This version of the form is not currently in use and is provided for reference only. Download this version of

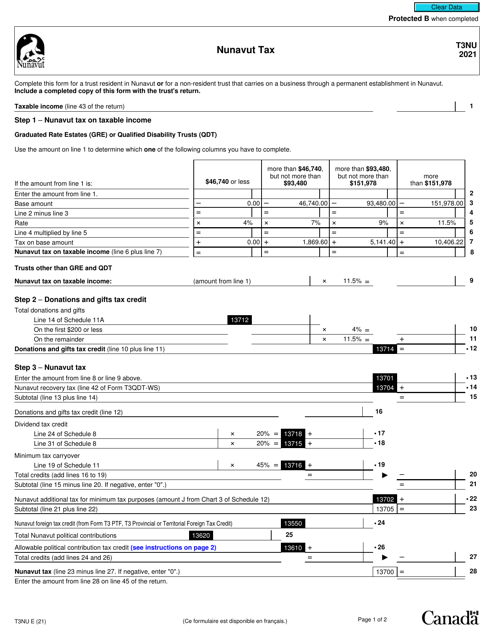

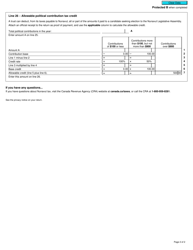

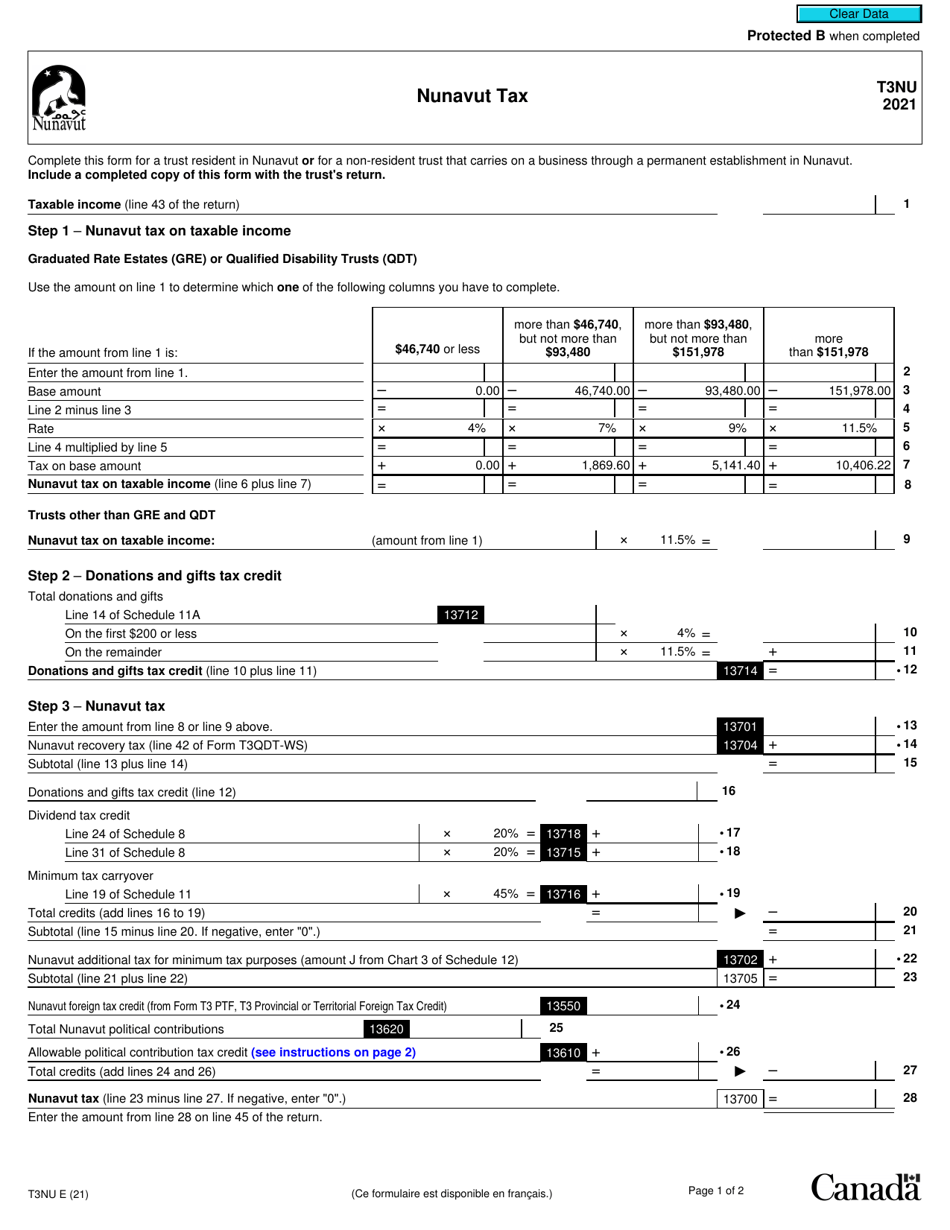

Form T3NU

for the current year.

