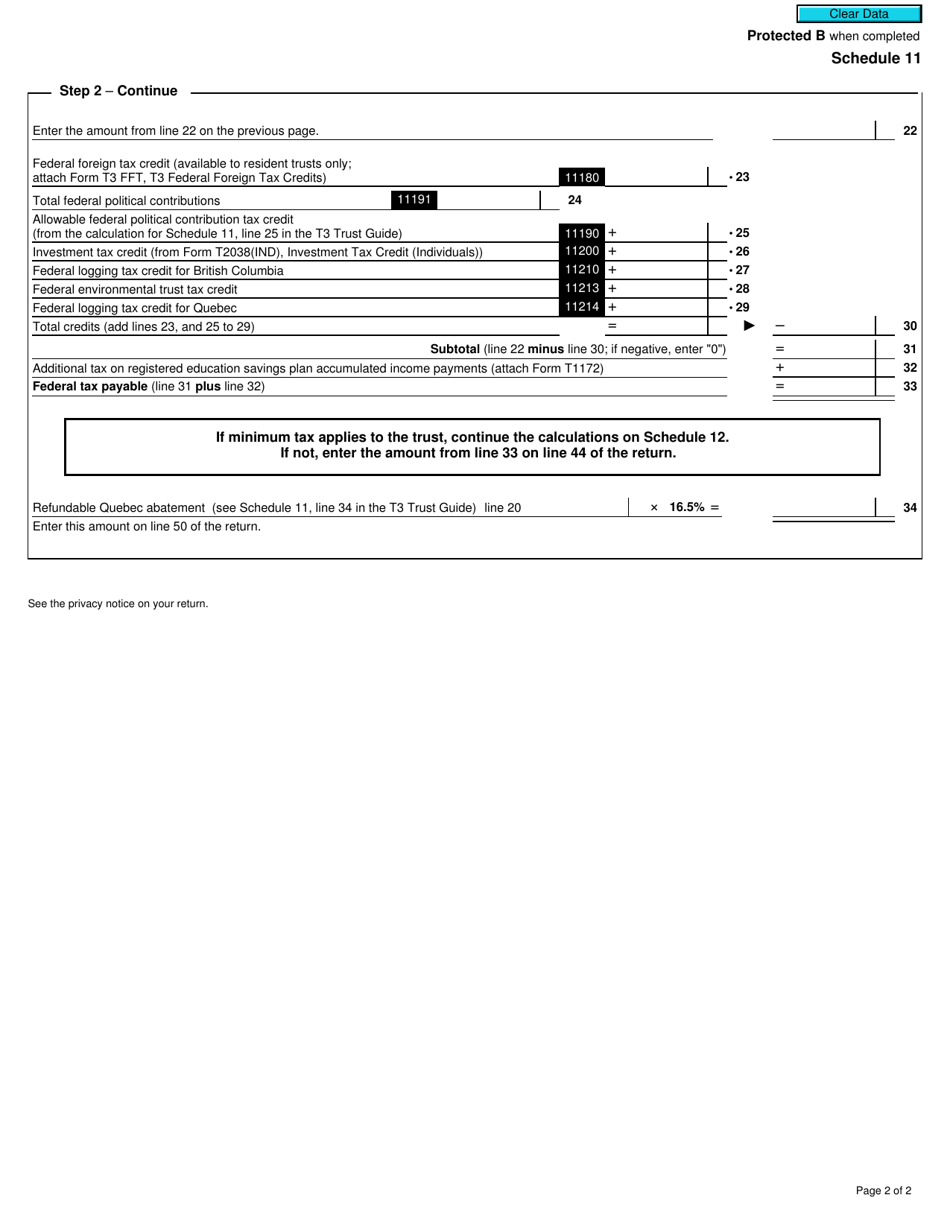

This version of the form is not currently in use and is provided for reference only. Download this version of

