This version of the form is not currently in use and is provided for reference only. Download this version of

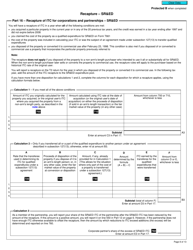

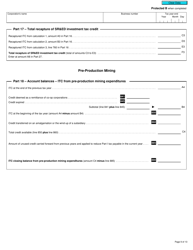

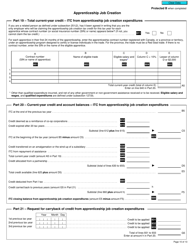

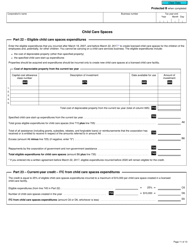

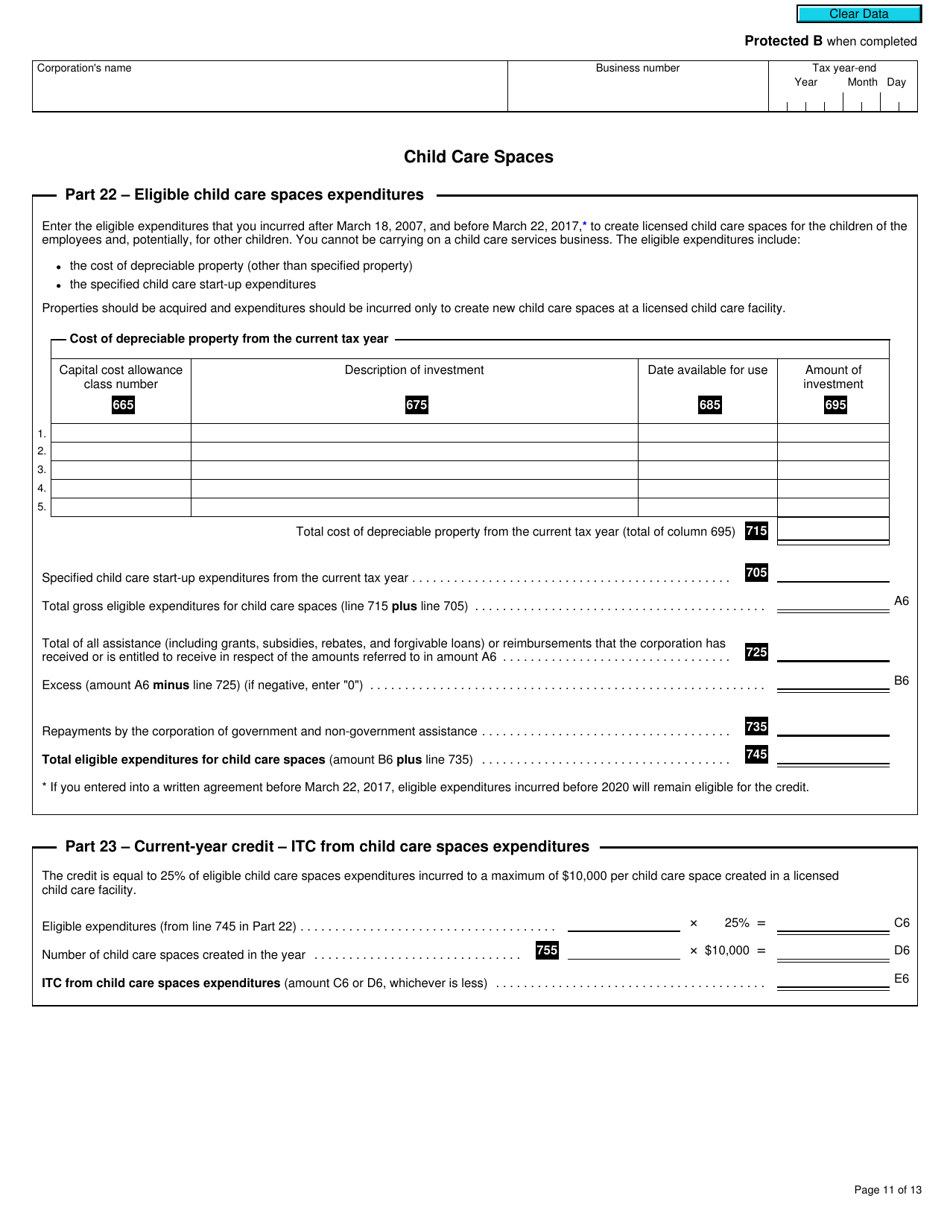

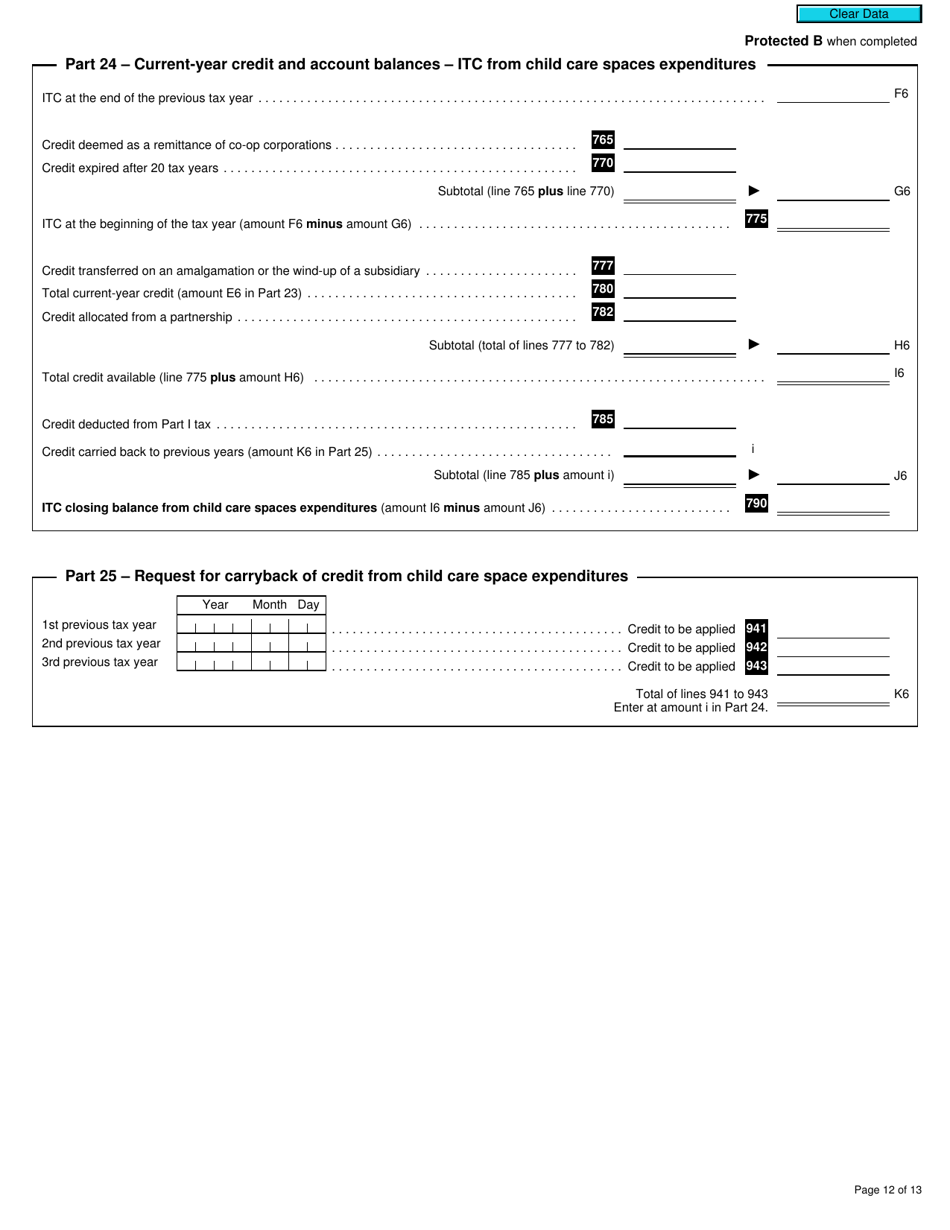

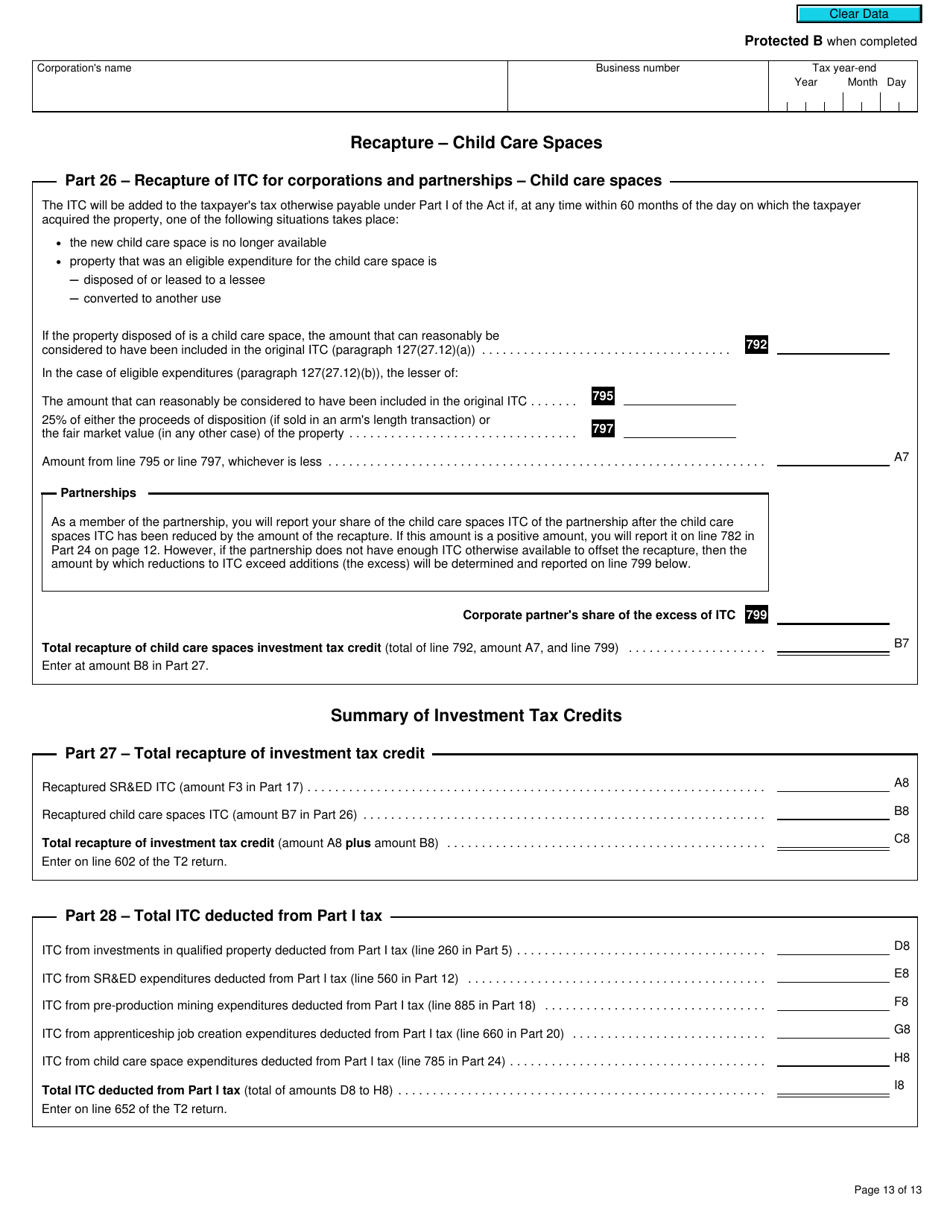

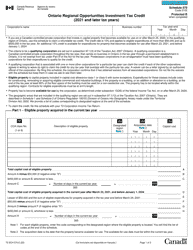

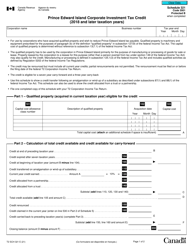

Form T2 Schedule 31

for the current year.

