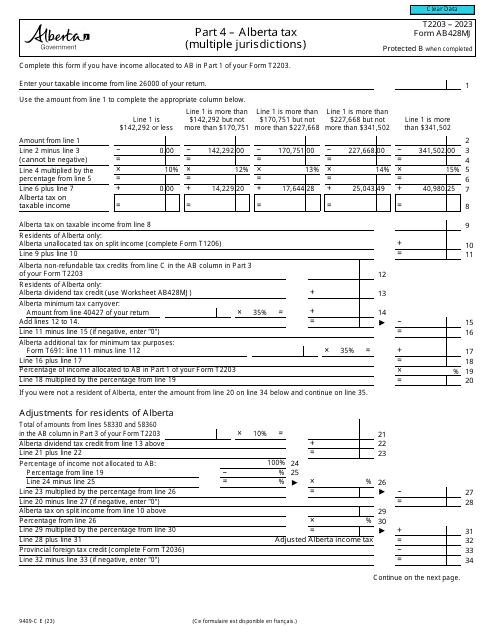

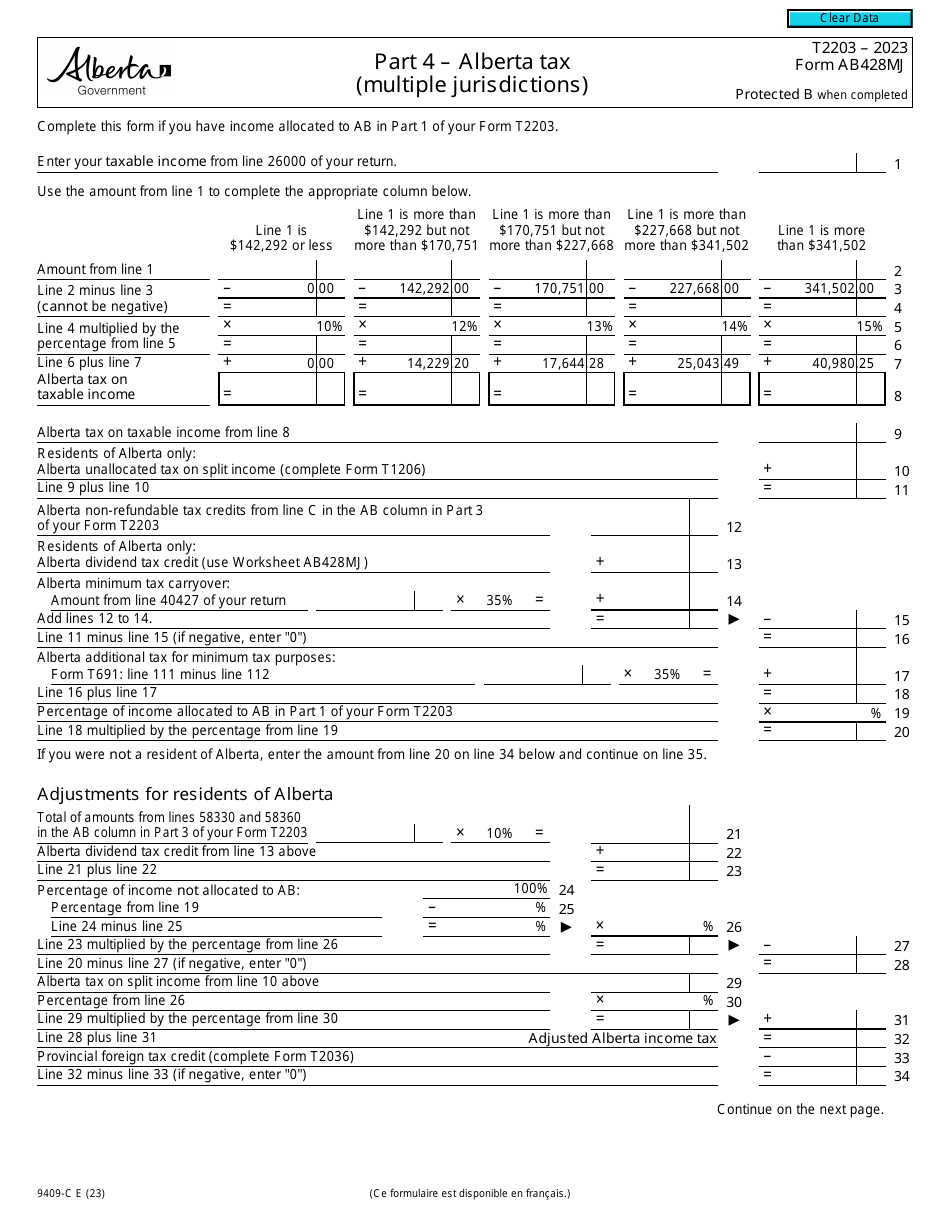

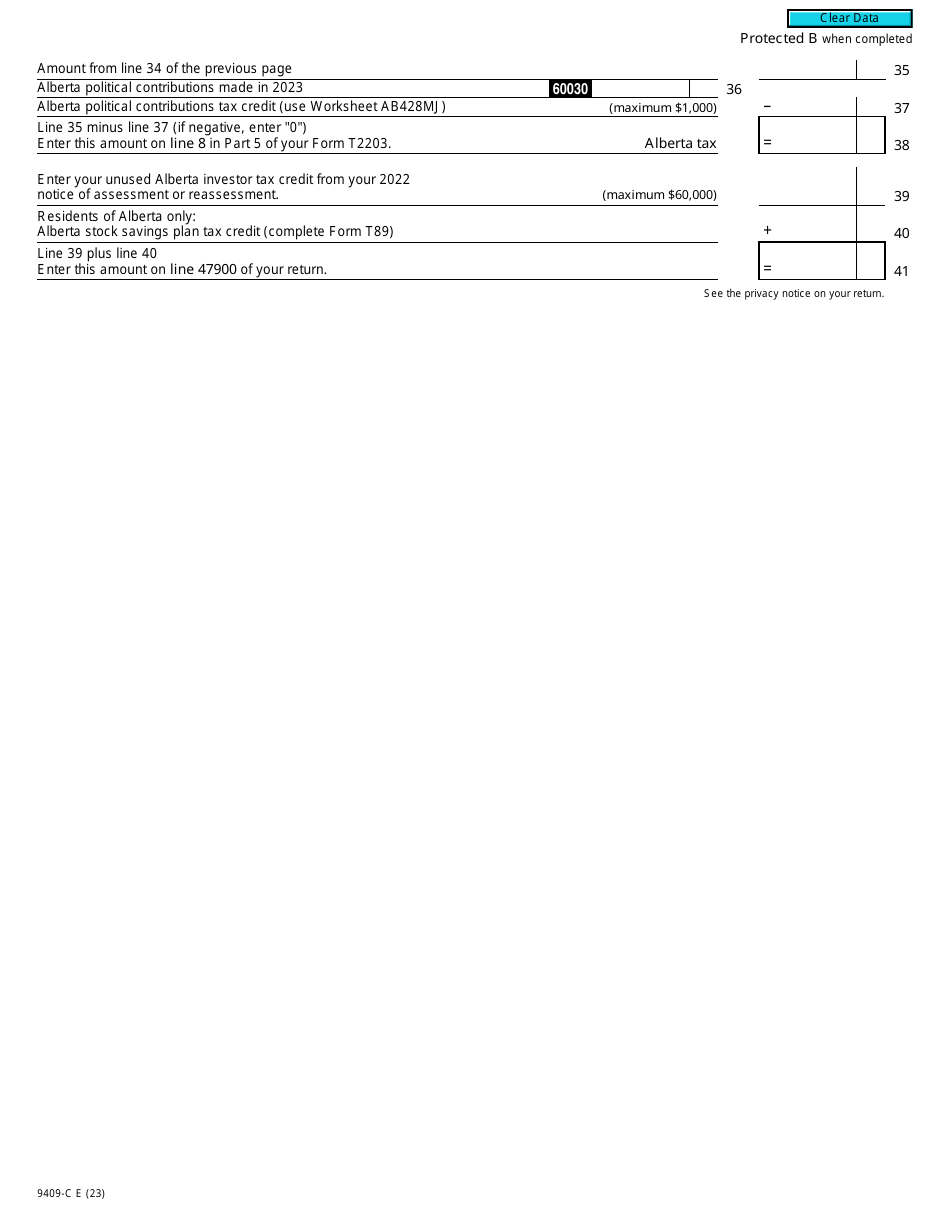

Form T2203 (9409-C; AB428MJ) Part 4 Alberta Tax (Multiple Jurisdictions) - Canada

Form T2203 (AB428MJ; 9409-C) Part 4 is used for reporting the Alberta tax payable by individuals who reside in multiple jurisdictions in Canada. It helps determine the amount of Alberta tax that needs to be paid based on an individual's income and residency status.

The form T2203 (AB428MJ; 9409-C) Part 4 Alberta Tax (Multiple Jurisdictions) in Canada is filed by individuals who have income from multiple jurisdictions in Alberta.

Form T2203 (AB428MJ; 9409-C) Part 4 Alberta Tax (Multiple Jurisdictions) - Canada - Frequently Asked Questions (FAQ)

Q: What is Form T2203?

A: Form T2203 is a tax form used by residents of Alberta, Canada to calculate their provincial taxes.

Q: What does AB428MJ stand for on Form T2203?

A: AB428MJ is the code used to identify the part of the form that pertains to Alberta tax.

Q: What is the purpose of Part 4 on Form T2203?

A: Part 4 of Form T2203 is used to calculate the Alberta tax for individuals who have income from multiple jurisdictions.

Q: What does 9409-C stand for on Form T2203?

A: 9409-C is the code used to identify the specific section of the form that relates to multiple jurisdictions.

Q: Who needs to fill out Form T2203?

A: Residents of Alberta, Canada who have income from multiple jurisdictions need to fill out Form T2203 to calculate their provincial taxes.

Q: Is Form T2203 only for residents of Alberta, Canada?

A: Yes, Form T2203 is specifically for residents of Alberta, Canada.

Q: What should I include in Part 4 of Form T2203?

A: In Part 4 of Form T2203, you should include information about your income from different jurisdictions and calculate your Alberta tax accordingly.

Q: Can I file Form T2203 electronically?

A: No, as of now, Form T2203 cannot be filed electronically. It must be printed, signed, and mailed to the Canada Revenue Agency (CRA).