This version of the form is not currently in use and is provided for reference only. Download this version of

Form T2203 (9414-S11) Schedule NU(S11)MJ

for the current year.

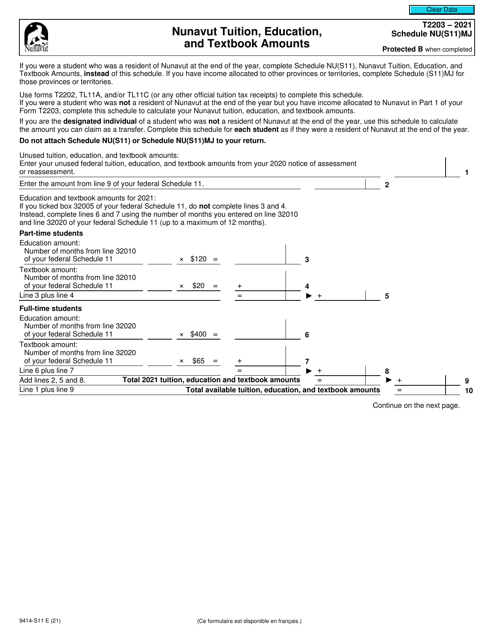

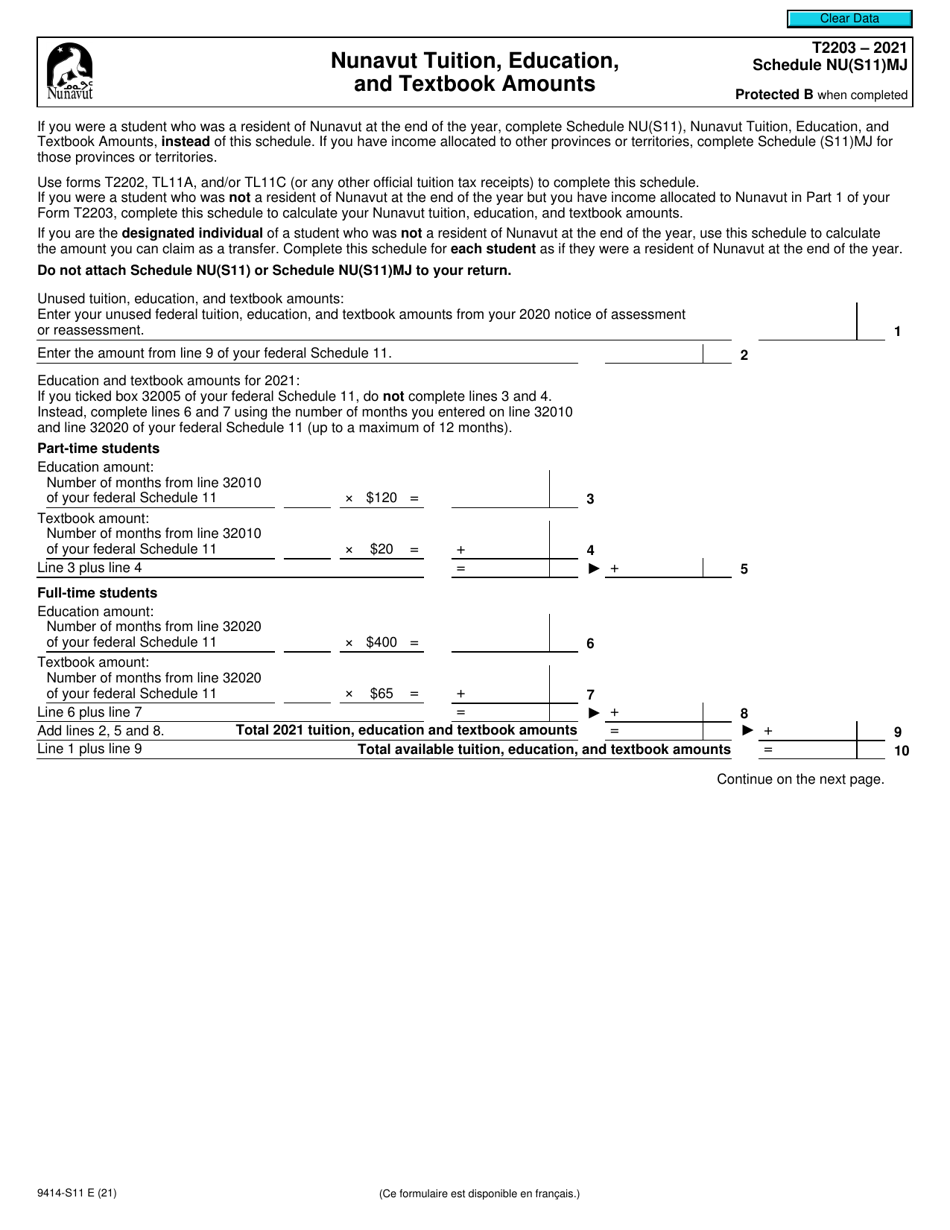

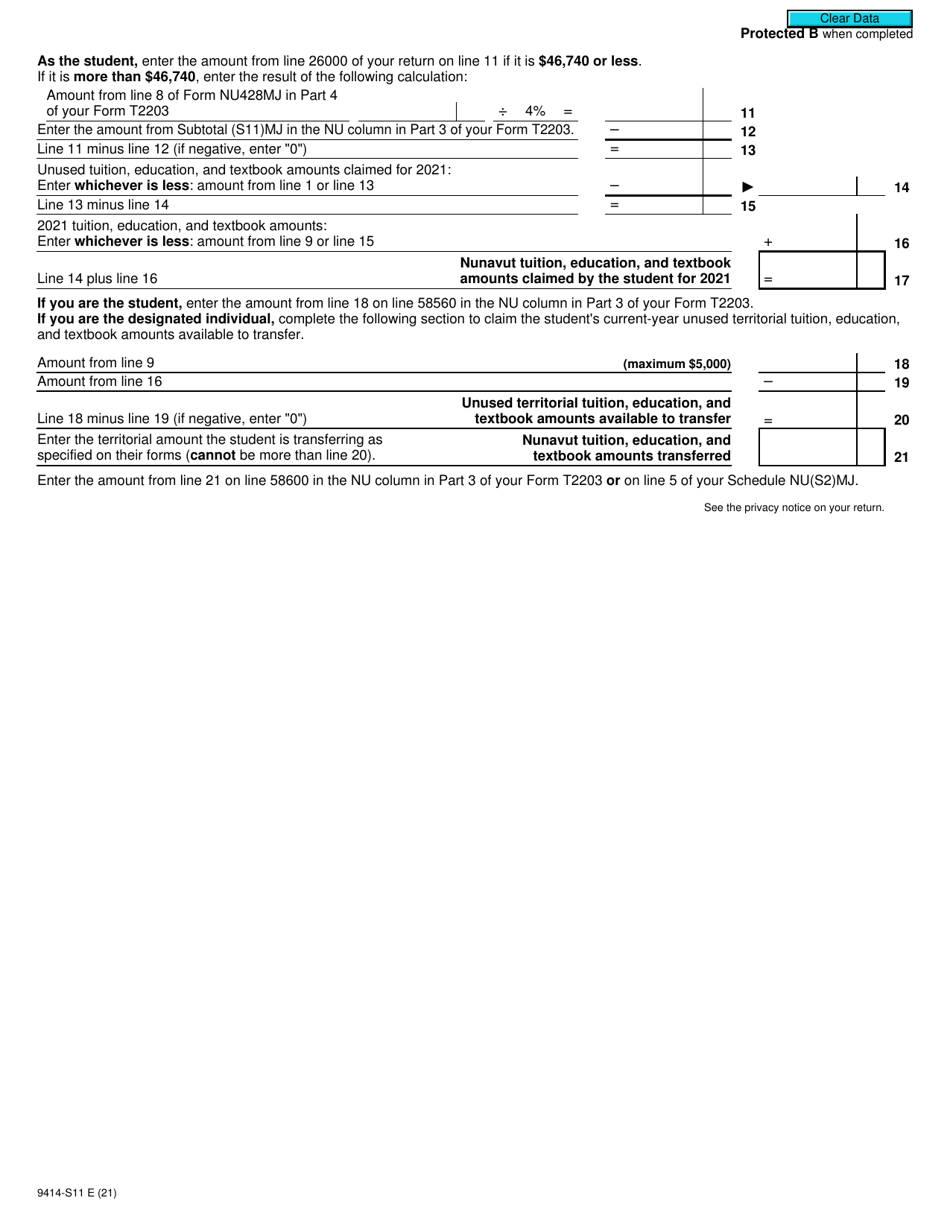

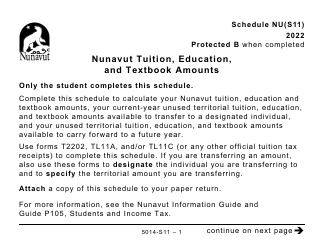

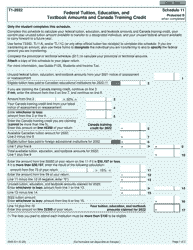

Form T2203 (9414-S11) Schedule NU(S11)MJ Nunavut Tuition, Education, and Textbook Amounts - Canada

Form T2203 (9414-S11) Schedule NU(S11)MJ Nunavut Tuition, Education, and Textbook Amounts is a form used in Canada for claiming tuition, education, and textbook amounts specifically for residents of Nunavut. It allows individuals to claim deductions and credits related to these expenses on their tax returns.

FAQ

Q: What is Form T2203 (9414-S11) Schedule NU(S11)MJ?