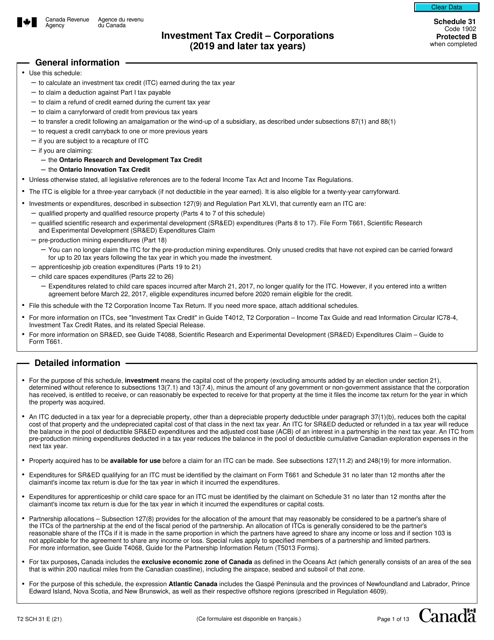

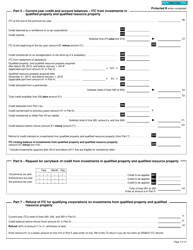

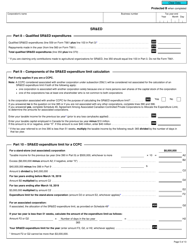

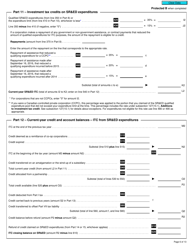

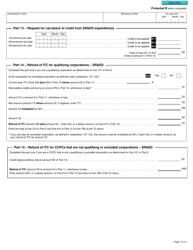

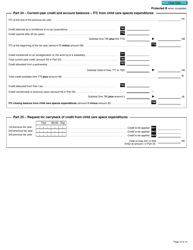

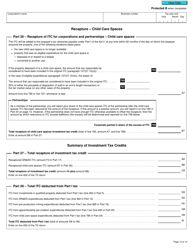

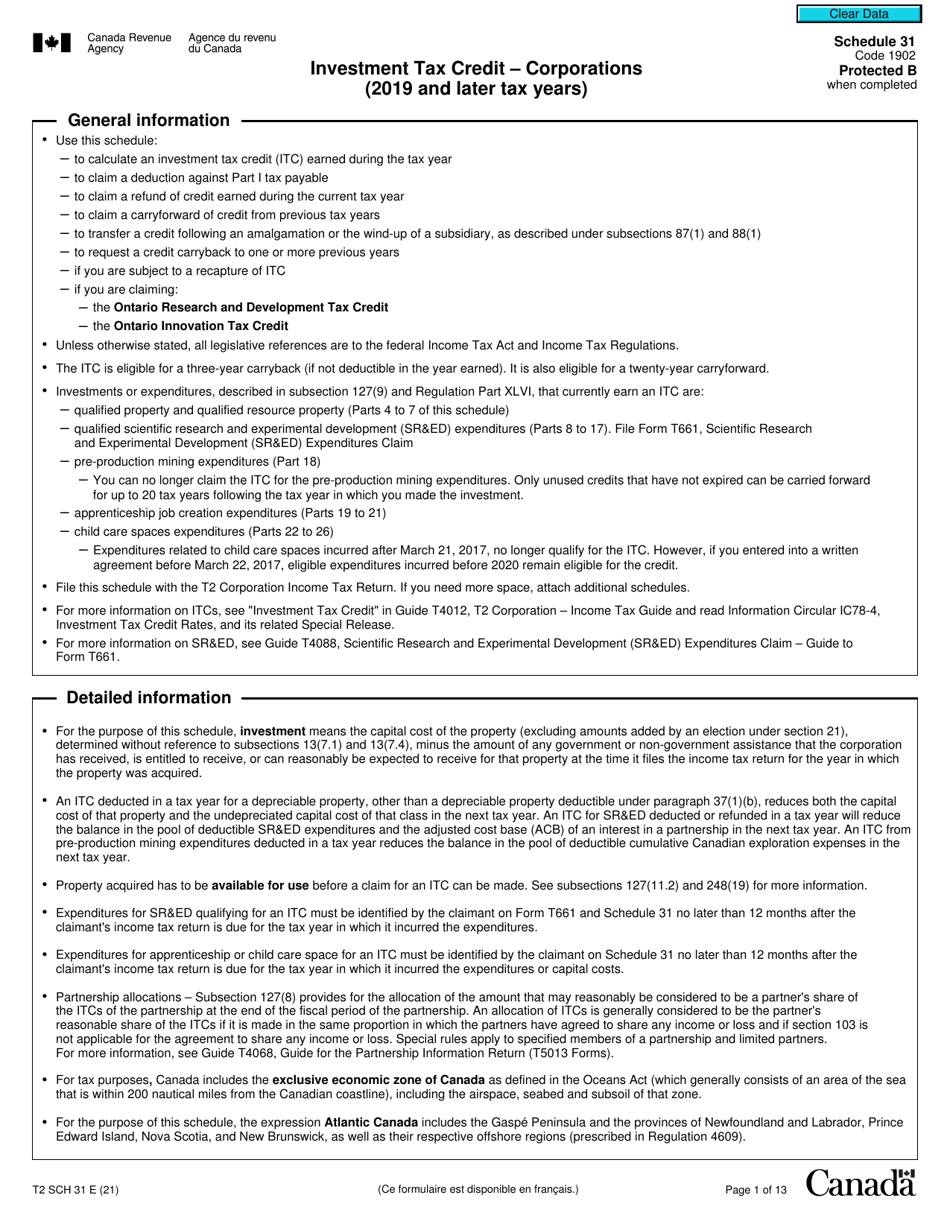

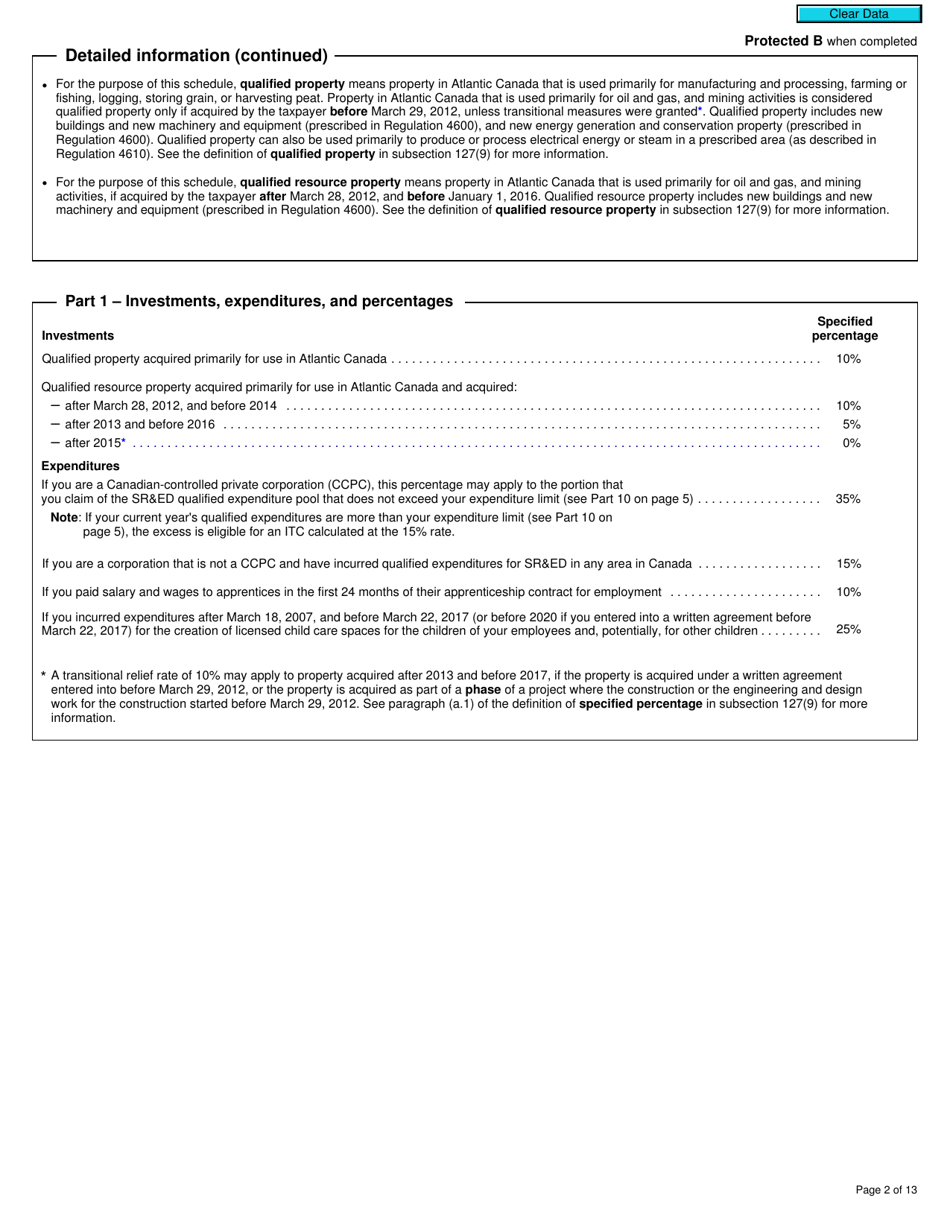

