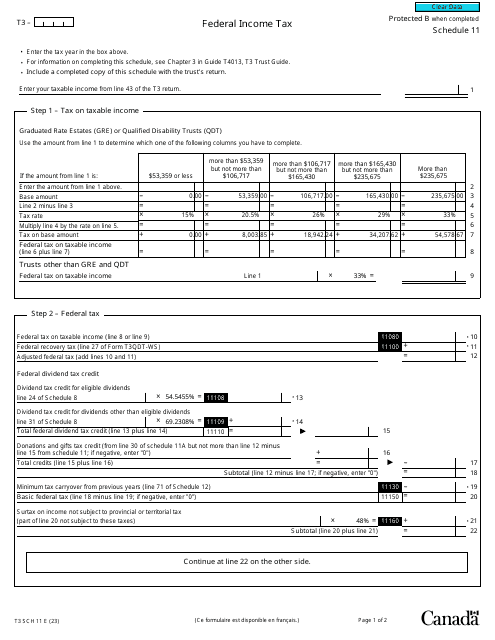

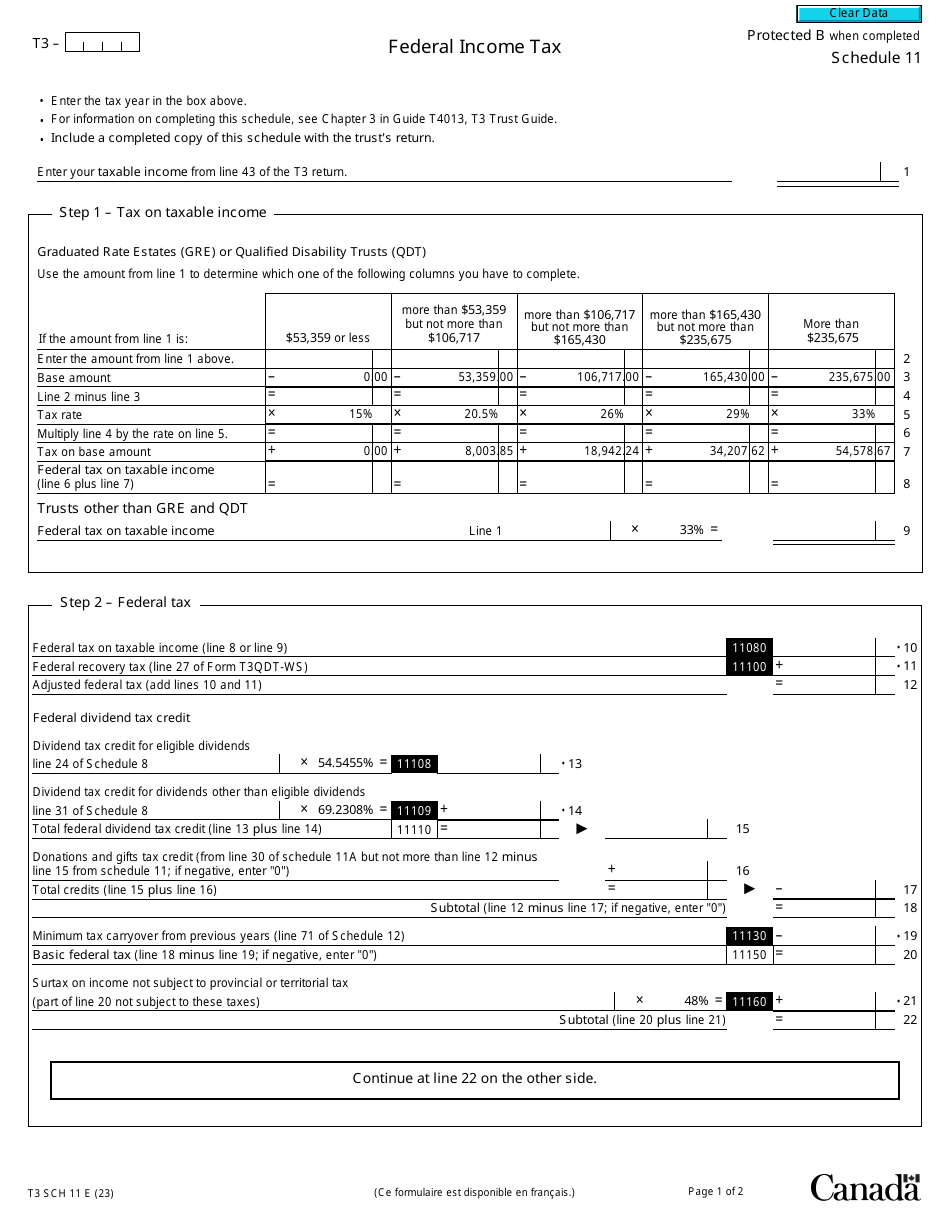

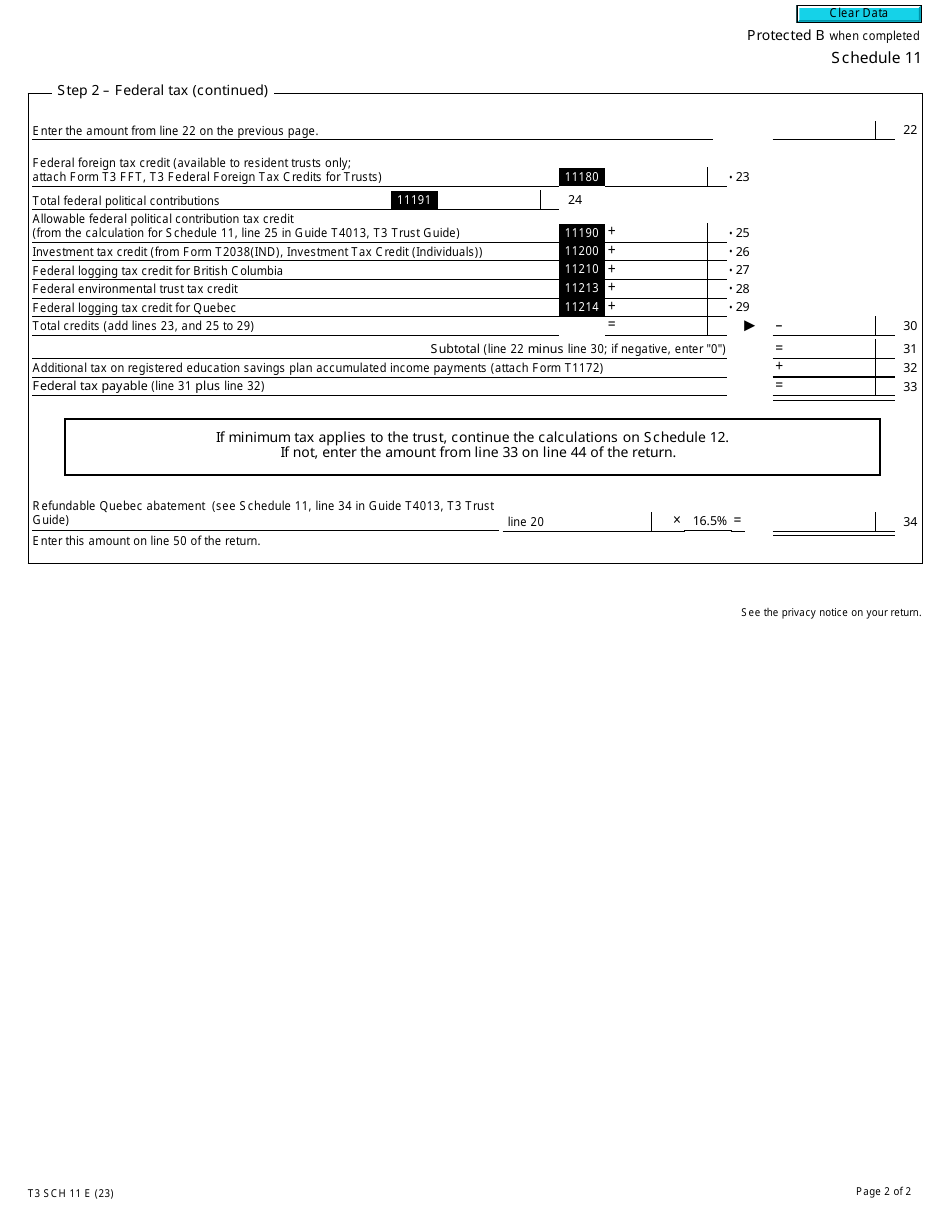

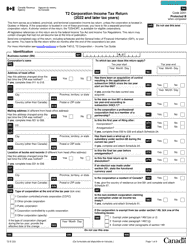

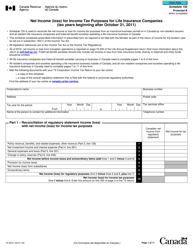

Form T3 Schedule 11 Federal Income Tax - Canada

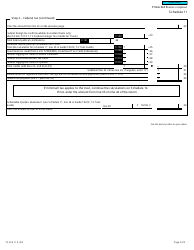

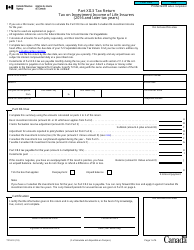

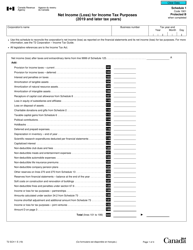

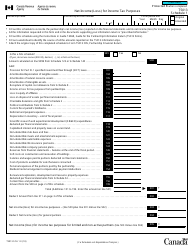

Form T3 Schedule 11 Federal Income Tax in Canada is used for reporting income, deductions, and tax credits related to trusts. It helps calculate the federal tax liability of the trust.

The Form T3 Schedule 11 for Federal Income Tax in Canada is generally filed by individuals and corporations who are filing a tax return for a trust.

Form T3 Schedule 11 Federal Income Tax - Canada - Frequently Asked Questions (FAQ)

Q: What is Form T3 Schedule 11?

A: Form T3 Schedule 11 is a tax form used in Canada to calculate federal income tax liabilities for trusts.

Q: Who needs to file Form T3 Schedule 11?

A: Trusts in Canada that are required to file a T3 return must include Form T3 Schedule 11 to calculate their federal income tax.

Q: What does Form T3 Schedule 11 calculate?

A: Form T3 Schedule 11 calculates the federal income tax liability of a trust in Canada.

Q: Is Form T3 Schedule 11 the only form required for trust tax filing?

A: No, Form T3 Schedule 11 is just one part of the T3 tax return. Trusts may need to file other forms depending on their specific situation.

Q: When is the deadline to file Form T3 Schedule 11?

A: The deadline to file Form T3 Schedule 11 is typically three months after the end of the trust's taxation year.

Q: What happens if I fail to file Form T3 Schedule 11?

A: Failing to file Form T3 Schedule 11 or other required tax forms can result in penalties and interest charges from the Canada Revenue Agency.