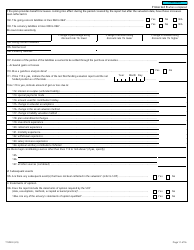

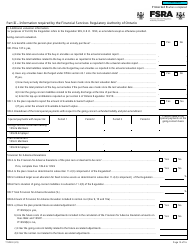

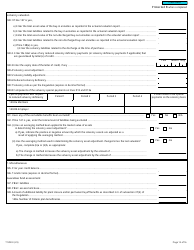

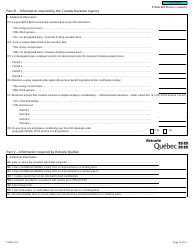

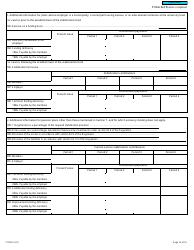

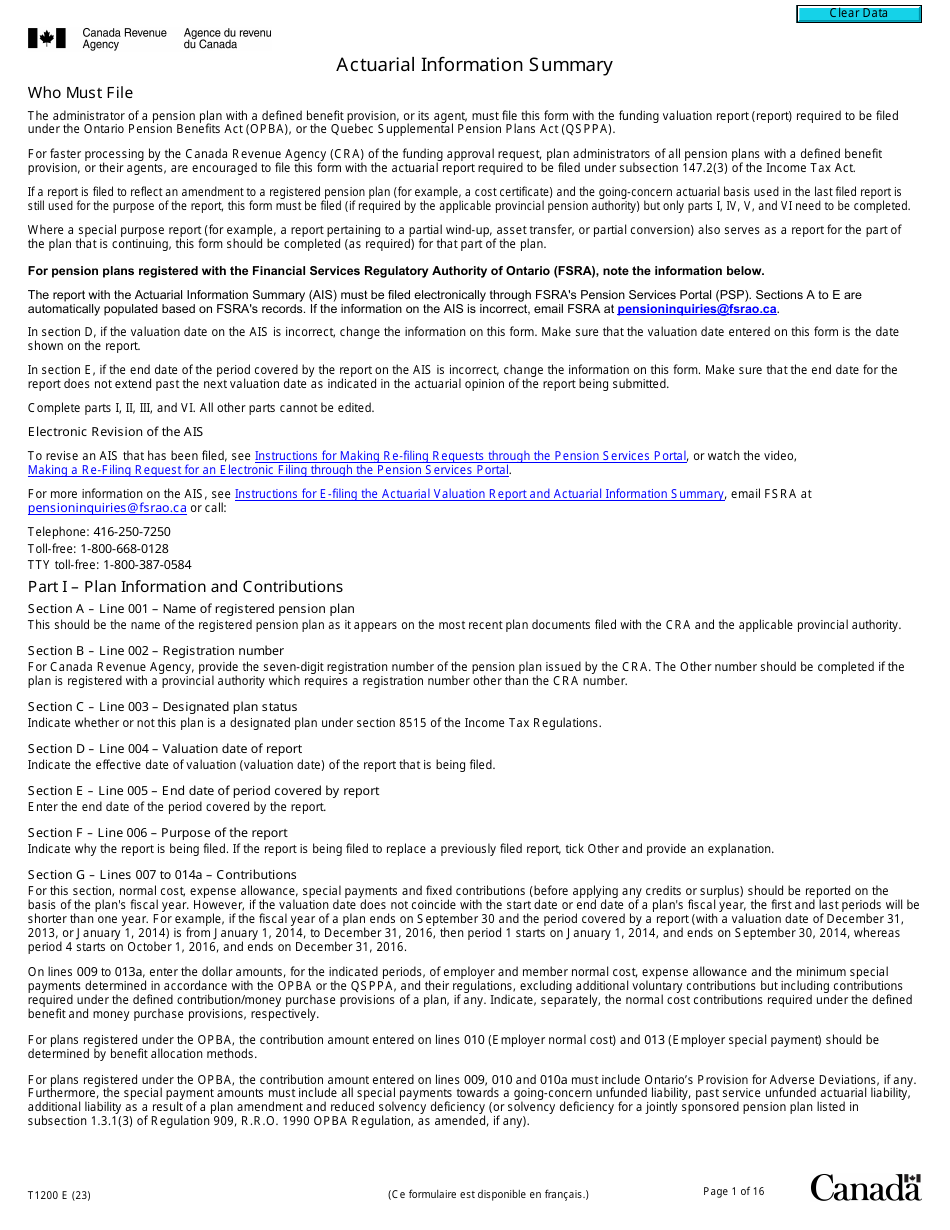

