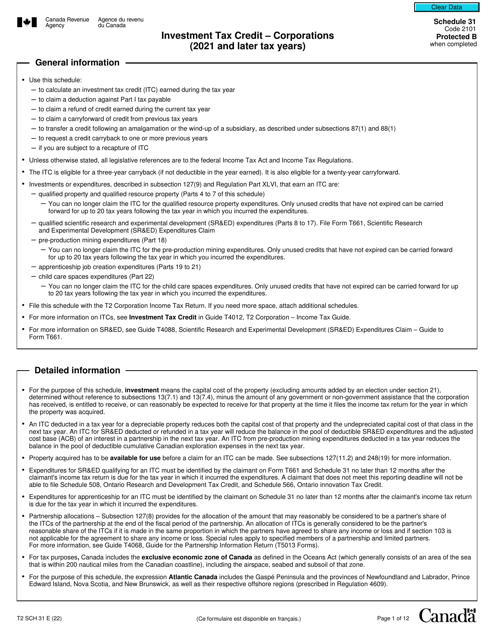

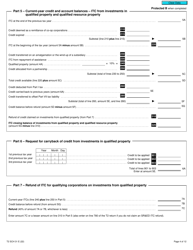

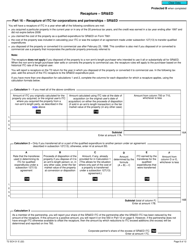

