This version of the form is not currently in use and is provided for reference only. Download this version of

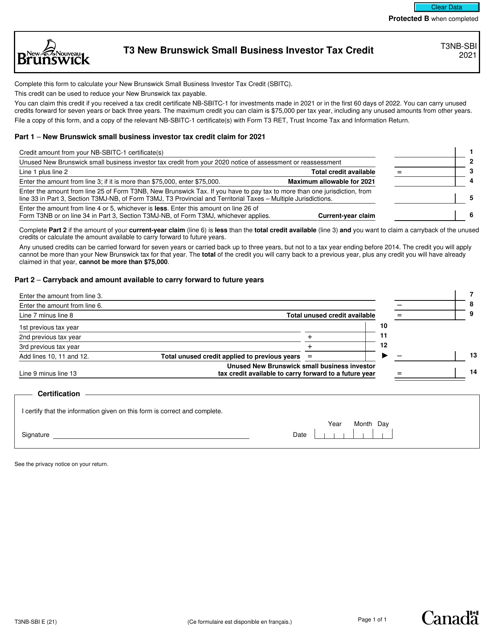

Form T3NB-SBI

for the current year.

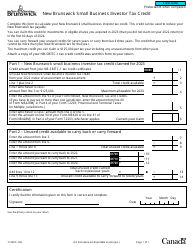

Form T3NB-SBI New Brunswick Small Business Investor Tax Credit - Canada

Form T3NB-SBI is used for claiming the New Brunswick Small Business Investor Tax Credit in Canada. This credit is available to individuals who have invested in eligible small businesses in New Brunswick and allows them to reduce their taxes payable.

The Form T3NB-SBI New Brunswick Small Business Investor Tax Credit in Canada is filed by individuals who meet the eligibility criteria for the tax credit. They must be small business investors in New Brunswick.

FAQ

Q: What is Form T3NB-SBI?

A: Form T3NB-SBI is a tax form used in New Brunswick, Canada to claim the Small Business Investor Tax Credit.

Q: Who is eligible to use Form T3NB-SBI?

A: Individuals who have invested in eligible small businesses in New Brunswick are eligible to use Form T3NB-SBI.

Q: What is the Small Business Investor Tax Credit?

A: The Small Business Investor Tax Credit is a tax credit offered by the government of New Brunswick to incentivize investment in small businesses in the province.

Q: What is the purpose of Form T3NB-SBI?

A: The purpose of Form T3NB-SBI is to claim the Small Business Investor Tax Credit for investments made in eligible small businesses in New Brunswick.

Q: Are there any deadlines for filing Form T3NB-SBI?

A: Yes, Form T3NB-SBI must be filed within the prescribed deadline set by the government of New Brunswick. It is recommended to consult the official guidelines or a tax professional for the specific deadline.

Q: What supporting documents do I need to include with Form T3NB-SBI?

A: Supporting documents such as investment certificates or statements from the eligible small businesses may be required to be submitted along with Form T3NB-SBI. It is advised to refer to the official guidelines for the specific requirements.

Q: Can I claim the Small Business Investor Tax Credit for investments made outside of New Brunswick?

A: No, the Small Business Investor Tax Credit is specifically for investments made in eligible small businesses in New Brunswick.

Q: What are the benefits of claiming the Small Business Investor Tax Credit?

A: By claiming the Small Business Investor Tax Credit, individuals can reduce their tax liability and support the growth of small businesses in New Brunswick.