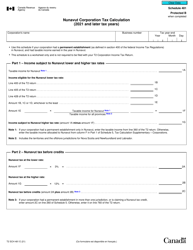

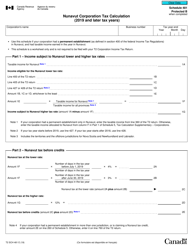

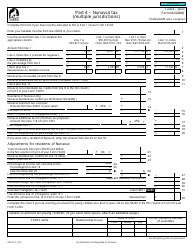

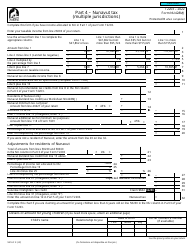

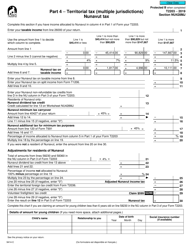

Form T3NU Nunavut Tax - Canada

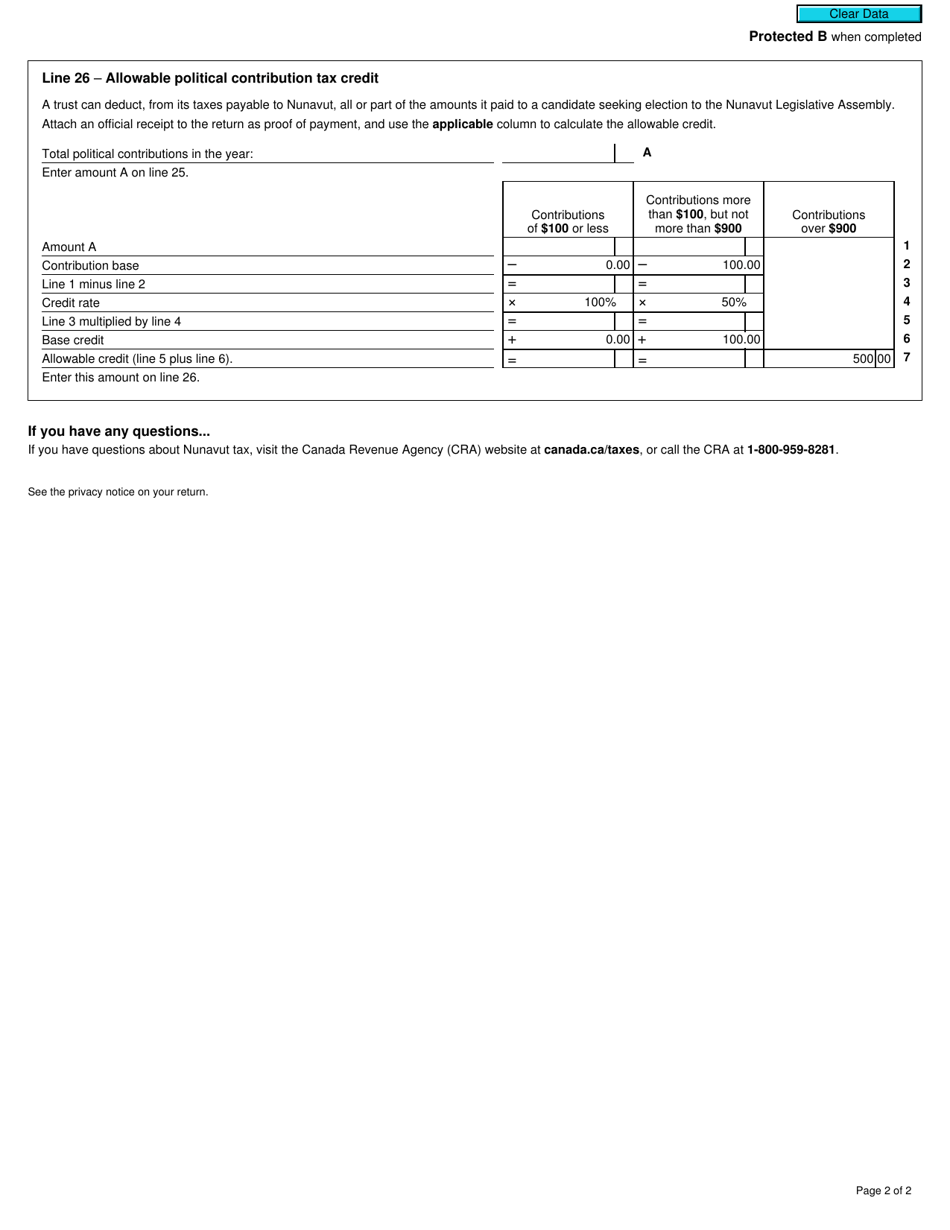

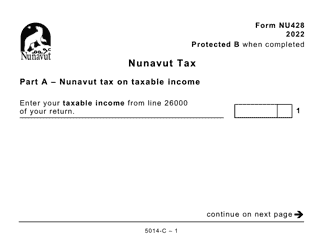

Form T3NU, also known as the Nunavut Tax Return, is used by residents of Nunavut, a territory in Canada, to report their income, deductions, and credits for the purpose of calculating and paying their provincial or territorial taxes. It is specifically designed for individuals who are residents of Nunavut and have income to report from sources within Nunavut.

The Form T3NU Nunavut Tax in Canada is filed by individuals who are residents of Nunavut and have taxable income for the tax year.

FAQ

Q: What is Form T3NU?

A: Form T3NU is a tax form used by residents of Nunavut, Canada to report their income and calculate their provincial tax liability.

Q: Who needs to file Form T3NU?

A: Residents of Nunavut, Canada who have earned income or have tax payable during the tax year must file Form T3NU.

Q: What information is required to fill out Form T3NU?

A: To fill out Form T3NU, you will need to provide your personal information, details of your income, and any deductions or credits you may be eligible for.

Q: When is the deadline to file Form T3NU?

A: The deadline to file Form T3NU in Nunavut, Canada is usually April 30th of each year, unless it falls on a weekend or holiday, in which case the deadline is extended to the next business day.

Q: Are there any penalties for late filing of Form T3NU?

A: Yes, if you file your Form T3NU after the deadline, you may be subject to penalties and interest charges on any unpaid tax amounts.

Q: Can I file Form T3NU electronically?

A: Yes, residents of Nunavut, Canada have the option to file Form T3NU electronically using the CRA's NETFILE service or through certified tax software.

Q: Do I need to include supporting documents with Form T3NU?

A: You generally do not need to attach supporting documents when filing Form T3NU, but you should keep them in case the CRA requests them for verification purposes.

Q: Can I get help filling out Form T3NU?

A: Yes, if you need help filling out Form T3NU, you can consult the instructions provided by the CRA or seek assistance from a tax professional.

Q: What happens after I file Form T3NU?

A: After you file Form T3NU, the CRA will assess your tax return and issue a notice of assessment, which will indicate whether you have a refund or balance owing.