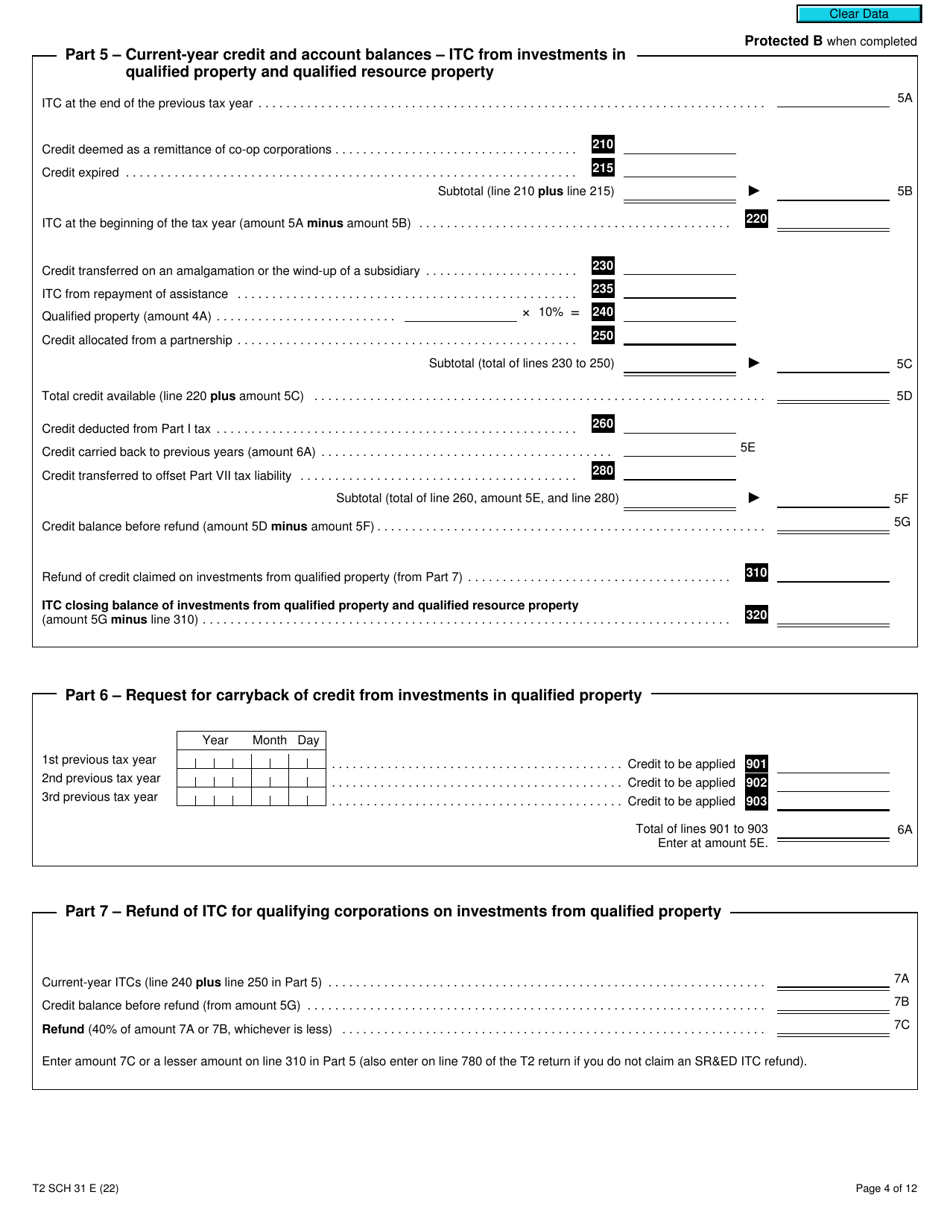

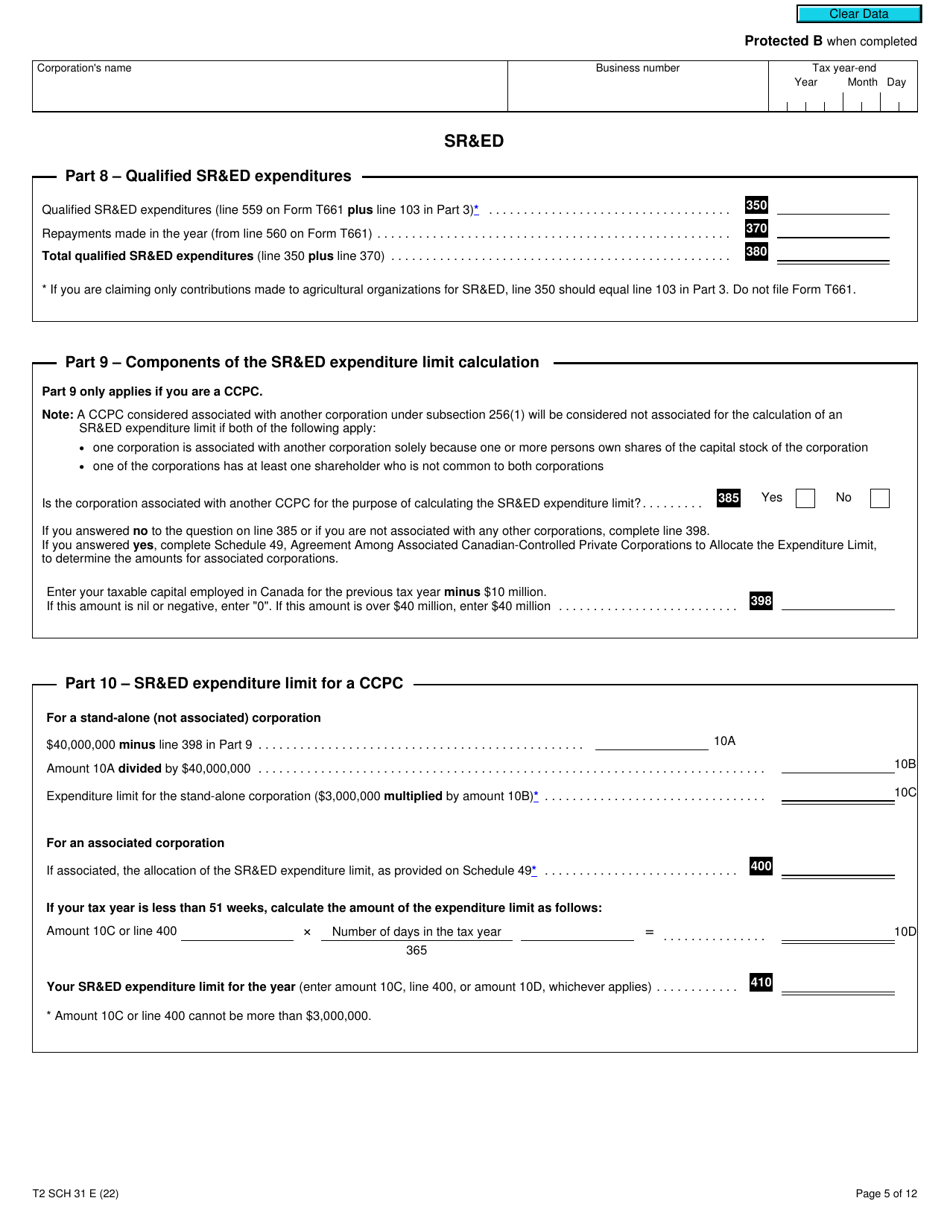

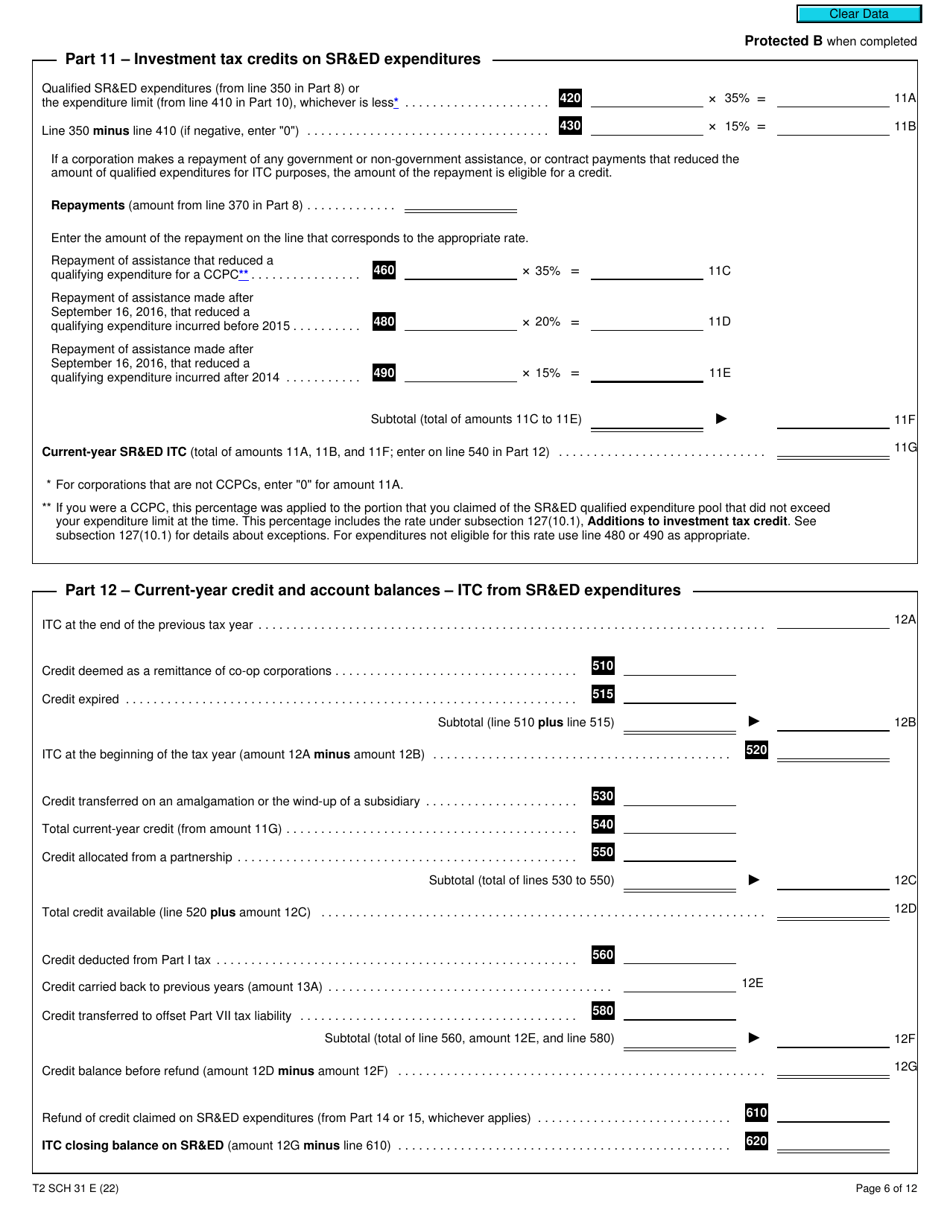

