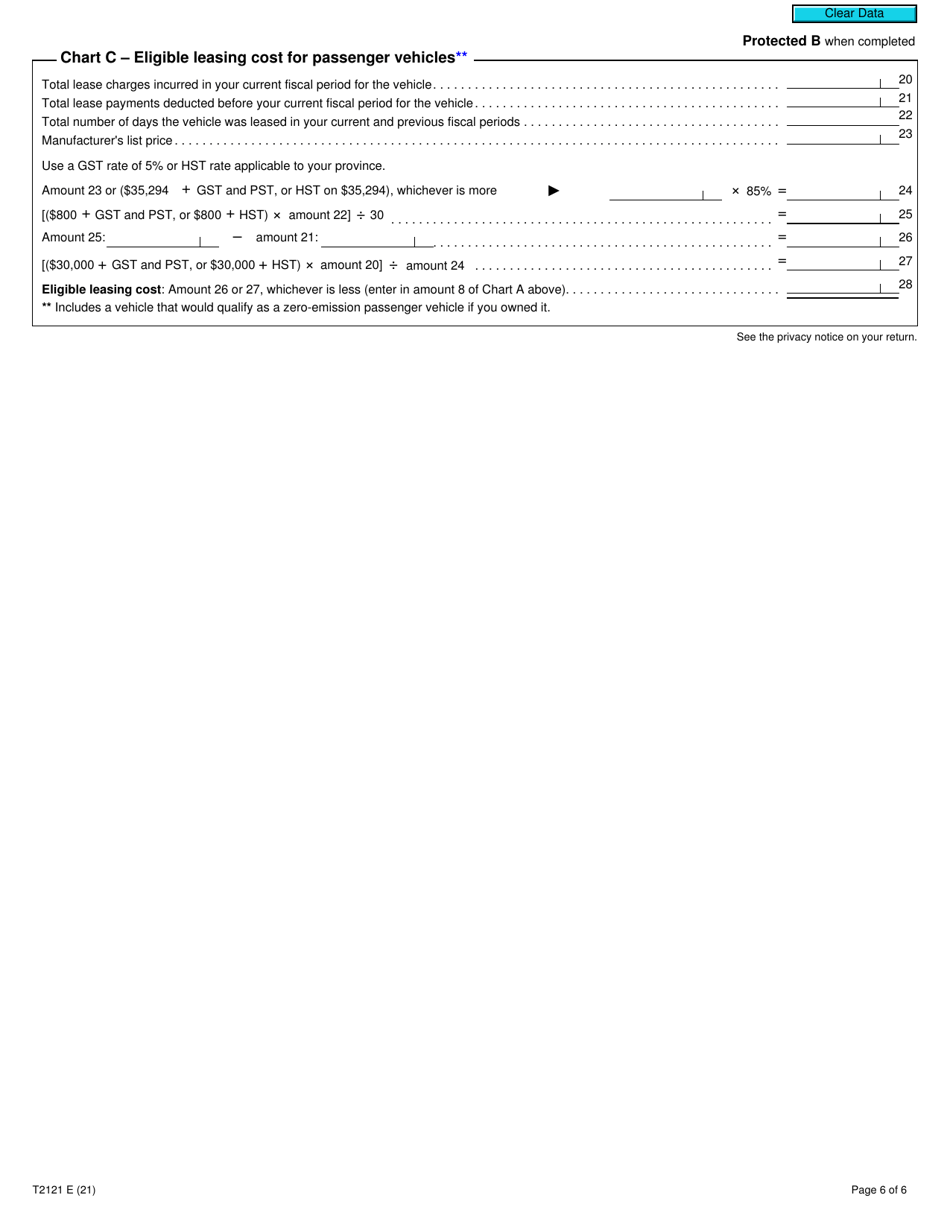

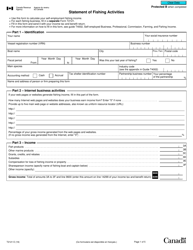

This version of the form is not currently in use and is provided for reference only. Download this version of

Form T2121

for the current year.

