This version of the form is not currently in use and is provided for reference only. Download this version of

Form T2200

for the current year.

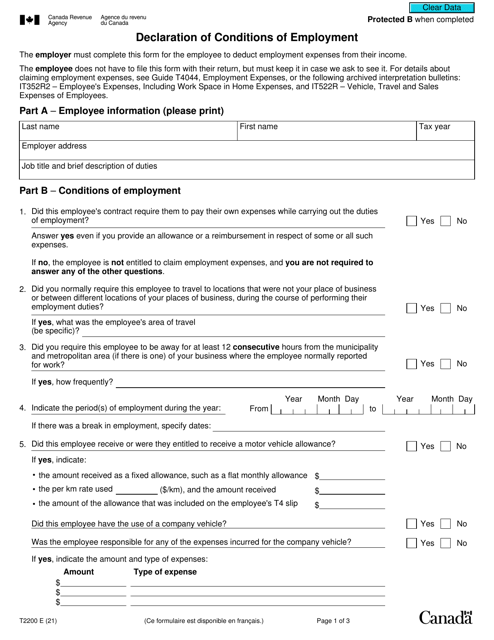

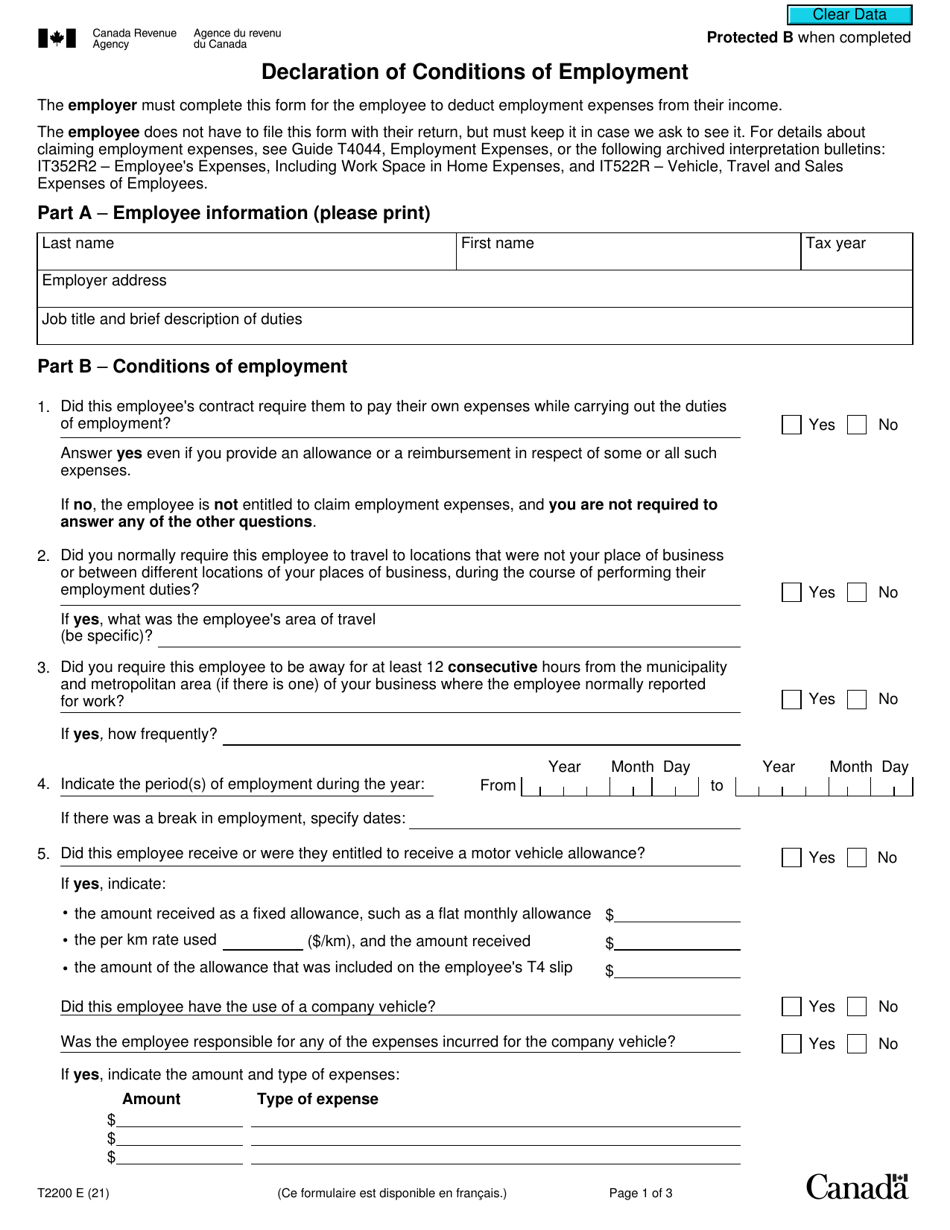

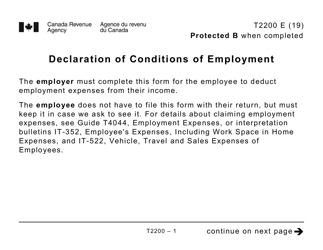

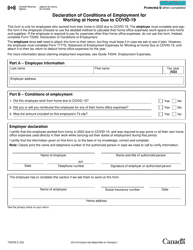

Form T2200 Declaration of Conditions of Employment - Canada

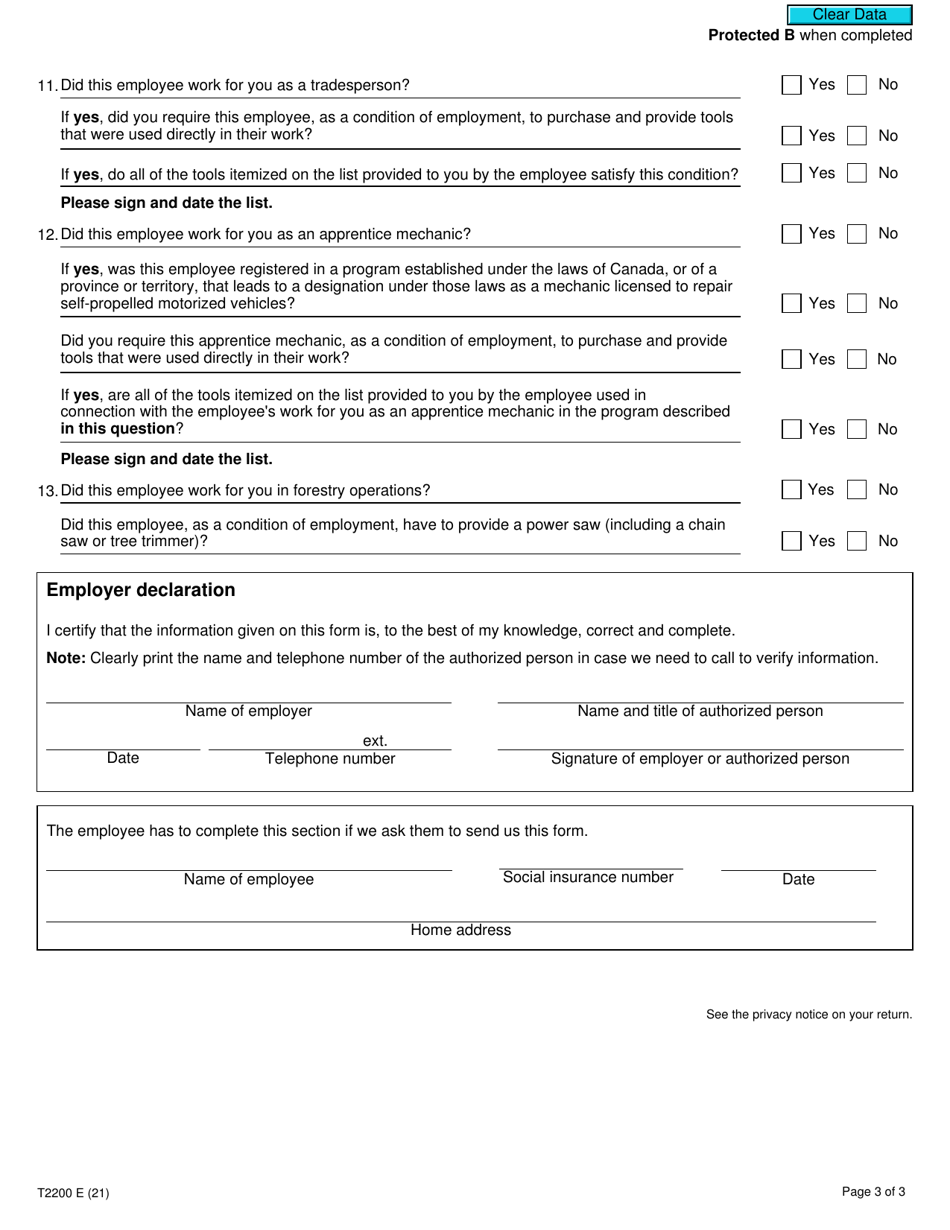

Form T2200 Declaration of Conditions of Employment is used by employees in Canada to claim employment expenses on their personal income tax return. It is completed by an employer to certify that the employee is required to pay for certain expenses related to their job that are not reimbursed by the employer.

The Form T2200 Declaration of Conditions of Employment in Canada is typically filed by employees who need to claim certain employment expenses on their tax return. It is filled out and signed by the employee's employer.

FAQ

Q: What is Form T2200 Declaration of Conditions of Employment?

A: Form T2200 is a declaration that allows employees in Canada to claim certain employment expenses on their tax return.

Q: Who is eligible to claim employment expenses using Form T2200?

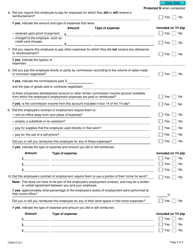

A: Only employees who are required to pay expenses as a condition of their employment and who have the approval of their employer can claim employment expenses using Form T2200.

