This version of the form is not currently in use and is provided for reference only. Download this version of

Form T1200

for the current year.

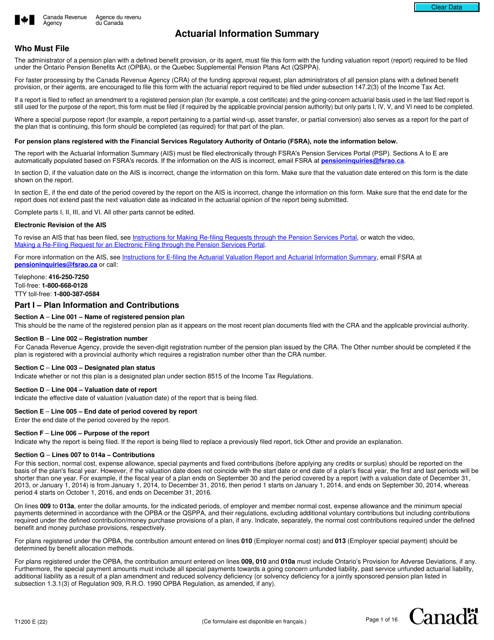

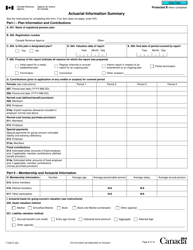

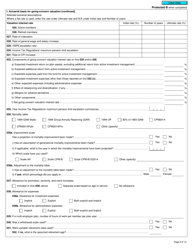

