This version of the form is not currently in use and is provided for reference only. Download this version of

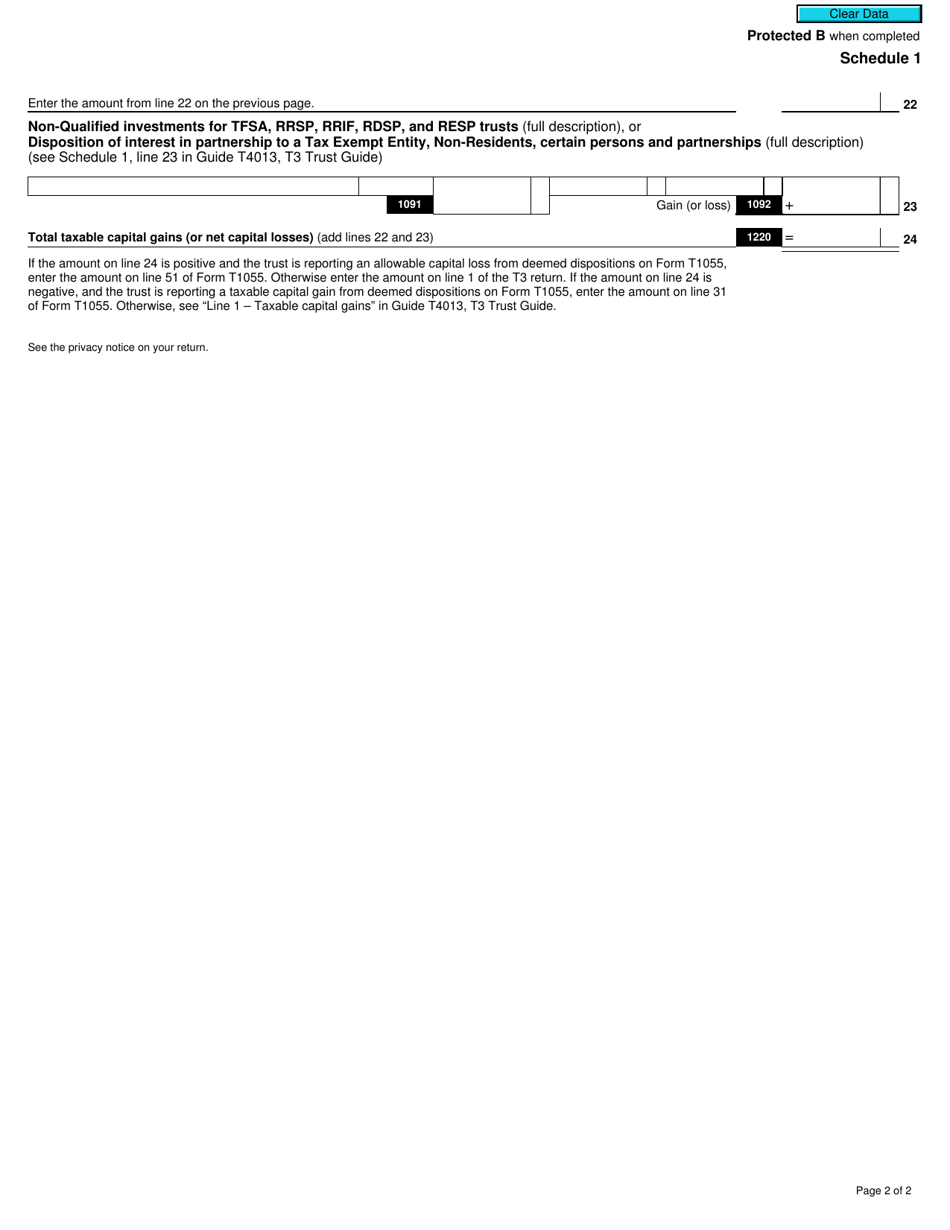

Form T3 Schedule 1

for the current year.

