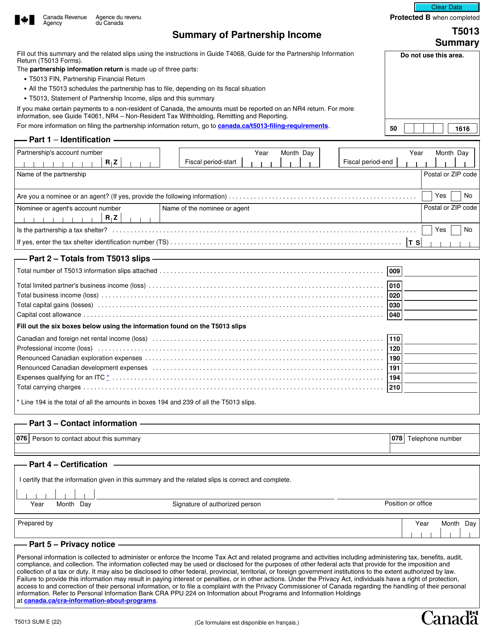

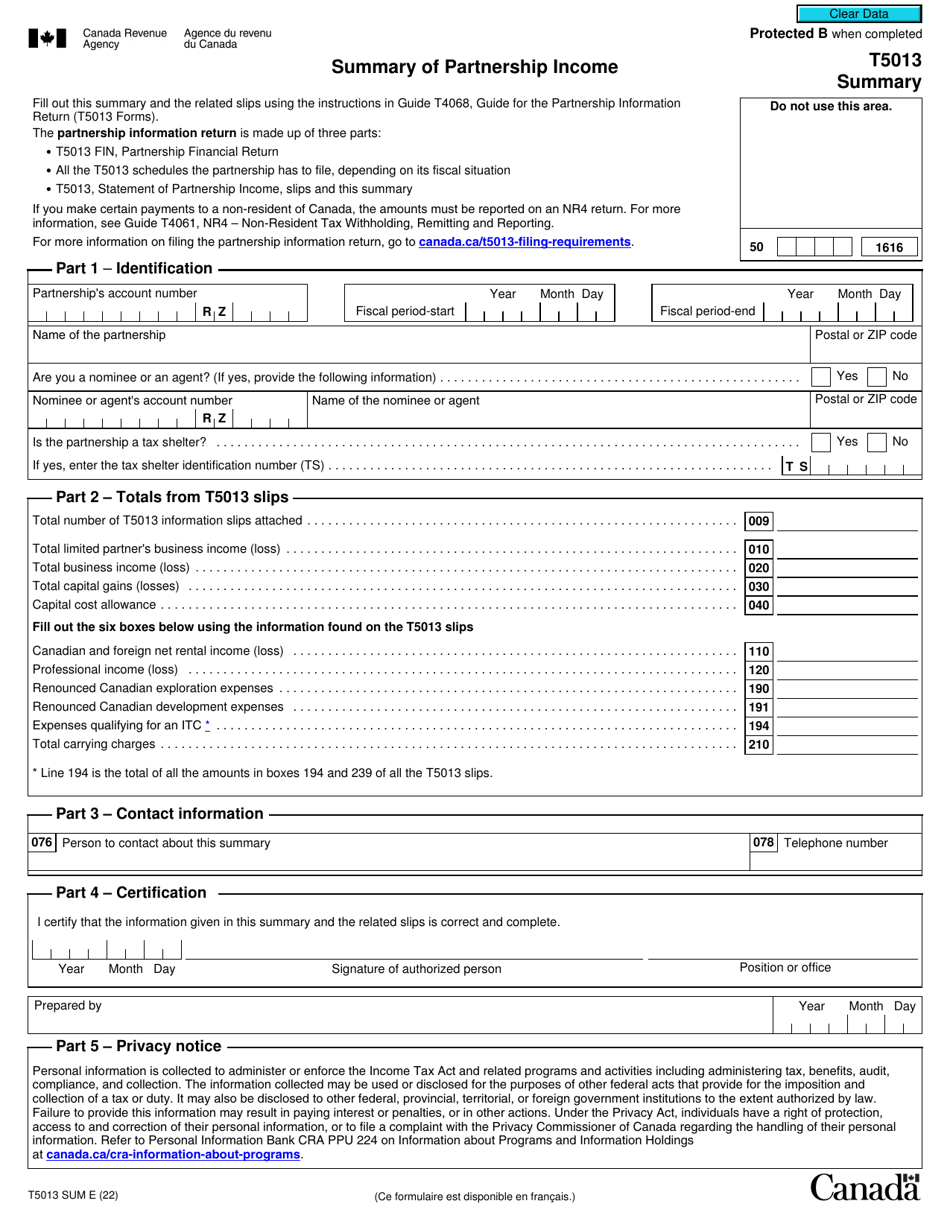

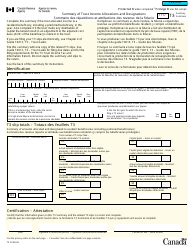

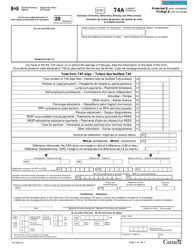

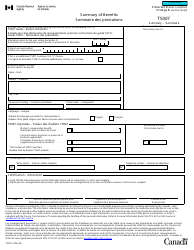

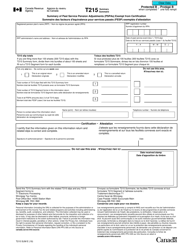

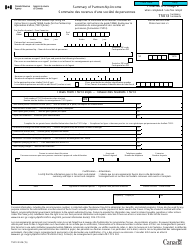

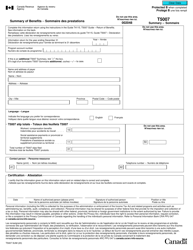

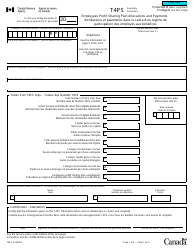

Form T5013 SUM Summary of Partnership Income - Canada

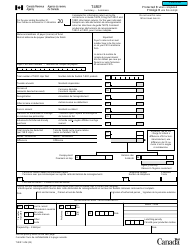

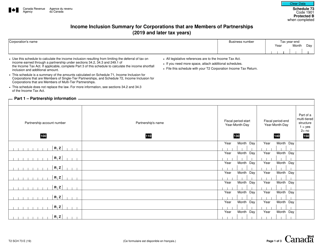

Form T5013 SUM, or the Summary of Partnership Income, is used in Canada to provide a summarized overview of the income, expenses, and deductions of a partnership. It helps the Canadian Revenue Agency (CRA) to assess the partnership's tax liability and allows the partners to report their share of the partnership's income on their individual tax returns.

The form T5013 SUM Summary of Partnership Income in Canada is typically filed by the partnership itself, not the individual partners.

Form T5013 SUM Summary of Partnership Income - Canada - Frequently Asked Questions (FAQ)

Q: What is a Form T5013? A: Form T5013 is a summary of partnership income in Canada.

Q: Who needs to fill out Form T5013? A: Partnerships in Canada need to fill out Form T5013.

Q: What information does Form T5013 include? A: Form T5013 includes information about partnership income, expenses, and allocations.

Q: When is Form T5013 due? A: Form T5013 is due within five months of the partnership's fiscal period end date.

Q: Are there penalties for late or incorrect filing of Form T5013? A: Yes, there may be penalties for late or incorrect filing of Form T5013.

Q: Do I need to include Form T5013 with my personal tax return? A: No, Form T5013 is not included with personal tax returns. It is filed separately for partnership income.

Q: What should I do if I have questions or need assistance with Form T5013? A: If you have questions or need assistance with Form T5013, you can contact the CRA or consult a tax professional.