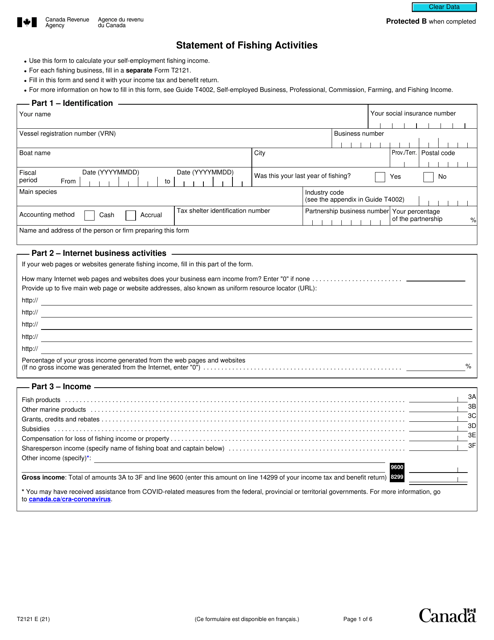

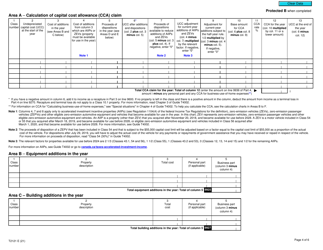

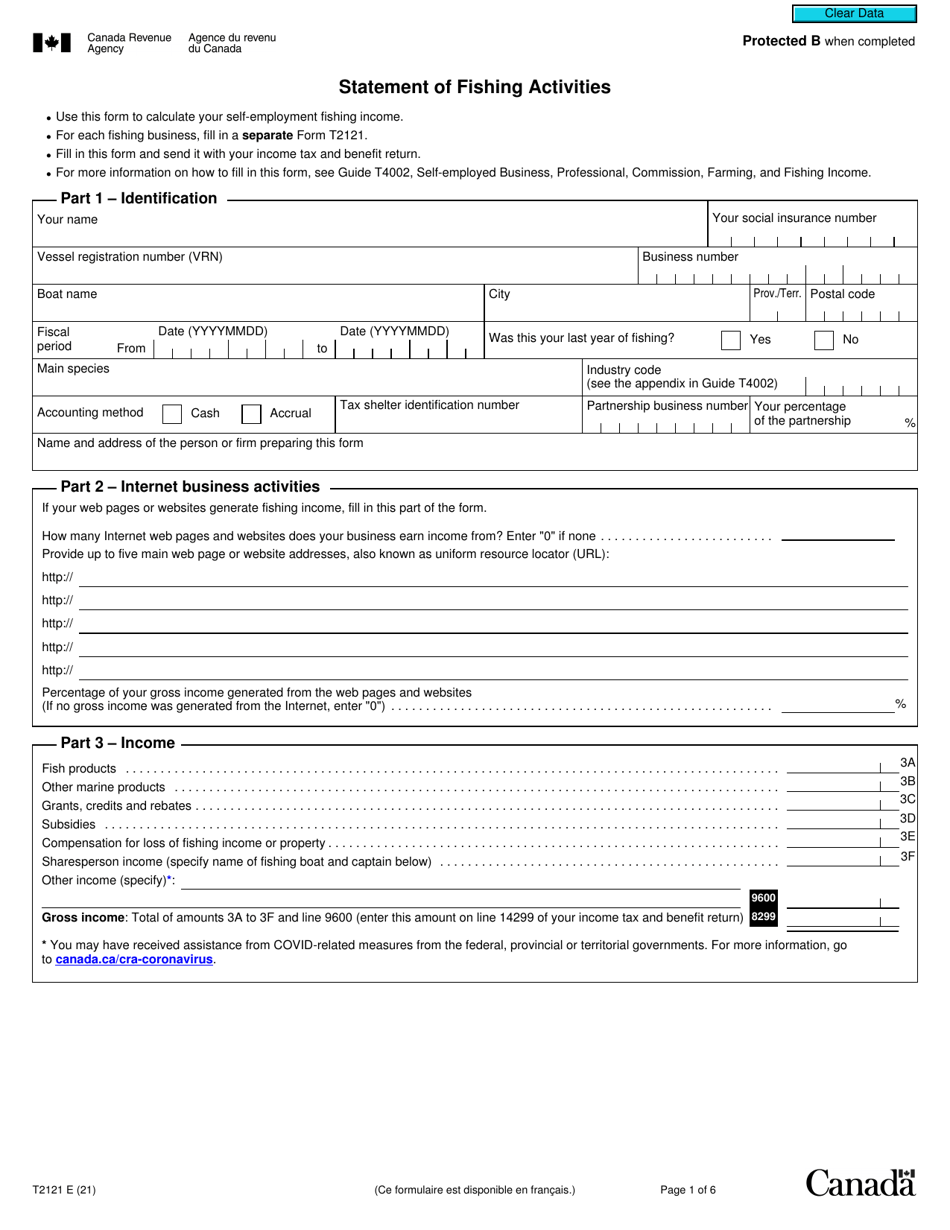

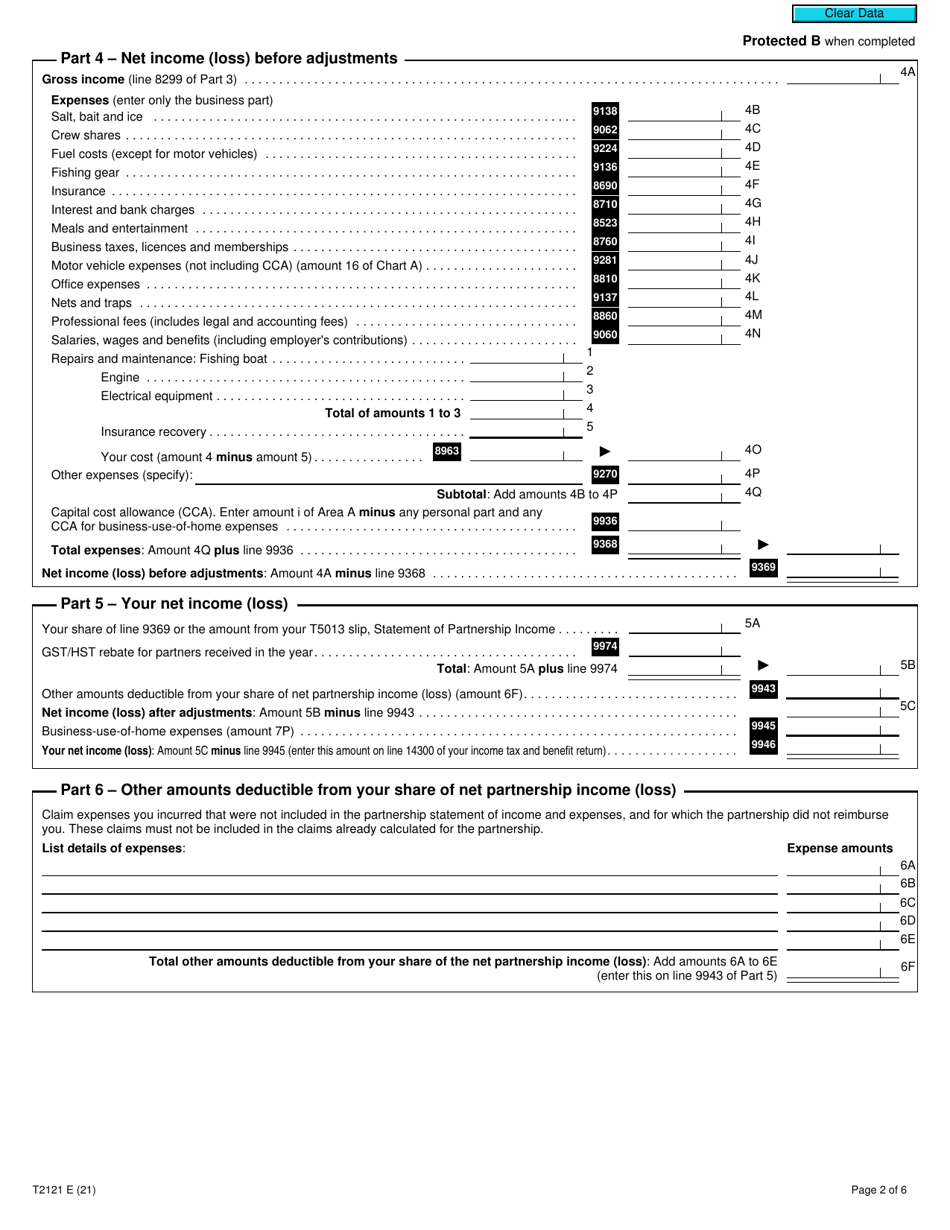

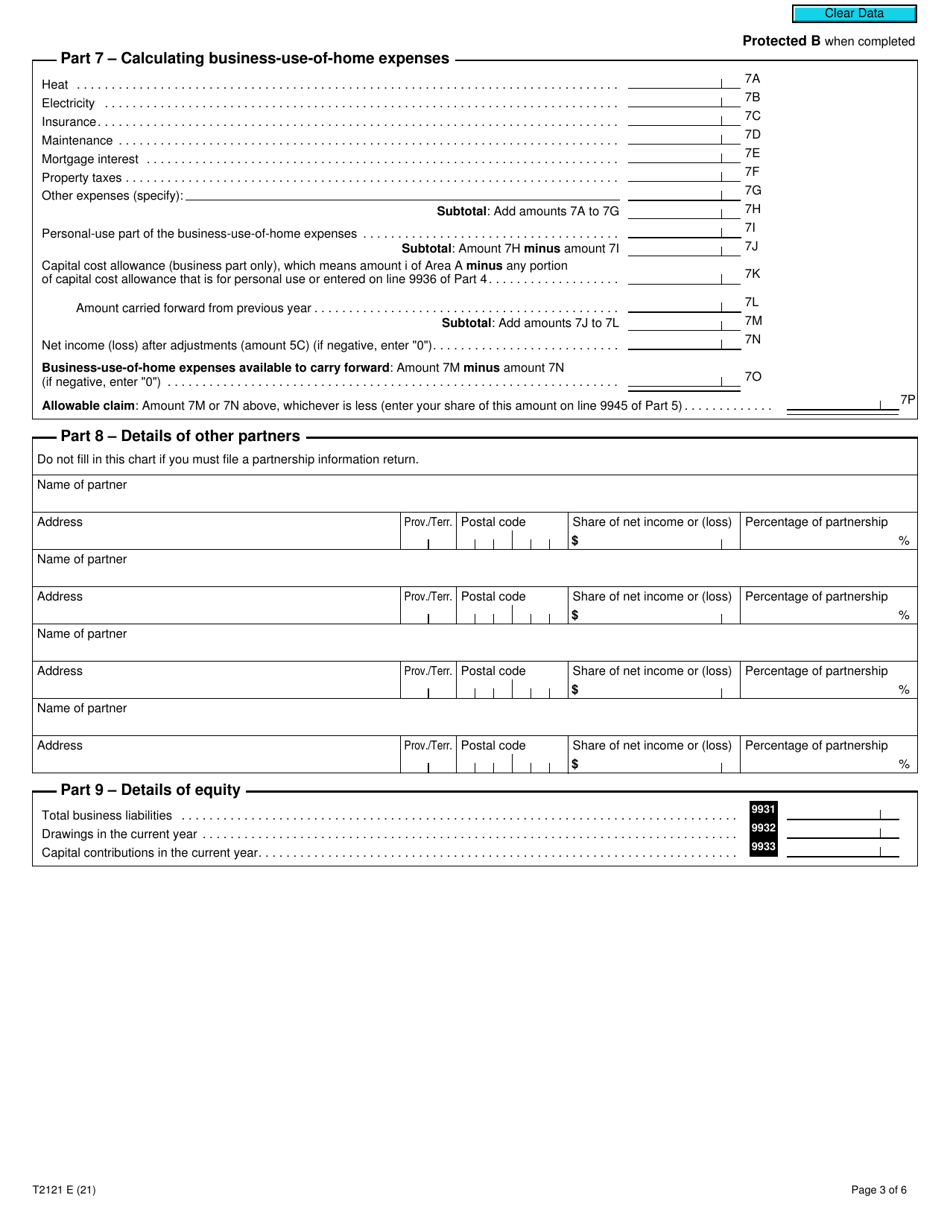

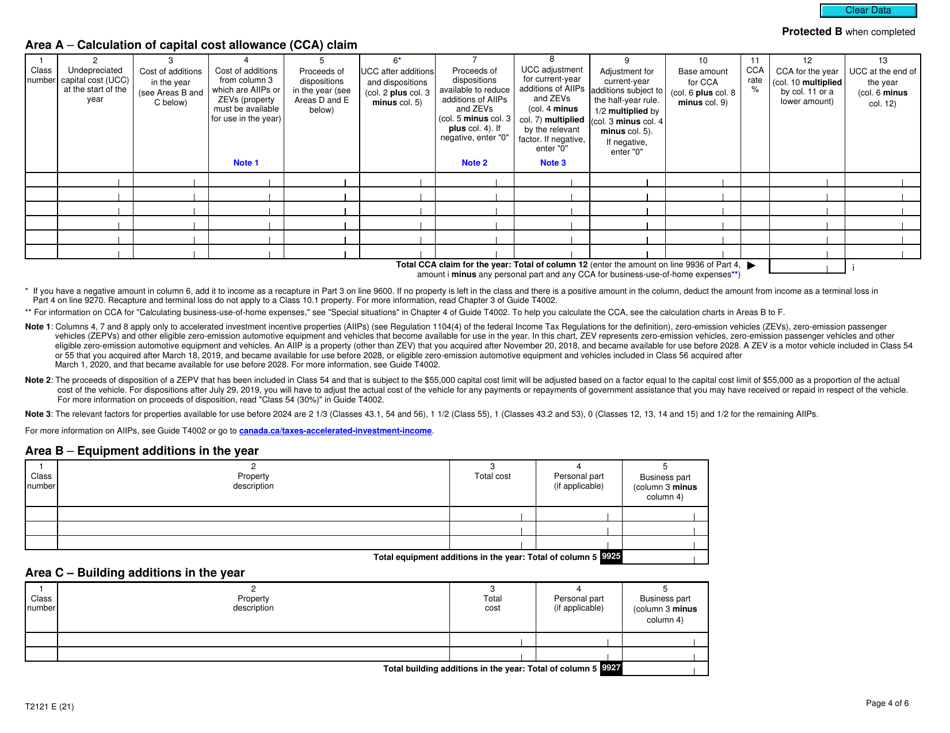

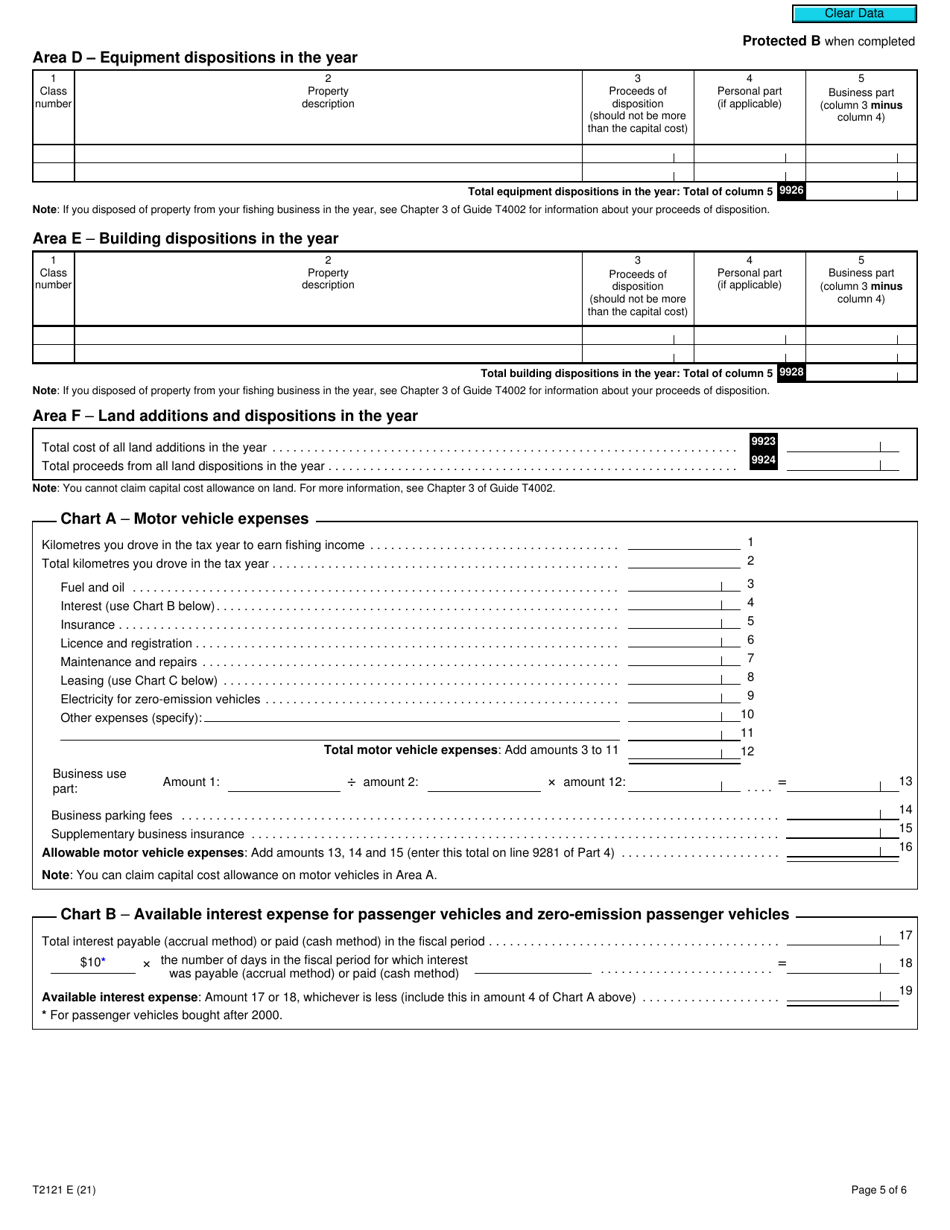

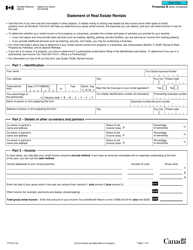