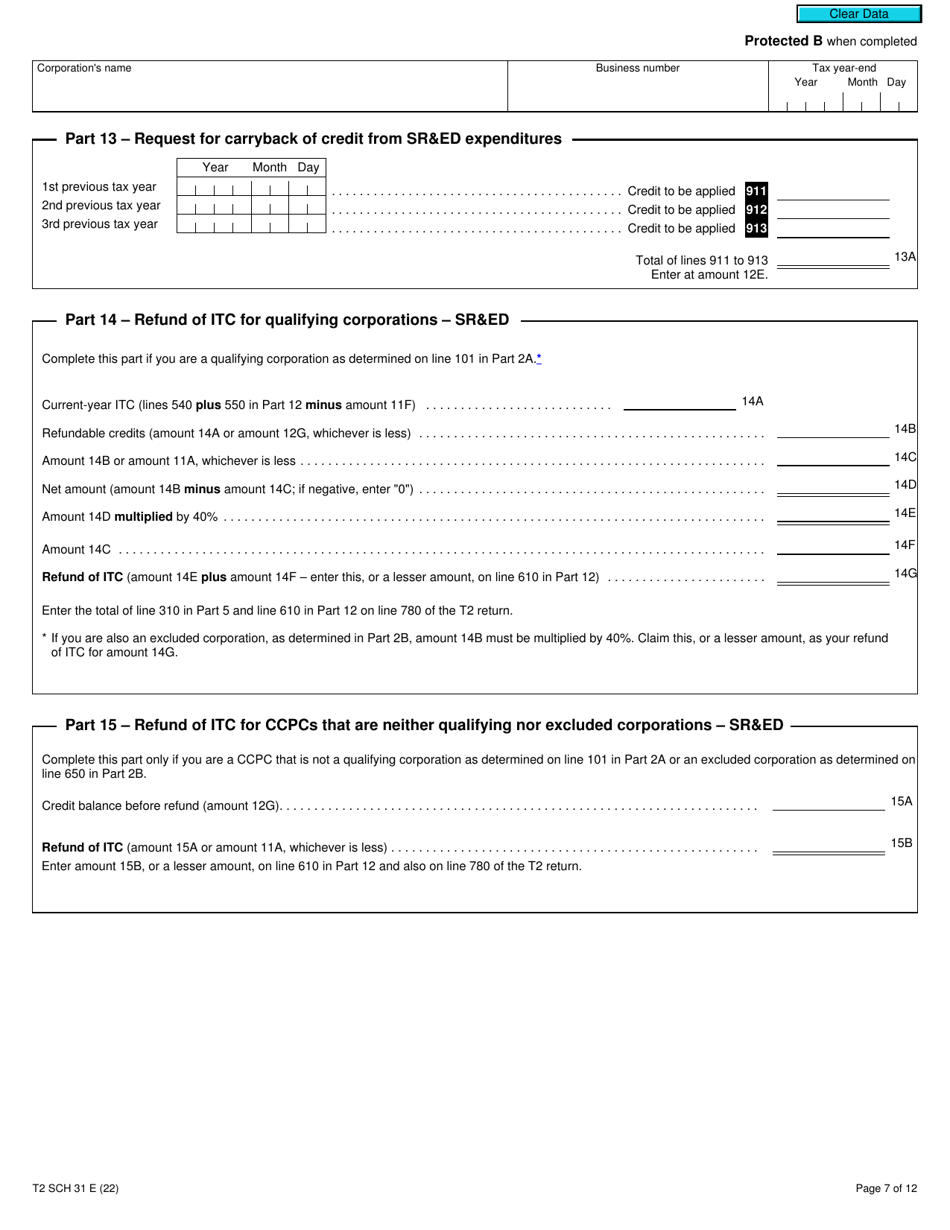

Form T2 Schedule 31 Investment Tax Credit - Corporations (2021 and Later Tax Years) - Canada

