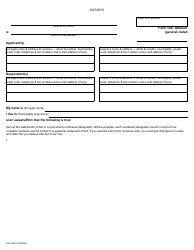

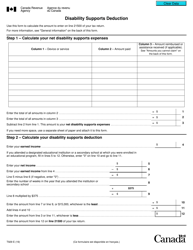

This version of the form is not currently in use and is provided for reference only. Download this version of

Form T929

for the current year.

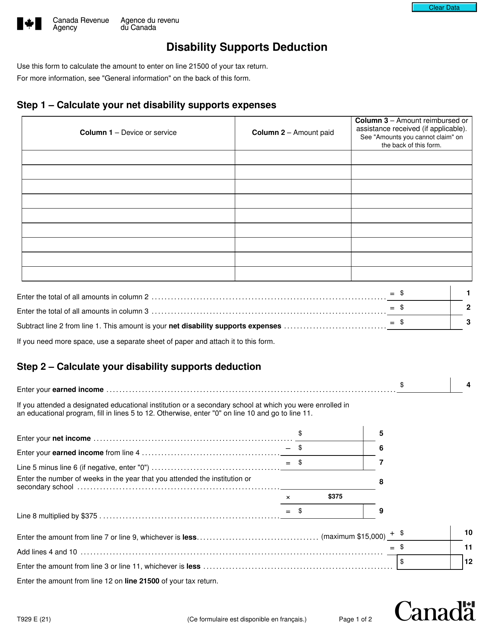

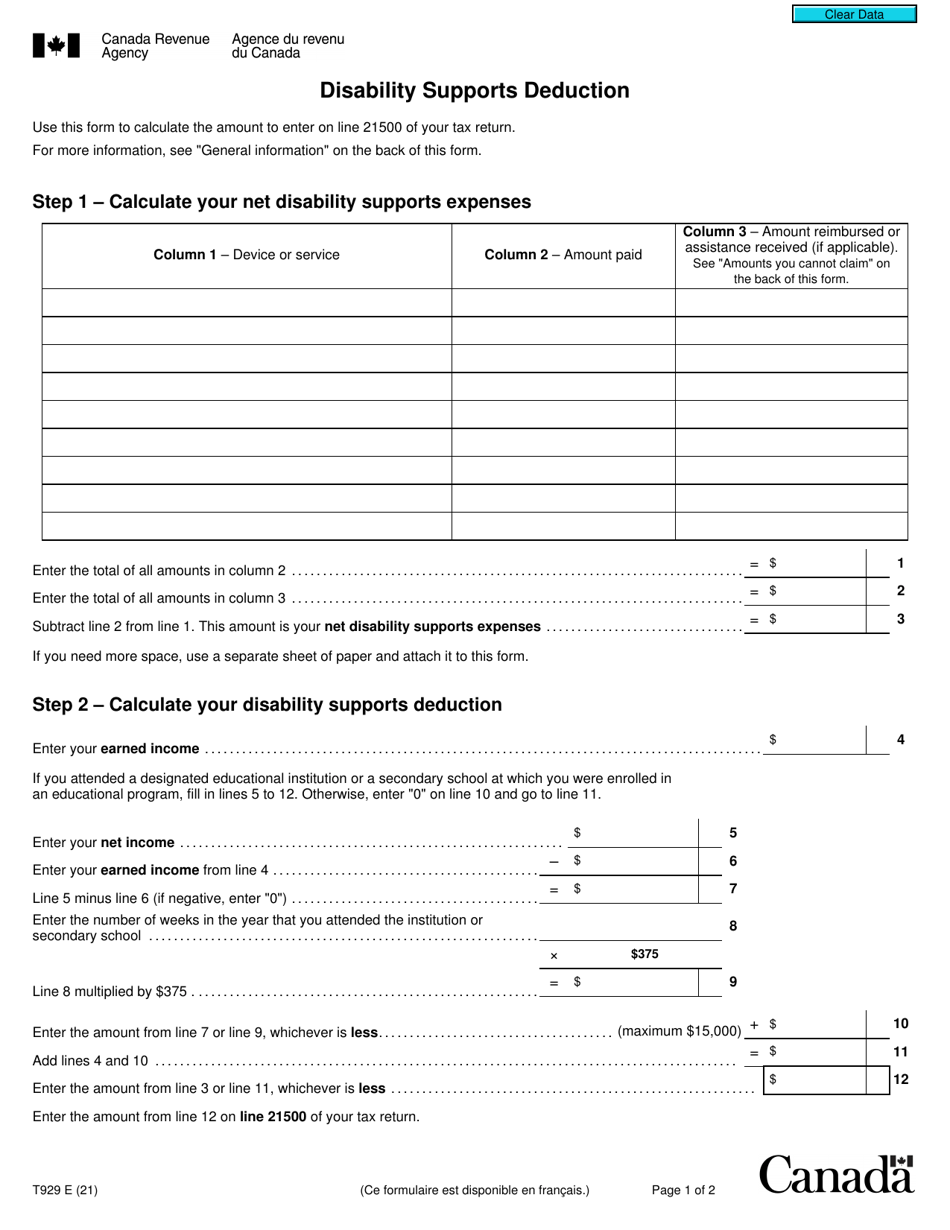

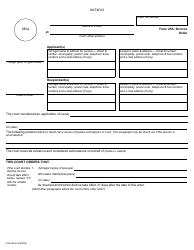

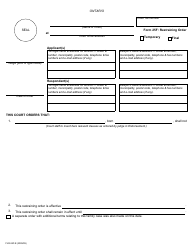

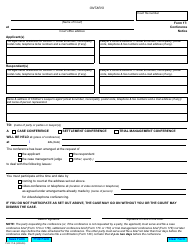

Form T929 Disability Supports Deduction - Canada

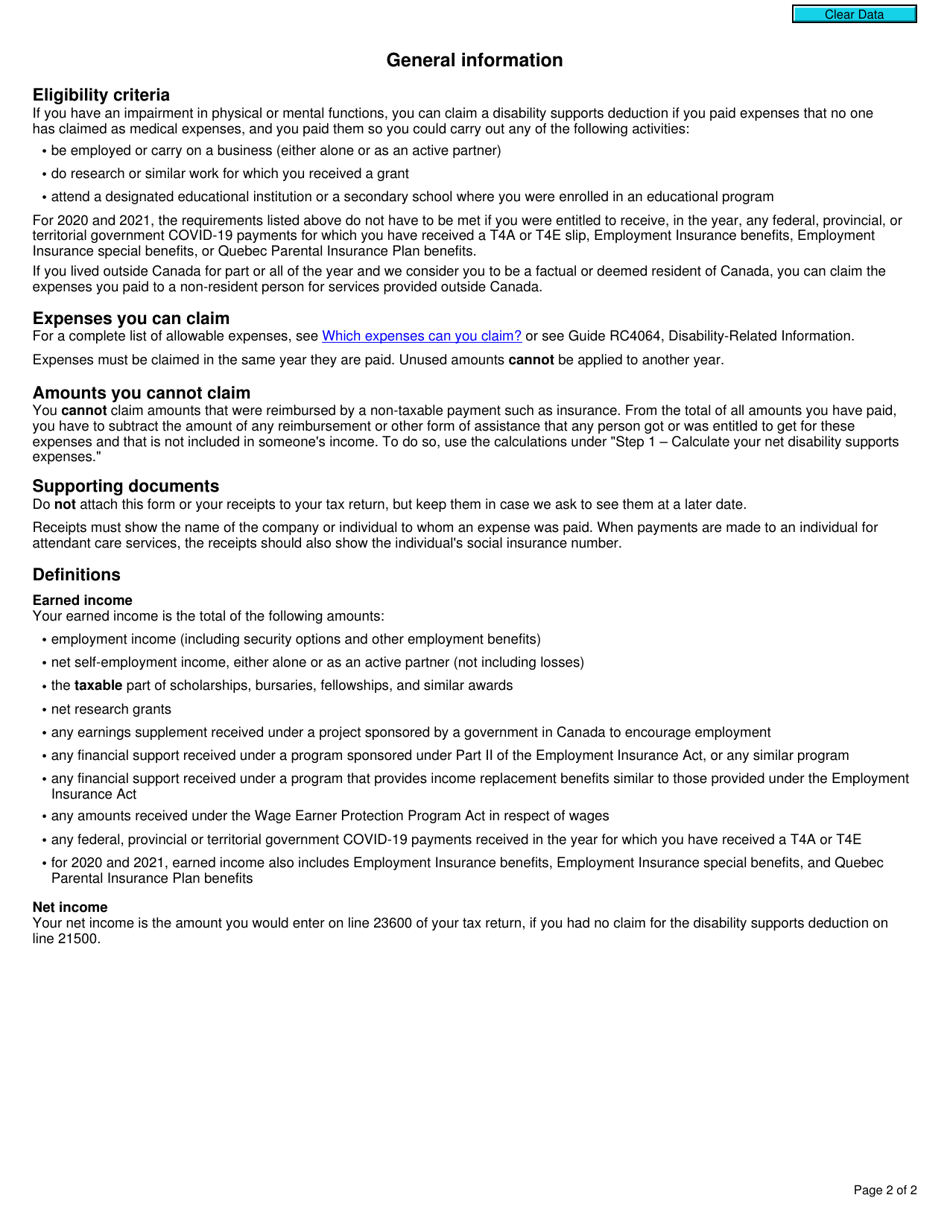

Form T929 Disability Supports Deduction in Canada is used to claim the disability supports deduction. This deduction allows individuals with disabilities to claim expenses related to disability supports or devices that are necessary for them to perform daily activities or to work.

The Form T929 Disability Supports Deduction in Canada is filed by individuals who have a physical or mental impairment and are eligible for the disability tax credit.

FAQ

