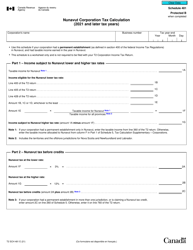

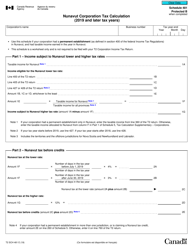

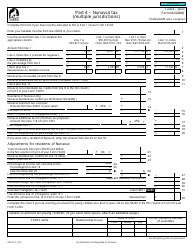

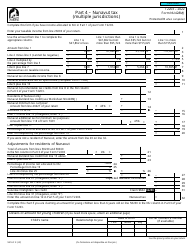

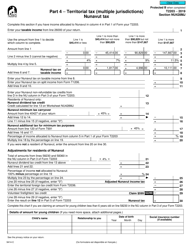

Form T3NU Nunavut Tax - Canada

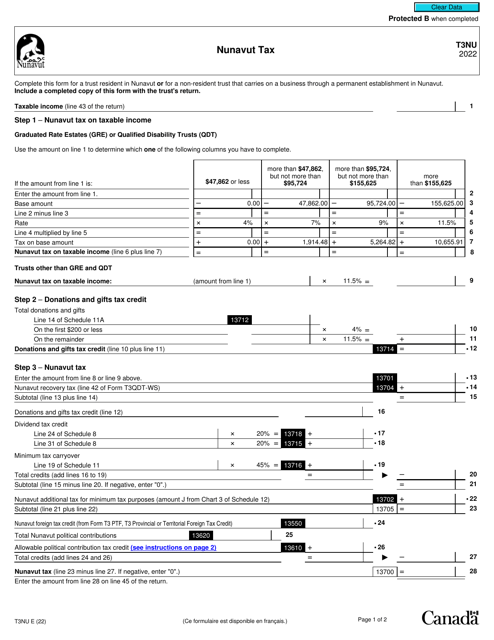

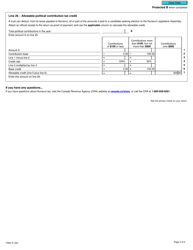

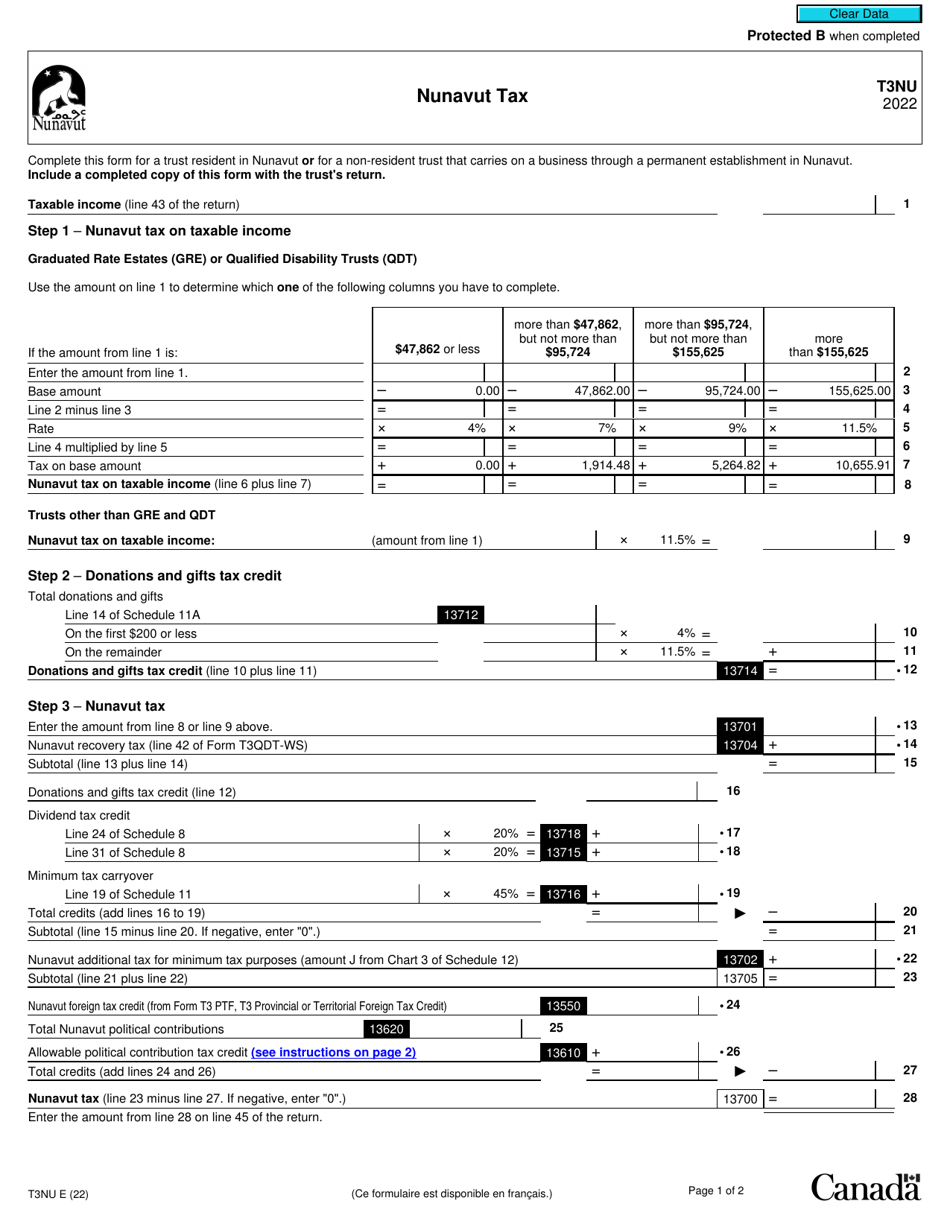

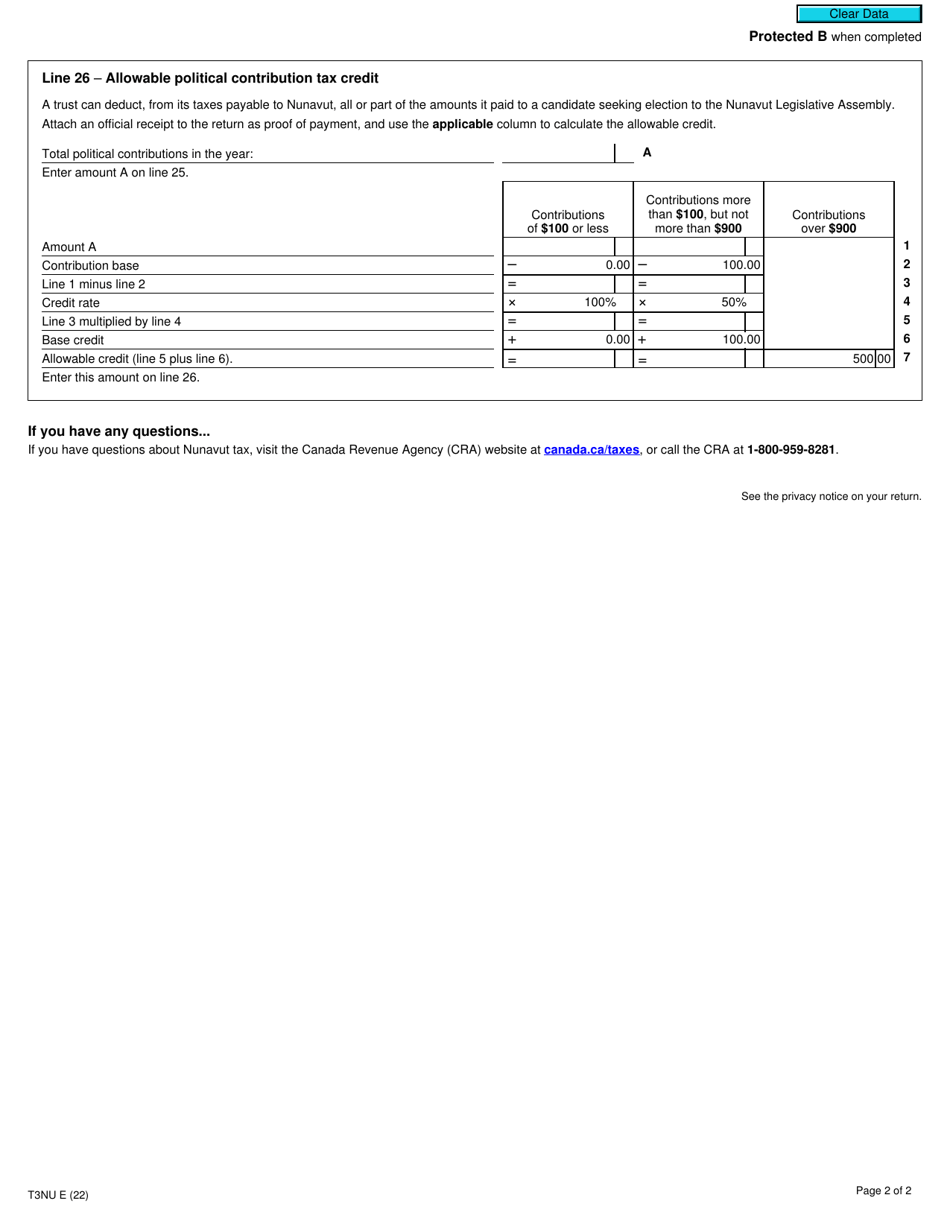

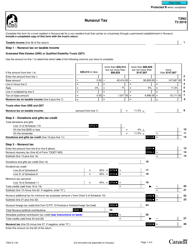

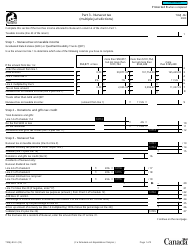

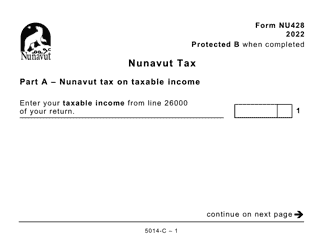

Form T3NU, also known as Nunavut Tax, is used by residents of Nunavut, a territory in Canada, to report their income, deductions, and tax credits specific to Nunavut. This form is used to calculate and pay the Nunavut territorial tax, which is separate from the federal income tax.

Individuals or businesses who are residents of Nunavut and have taxable income in Nunavut are required to file the Form T3NU Nunavut Tax.

Form T3NU Nunavut Tax - Canada - Frequently Asked Questions (FAQ)

Q: What is Form T3NU?

A: Form T3NU is a tax form used in Nunavut, Canada.

Q: Who needs to file Form T3NU?

A: Residents of Nunavut who have taxable income and meet specific criteria must file Form T3NU.

Q: What is Nunavut tax?

A: Nunavut tax refers to the provincial or territorial tax imposed on residents of Nunavut.

Q: When is the deadline for filing Form T3NU?

A: The deadline for filing Form T3NU is usually April 30th of each year, unless it falls on a weekend or holiday.

Q: What should I include when filing Form T3NU?

A: When filing Form T3NU, you should include information about your income, deductions, and credits.

Q: Are there penalties for late filing of Form T3NU?

A: Yes, there may be penalties for late filing of Form T3NU, so it's important to file by the deadline.