This version of the form is not currently in use and is provided for reference only. Download this version of

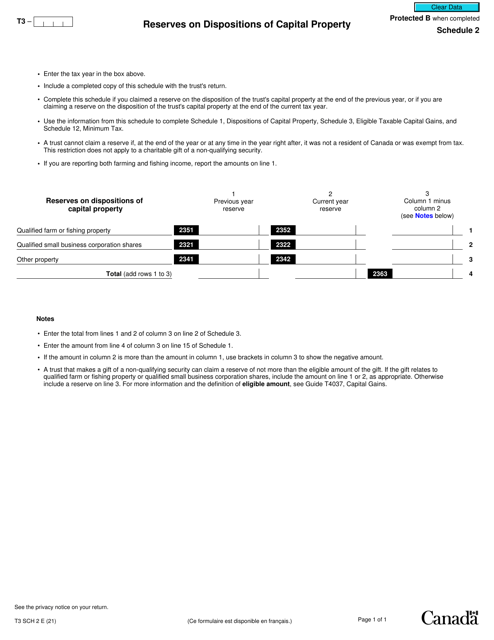

Form T3 Schedule 2

for the current year.

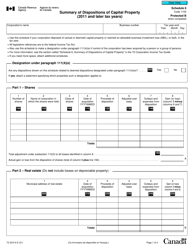

Form T3 Schedule 2 Reserves on Dispositions of Capital Property - Canada

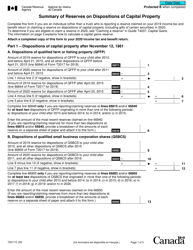

Form T3 Schedule 2 Reserves on Dispositions of Capital Property in Canada is used to report the reserves claimed on the disposition of capital property by an estate or trust. It helps calculate the taxable income and determine any tax liability on such dispositions.

In Canada, the taxpayer who disposes of capital property needs to file the Form T3 Schedule 2 Reserves.

FAQ

Q: What is Form T3 Schedule 2?

A: Form T3 Schedule 2 is a tax form used in Canada to report reserves on dispositions of capital property.

Q: What are reserves on dispositions of capital property?

A: Reserves on dispositions of capital property refer to amounts that are set aside to defer the recognition of taxable capital gains.

Q: Who needs to file Form T3 Schedule 2?

A: Individuals or entities in Canada who have disposed of capital property and need to report reserves on the transaction.

Q: What information is required on Form T3 Schedule 2?

A: The form requires details of the property, the disposition, and the calculation of the reserve.

Q: When is the deadline to file Form T3 Schedule 2?

A: The deadline to file Form T3 Schedule 2 is typically the same as the deadline for filing your income tax return, which is April 30th for most individuals.