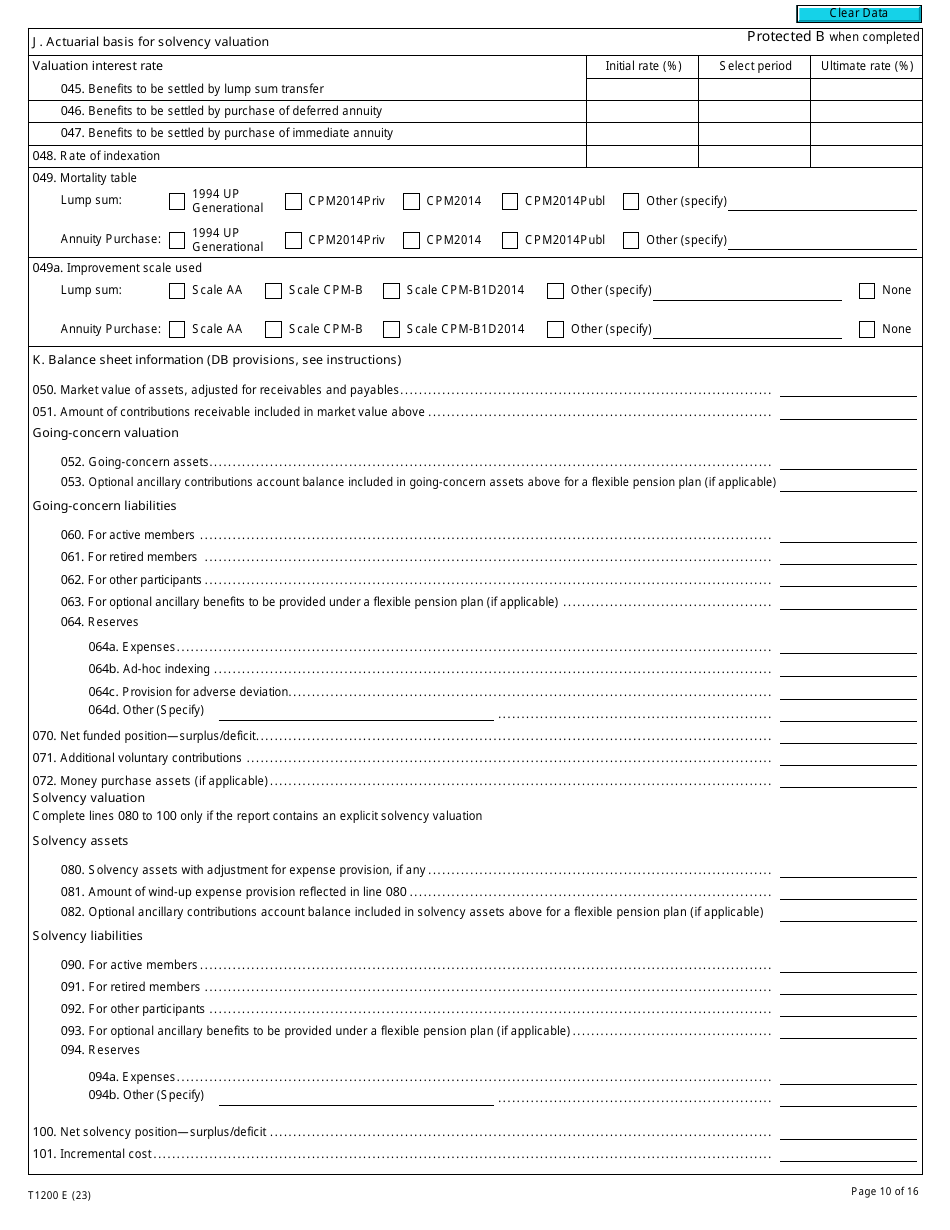

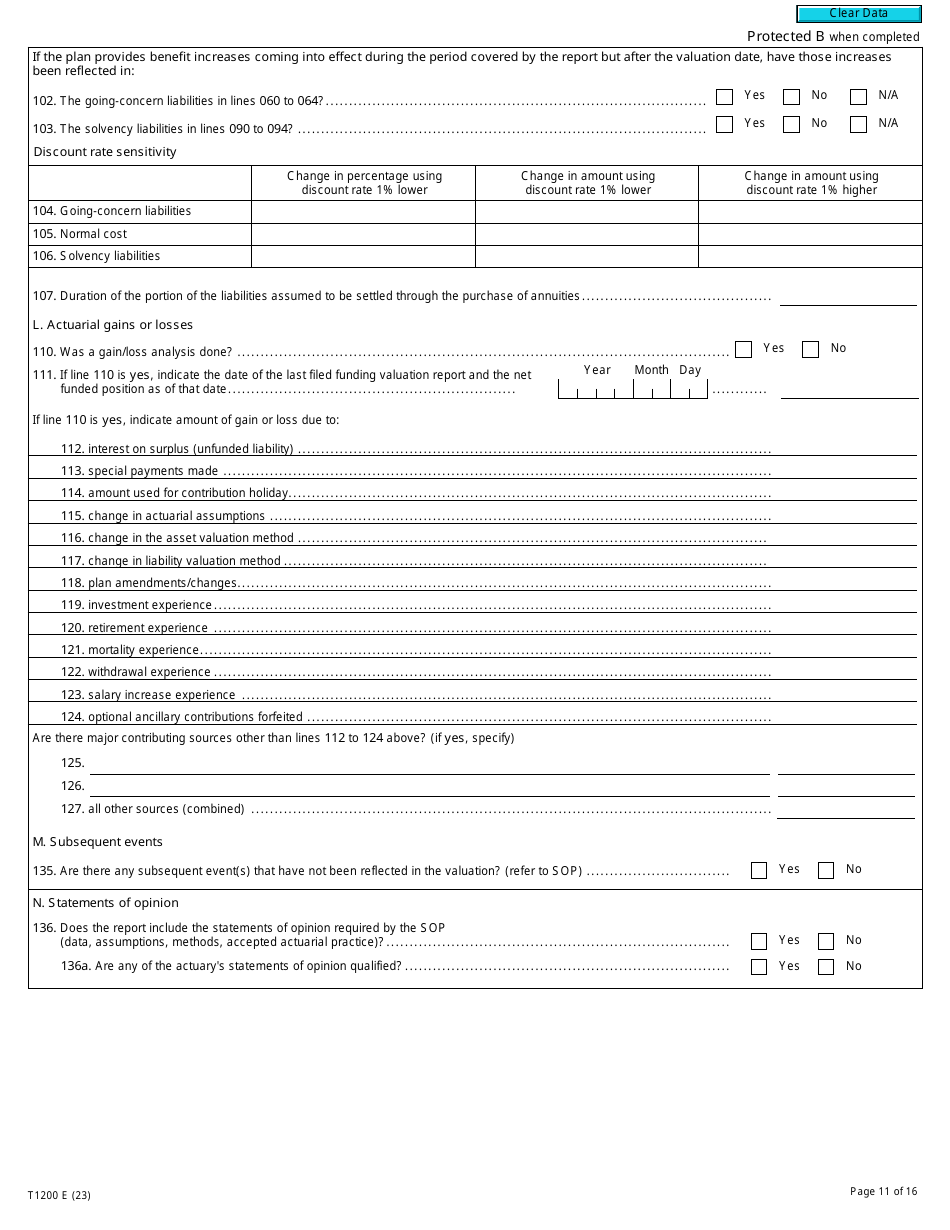

