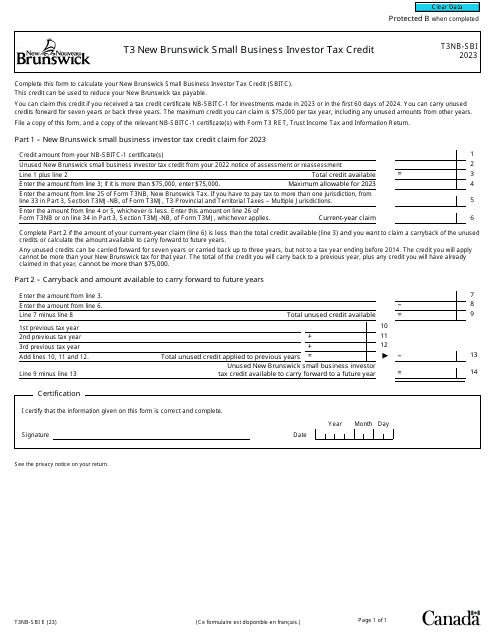

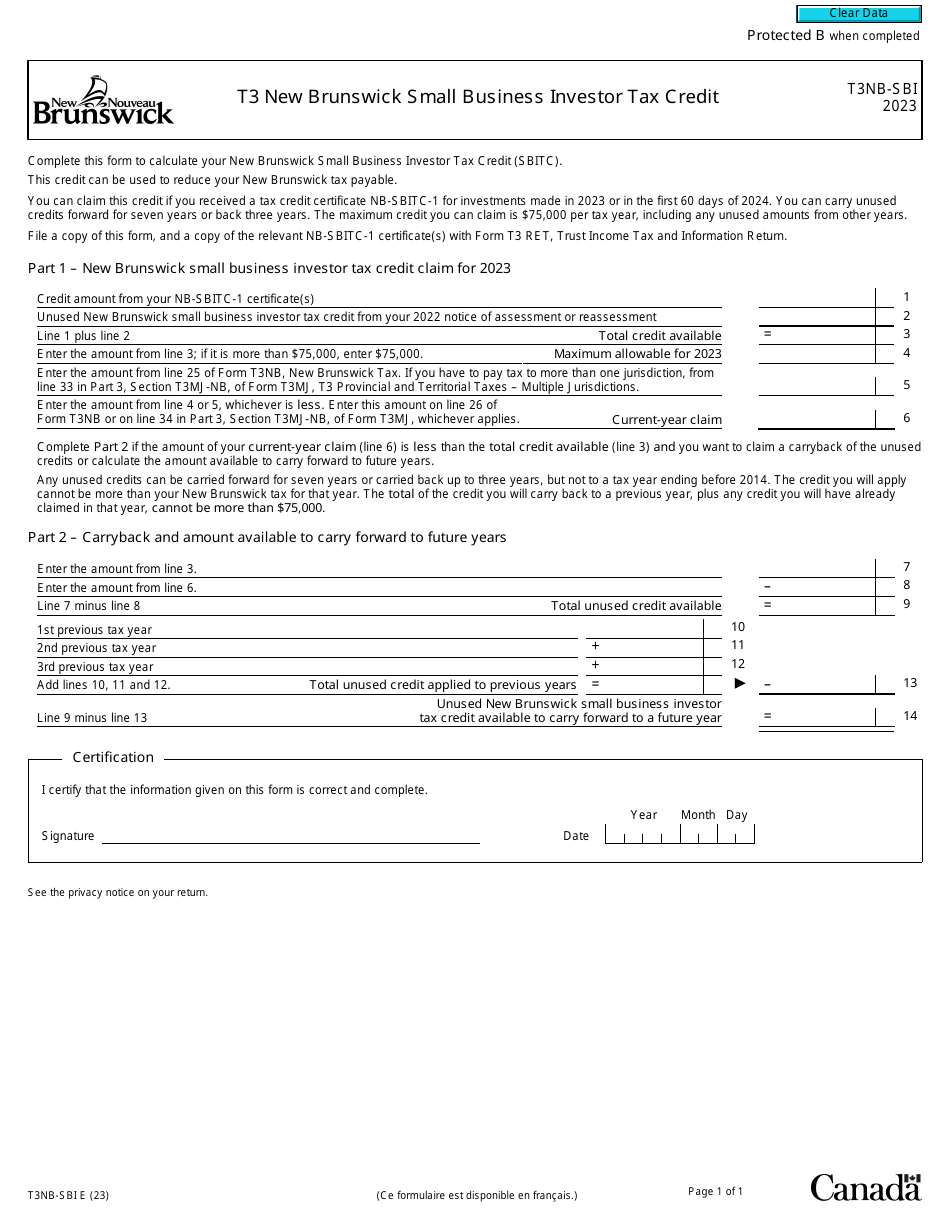

Form T3NB-SBI New Brunswick Small Business Investor Tax Credit - Canada

Form T3NB-SBI is used in Canada for claiming the New Brunswick Small Business Investor Tax Credit. This tax credit is available to individuals who invest in eligible small businesses in New Brunswick to support economic growth in the province.

The Form T3NB-SBI New Brunswick Small Business Investor Tax Credit is filed by individual taxpayers who have invested in eligible small businesses in the province of New Brunswick, Canada.

Form T3NB-SBI New Brunswick Small Business Investor Tax Credit - Canada - Frequently Asked Questions (FAQ)

Q: What is Form T3NB-SBI?

A: Form T3NB-SBI is a tax form used in New Brunswick, Canada for claiming the Small Business Investor Tax Credit.

Q: What is the Small Business Investor Tax Credit?

A: The Small Business Investor Tax Credit is a tax credit offered by the New Brunswick government to encourage investment in small businesses.

Q: Who is eligible for the Small Business Investor Tax Credit?

A: Individuals or corporations who invest in eligible small businesses in New Brunswick may be eligible for the tax credit.

Q: How much is the Small Business Investor Tax Credit?

A: The tax credit is equal to 50% of the eligible investment, up to a maximum credit of $125,000 per year.

Q: What is the purpose of Form T3NB-SBI?

A: Form T3NB-SBI is used to report the details of the eligible investment and calculate the tax credit amount.

Q: When is the deadline for filing Form T3NB-SBI?

A: The deadline for filing Form T3NB-SBI is usually April 30th of the year following the tax year in which the investment was made.

Q: Can I claim the Small Business Investor Tax Credit if I don't live in New Brunswick?

A: No, the tax credit is only available to individuals or corporations who are residents of New Brunswick.

Q: Are there any other requirements to be eligible for the tax credit?

A: Yes, there are additional requirements such as the investment must be made in an eligible small business and the investment must be held for a minimum period of time.

Q: How do I calculate the eligible investment amount?

A: The eligible investment amount is calculated by subtracting any federal or provincial assistance received for the investment from the total investment amount.