Q: What is Form T929?

A: Form T929 is a form used in Canada to claim the Disability Supports Deduction.

Q: What is the Disability Supports Deduction?

A: The Disability Supports Deduction is a deduction available to individuals with disabilities in Canada.

Q: Who is eligible for the Disability Supports Deduction?

A: Individuals who have a severe and prolonged impairment in physical or mental functions may be eligible for the Disability Supports Deduction.

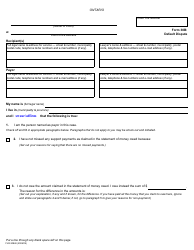

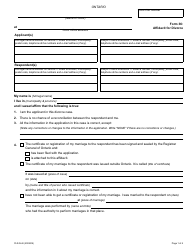

Q: What expenses can be claimed on Form T929?

A: Expenses related to disability supports, such as attendant care, nursing home care, and assistive devices, can be claimed on Form T929.

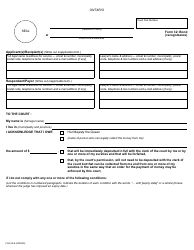

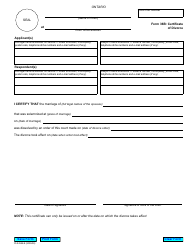

Q: Is there a deadline for filing Form T929?

A: Form T929 should be filed with your tax return by the tax filing deadline, which is generally April 30th of each year in Canada.