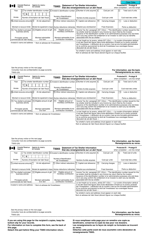

Form T2121 Statement of Fishing Activities - Canada

Form T2121 Statement of Fishing Activities - Canada is used by individuals or partnerships engaged in commercial fishing activities to report their income and expenses for tax purposes. It helps the Canada Revenue Agency (CRA) assess the correct amount of taxes owed on fishing income.

In Canada, individuals who are self-employed and involved in fishing activities file the Form T2121 Statement of Fishing Activities.

FAQ

Q: What is Form T2121?

A: Form T2121 is the Statement of Fishing Activities used in Canada.

Q: Who needs to file Form T2121?

A: Fishers in Canada who earned income from fishing need to file Form T2121.

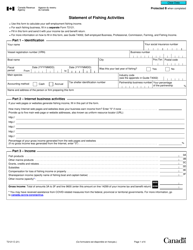

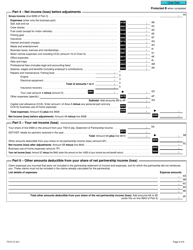

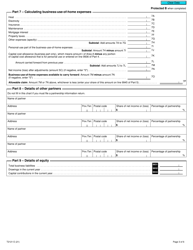

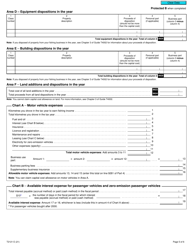

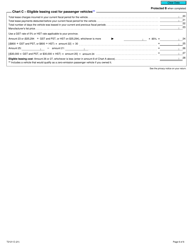

Q: What information is required on Form T2121?

A: Form T2121 requires information about the fishing income, expenses, and related activities.

Q: Are there any specific deadlines for filing Form T2121?

A: The deadline for filing Form T2121 depends on your filing status and can vary. It is important to check the official guidelines or consult with a tax professional.