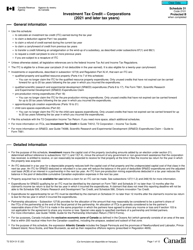

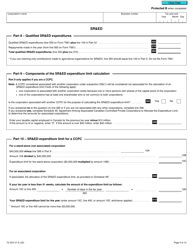

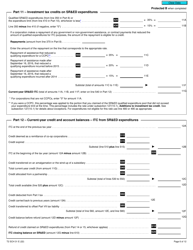

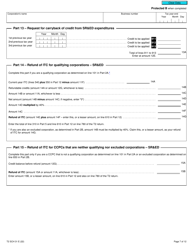

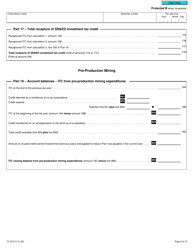

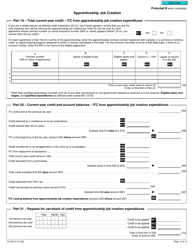

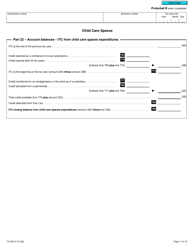

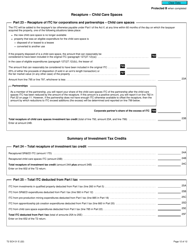

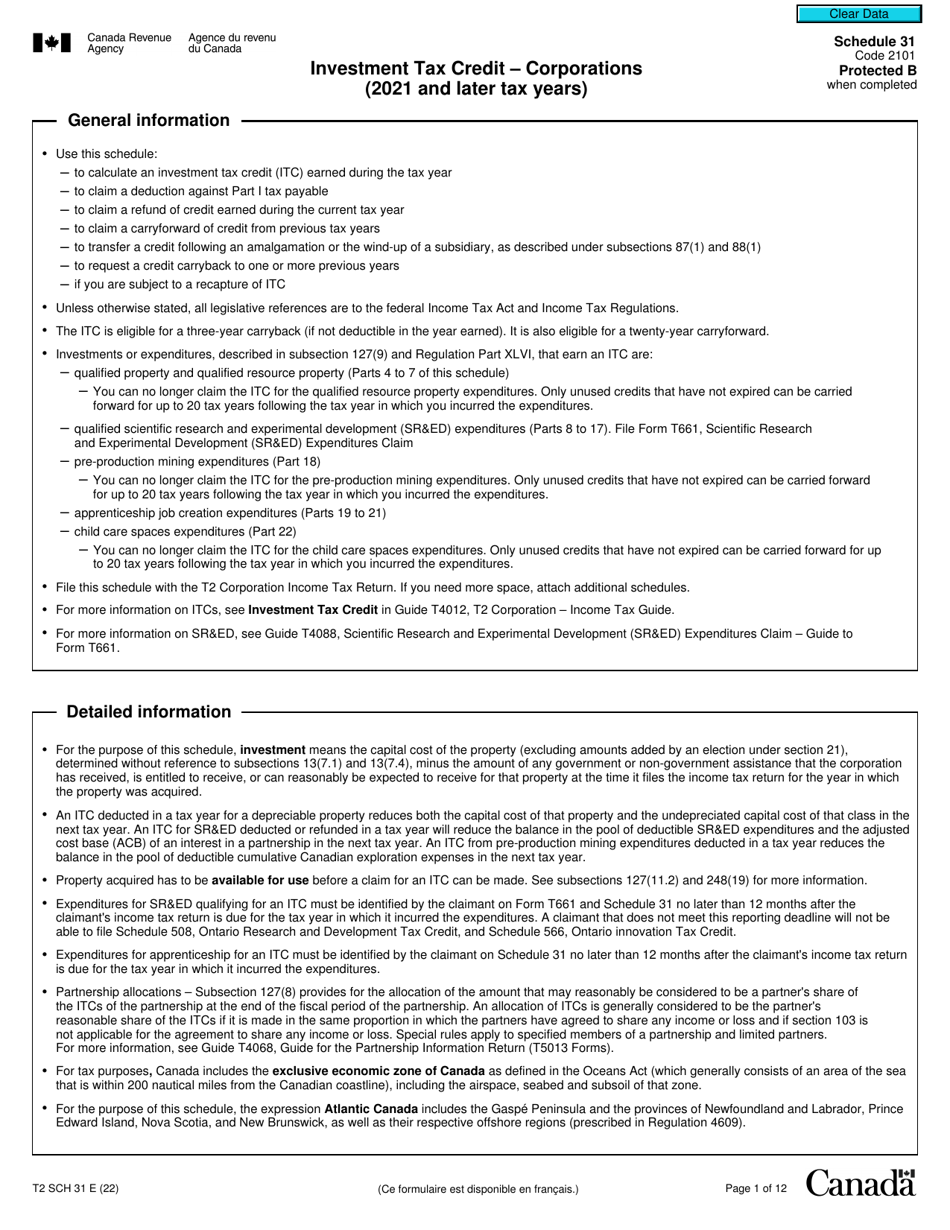

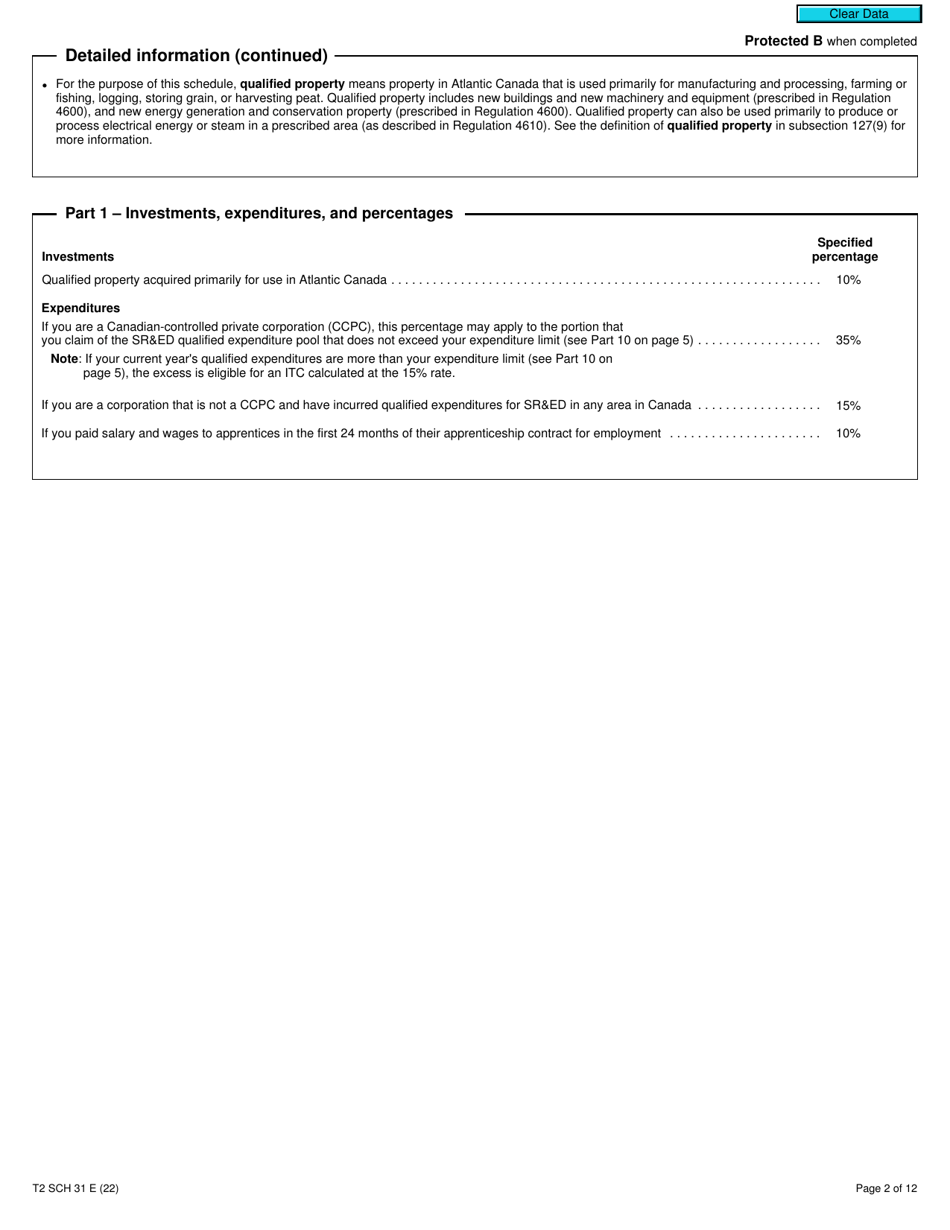

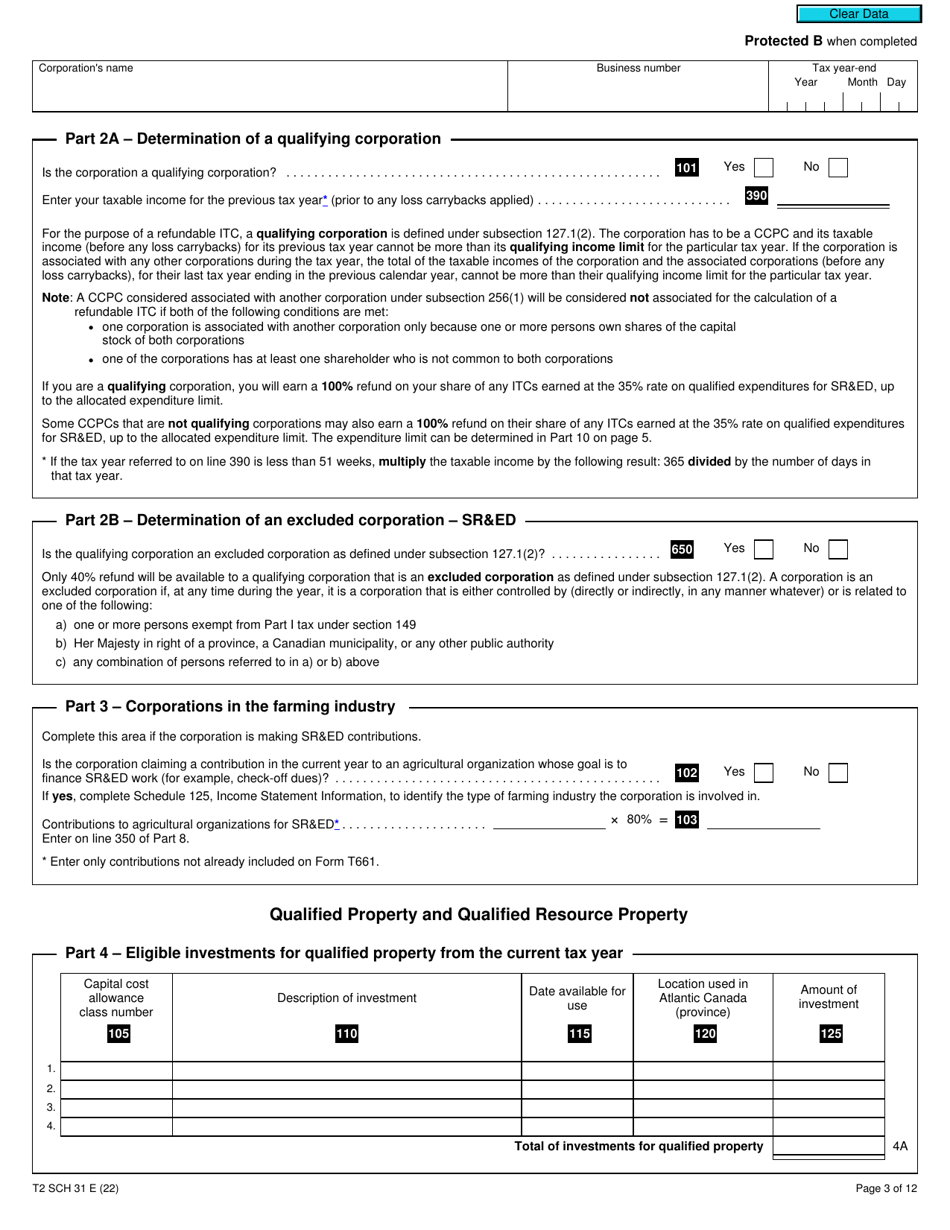