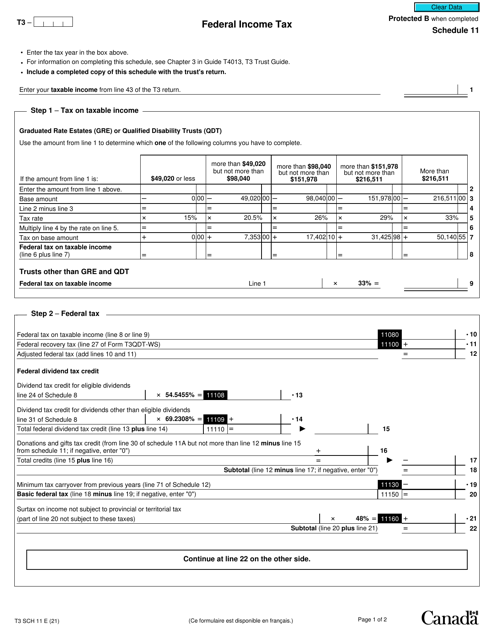

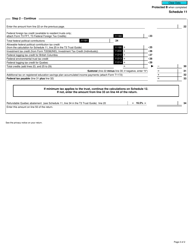

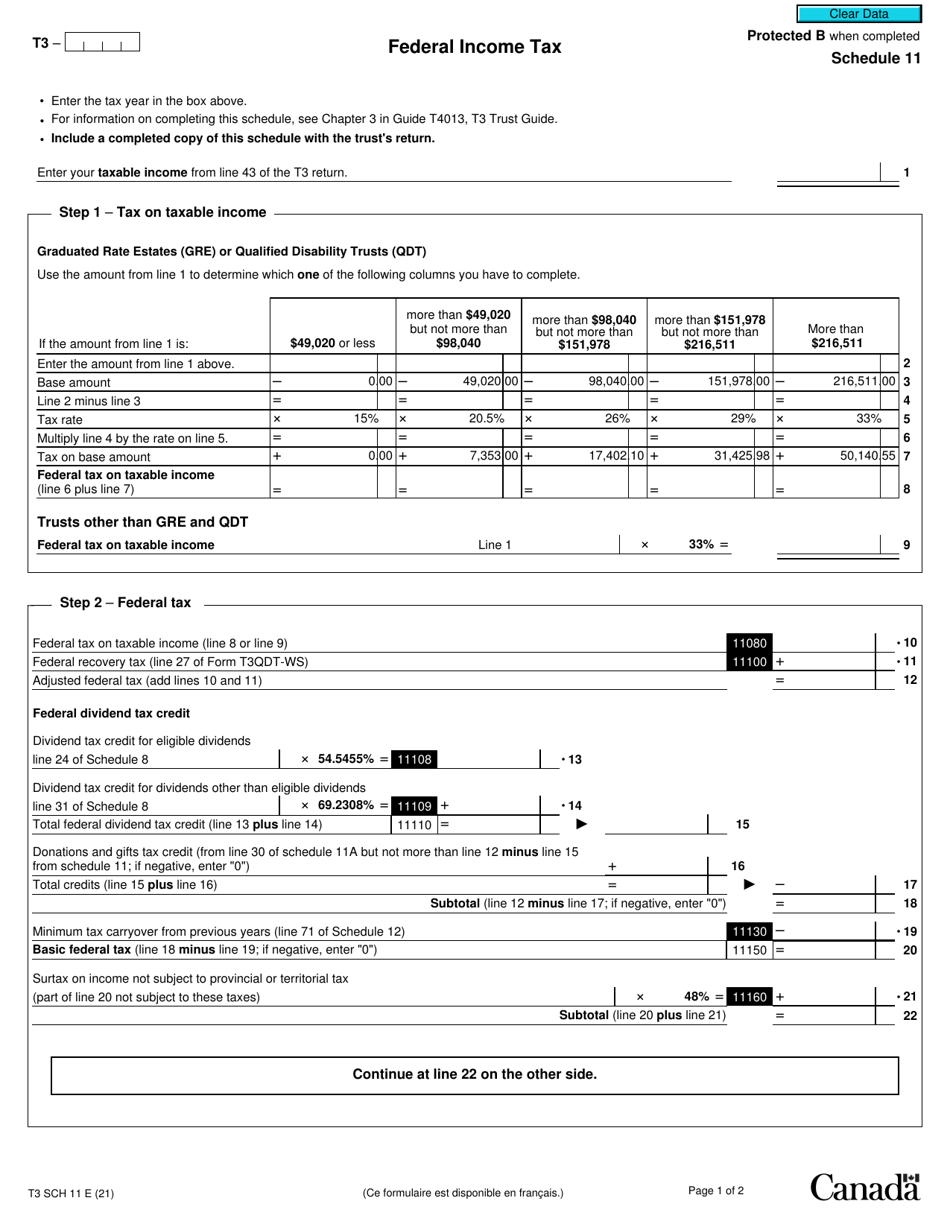

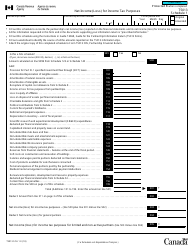

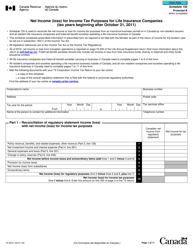

Form T3 Schedule 11

for the current year.

Form T3 Schedule 11 Federal Income Tax - Canada

Form T3 Schedule 11 is used in Canada to report rental income and expenses from real estate properties for the purpose of federal income tax calculation.

The Form T3 Schedule 11 for Federal Income Tax in Canada is filed by individuals or companies who are filing a T3 Trust Income Tax and Information Return.

FAQ

Q: What is Form T3 Schedule 11?

A: Form T3 Schedule 11 is a federal income tax form used in Canada.

Q: Who needs to fill out Form T3 Schedule 11?

A: Individuals who are residents of Canada and earn income from trusts need to fill out this form.

Q: What is the purpose of Form T3 Schedule 11?

A: The form is used to calculate and report federal income tax owed by individuals who earn income from trusts.

Q: When is the deadline to file Form T3 Schedule 11?

A: The deadline to file Form T3 Schedule 11 is usually April 30th of the following year, unless that day falls on a weekend or holiday.

Q: Are there any penalties for filing Form T3 Schedule 11 late?

A: Yes, there may be penalties and interest charged for late filing or late payment of taxes. It's important to file on time to avoid these penalties.