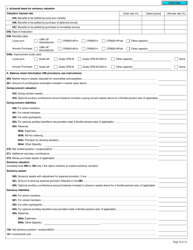

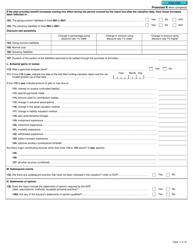

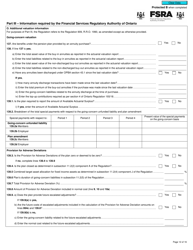

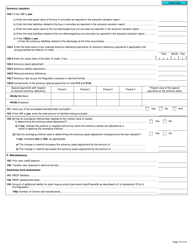

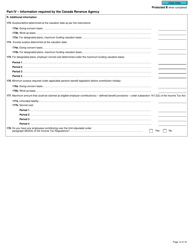

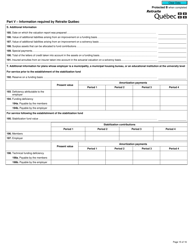

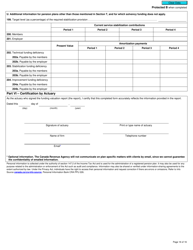

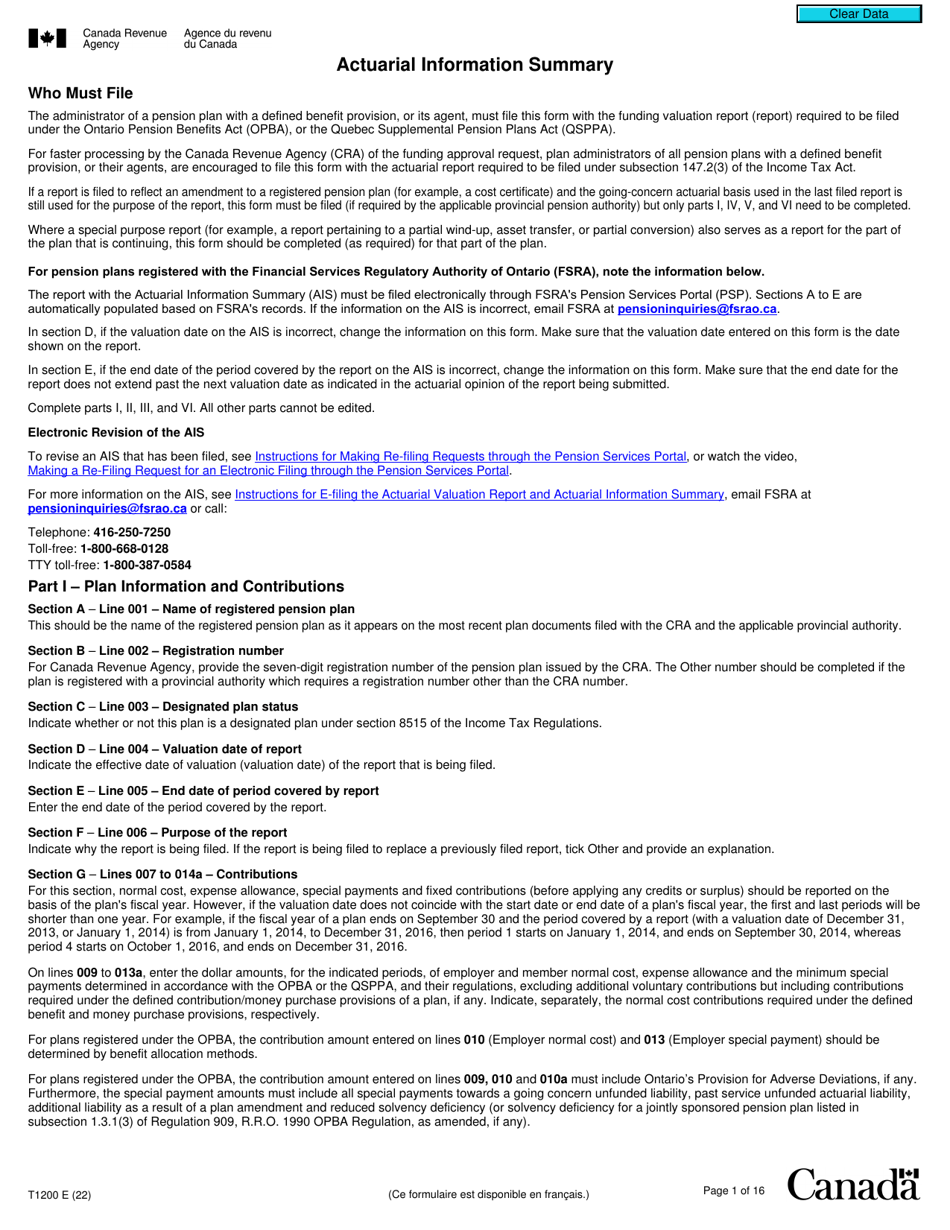

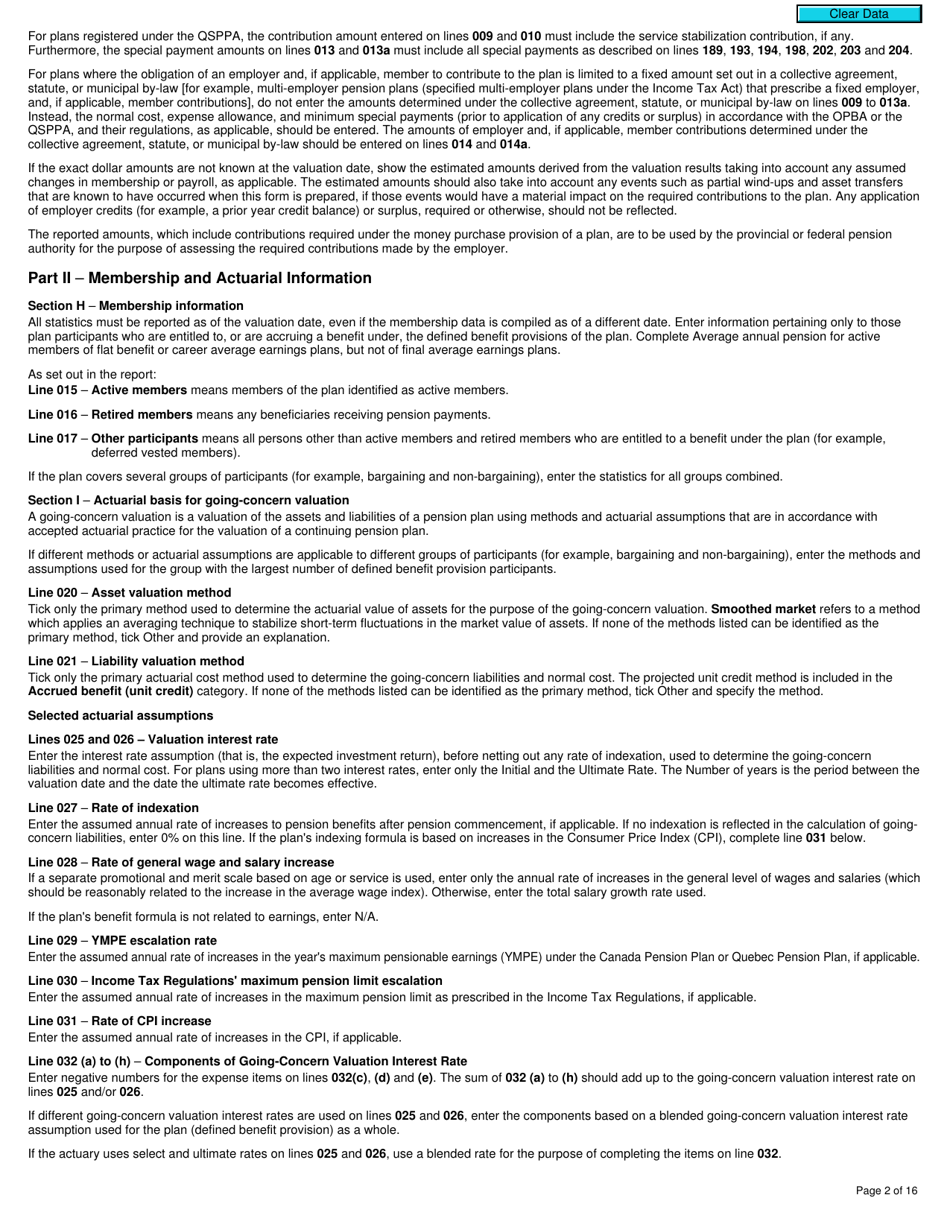

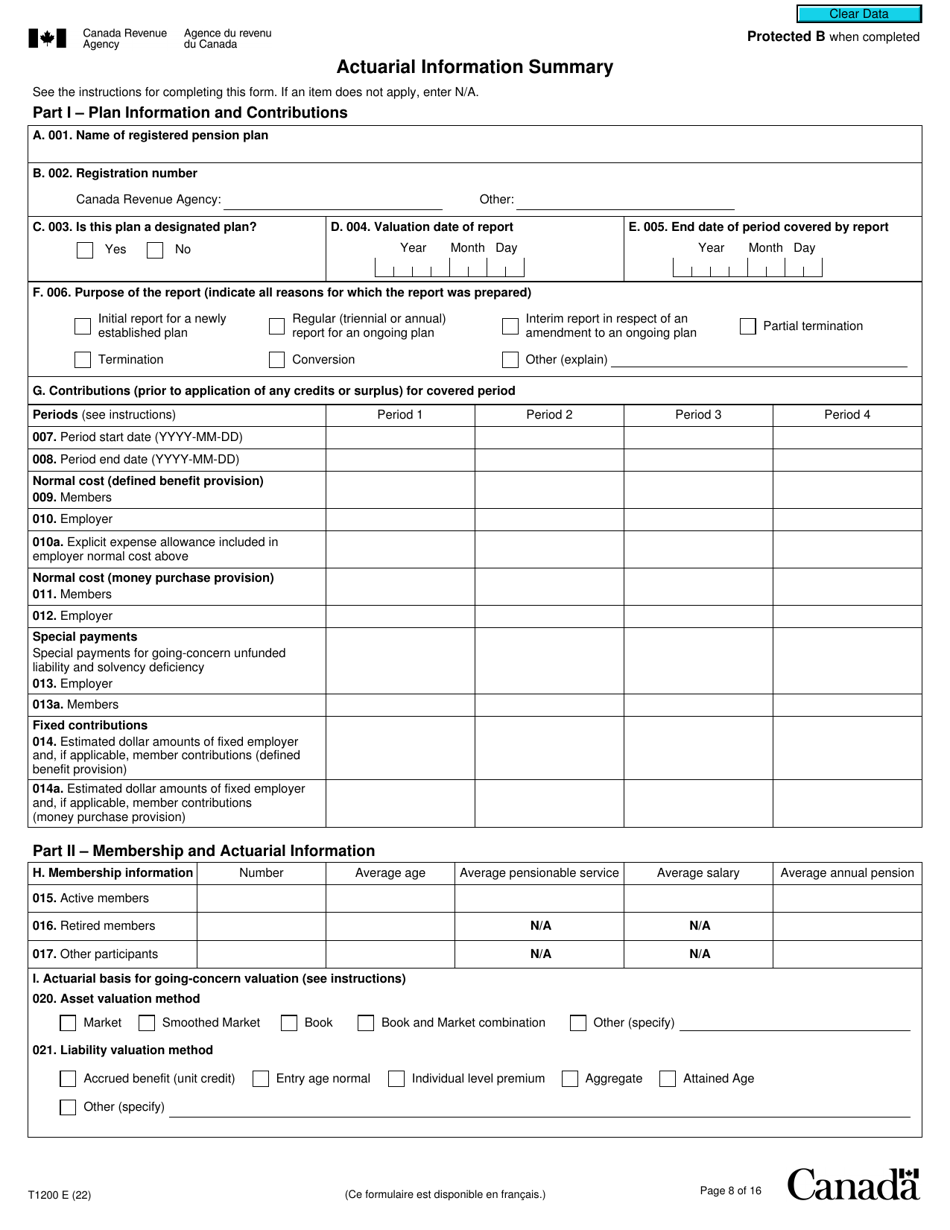

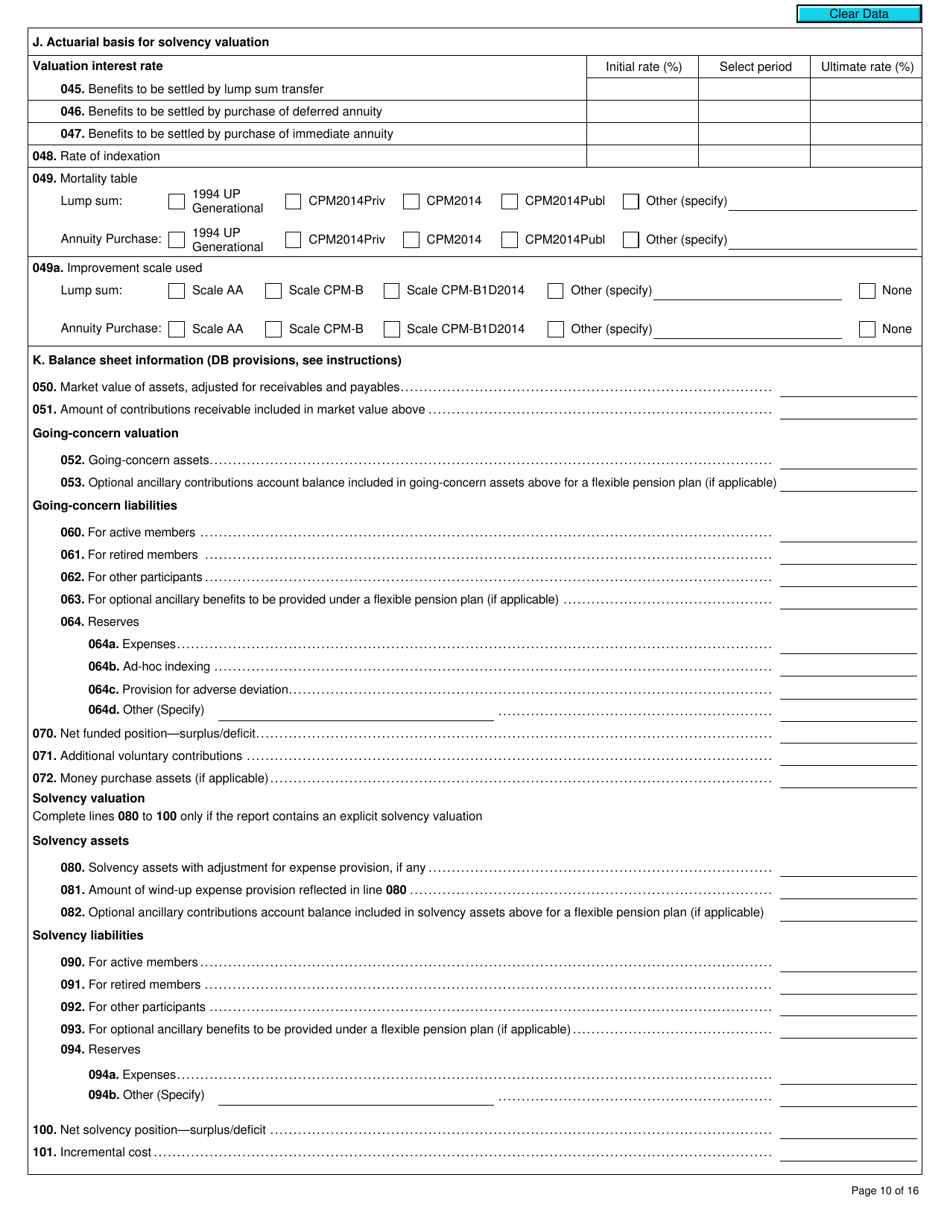

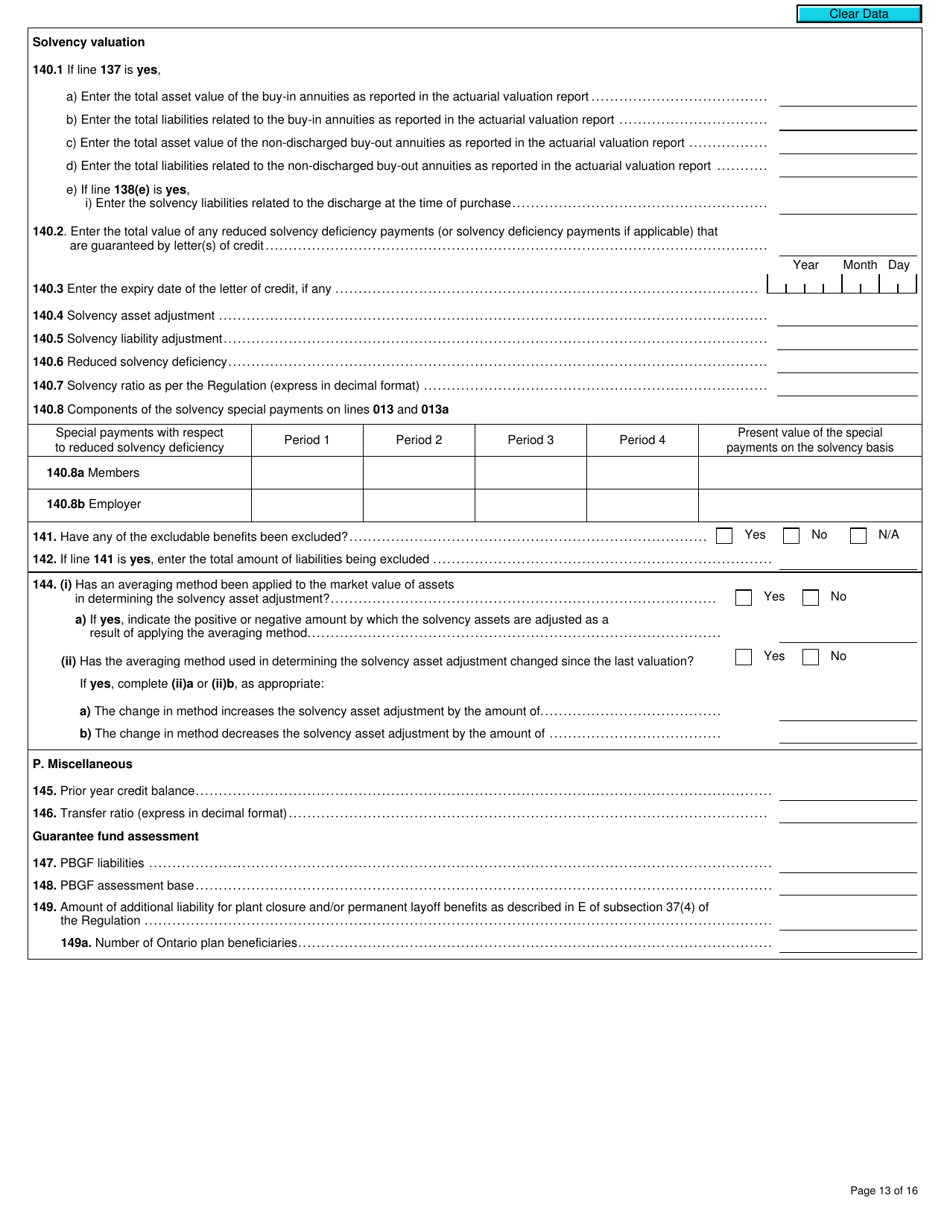

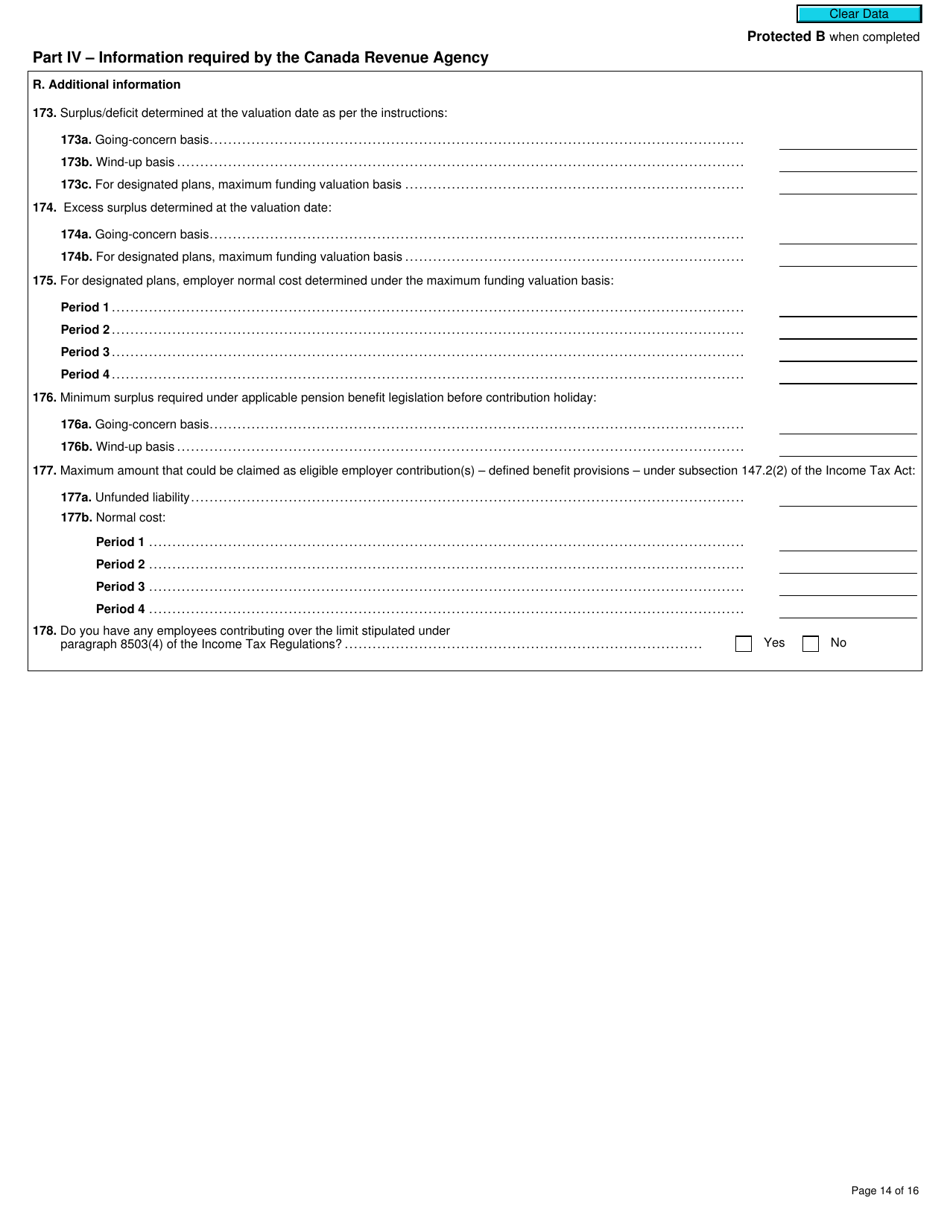

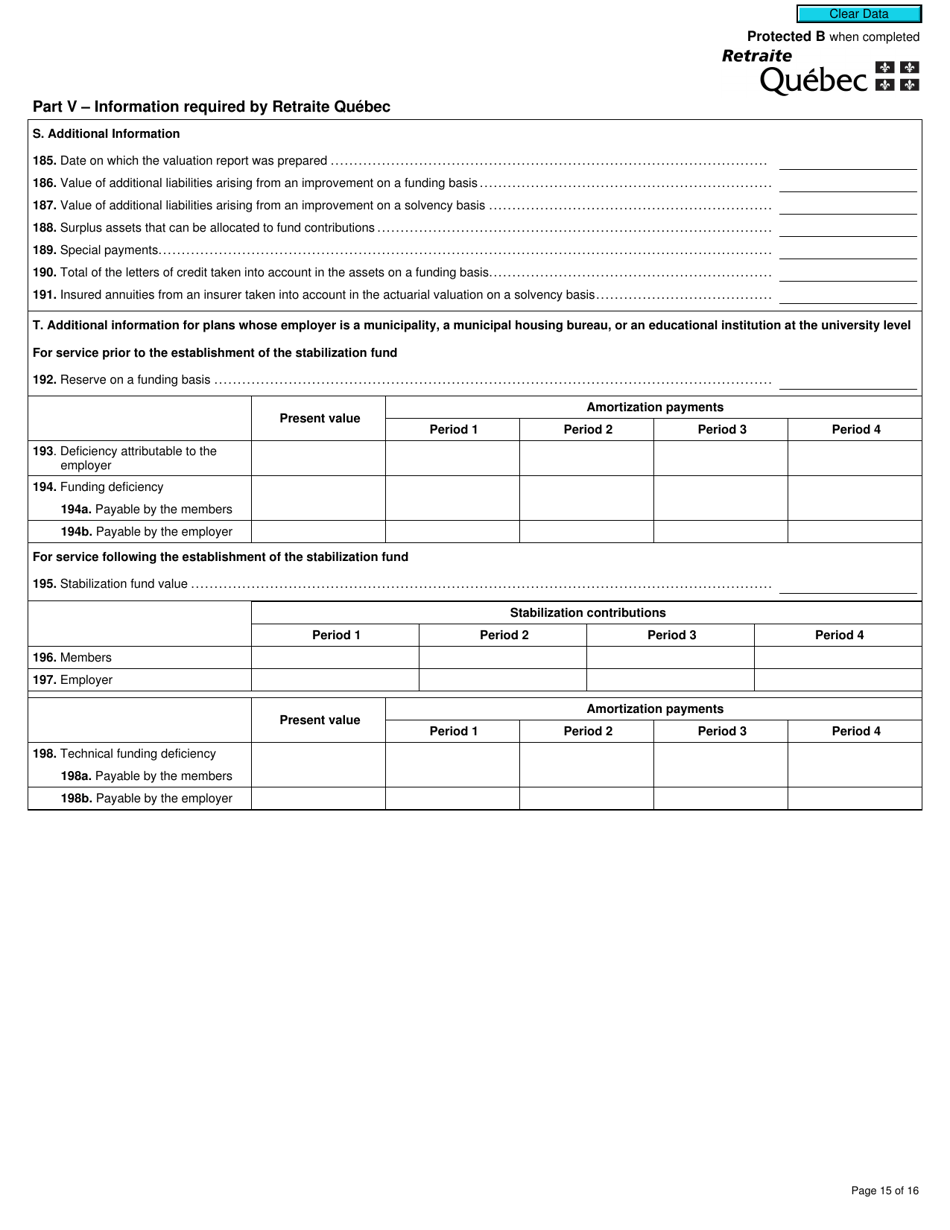

