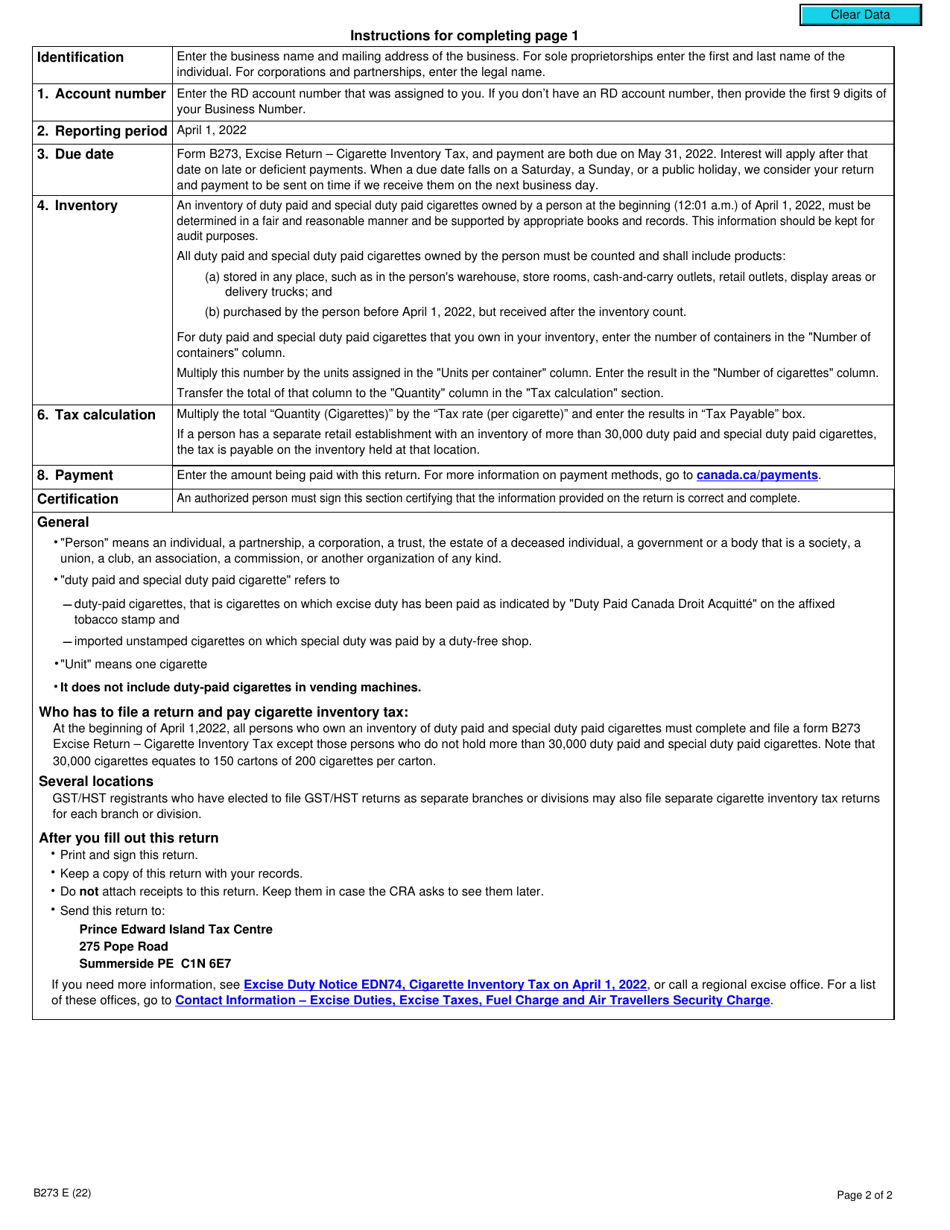

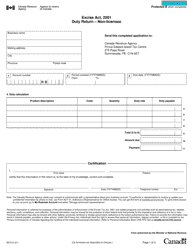

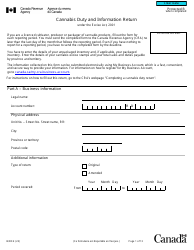

This version of the form is not currently in use and is provided for reference only. Download this version of

Form B273

for the current year.

