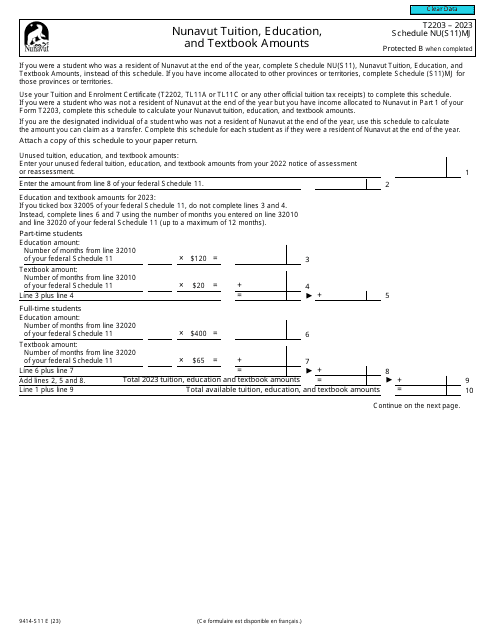

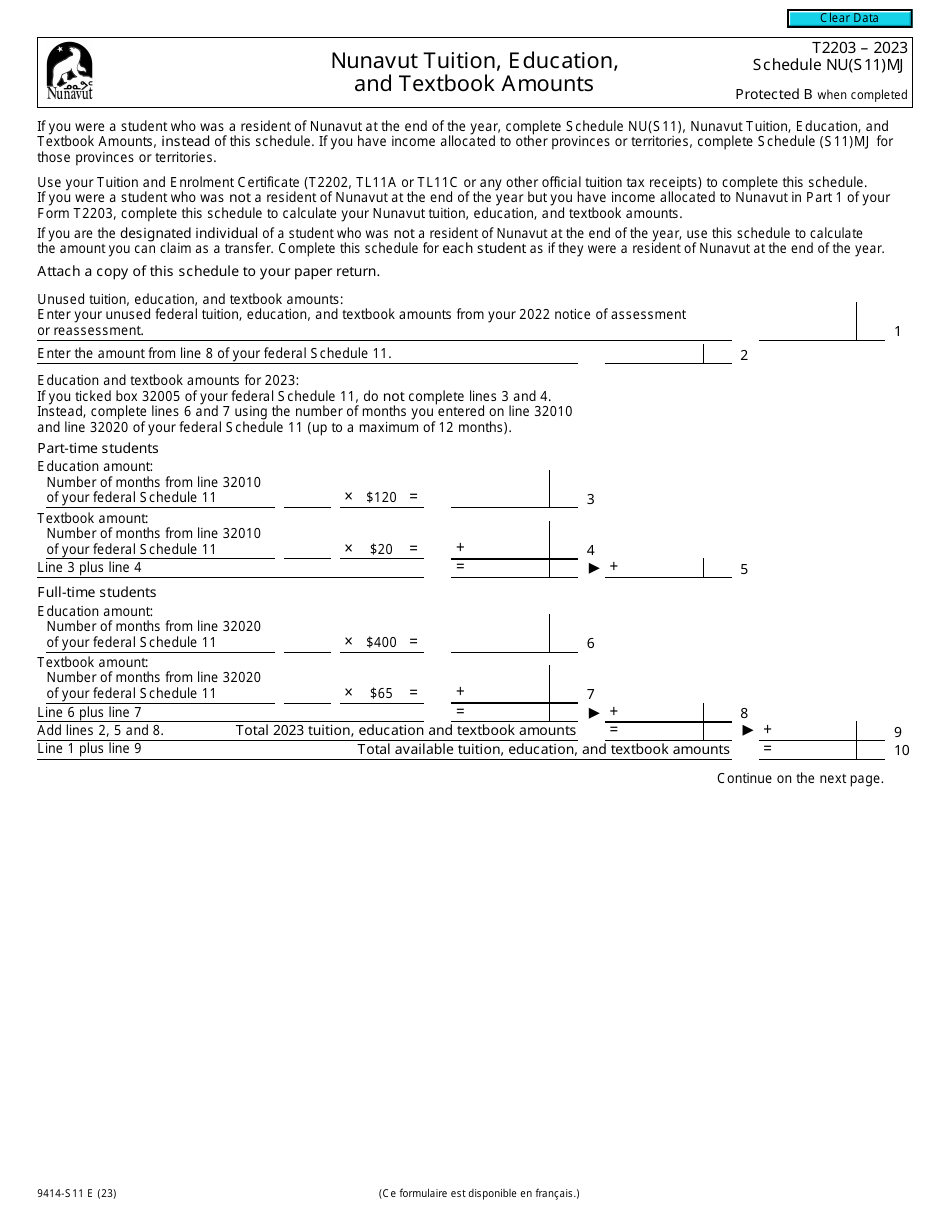

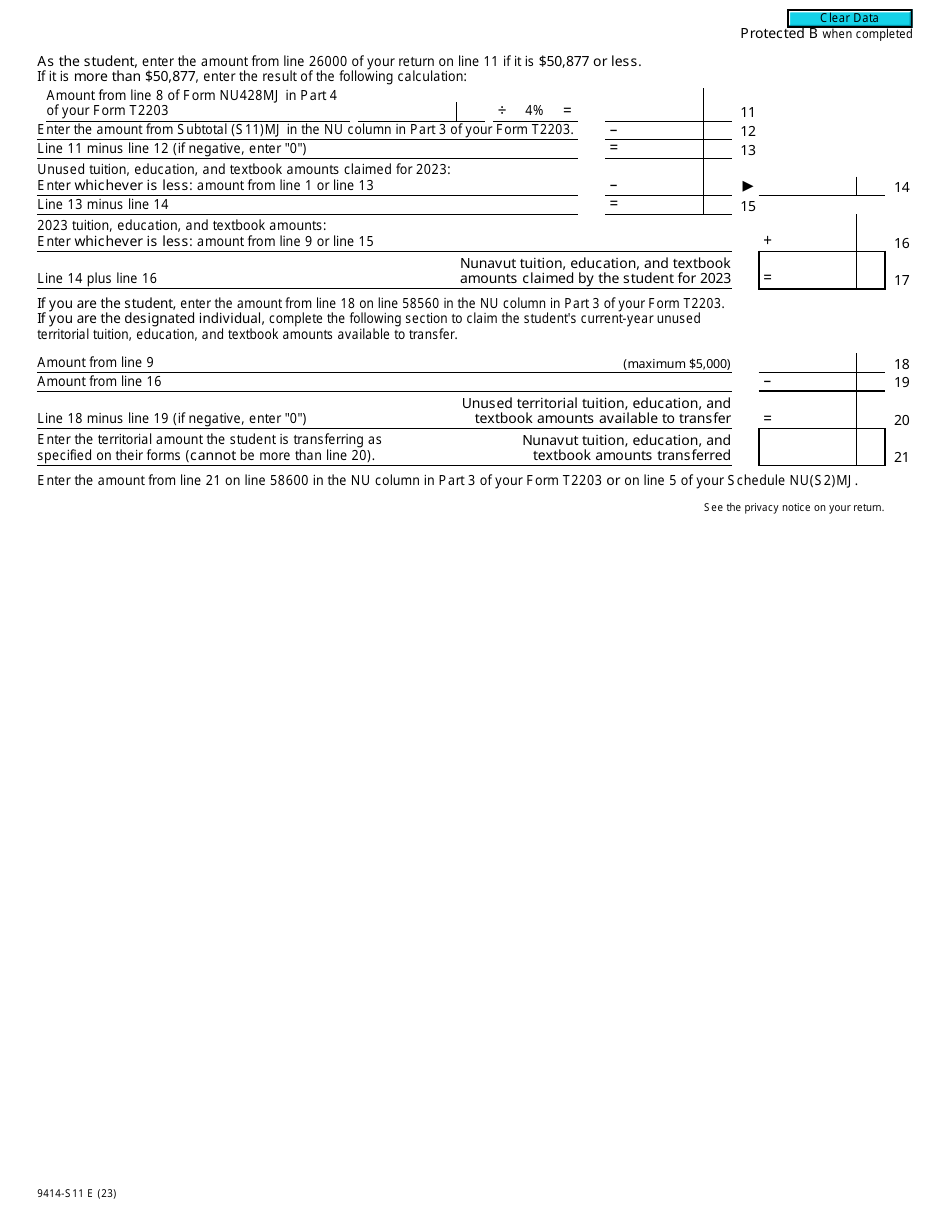

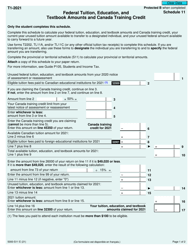

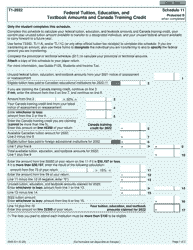

Form T2203 (9414-S11) Schedule NU(S11)MJ Nunavut Tuition, Education, and Textbook Amounts - Canada

Form T2203 (9414-S11) Schedule NU(S11)MJ Nunavut Tuition, Education, and Textbook Amounts is used by residents of Nunavut, Canada, to claim tuition, education, and textbook amounts for income tax purposes. This form allows individuals to report eligible amounts that can be used to reduce their taxes payable or generate tax credits.

The form T2203 (9414-S11) Schedule NU(S11)MJ Nunavut Tuition, Education, and Textbook Amounts - Canada is filed by residents of Nunavut, Canada who want to claim tuition, education, and textbook amounts for tax purposes.

Form T2203 (9414-S11) Schedule NU(S11)MJ Nunavut Tuition, Education, and Textbook Amounts - Canada - Frequently Asked Questions (FAQ)

Q: What is Form T2203?

A: Form T2203 is a tax form used in Canada for claiming Nunavut Tuition, Education, and Textbook Amounts.

Q: What is Schedule NU(S11)MJ?

A: Schedule NU(S11)MJ is a specific schedule of Form T2203 that is used in Nunavut to claim tuition, education, and textbook amounts.

Q: What is the purpose of Form T2203?

A: The purpose of Form T2203 is to claim tuition, education, and textbook amounts for tax purposes in Canada.

Q: Who can use Form T2203?

A: Residents of Nunavut in Canada can use Form T2203 to claim tuition, education, and textbook amounts.

Q: What can I claim on Form T2203?

A: You can claim tuition fees, education amounts, and textbook amounts on Form T2203.

Q: Is Form T2203 specific to Nunavut?

A: Yes, Form T2203 is specific to Nunavut and is used to claim education-related expenses in that territory.

Q: Do I need to submit supporting documents with Form T2203?

A: You may be required to submit supporting documents such as tuition receipts with Form T2203. It is advised to keep these documents for your records.

Q: When do I need to file Form T2203?

A: Form T2203 should be filed along with your income tax return for the applicable tax year.

Q: Can I claim tuition amounts for previous years on Form T2203?

A: No, Form T2203 is used for claiming tuition amounts for the current tax year only.