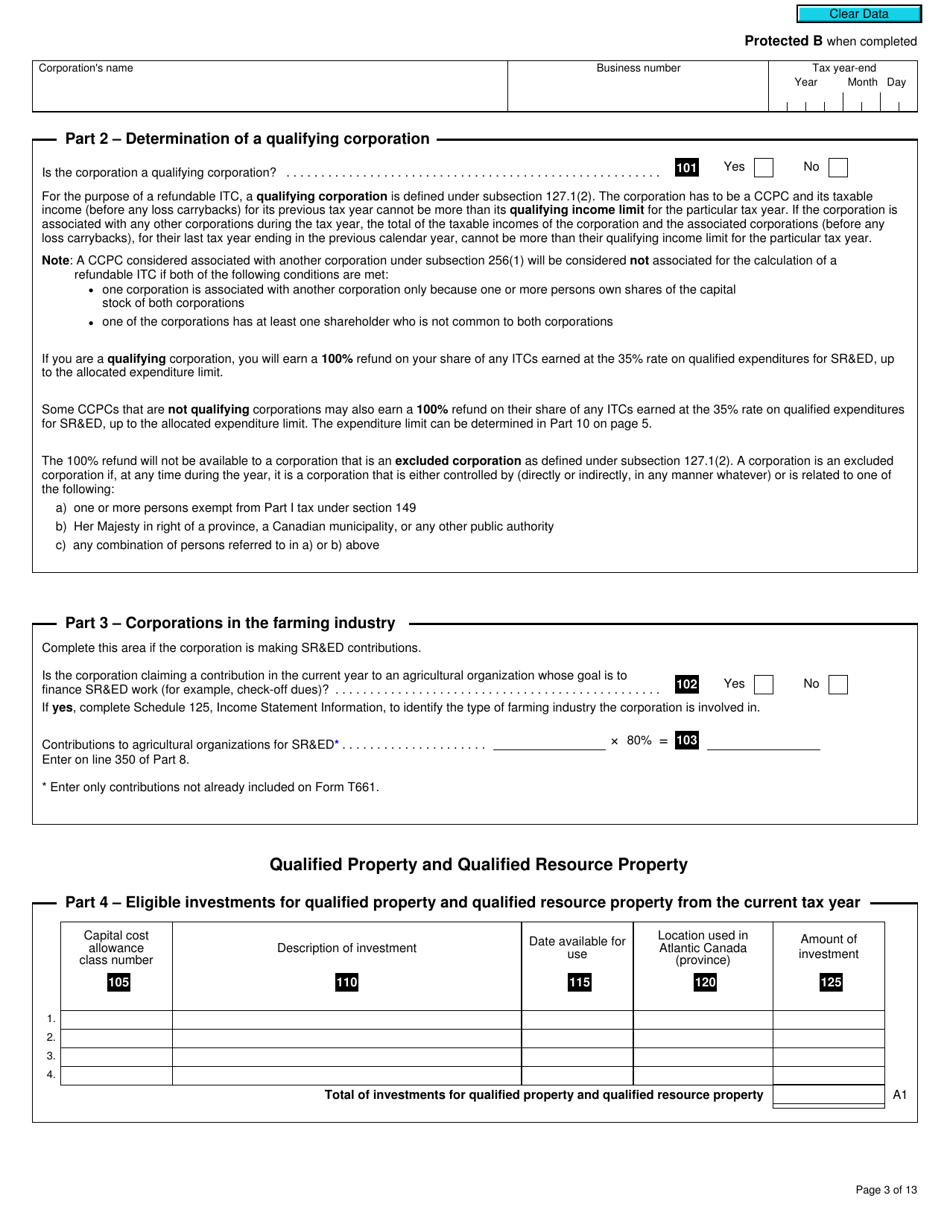

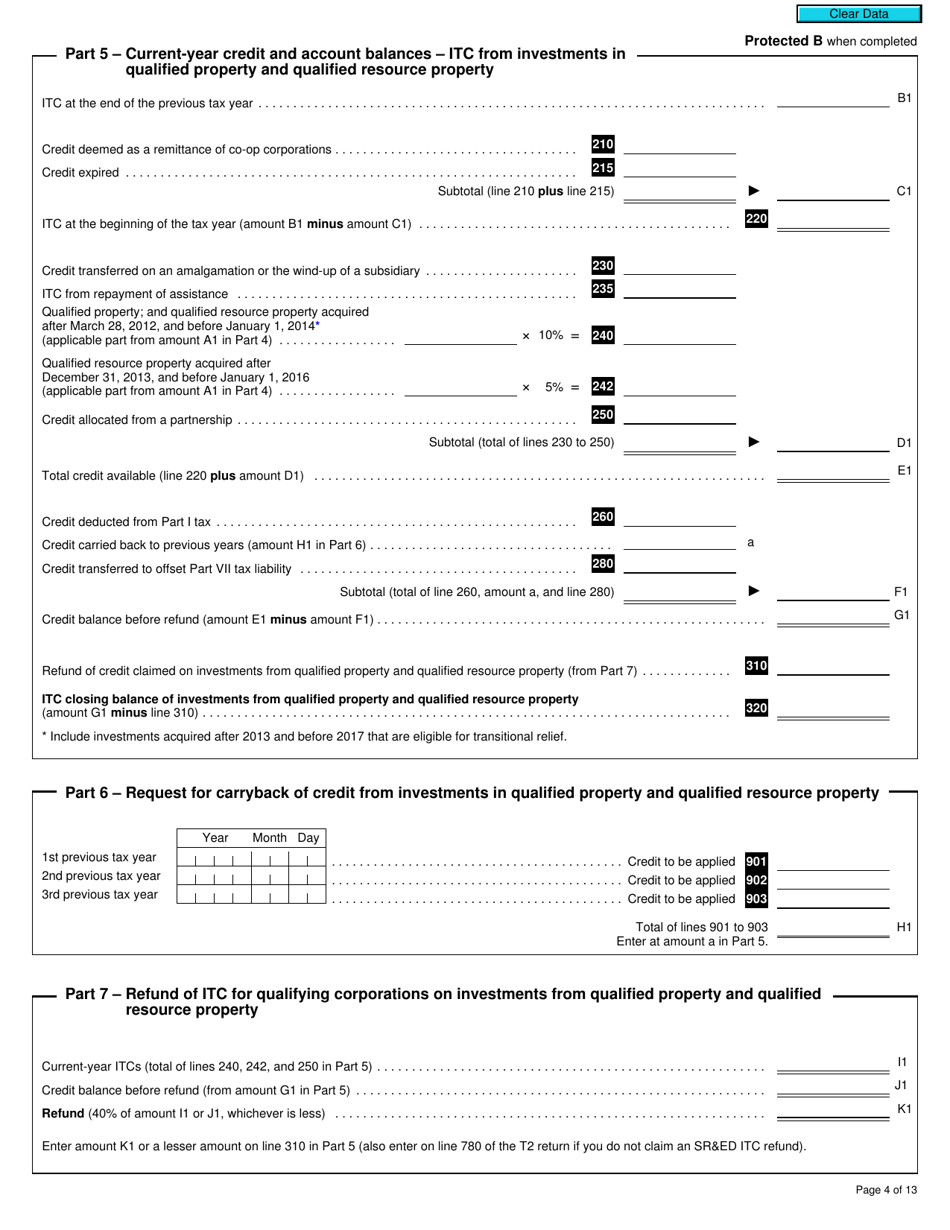

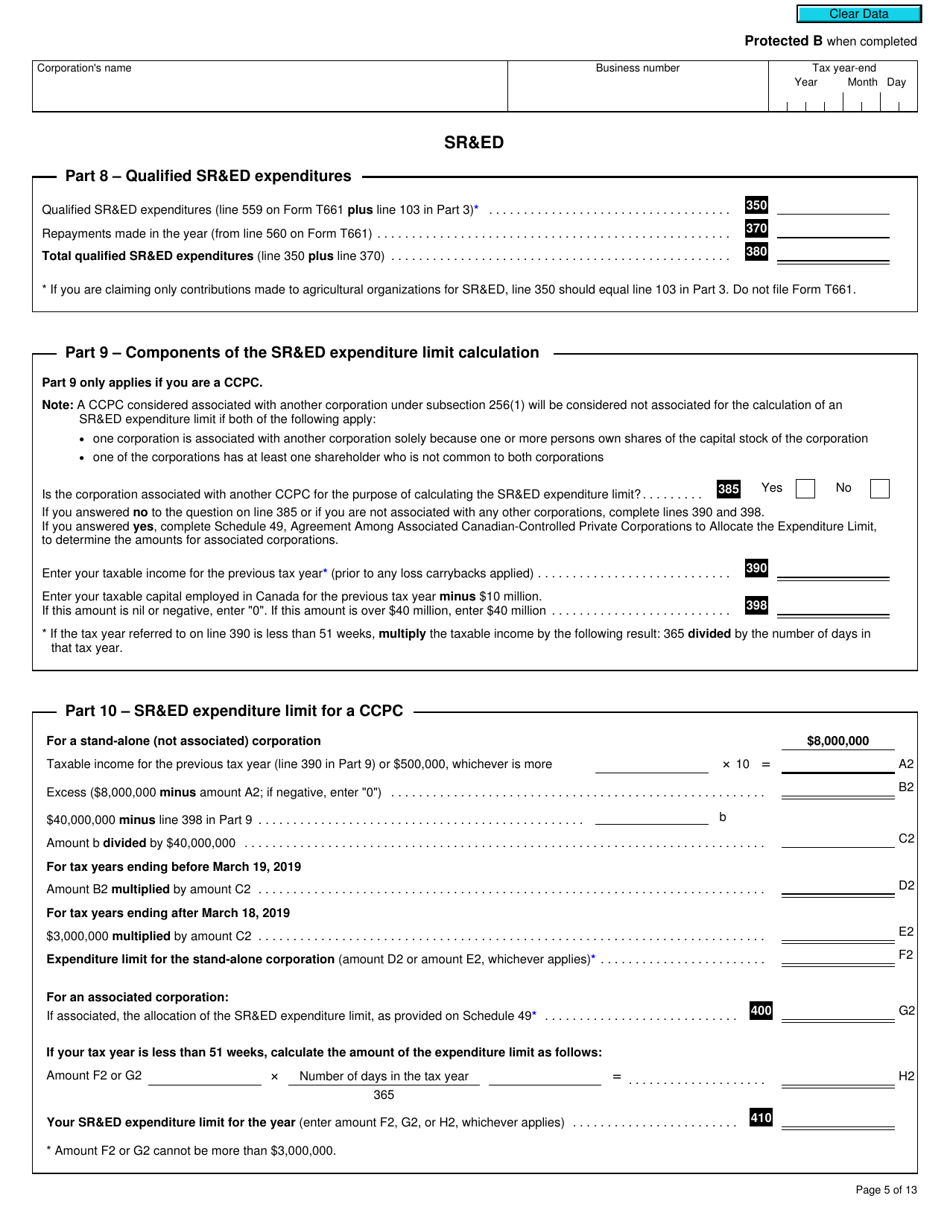

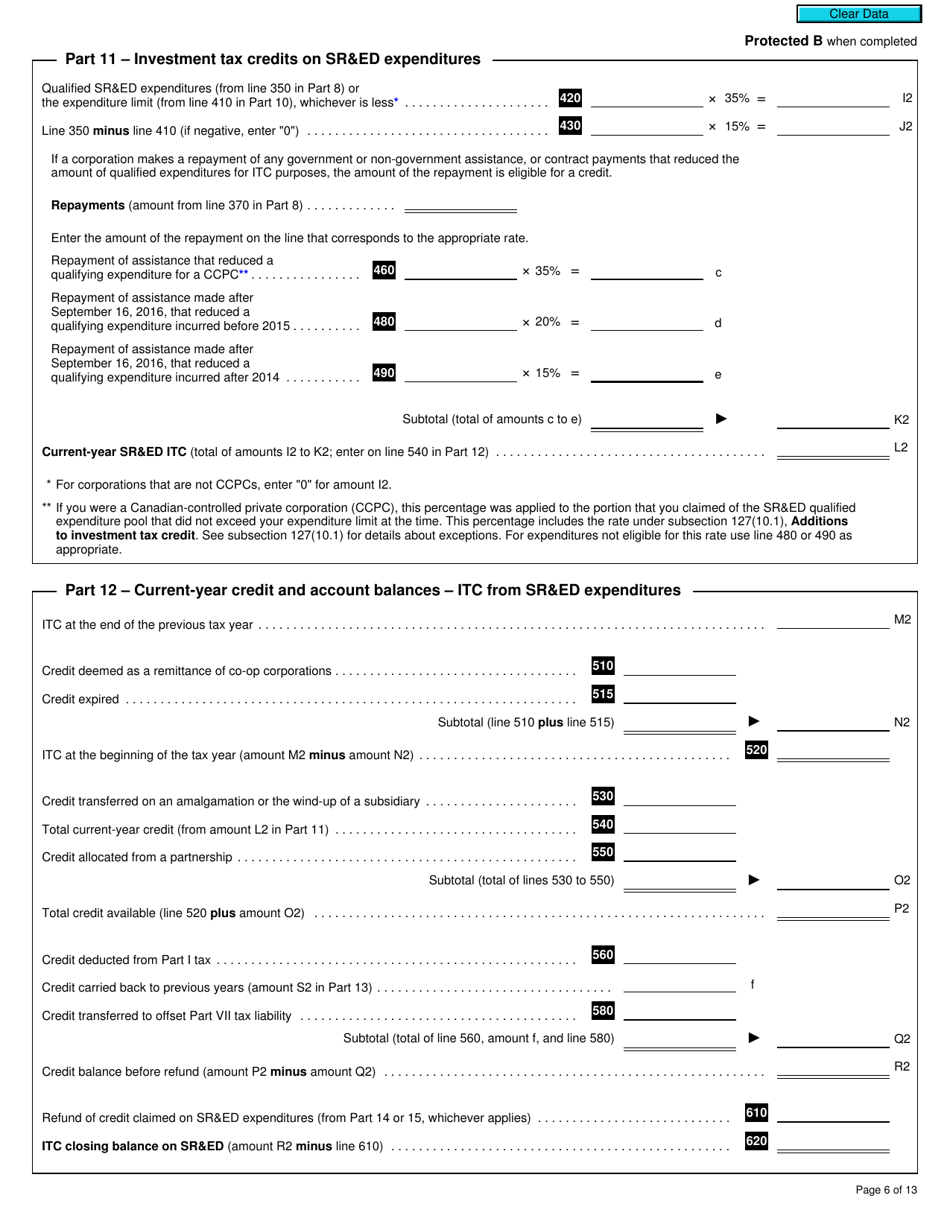

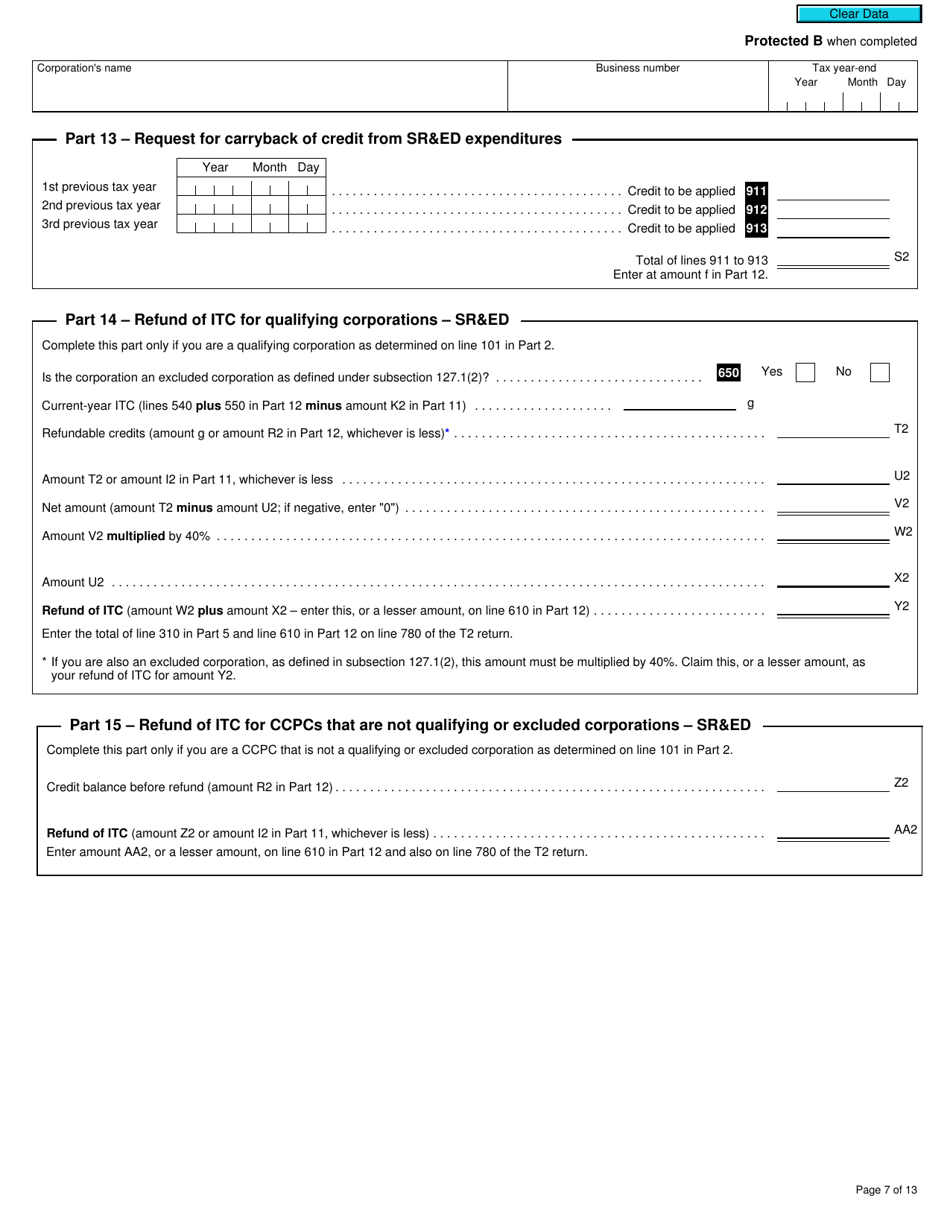

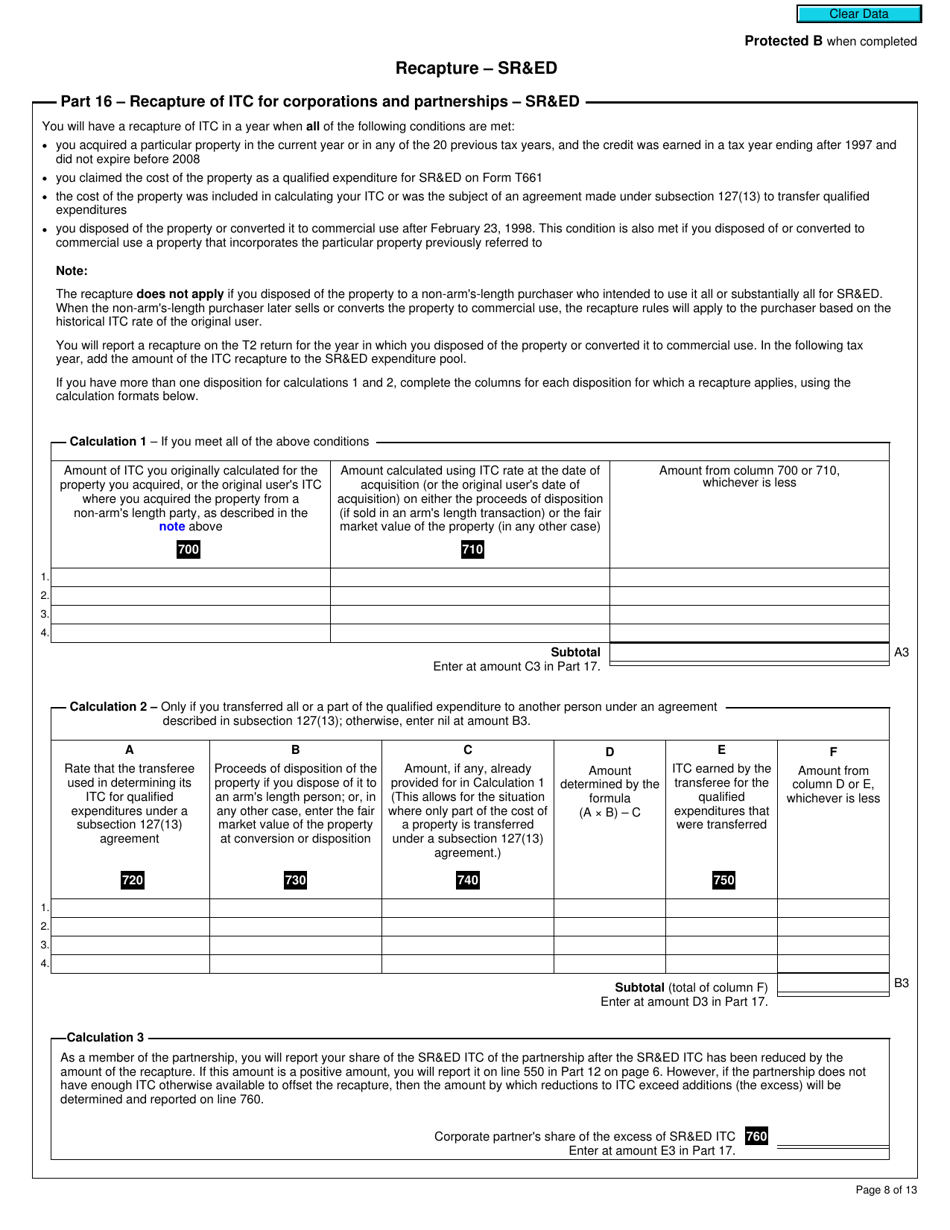

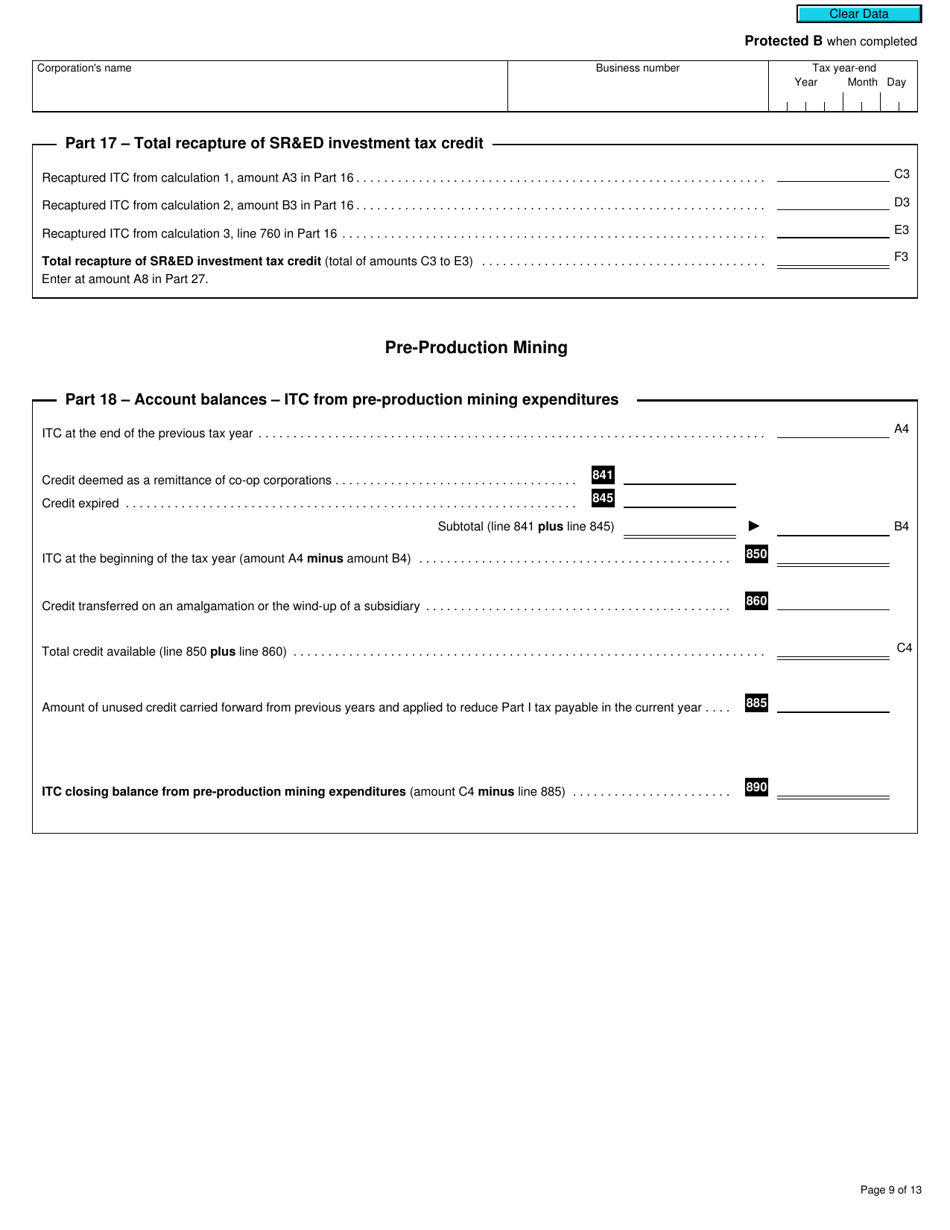

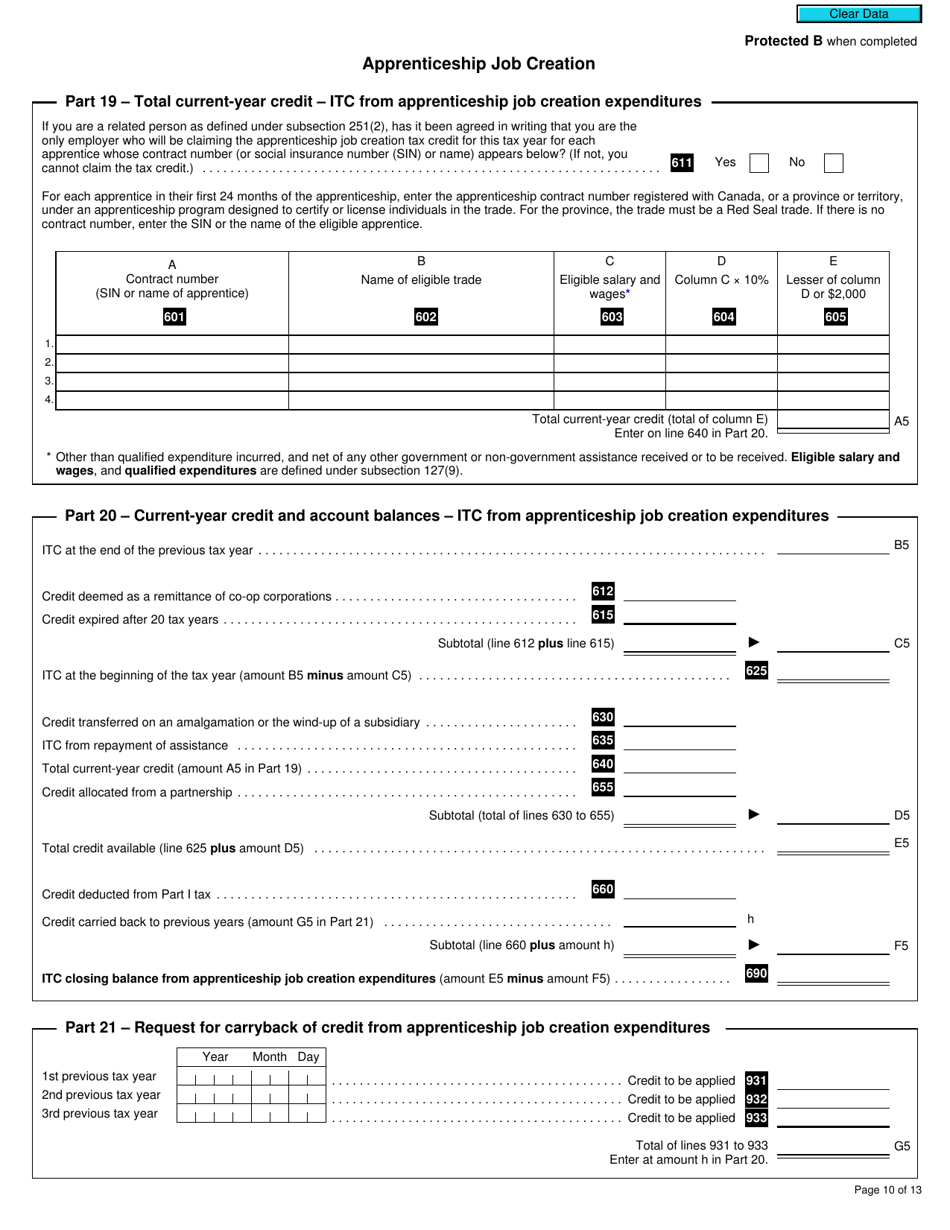

Form T2 Schedule 31 Investment Tax Credit - Corporations (2019 and Later Tax Years) - Canada