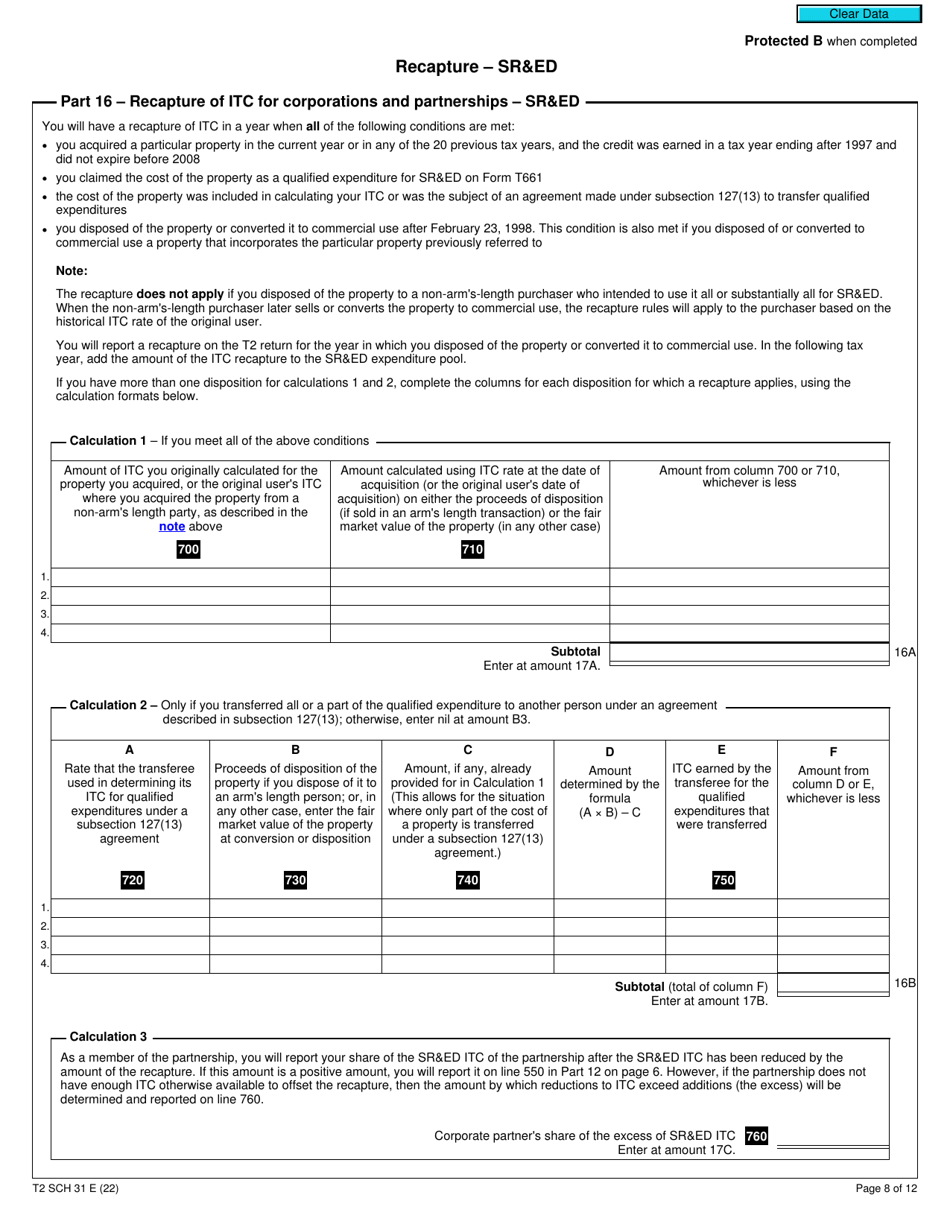

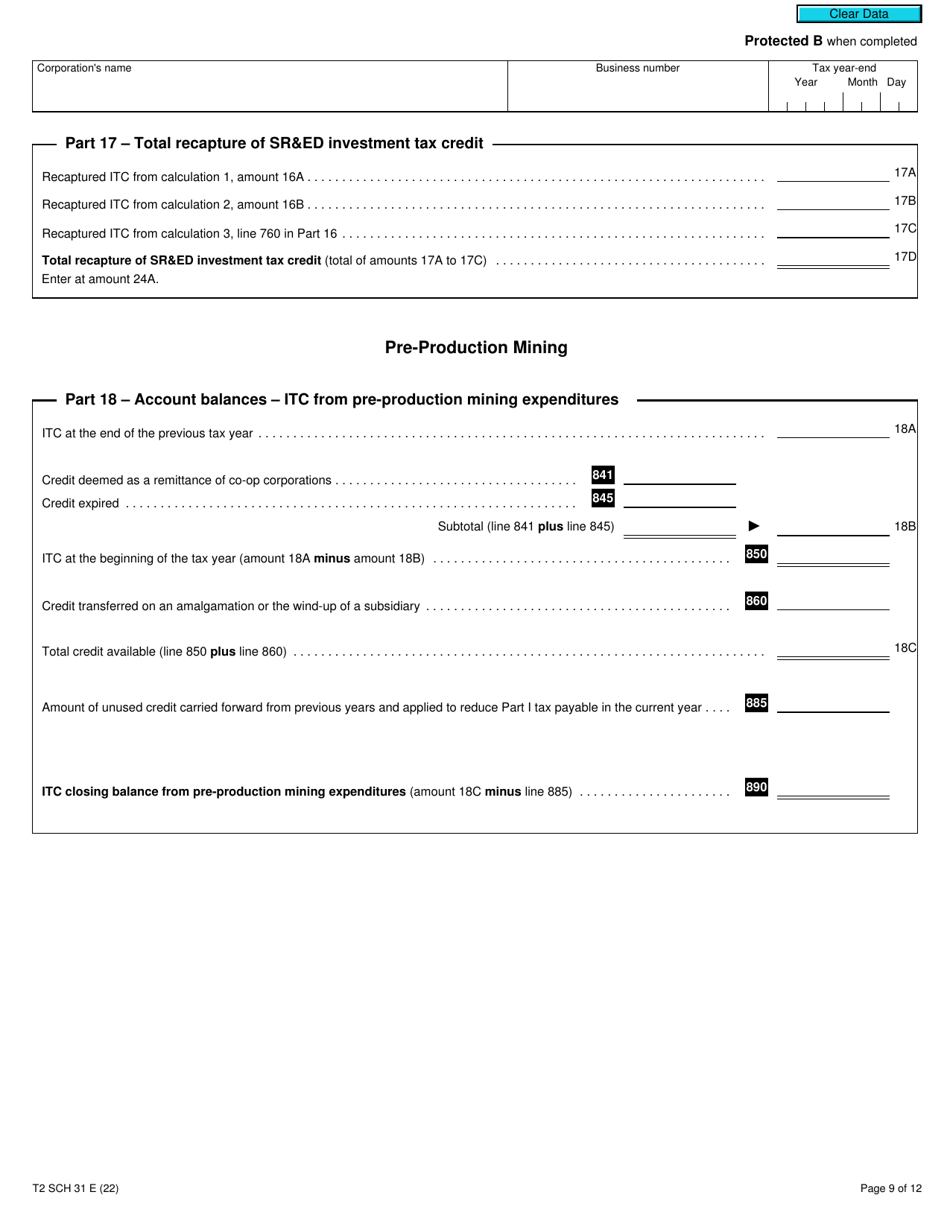

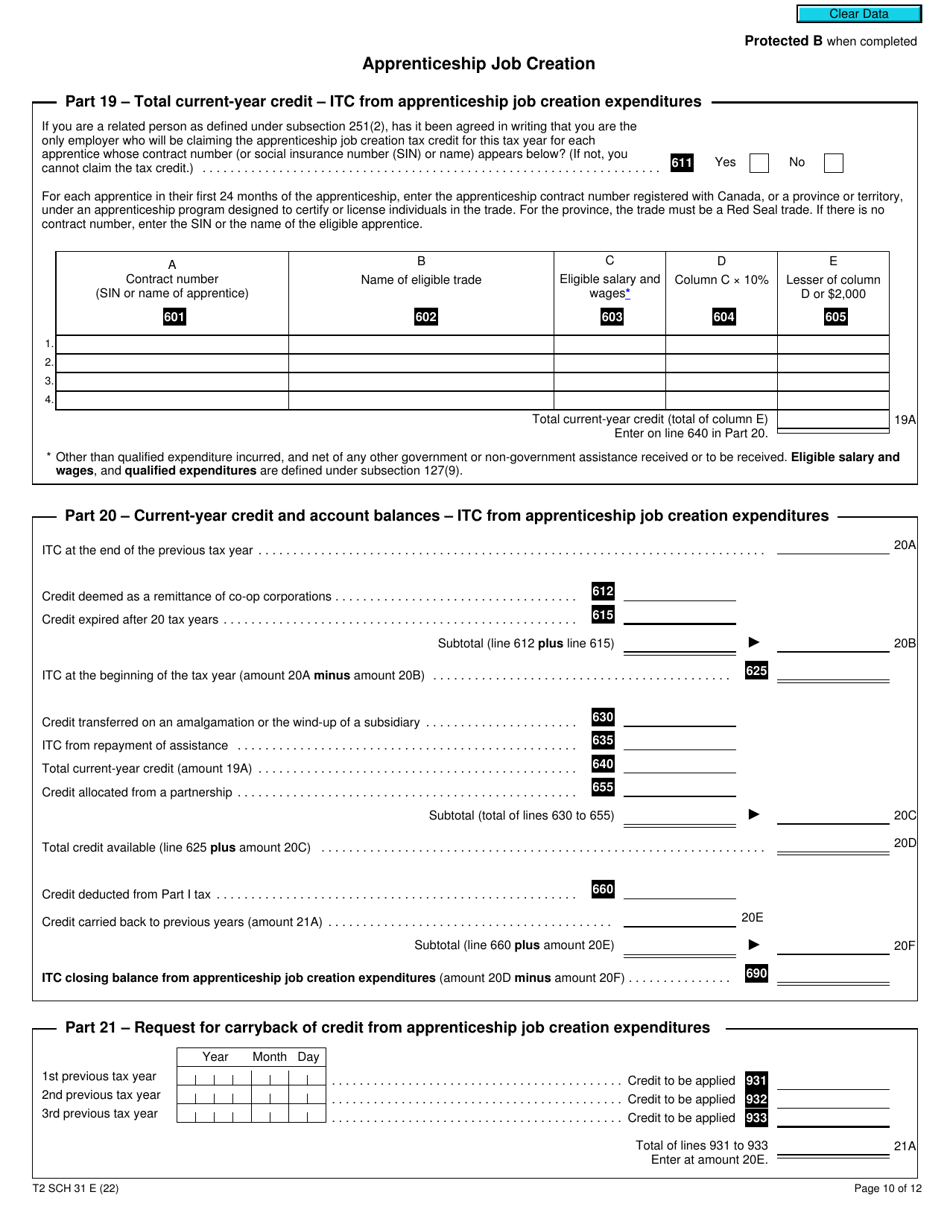

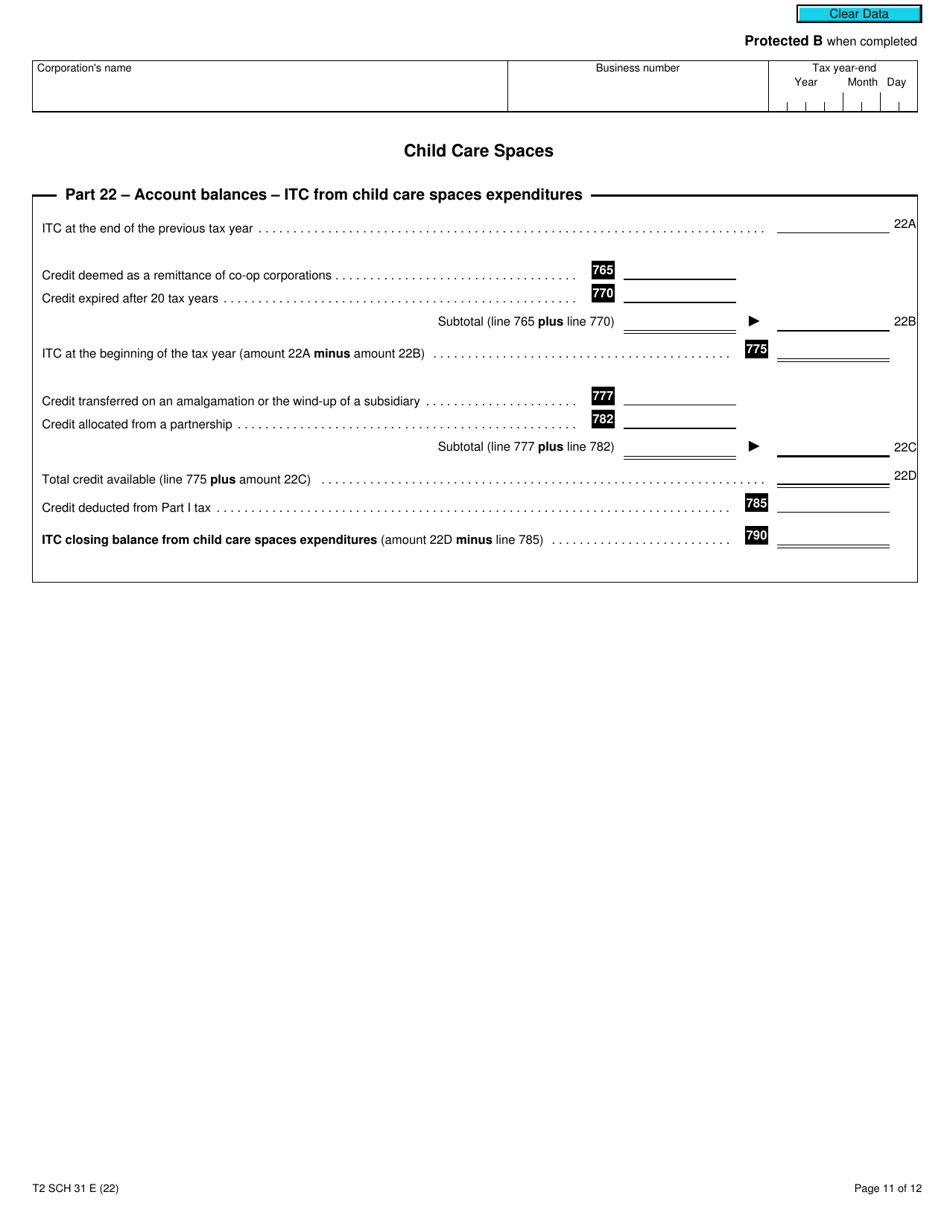

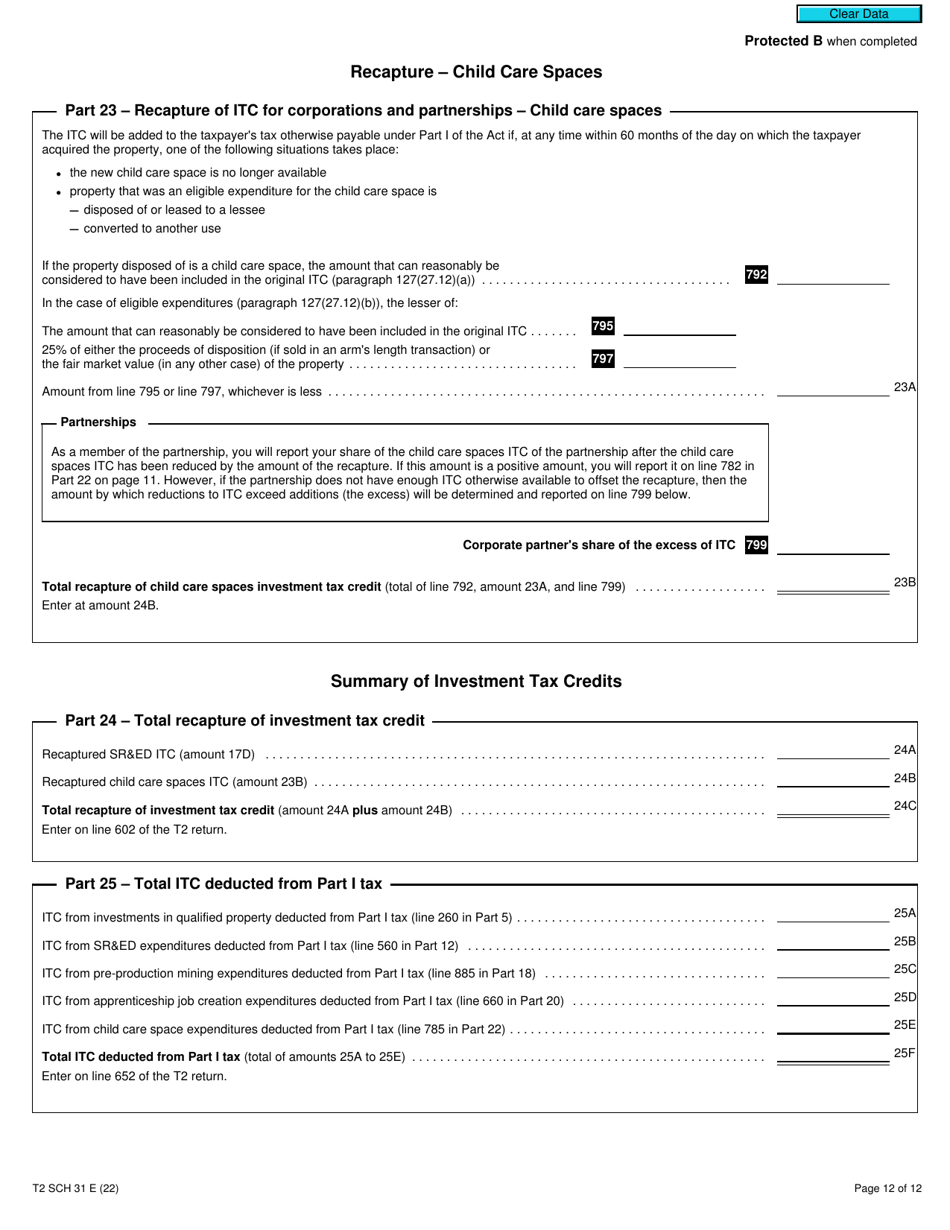

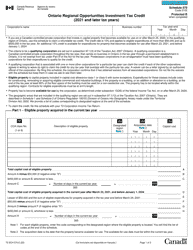

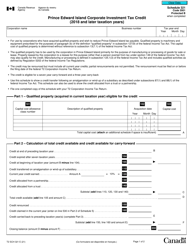

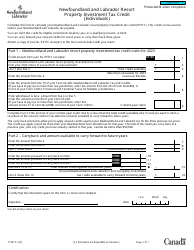

Form T2 Schedule 31, Investment Tax Credit - Corporations, is used by Canadian corporations to claim tax credits for certain