This version of the form is not currently in use and is provided for reference only. Download this version of

Form T2203 (AB428MJ; 9409-C) Part 4

for the current year.

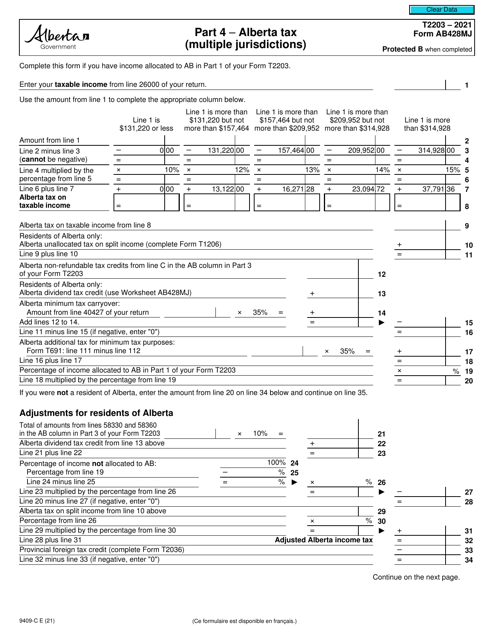

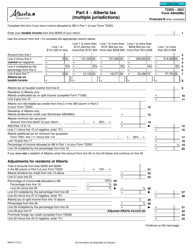

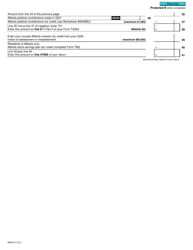

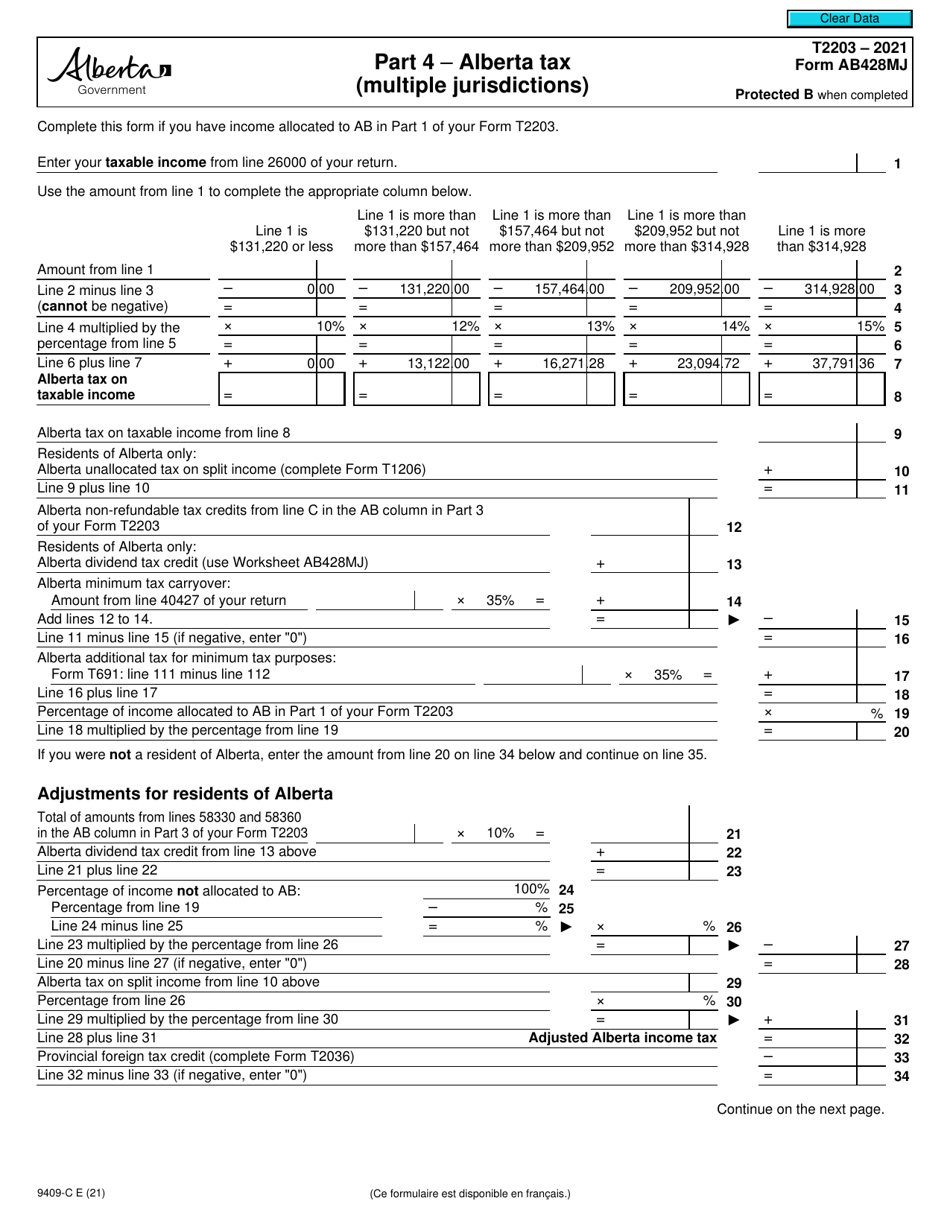

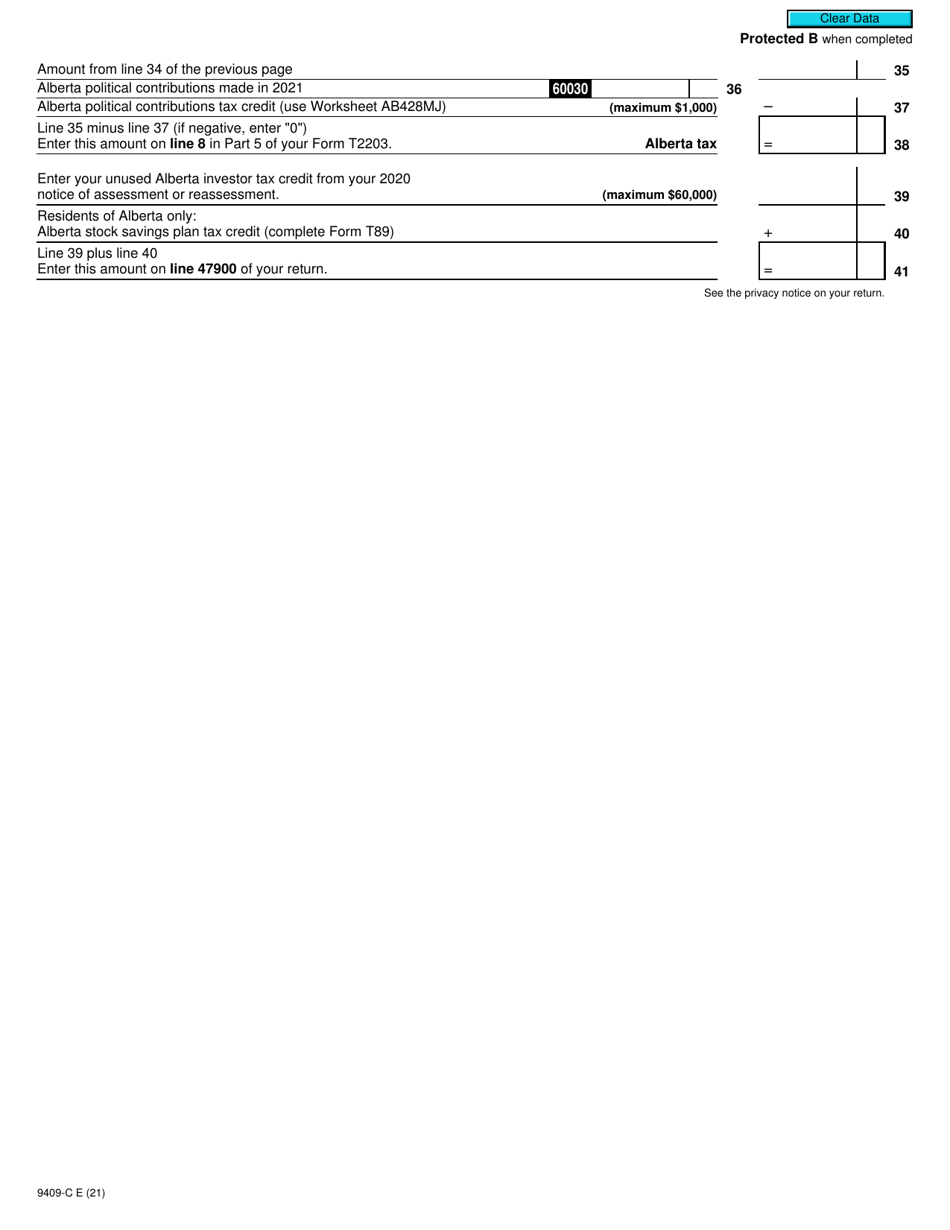

Form T2203 (AB428MJ; 9409-C) Part 4 Alberta Tax (Multiple Jurisdictions) - Canada

Form T2203 (AB428MJ; 9409-C) Part 4 Alberta Tax (Multiple Jurisdictions) in Canada is used to calculate the amount of tax owed by individuals who live in Alberta but work in multiple jurisdictions. It helps determine the portion of income that is subject to taxation in Alberta and ensures that individuals are not double-taxed on income earned outside the province.

The Form T2203 (AB428MJ; 9409-C) Part 4 Alberta Tax (Multiple Jurisdictions) is filed by individuals or businesses who are residents of Alberta, Canada. This form is specifically used for reporting taxes owed to multiple jurisdictions within Alberta.

FAQ

Q: What is Form T2203?

A: Form T2203 is a tax form used in Canada for reporting Alberta tax (Multiple Jurisdictions).

Q: What is the purpose of Form T2203?

A: The purpose of Form T2203 is to calculate and report the Alberta tax (Multiple Jurisdictions) as part of your overall tax return in Canada.

Q: Do I need to fill out Form T2203?

A: You need to fill out Form T2203 if you are a resident of Alberta and have income from multiple jurisdictions in Canada.

Q: What information do I need to complete Form T2203?

A: To complete Form T2203, you will need information about your income earned in Alberta and income earned from other jurisdictions in Canada.

Q: Are there any additional schedules or forms related to Form T2203?

A: Yes, if you have income from other provinces or territories in Canada, you may need to complete additional schedules or forms to calculate and report the taxes related to those jurisdictions.

Q: Can I file Form T2203 electronically?

A: Yes, you can file Form T2203 electronically through the CRA's NETFILE service or file a paper copy by mail.