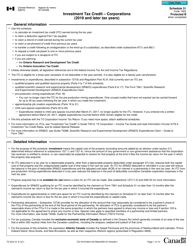

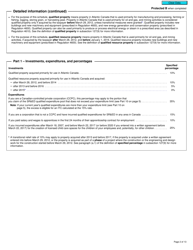

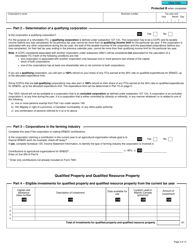

The Form T2 Schedule 31 Investment Tax Credit - Corporations is used by Canadian corporations to claim investment tax credits for certain types of business investments. It is applicable for the 2019 and later tax years.

The corporation that is claiming the investment tax credit files the Form T2 Schedule 31 in Canada.

FAQ

Q: What is Form T2 Schedule 31?

A: Form T2 Schedule 31 is a tax form used by Canadian corporations to claim the Investment Tax Credit.

Q: What is the purpose of Form T2 Schedule 31?

A: The purpose of Form T2 Schedule 31 is to calculate and claim the Investment Tax Credit for corporations in Canada.

Q: Who needs to fill out Form T2 Schedule 31?

A: Canadian corporations that are eligible for the Investment Tax Credit need to fill out Form T2 Schedule 31.

Q: What is the Investment Tax Credit?

A: The Investment Tax Credit is a tax incentive that allows eligible corporations to claim a credit for qualifying investments.

Q: What qualifies for the Investment Tax Credit?

A: Qualifying investments for the Investment Tax Credit include certain types of property, such as machinery and equipment, that are used for business purposes.

Q: Can individuals claim the Investment Tax Credit?

A: No, the Investment Tax Credit is only available to eligible Canadian corporations.

Q: What tax years does Form T2 Schedule 31 apply to?

A: Form T2 Schedule 31 applies to tax years starting in 2019 and later.