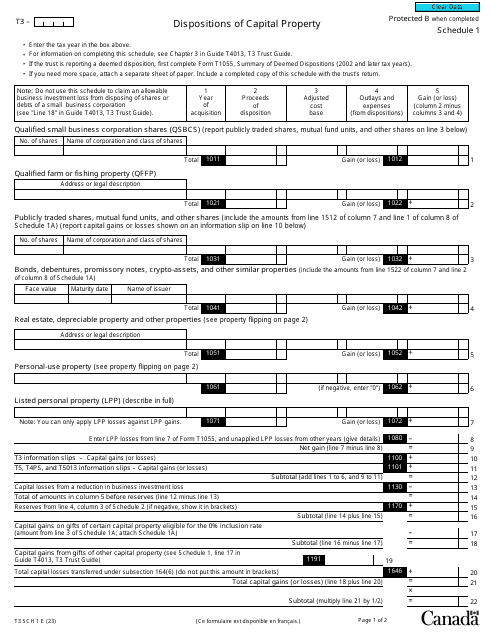

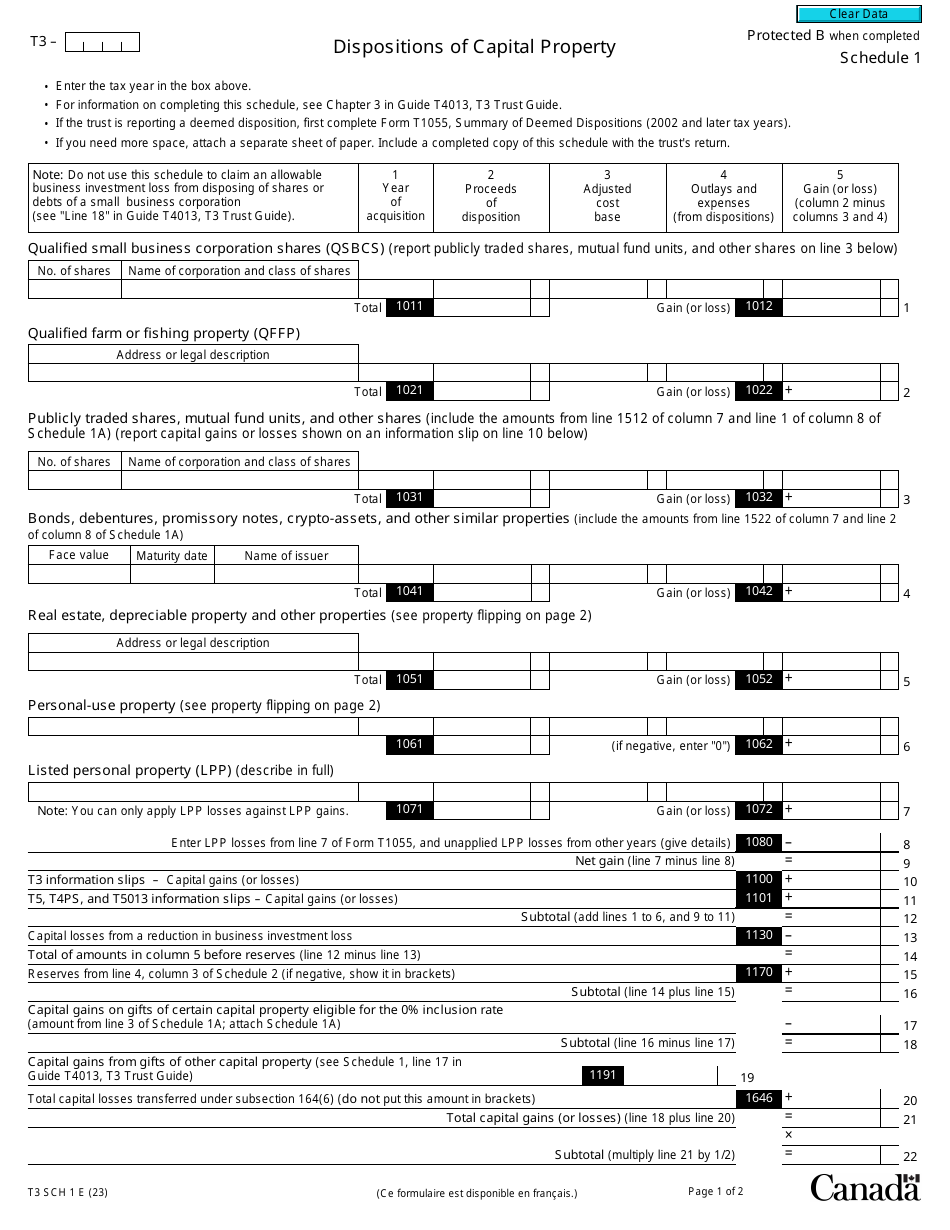

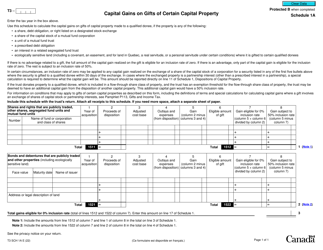

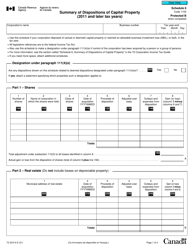

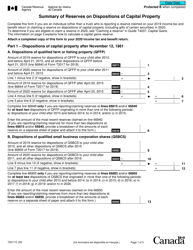

Form T3 Schedule 1 Dispositions of Capital Property - Canada

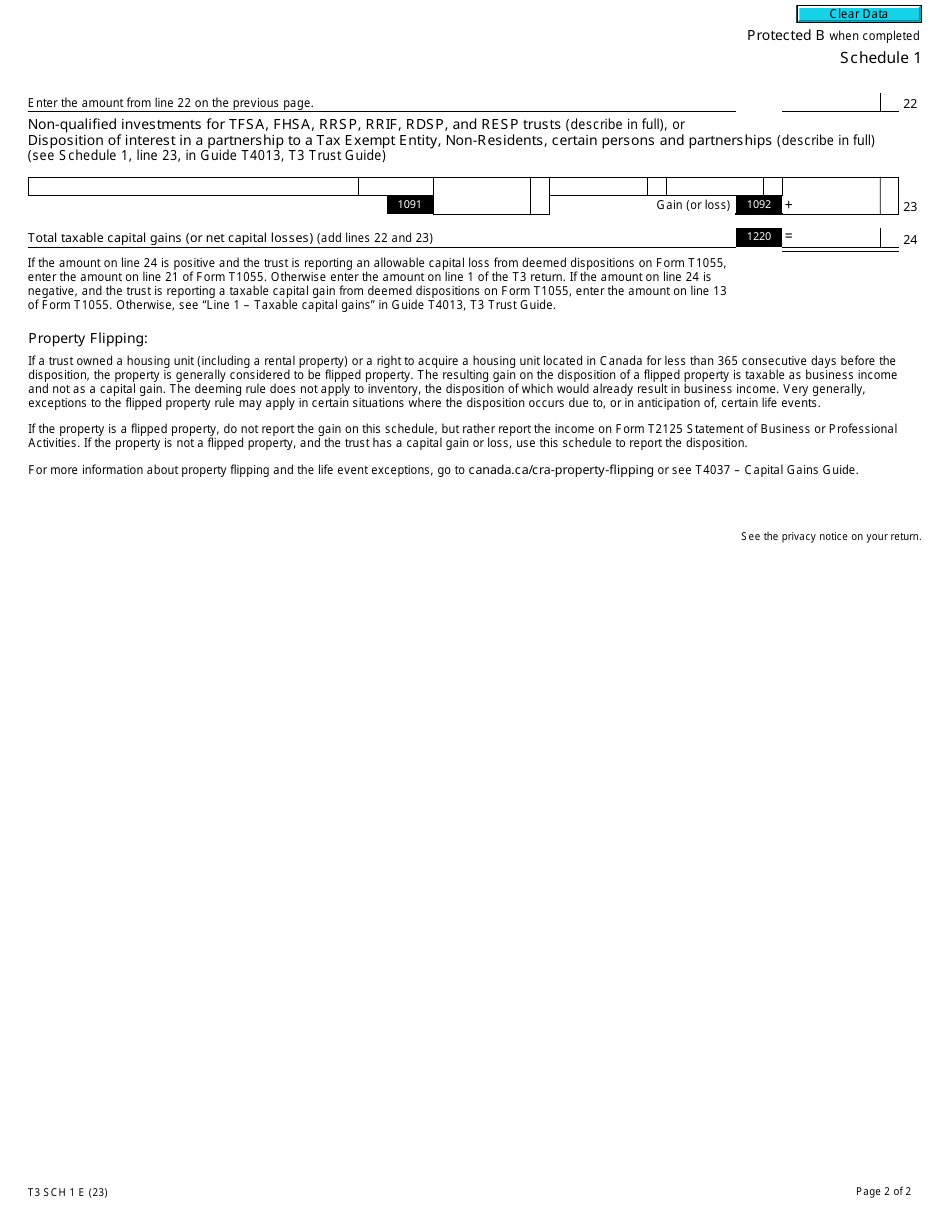

Form T3 Schedule 1 - Dispositions of Capital Property - Canada is used to report the sale or transfer of capital property within the context of a trust return. It helps calculate the capital gains or losses incurred from these dispositions.

The individual or entity who has disposed of capital property in Canada is responsible for filing the Form T3 Schedule 1.

Form T3 Schedule 1 Dispositions of Capital Property - Canada - Frequently Asked Questions (FAQ)

Q: What is Form T3 Schedule 1?

A: Form T3 Schedule 1 is a tax form used in Canada to report dispositions of capital property.

Q: What is a disposition of capital property?

A: A disposition of capital property refers to the sale or transfer of an asset that is considered a capital asset for tax purposes.

Q: Who needs to file Form T3 Schedule 1?

A: Individuals, estates, and trusts that have disposed of capital property in Canada need to file Form T3 Schedule 1.

Q: What information do I need to complete Form T3 Schedule 1?

A: You will need to provide details about the property being disposed of, such as the date of the disposition, the proceeds of disposition, and the cost base of the property.

Q: When is the deadline to file Form T3 Schedule 1?

A: The deadline to file Form T3 Schedule 1 is generally within 90 days after the end of the taxation year in which the disposition occurred.

Q: Is there a fee to file Form T3 Schedule 1?

A: There is currently no fee to file Form T3 Schedule 1.

Q: Do I need to keep a copy of Form T3 Schedule 1 for my records?

A: Yes, it is recommended to keep a copy of Form T3 Schedule 1 and any supporting documentation for your records in case the CRA requests it.

Q: What happens if I don't file Form T3 Schedule 1?

A: If you are required to file Form T3 Schedule 1 and fail to do so, you may face penalties and interest charges imposed by the CRA.