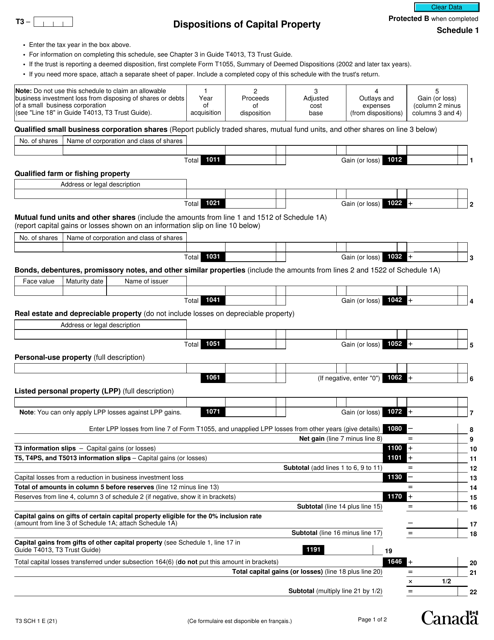

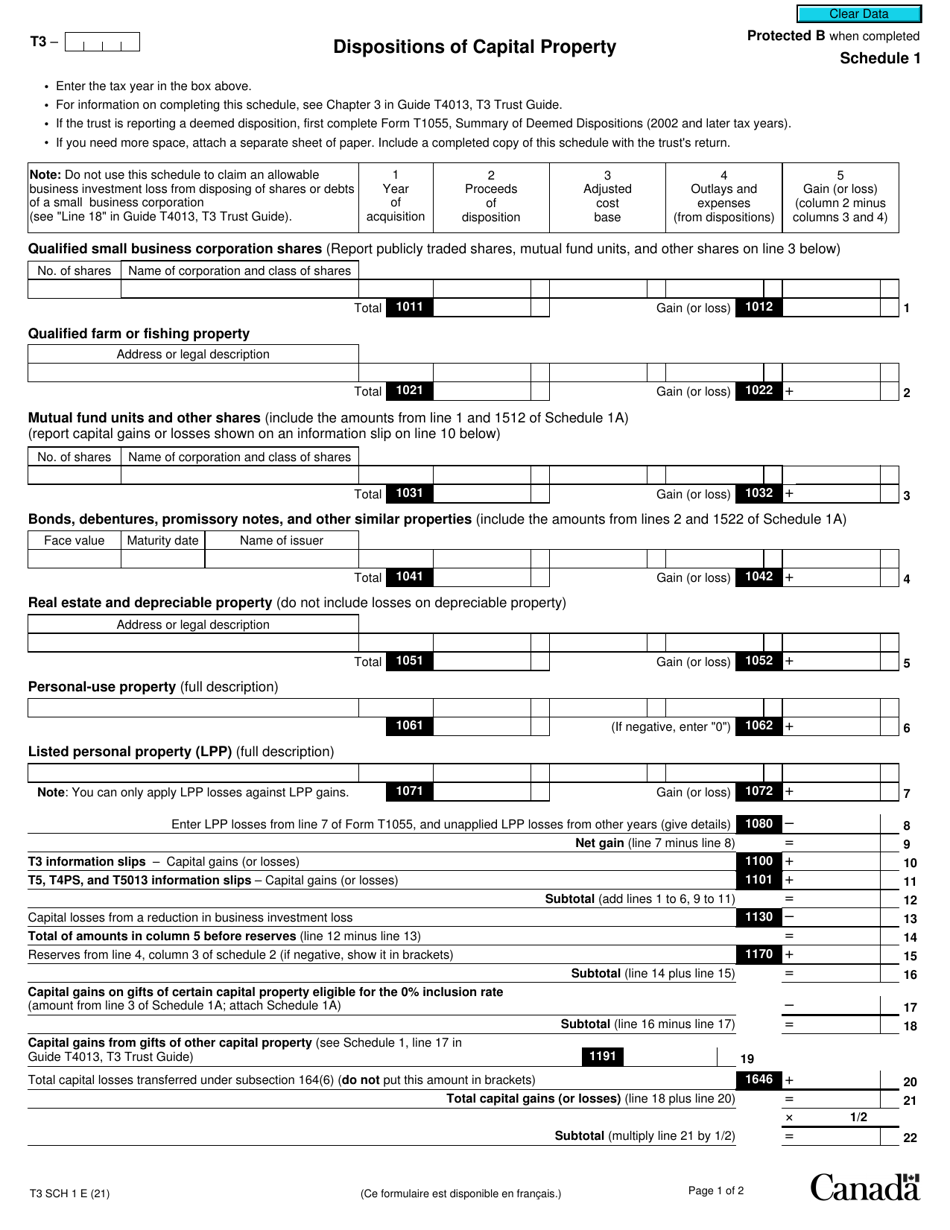

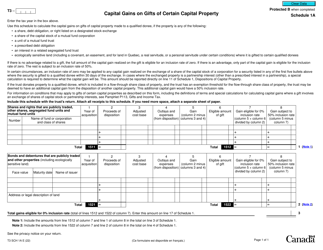

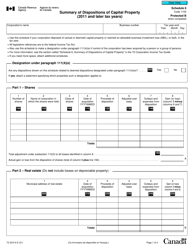

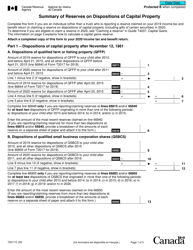

Form T3 Schedule 1 Dispositions of Capital Property - Canada

Form T3 Schedule 1 Dispositions of Capital Property in Canada is used to report and calculate the capital gains or losses made from the disposition (sale or transfer) of capital property within a trust. It helps determine the tax implications for the trust.

Individuals, corporations, or trusts who have disposed of capital property in Canada are required to file Form T3 Schedule 1 - Dispositions of Capital Property.

FAQ

Q: What is Form T3 Schedule 1?

A: Form T3 Schedule 1 is a tax form used in Canada to report dispositions of capital property.

Q: What is a disposition of capital property?

A: A disposition of capital property refers to the sale or transfer of assets that are considered capital property for tax purposes.

Q: When do I need to file Form T3 Schedule 1?

A: You need to file Form T3 Schedule 1 if you have disposed of capital property during the tax year and need to report the transaction.

Q: What information do I need to provide on Form T3 Schedule 1?

A: You will need to provide details such as the date of the disposition, the proceeds of the disposition, and the cost or adjusted cost base of the property.

Q: Do I need to include supporting documents with Form T3 Schedule 1?

A: Yes, you may need to include supporting documents such as sales contracts or purchase agreements to substantiate the information provided on the form.

Q: Are there any deadlines for filing Form T3 Schedule 1?

A: The deadline for filing Form T3 Schedule 1 is generally the same as the deadline for filing your tax return, which is usually April 30th of the following year.

Q: What happens if I don't file Form T3 Schedule 1?

A: If you fail to file Form T3 Schedule 1 when required, you may be subject to penalties and interest charges from the Canada Revenue Agency.