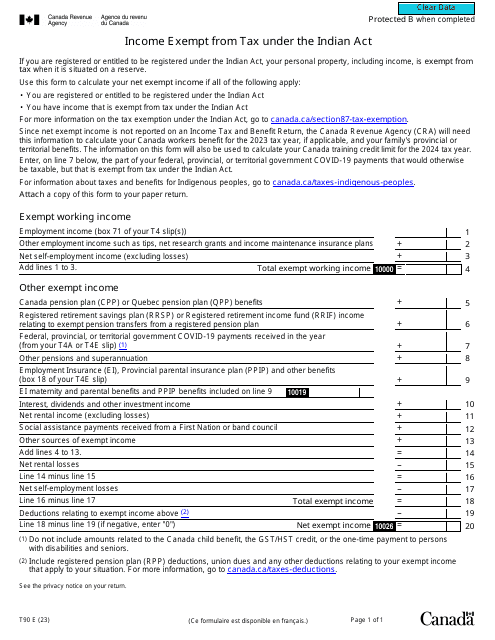

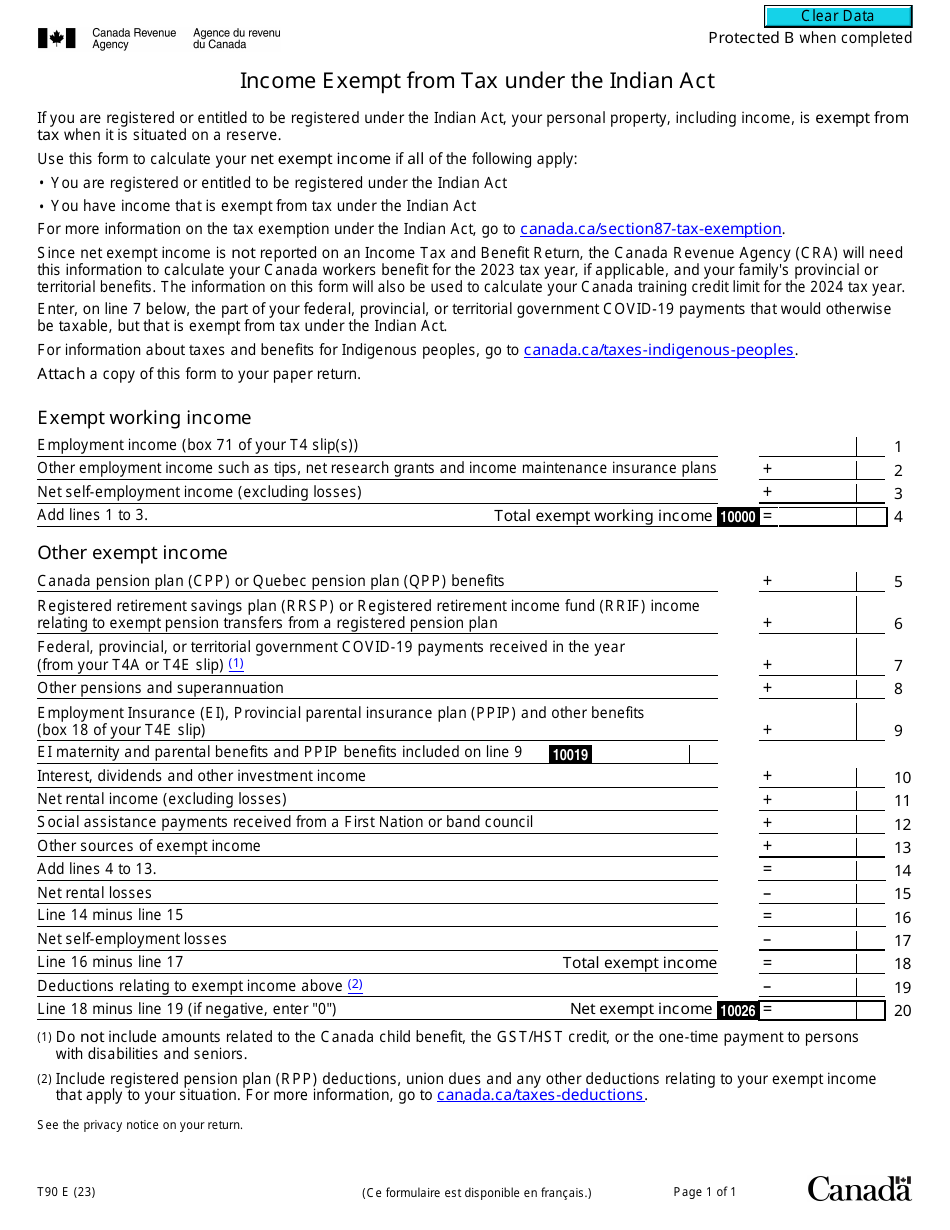

Form T90 Income Exempt From Tax Under the Indian Act - Canada

Form T90 is not directly related to the Indian Act in Canada. The Indian Act is a Canadian federal law that governs various matters concerning Indigenous peoples in Canada. Form T90, on the other hand, pertains to the Indian Income Tax Exemption and is used by First Nations individuals who are claiming an exemption from income tax under specific provisions of the Indian Act. It establishes their eligibility for exempt status and serves as a declaration of their income for taxation purposes.

Form T90 Income Exempt From Tax Under the Indian Act - Canada - Frequently Asked Questions (FAQ)

Q: What is Form T90?

A: Form T90 is a form used in Canada to report income that is exempt from tax under the Indian Act.

Q: What is the Indian Act?

A: The Indian Act is a Canadian law that governs the rights and status of Indigenous peoples in Canada.

Q: What income is exempt from tax under the Indian Act?

A: Income earned by individuals who are registered as Indians under the Indian Act is generally exempt from tax.

Q: Who needs to file Form T90?

A: Individuals who are registered as Indians under the Indian Act and have income that is exempt from tax need to file Form T90.

Q: Is all income earned by registered Indians exempt from tax?

A: Not all income earned by registered Indians is exempt from tax. Only income that is specifically exempt under the Indian Act qualifies for the exemption.

Q: Are there any documentation requirements for claiming the exemption?

A: Yes, individuals claiming the income exemption under the Indian Act need to provide documentation to support their claim, such as a certificate of Indian status.