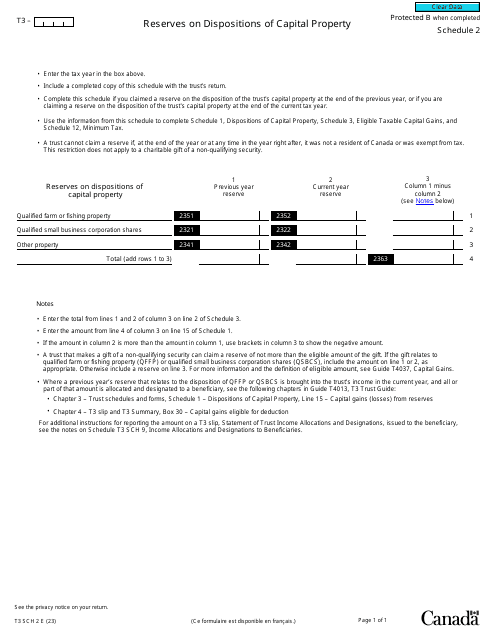

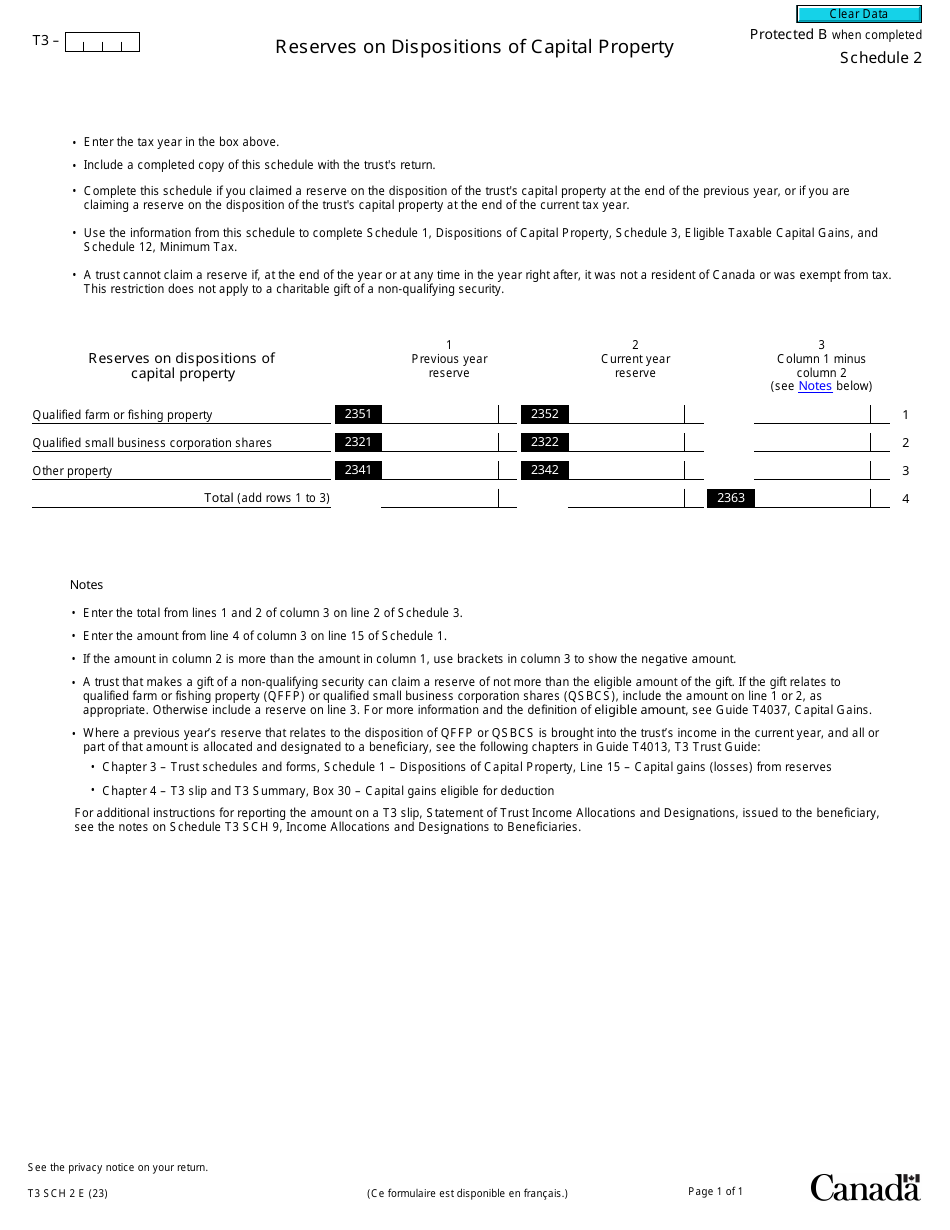

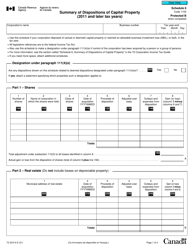

Form T3 Schedule 2 Reserves on Dispositions of Capital Property - Canada

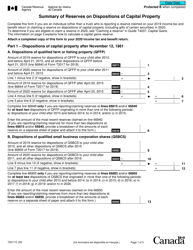

Form T3 Schedule 2 Reserves on Dispositions of Capital Property in Canada is used by trusts to calculate and report the amount of reserves that need to be set aside for tax purposes when there is a disposition of capital property. These reserves help to defer the recognition of taxable capital gains over a period of time.

In Canada, the Form T3 Schedule 2 Reserves on Dispositions of Capital Property is filed by the estate or trust that has disposed of capital property.

Form T3 Schedule 2 Reserves on Dispositions of Capital Property - Canada - Frequently Asked Questions (FAQ)

Q: What is Form T3 Schedule 2? A: Form T3 Schedule 2 is a tax form used in Canada to report reserves on dispositions of capital property.

Q: What are reserves on dispositions of capital property? A: Reserves are amounts that you set aside and deduct over a period of time for certain types of capital property dispositions.

Q: When do I need to file Form T3 Schedule 2? A: You need to file Form T3 Schedule 2 if you have disposed of capital property and want to report reserves on the disposition.

Q: What information do I need to complete Form T3 Schedule 2? A: You will need information about the capital property disposition and the related reserves, such as the date of disposition, the cost and fair market value of the property, and the amount of reserves claimed.

Q: Are there any deadlines for filing Form T3 Schedule 2? A: The deadline for filing Form T3 Schedule 2 is generally the same as the deadline for filing your T3 return. However, it is important to check the specific deadline for your tax year.

Q: Can I e-file Form T3 Schedule 2? A: No, Form T3 Schedule 2 cannot be e-filed. It must be filed by mail.

Q: Can I get help with filling out Form T3 Schedule 2? A: Yes, you can seek assistance from a tax professional or contact the CRA for guidance on completing Form T3 Schedule 2.