This version of the form is not currently in use and is provided for reference only. Download this version of

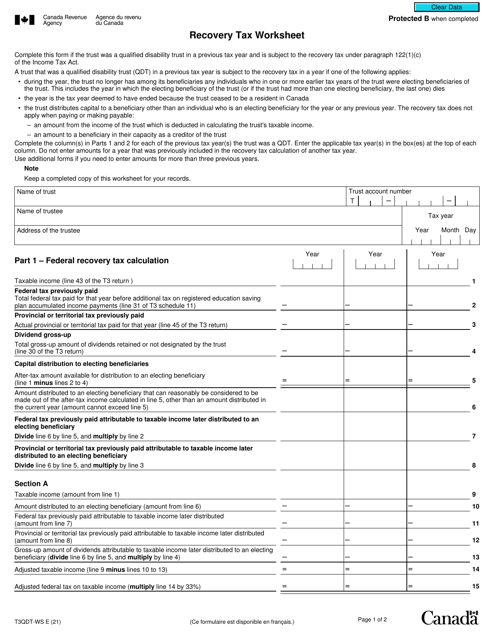

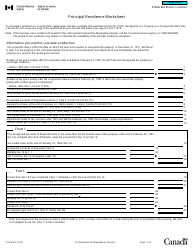

Form T3QDT-WS

for the current year.