investments made in qualifying properties. These tax credits can help offset the corporation's tax liability.

Corporations in Canada file the Form T2 Schedule 31 Investment Tax Credit for 2021 and later tax years.

Form T2 Schedule 31 Investment Tax Credit - Corporations (2021 and Later Tax Years) - Canada - Frequently Asked Questions (FAQ)

Q: What is Form T2 Schedule 31?

A: Form T2 Schedule 31 is a tax form used by corporations in Canada to calculate their investment tax credit.

Q: What is the purpose of Form T2 Schedule 31?

A: The purpose of Form T2 Schedule 31 is to determine the amount of investment tax credit that a corporation is eligible for.

Q: Who needs to file Form T2 Schedule 31?

A: Corporations in Canada that are eligible for the investment tax credit need to file Form T2 Schedule 31.

Q: When is Form T2 Schedule 31 due?

A: Form T2 Schedule 31 is generally due within 6 months after the end of the corporation's tax year.

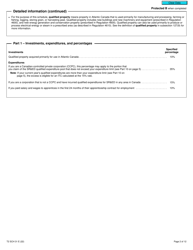

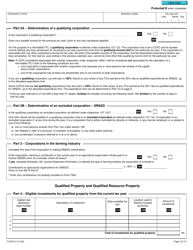

Q: What information is required to complete Form T2 Schedule 31?

A: To complete Form T2 Schedule 31, the corporation will need to provide information about their eligible investments and calculate the credit amounts.

Q: Is Form T2 Schedule 31 available for tax years before 2021?

A: No, Form T2 Schedule 31 is specifically for tax years 2021 and later.