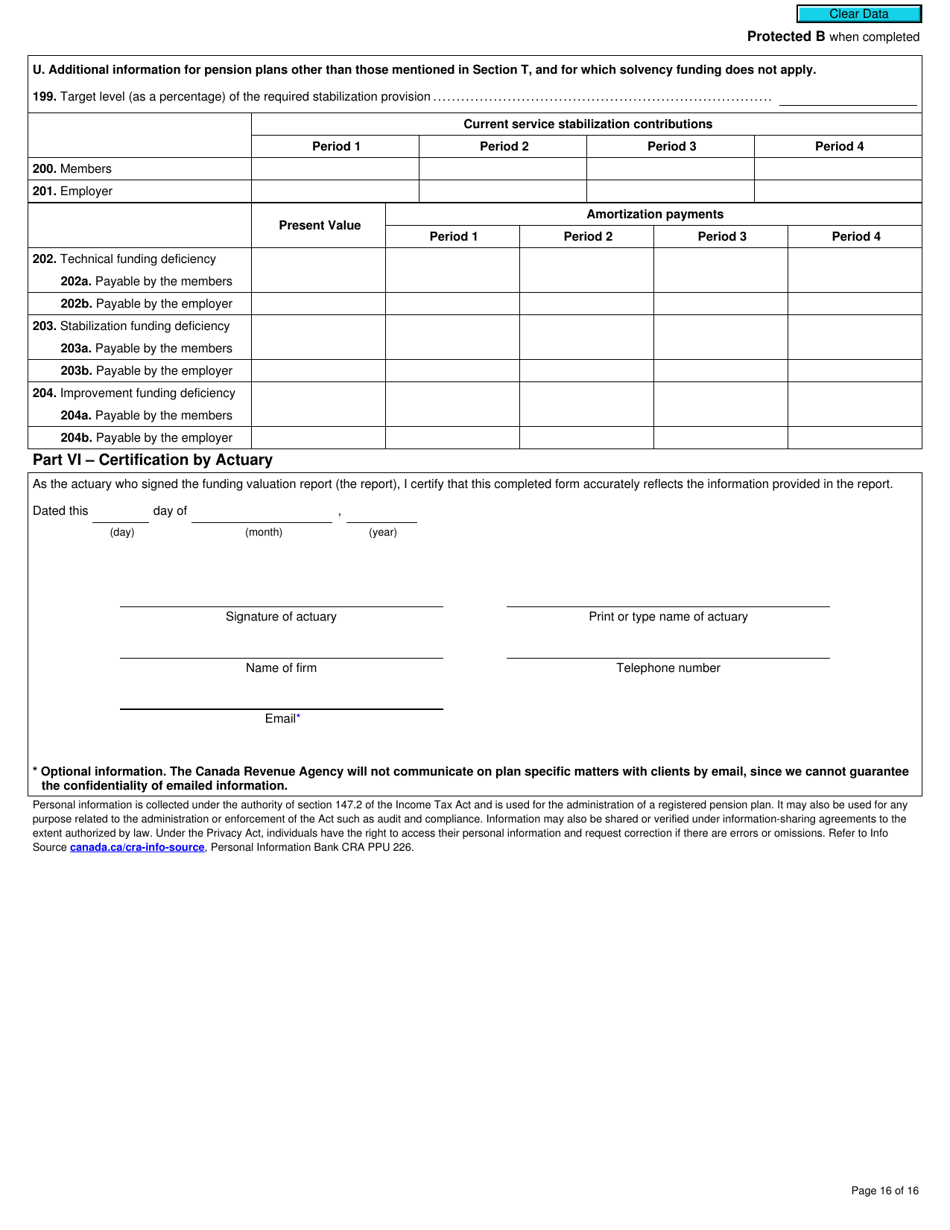

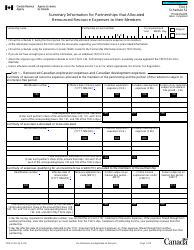

Form T1200 Actuarial Information Summary - Canada

Form T1200 Actuarial Information Summary is a form used in Canada for reporting actuarial information related to registered pension plans. It provides a summary of the assumptions and calculations made by the plan's actuary.

The Form T1200 Actuarial Information Summary in Canada is filed by the actuary.

FAQ

Q: What is Form T1200?

A: Form T1200 is an Actuarial Information Summary form used in Canada.

Q: Who needs to file Form T1200?

A: Individuals and businesses with registered pension plans in Canada that have more than 50 members need to file Form T1200.

Q: What information does Form T1200 include?

A: Form T1200 includes actuarial information such as the plan's funding status, benefit obligations, and actuarial assumptions.

Q: When is Form T1200 due?

A: Form T1200 is generally due within 9 months after the end of the pension plan's fiscal year.

Q: Are there any penalties for not filing Form T1200?

A: Yes, there are penalties for not filing Form T1200, including financial penalties imposed by the CRA.

Q: Do I need to keep a copy of Form T1200?

A: Yes, it is recommended to keep a copy of Form T1200 for record-keeping purposes.

Q: What should I do if I have questions about Form T1200?

A: If you have questions about Form T1200, you can contact the CRA or consult with a qualified actuary or tax professional.