This version of the form is not currently in use and is provided for reference only. Download this version of

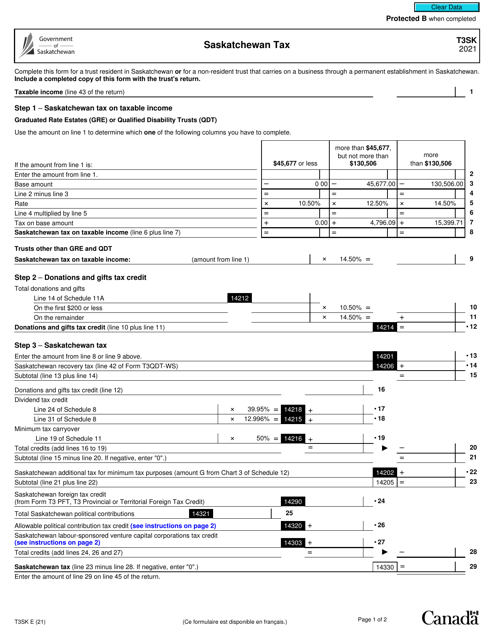

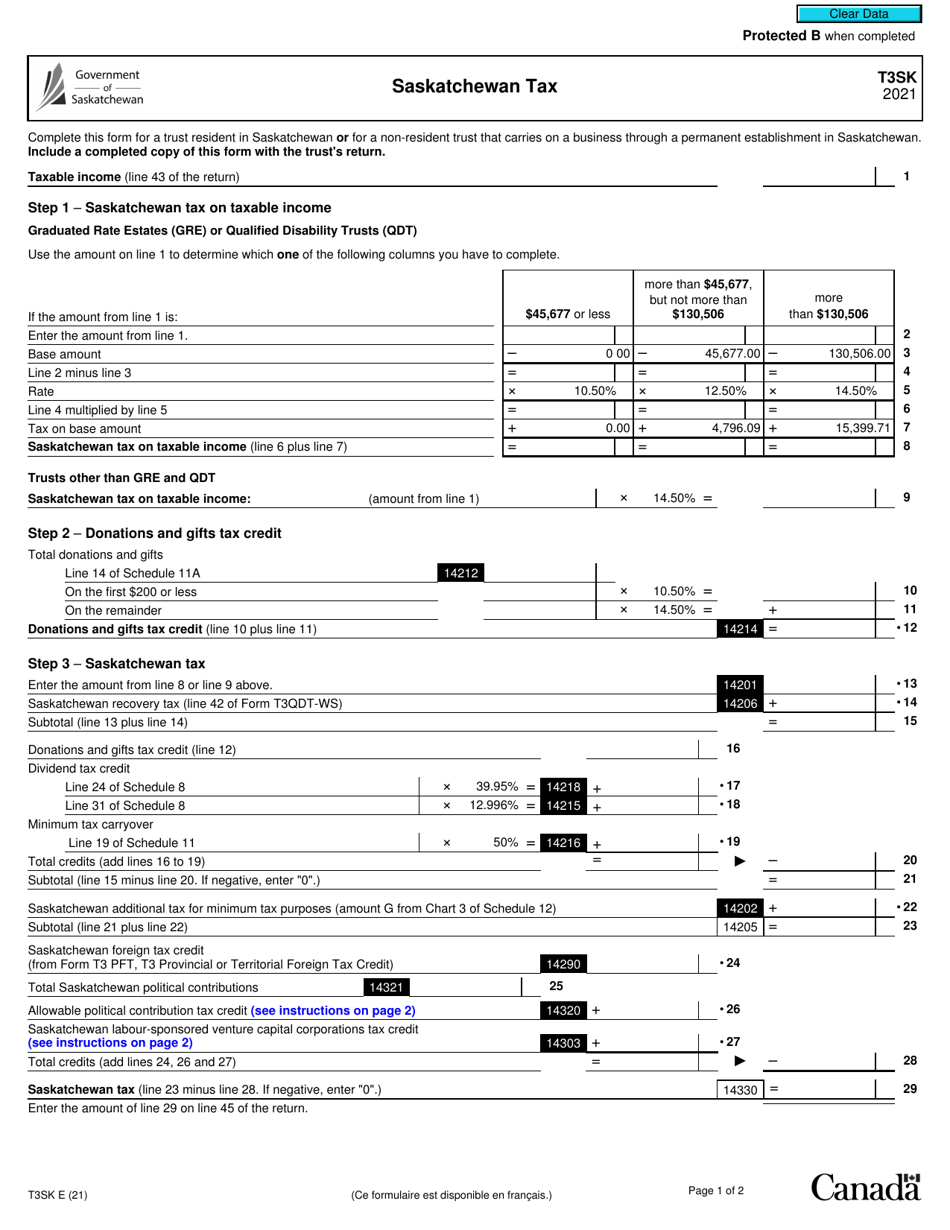

Form T3SK

for the current year.

