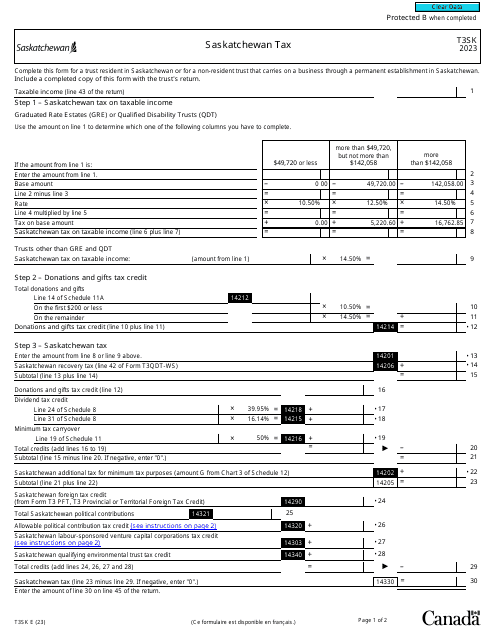

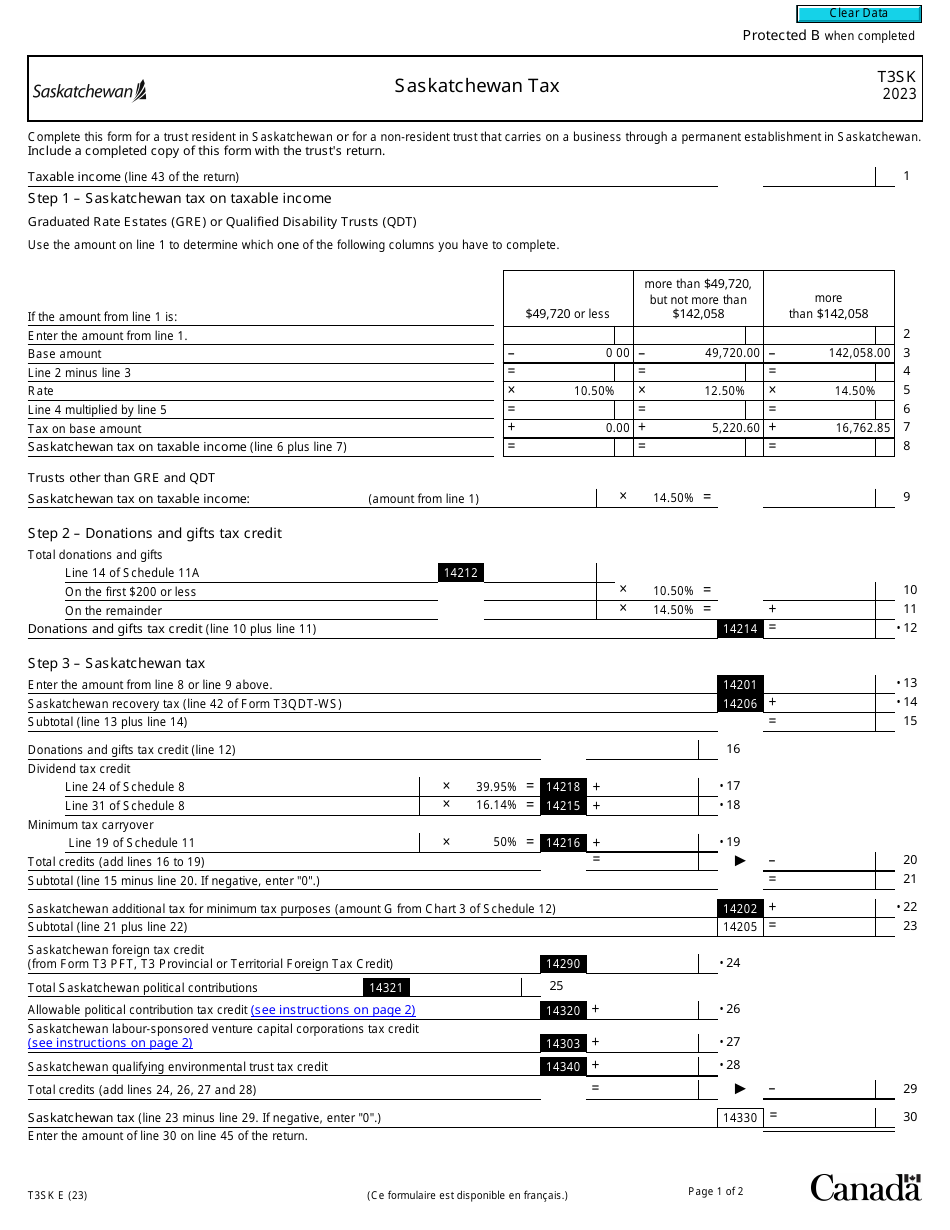

Form T3SK Saskatchewan Tax - Canada

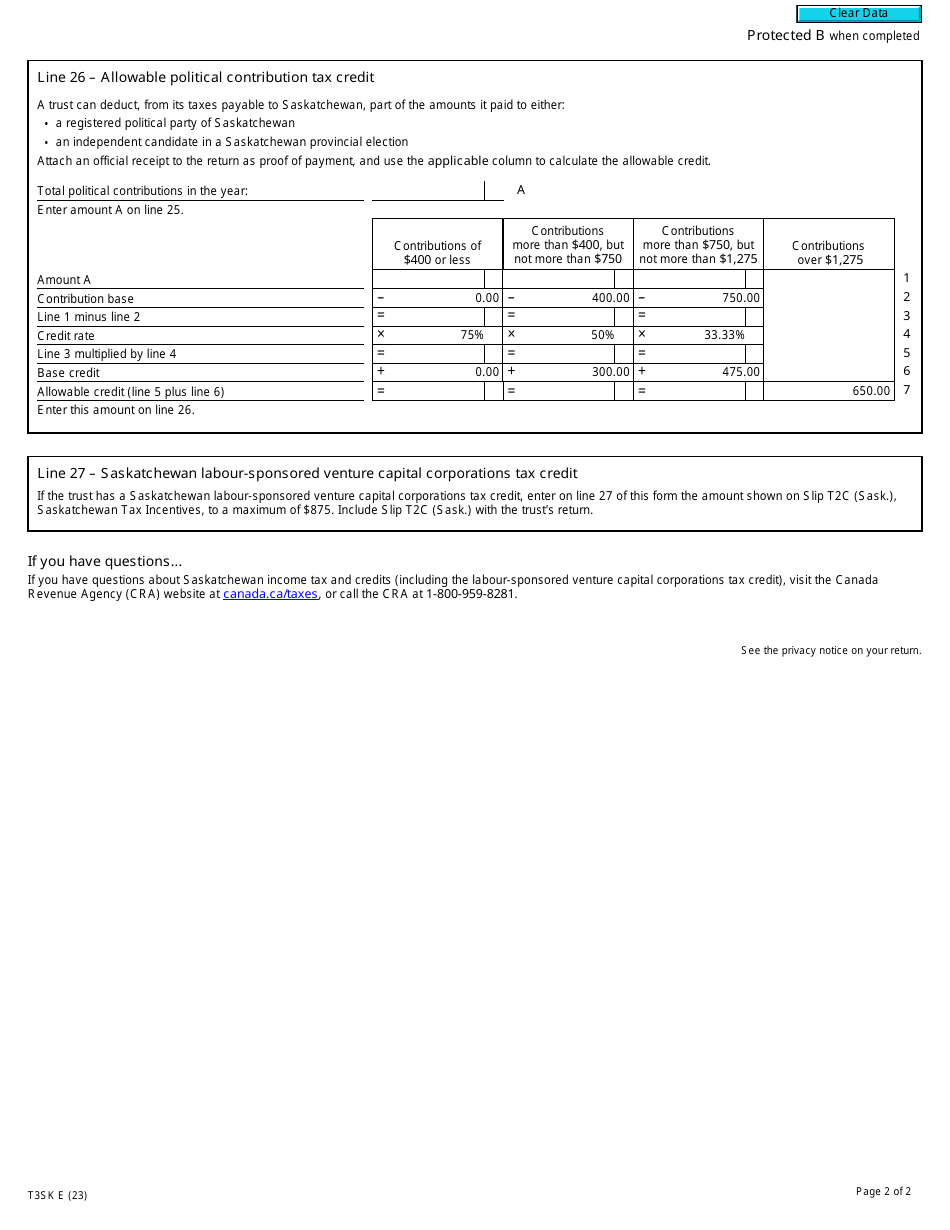

Form T3SK is used by taxpayers in the province of Saskatchewan in Canada to report and pay their provincial income tax. It is specifically for individuals and corporations who have income from sources in Saskatchewan or who are residents of Saskatchewan for tax purposes.

The form T3SK Saskatchewan Tax is filed by individuals who are residents of Saskatchewan and have income to report for tax purposes.

Form T3SK Saskatchewan Tax - Canada - Frequently Asked Questions (FAQ)

Q: What is Form T3SK?

A: Form T3SK is a tax form used for reporting income in the province of Saskatchewan, Canada.

Q: Who needs to file Form T3SK?

A: Residents of Saskatchewan who have income from various sources need to file Form T3SK.

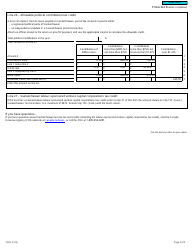

Q: What information is required to complete Form T3SK?

A: To complete Form T3SK, you will need details of your income sources, deductions, and personal information.

Q: When is the deadline for filing Form T3SK?

A: The deadline for filing Form T3SK is typically April 30th of the following year.

Q: Are there penalties for late filing of Form T3SK?

A: Yes, there may be penalties for late filing of Form T3SK, so it is important to file on time.

Q: Do I need to keep a copy of Form T3SK for my records?

A: Yes, it is recommended to keep a copy of Form T3SK and any supporting documents for your records in case of future audits or inquiries.