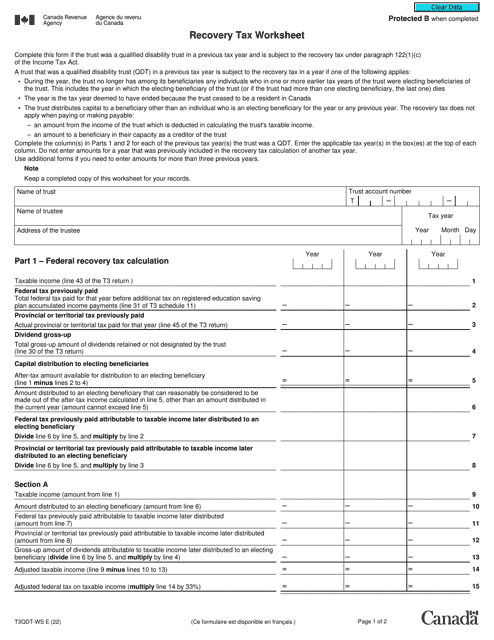

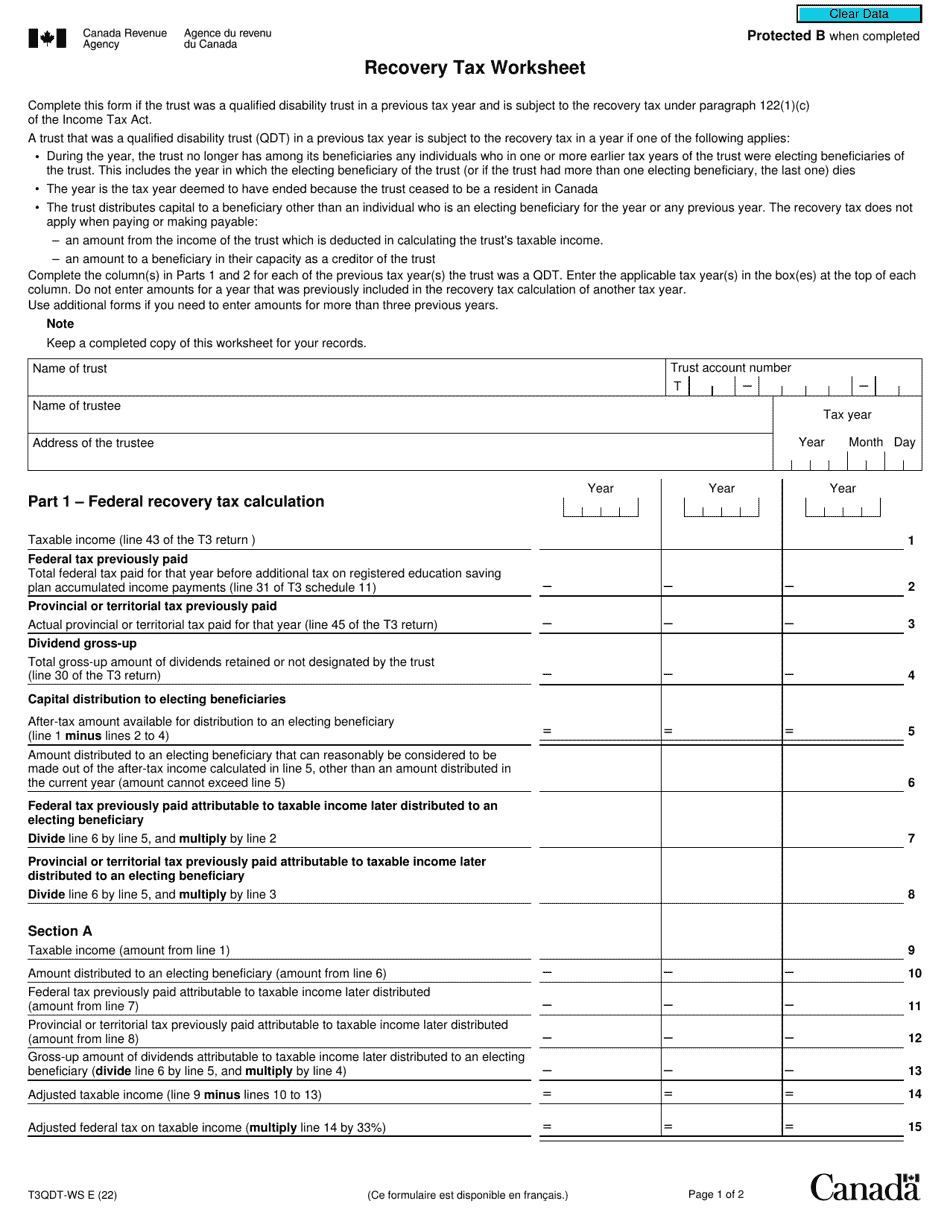

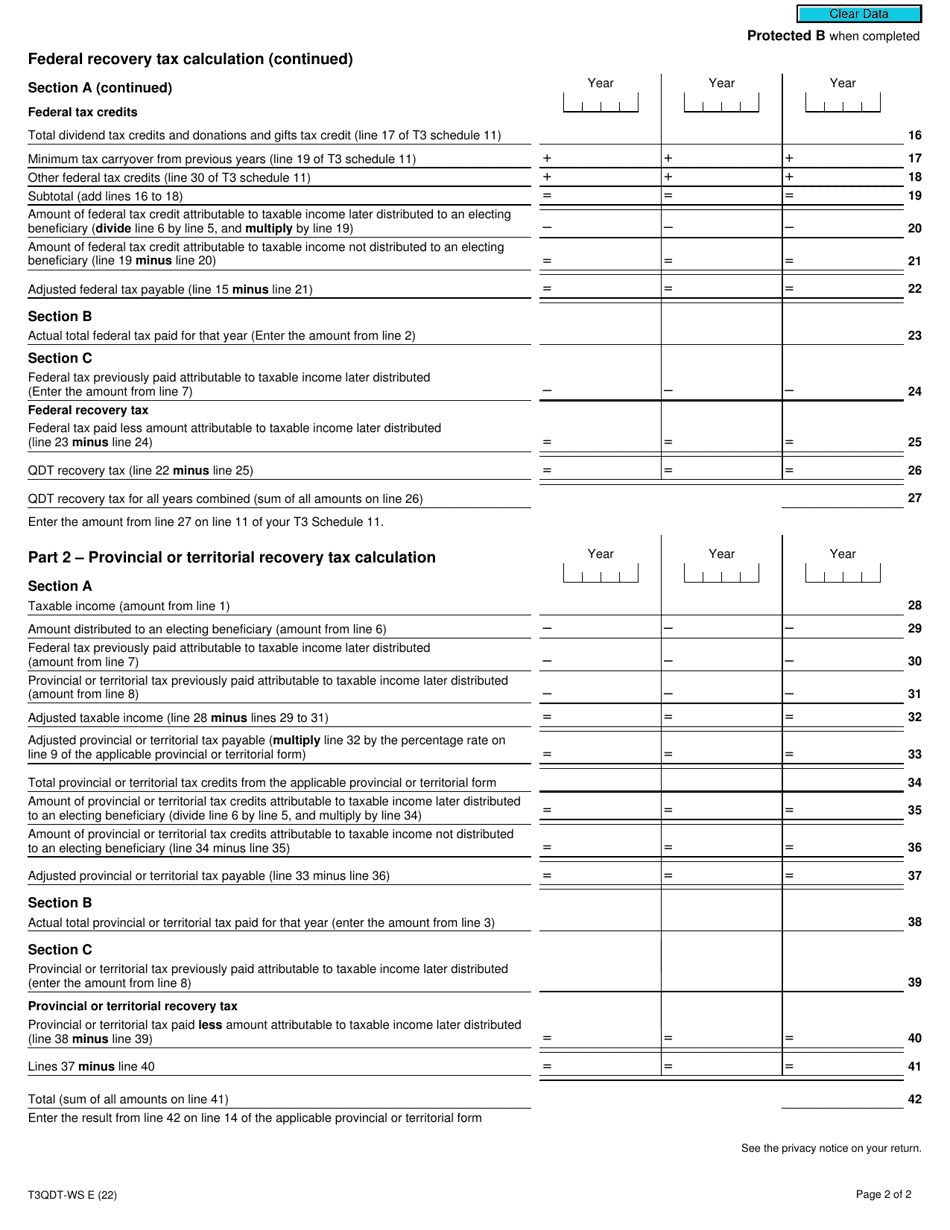

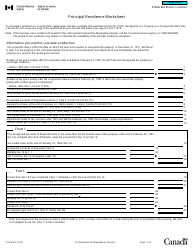

Form T3QDT-WS Recovery Tax Worksheet - Canada

The Form T3QDT-WS Recovery Tax Worksheet is used in Canada to calculate the amount of the recovery tax payable on an excess refund of an investment tax credit.

The Form T3QDT-WS Recovery Tax Worksheet in Canada is typically filed by individuals who are eligible to claim the recovery tax.

Form T3QDT-WS Recovery Tax Worksheet - Canada - Frequently Asked Questions (FAQ)

Q: What is Form T3QDT-WS?

A: Form T3QDT-WS is the Recovery Tax Worksheet used in Canada.

Q: What is the purpose of the Recovery Tax Worksheet?

A: The purpose of the Recovery Tax Worksheet is to calculate the recovery tax deducted from an estate or trust in Canada.

Q: What does T3QDT-WS stand for?

A: T3QDT-WS is an abbreviation for Trust Tax and Information Return - Worksheet.

Q: Who uses Form T3QDT-WS?

A: Form T3QDT-WS is used by estates and trusts in Canada.

Q: What information is needed to complete the Recovery Tax Worksheet?

A: To complete the Recovery Tax Worksheet, you will need information about the estate or trust's income, deductions, and tax credits.

Q: Is Form T3QDT-WS only used in Canada?

A: Yes, Form T3QDT-WS is specific to Canada and is used for Canadian tax purposes.