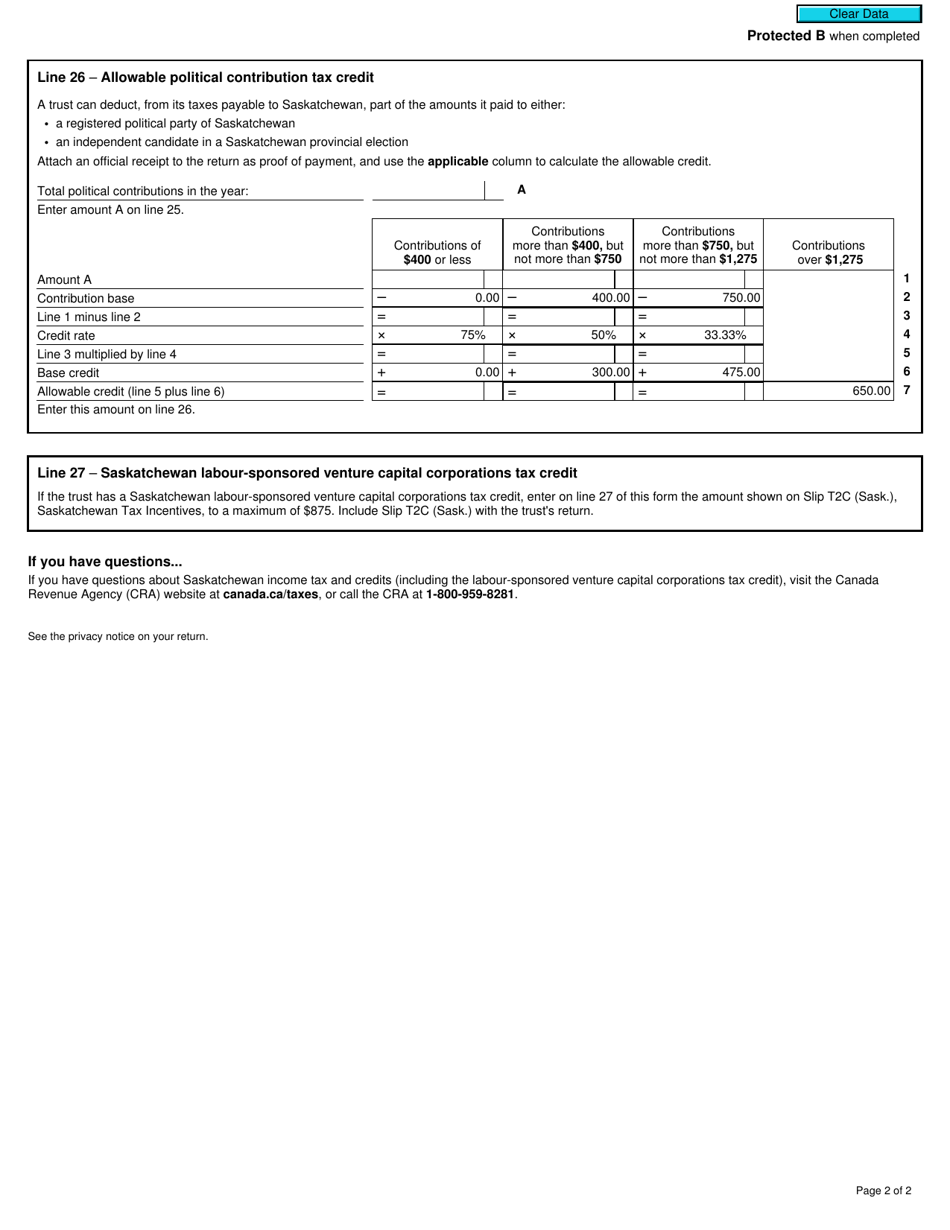

Form T3SK Saskatchewan Tax - Canada

Form T3SK is used for filing an income tax return specifically for residents of Saskatchewan, Canada. It is used to report various types of income, deductions, and credits for individuals or corporations residing or doing business in Saskatchewan.

Individuals or businesses who are residents of Saskatchewan and have taxable income or need to report taxes in the province of Saskatchewan file the Form T3SK, Saskatchewan Tax, in Canada.

FAQ

Q: What is Form T3SK?

A: Form T3SK is a tax form used in the province of Saskatchewan in Canada.

Q: Who needs to fill out Form T3SK?

A: Individuals who are residents of Saskatchewan and have taxable income need to fill out Form T3SK.

Q: What is the purpose of Form T3SK?

A: Form T3SK is used to calculate and report provincial income tax owed by residents of Saskatchewan.

Q: When is the deadline to file Form T3SK?

A: The deadline to file Form T3SK is April 30th, or June 15th if you or your spouse is self-employed.

Q: What happens if I don't file Form T3SK?

A: If you don't file Form T3SK, you may be subject to penalties and interest charges imposed by the Saskatchewan Ministry of Finance.

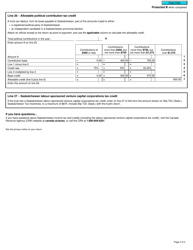

Q: What supporting documents do I need to attach to Form T3SK?

A: You may need to attach documents such as T4 slips, investment statements, and receipts for deductions or credits claimed.

Q: Can I use Form T3SK to claim federal tax credits?

A: No, Form T3SK is specifically for claiming provincial tax credits in Saskatchewan. You need to use other federal tax forms to claim federal tax credits.