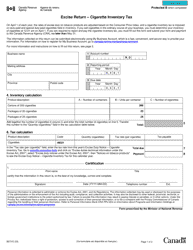

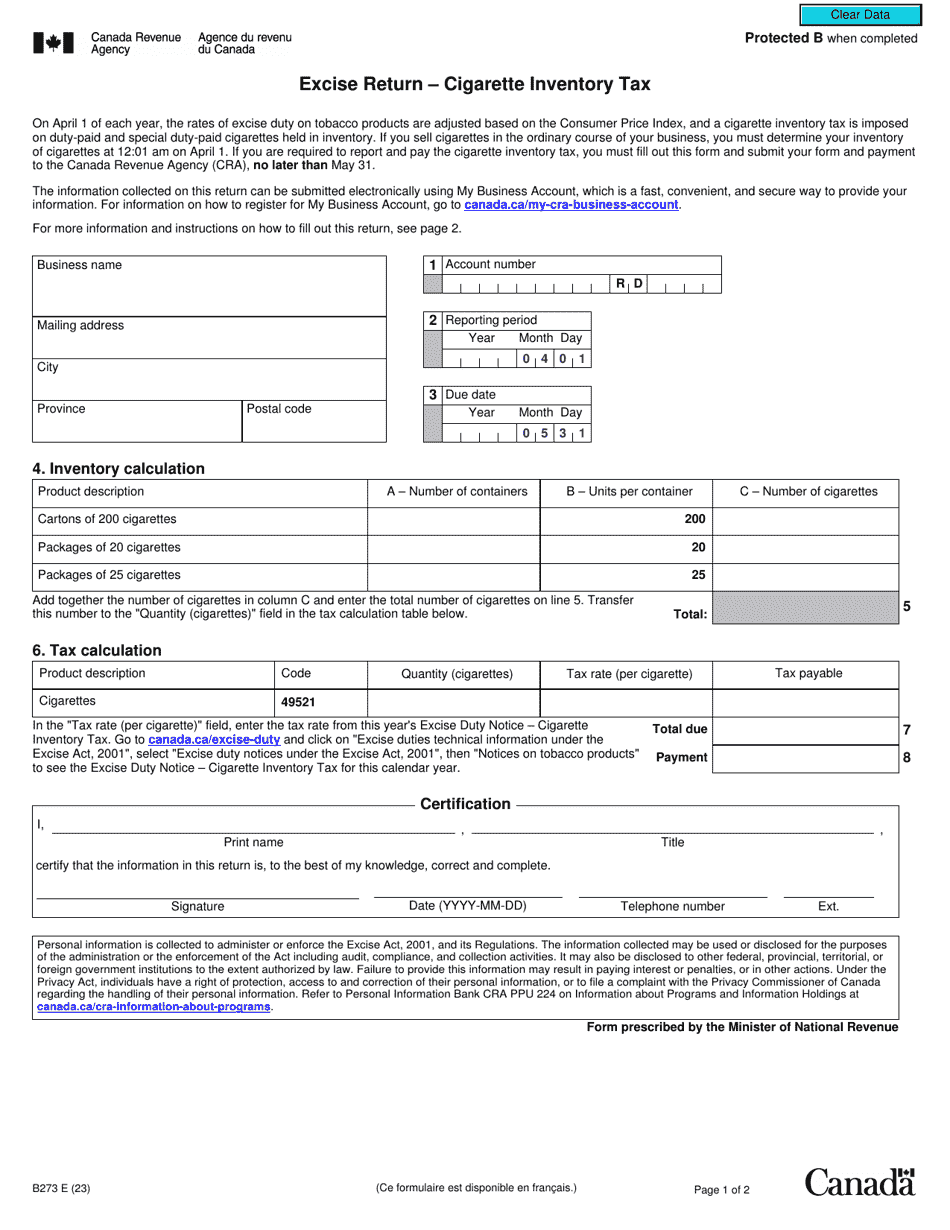

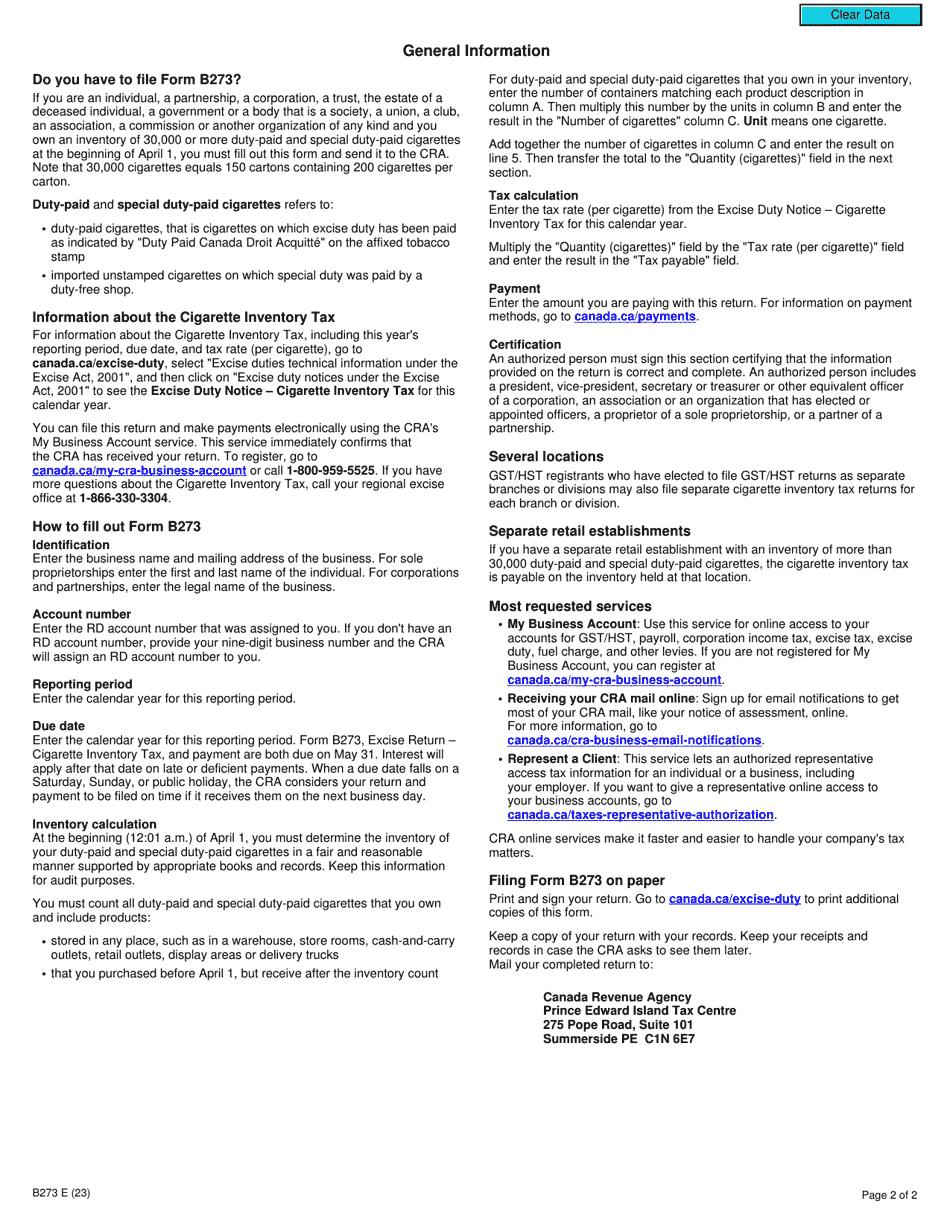

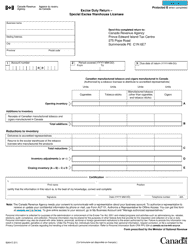

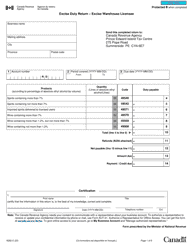

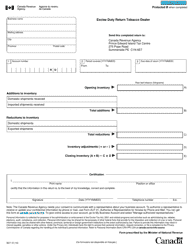

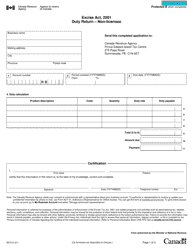

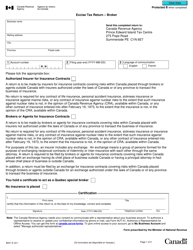

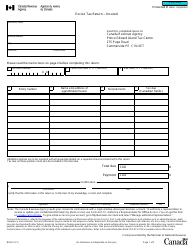

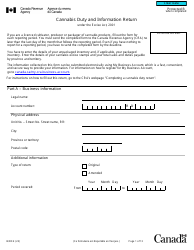

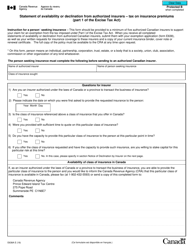

Form B273 Excise Return - Cigarette Inventory Tax - Canada

Form B273 Excise Return - Cigarette Inventory Tax is used in Canada to report and pay taxes on the inventory of cigarettes held by businesses.

Form B273 Excise Return - Cigarette Inventory Tax - Canada - Frequently Asked Questions (FAQ)

Q: What is Form B273?

A: Form B273 is an excise return used to report the inventory of cigarettes and pay the cigarette inventory tax in Canada.

Q: What is the purpose of the cigarette inventory tax?

A: The cigarette inventory tax is a tax levied on the inventory of cigarettes held by wholesalers and retailers in Canada.

Q: Who needs to file Form B273?

A: Wholesalers and retailers of cigarettes in Canada need to file Form B273 to report their inventory and pay the cigarette inventory tax.

Q: When is Form B273 due?

A: Form B273 is due on the 20th day of each month following the reporting period.

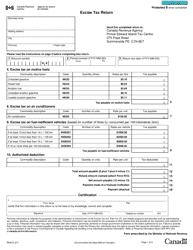

Q: How is the cigarette inventory tax calculated?

A: The cigarette inventory tax is calculated based on the number of cigarettes in inventory multiplied by the applicable tax rate.

Q: Are there any penalties for late filing or non-compliance?

A: Yes, there are penalties for late filing or non-compliance with the cigarette inventory tax requirements. It's important to file and pay on time to avoid penalties.

Q: Are there any exemptions or deductions available for the cigarette inventory tax?

A: There may be certain exemptions or deductions available for the cigarette inventory tax. It's best to consult the Canada Revenue Agency or a tax professional for specific details.