A: Form T2203 (9414-S11) Schedule NU(S11)MJ is a tax form used in Canada to claim tuition, education, and textbook amounts for residents of Nunavut.

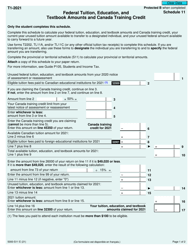

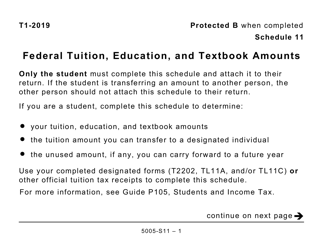

Q: What can I claim on Form T2203 (9414-S11) Schedule NU(S11)MJ?

A: You can claim tuition fees, education amounts, and textbook amounts on this form.

Q: Who is eligible to use Form T2203 (9414-S11) Schedule NU(S11)MJ?

A: Residents of Nunavut who have paid tuition fees and educational expenses can use this form.

Q: How do I fill out Form T2203 (9414-S11) Schedule NU(S11)MJ?

A: You need to enter your personal information, the amount of tuition fees and education amounts you are claiming, and the total number of months in which you were enrolled as a full-time or part-time student.

Q: When is the deadline to submit Form T2203 (9414-S11) Schedule NU(S11)MJ?

A: The deadline to submit this form is typically April 30th of the following year.

Q: Can I carry forward unused amounts from Form T2203 (9414-S11) Schedule NU(S11)MJ?

A: Yes, you can carry forward unused tuition, education, and textbook amounts to future tax years if you are unable to fully utilize them in the current year.

Q: Can I transfer my tuition, education, and textbook amounts to a family member?

A: Yes, you may be able to transfer these amounts to a spouse, common-law partner, or parent, depending on your situation.

Q: Do I need to attach receipts to Form T2203 (9414-S11) Schedule NU(S11)MJ?

A: No, you do not need to attach receipts to this form, but you should keep them for your records in case the Canada Revenue Agency (CRA) requests them for verification.