Form T3QDT-WS Recovery Tax Worksheet - Canada

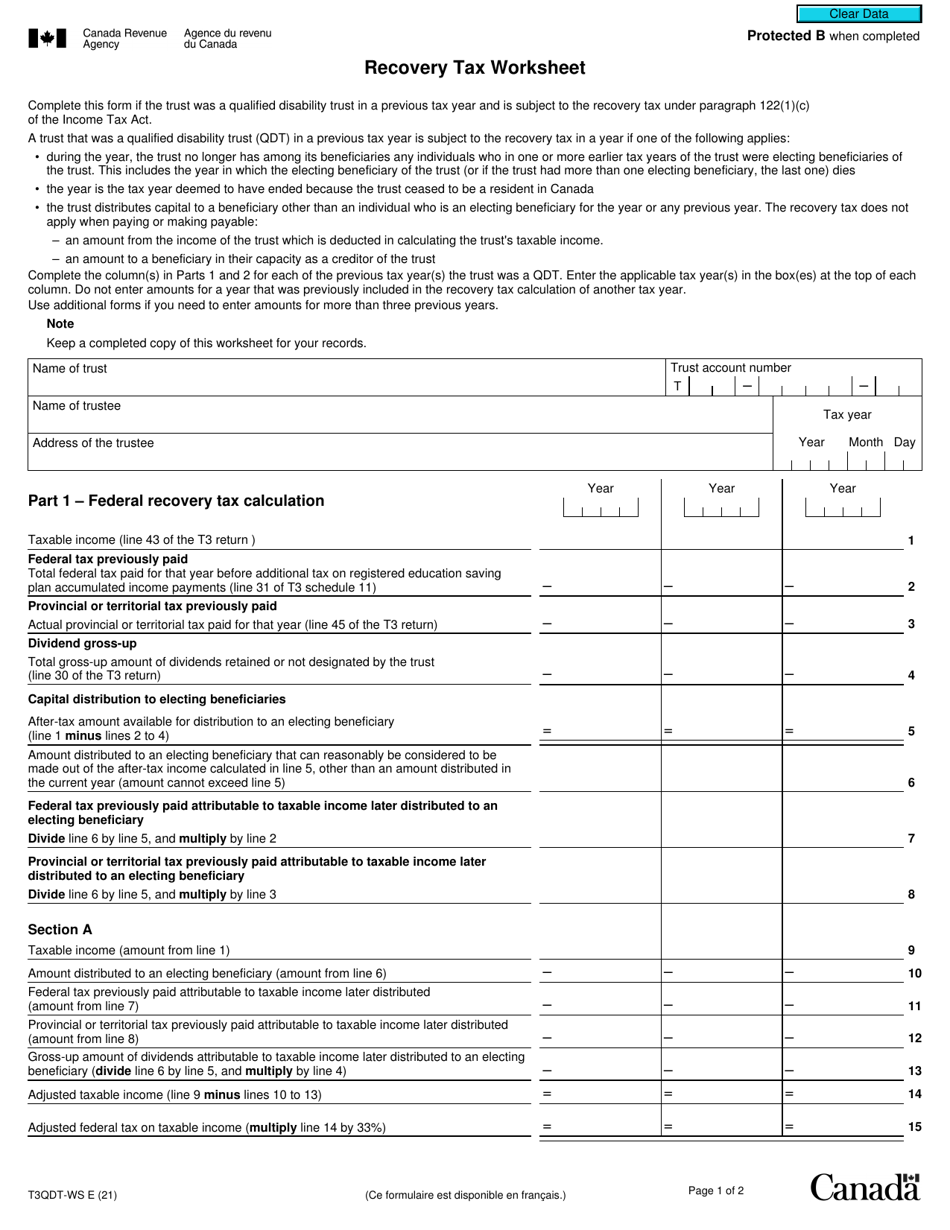

Form T3QDT-WS Recovery Tax Worksheet is a form used in Canada for the purpose of calculating the recovery tax. This tax is applicable to individuals who have received certain specified benefits under the Income Tax Act and have subsequently become non-residents of Canada. The purpose of this worksheet is to assist individuals in determining the amount of recovery tax they owe based on their specific circumstances. It provides a step-by-step calculation process to ensure accurate determination of the recovery tax payable.

The Form T3QDT-WS Recovery Tax Worksheet is filed by individuals in Canada who are claiming a recovery tax for excess minimum tax paid in previous years.

FAQ

Q: What is Form T3QDT-WS?

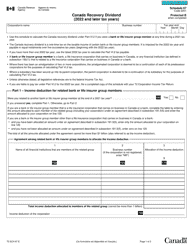

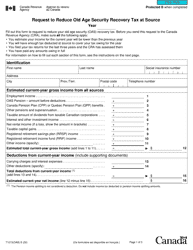

A: Form T3QDT-WS, also known as the Recovery Tax Worksheet, is a worksheet provided by the Canada Revenue Agency (CRA) for individuals and trusts to calculate the Recovery Tax Deduction (RTD).

Q: Who needs to fill out Form T3QDT-WS?

A: Form T3QDT-WS is typically used by individuals and trusts who are claiming the Recovery Tax Deduction (RTD) on their T3 tax return.

Q: What is the purpose of Form T3QDT-WS?

A: The main purpose of Form T3QDT-WS is to help individuals and trusts calculate the amount of Recovery Tax Deduction (RTD) they are eligible for. This deduction can be claimed by individuals and trusts who had previously included income from a qualified investment held outside a registered plan in their income.

Q: How do I fill out Form T3QDT-WS?

A: To fill out Form T3QDT-WS, you will need to refer to the instructions provided by the CRA. The worksheet requires you to enter specific information related to your qualified investment and calculate the corresponding Recovery Tax Deduction (RTD). Make sure to review all the instructions and enter the information accurately.

Q: When is the deadline to file Form T3QDT-WS?

A: The deadline to file Form T3QDT-WS is the same as the deadline to file your T3 tax return. Generally, the T3 tax return for individuals and trusts is due by June 30th of the following year.

Q: Do I need to include Form T3QDT-WS with my tax return?

A: No, you do not need to include Form T3QDT-WS with your tax return. The completed worksheet should be kept for your records and only submitted if requested by the Canada Revenue Agency (CRA). However, make sure to properly report the calculated Recovery Tax Deduction (RTD) on your T3 tax return.

Q: Are there any penalties for not filing Form T3QDT-WS?

A: If you are eligible for the Recovery Tax Deduction (RTD) and do not file Form T3QDT-WS or report the deduction on your T3 tax return, you may be subject to penalties or interest charges imposed by the Canada Revenue Agency (CRA). It is important to accurately report all eligible deductions to avoid any potential penalties.