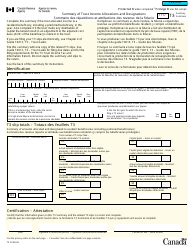

This version of the form is not currently in use and is provided for reference only. Download this version of

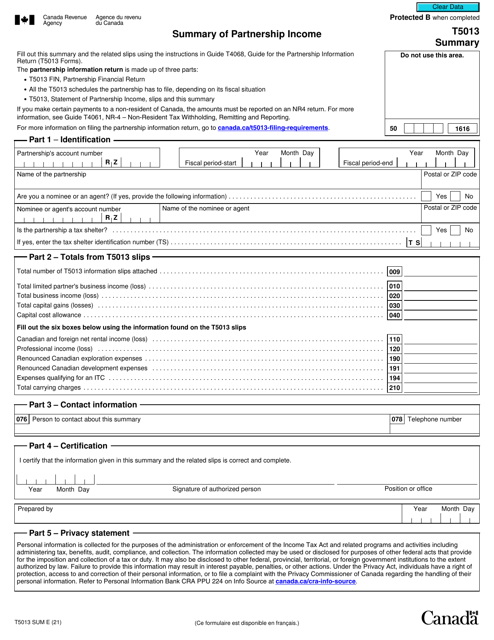

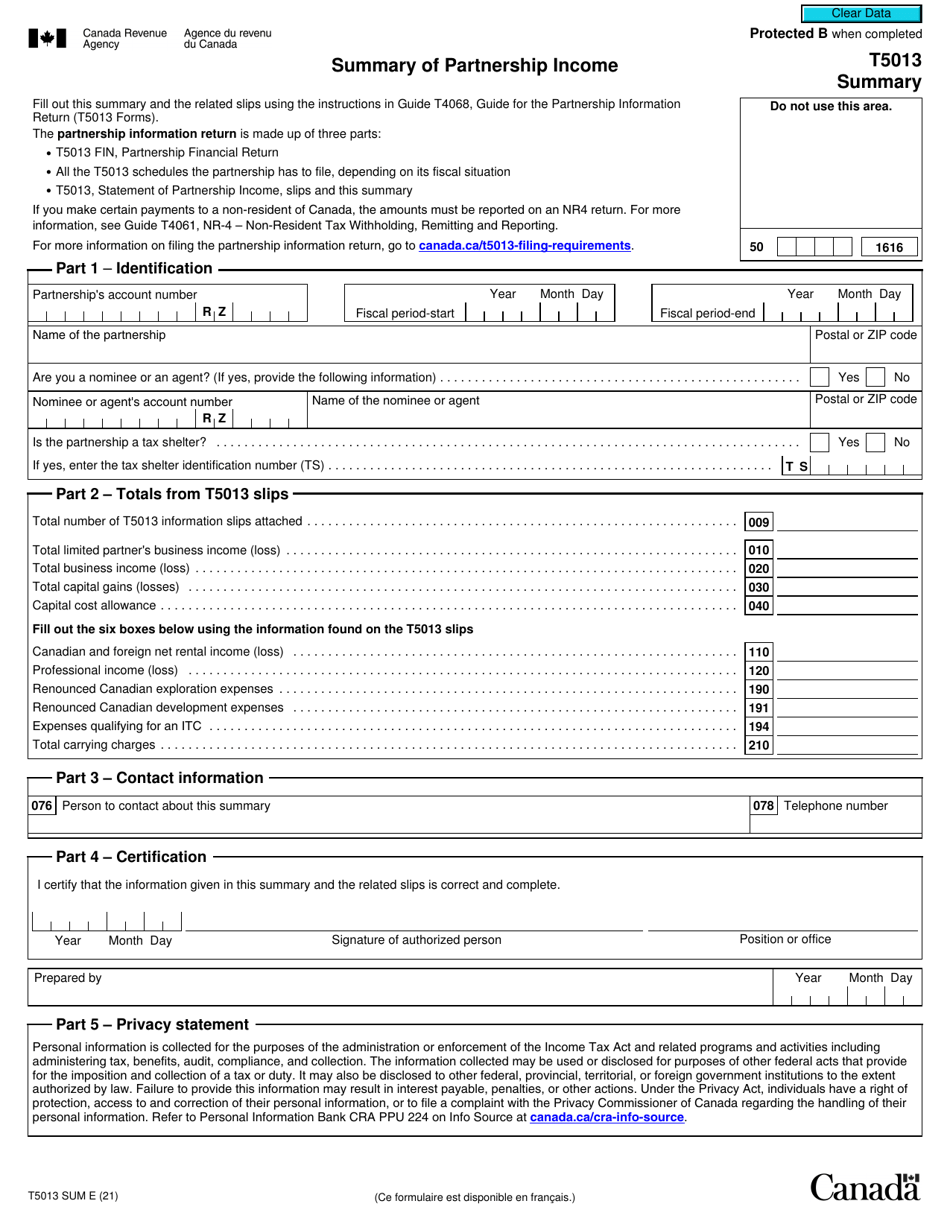

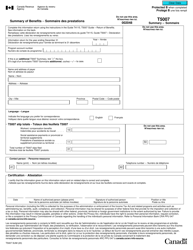

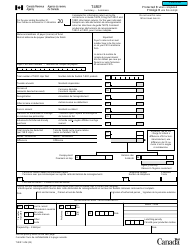

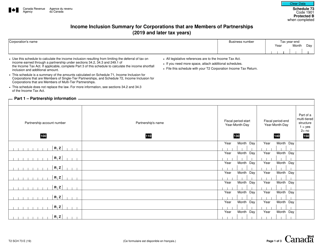

Form T5013 SUM

for the current year.

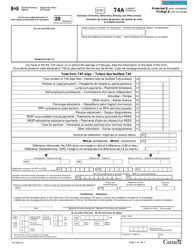

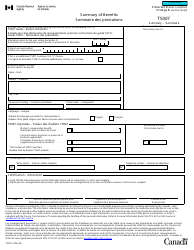

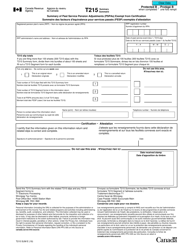

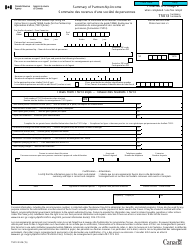

Form T5013 SUM Summary of Partnership Income - Canada

Form T5013 SUM (Summary of Partnership Income) is used in Canada to summarize the financial information of a partnership and report it to the Canada Revenue Agency (CRA). It provides a summary of income, expenses, losses, and other partnership details for tax reporting purposes.

The partnership itself is responsible for filing the Form T5013 SUM Summary of Partnership Income in Canada.

FAQ

Q: What is Form T5013 SUM?

A: Form T5013 SUM is a Summary of Partnership Income form used in Canada.

Q: Who needs to file Form T5013 SUM?

A: Partnerships in Canada that have more than $25,000 in gross partnership income or when requested by the Canada Revenue Agency (CRA) must file Form T5013 SUM.

Q: What information is included in Form T5013 SUM?

A: Form T5013 SUM includes information about the partnership's income, expenses, deductions, and other financial details.

Q: When is the deadline for filing Form T5013 SUM?

A: The deadline for filing Form T5013 SUM is generally the same as the partnership's tax return deadline, which is usually six months after the end of the fiscal year.

Q: Are there any penalties for not filing Form T5013 SUM?

A: Yes, there are penalties for not filing Form T5013 SUM or for filing it late. The penalties can vary depending on the circumstances, so it is important to file the form on time.