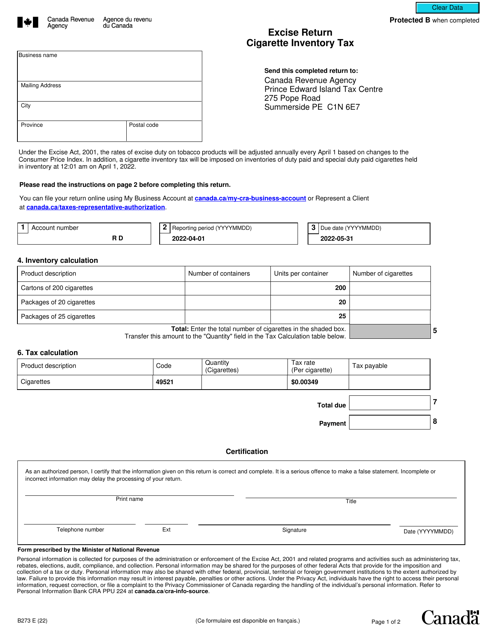

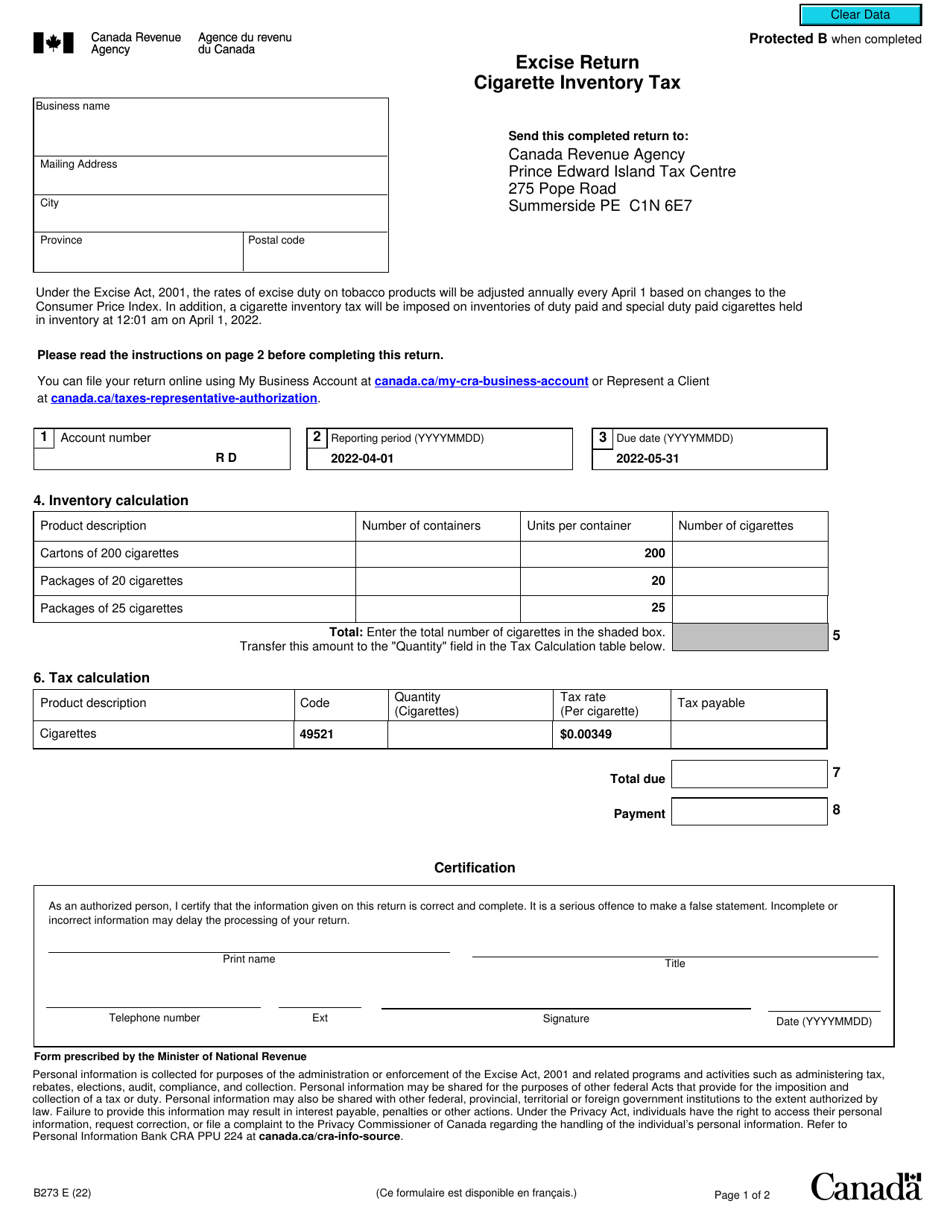

Form B273 Excise Return - Cigarette Inventory Tax - Canada

Form B273 Excise Return - Cigarette Inventory Tax is used in Canada to report and pay taxes on the inventory of cigarettes held by manufacturers and importers. It ensures compliance with the applicable tax laws.

FAQ

Q: What is Form B273?

A: Form B273 is an Excise Return form used for reporting and calculating the Cigarette Inventory Tax in Canada.

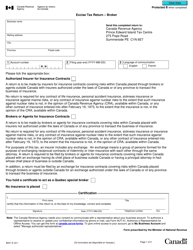

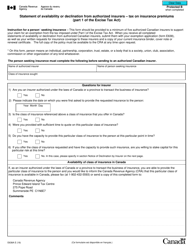

Q: Who needs to file Form B273?

A: Any person or business engaged in the sale or distribution of cigarettes in Canada is required to file Form B273.

Q: What is the Cigarette Inventory Tax?

A: The Cigarette Inventory Tax is a tax imposed on the inventory of cigarettes held by wholesalers, importers, and manufacturers in Canada.

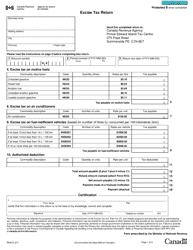

Q: How often is Form B273 filed?

A: Form B273 is typically filed on a monthly basis by the 15th day of the following month.

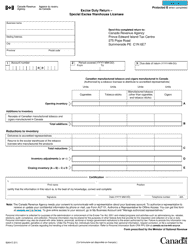

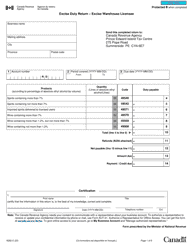

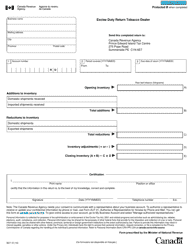

Q: What information is required on Form B273?

A: Form B273 requires information such as the beginning and ending inventory quantities, purchases, and sales of cigarettes.

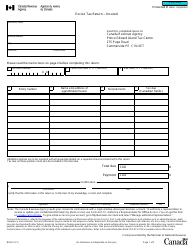

Q: How is the Cigarette Inventory Tax calculated?

A: The Cigarette Inventory Tax is calculated based on the inventory of cigarettes held at the beginning and end of the reporting period, as well as the purchases and sales during that period.

Q: Are there any penalties for not filing Form B273?

A: Yes, there can be penalties for failing to file Form B273 or not filing it on time. It is important to comply with the filing requirements to avoid penalties and potential legal consequences.