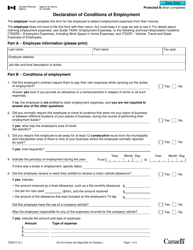

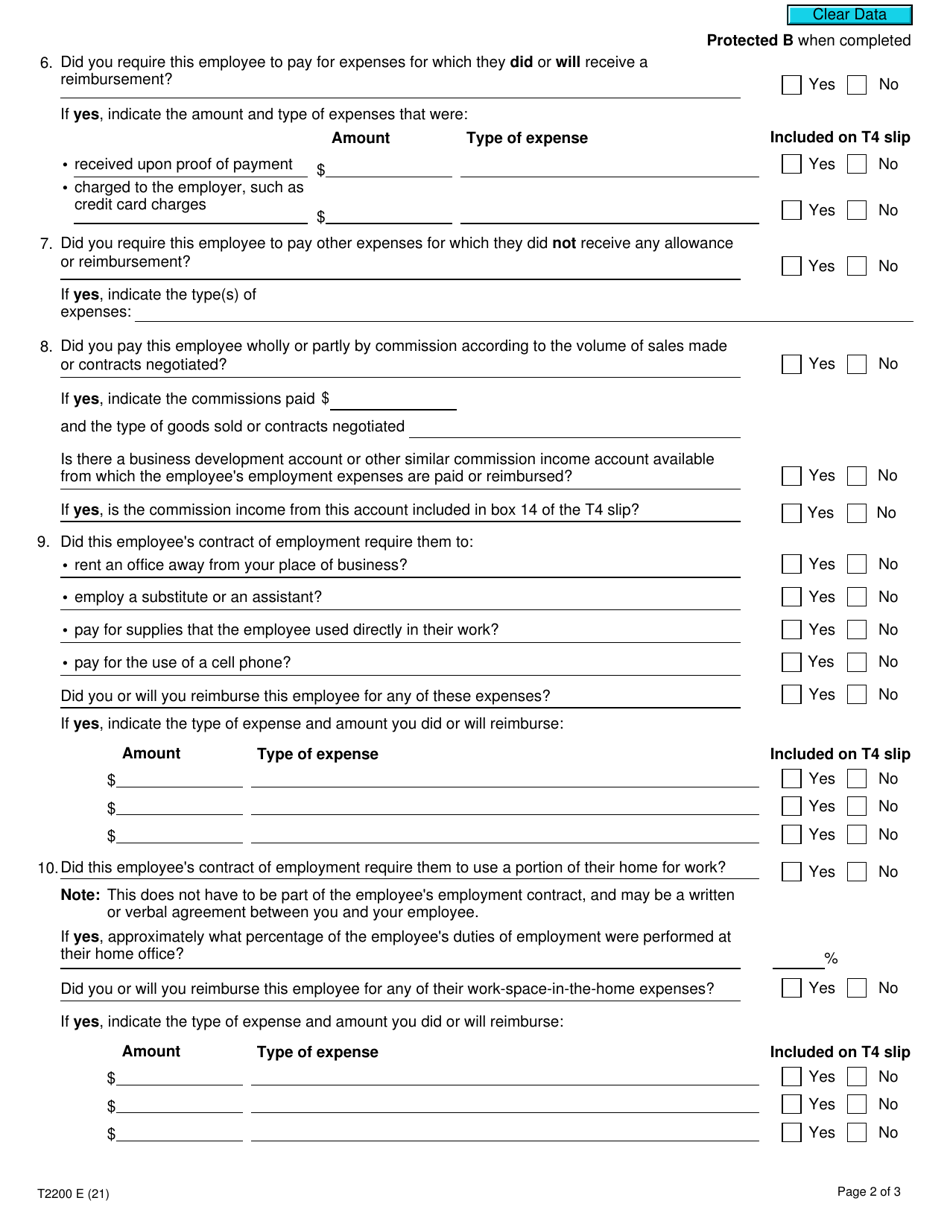

Q: What kind of employment expenses can be claimed using Form T2200?

A: Expenses such as vehicle expenses, office supplies, home office expenses, and professional dues can be claimed using Form T2200, if they meet the required conditions.

Q: Do I need to submit Form T2200 with my tax return?

A: You do not need to submit Form T2200 with your tax return. However, you must keep it along with your supporting documents in case the Canada Revenue Agency (CRA) requests to see them.

Q: How do I get Form T2200?

A: Your employer should provide you with Form T2200 if you are eligible to claim employment expenses. If your employer does not provide it, you can ask them to fill it out for you.

Q: Can I claim all my employment expenses using Form T2200?

A: No, you can only claim eligible employment expenses that meet the conditions outlined by the CRA. It is important to keep all your receipts and supporting documents for these expenses.

Q: Are there any limitations on the amount I can claim using Form T2200?

A: Yes, there are limitations and restrictions on the types and amounts of employment expenses that can be claimed. It is recommended to consult the CRA guidelines or seek professional advice to understand the specific limitations.

Q: Can I use Form T2200 if I am self-employed?

A: No, Form T2200 is specifically for employees. If you are self-employed, you would use different forms, such as Form T2125, to claim your business expenses.

Q: Can the CRA deny my claim if I submit Form T2200?

A: The CRA may deny your claim if they determine that the expenses you have claimed do not meet the necessary conditions or if your employer's declaration on Form T2200 is not considered valid.

Q: When should I submit Form T2200 to the CRA?

A: You do not need to submit Form T2200 to the CRA unless they specifically request it during an audit or review. However, you should keep it readily available along with your supporting documents.