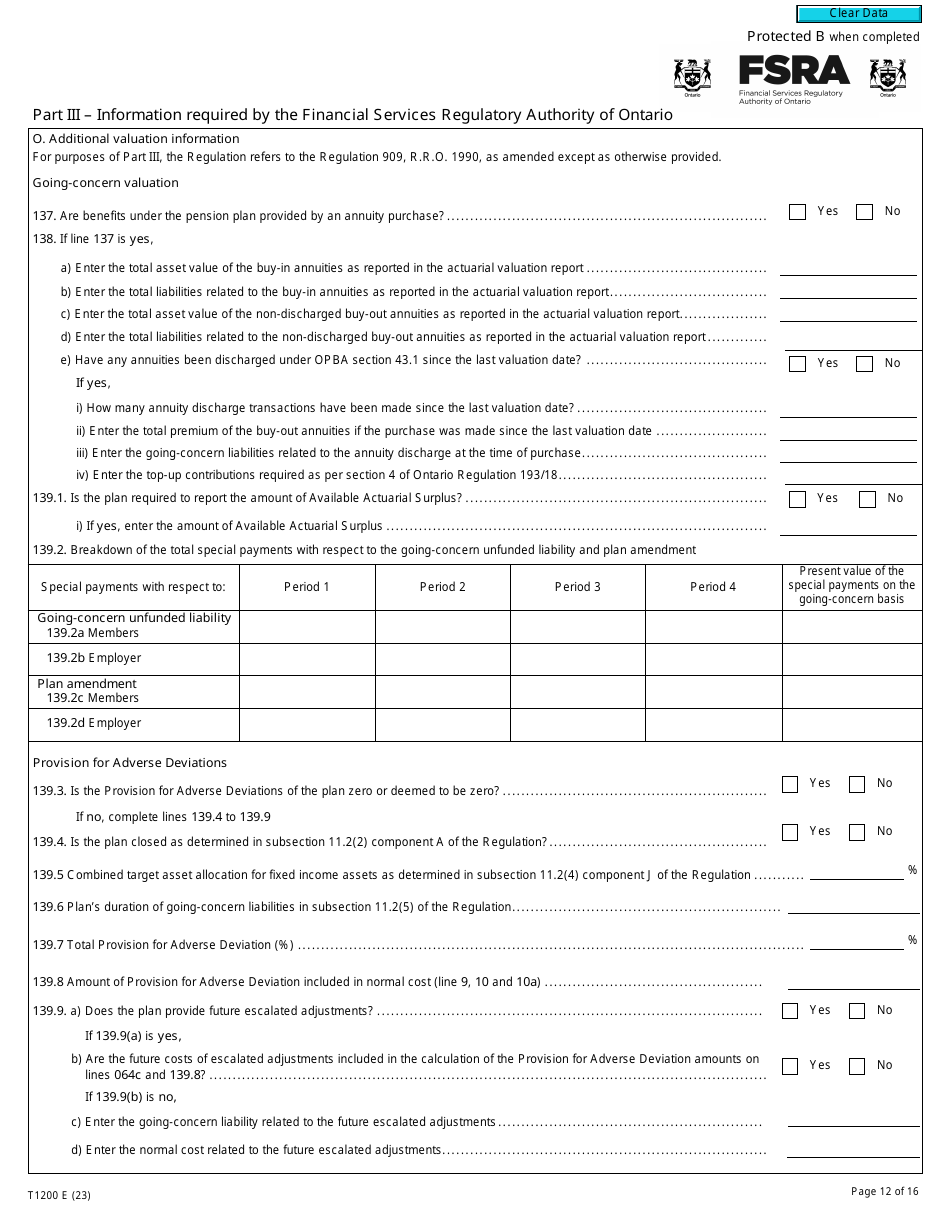

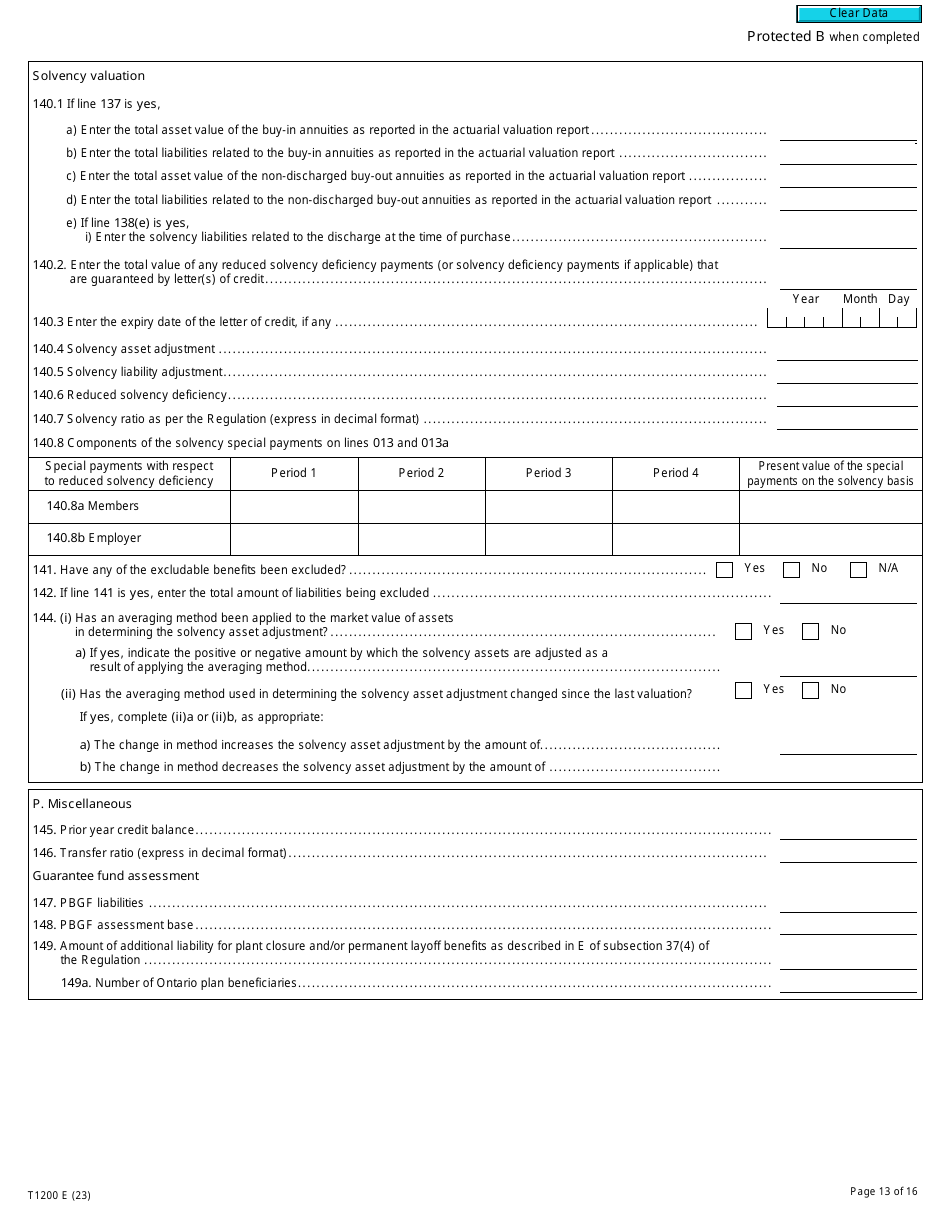

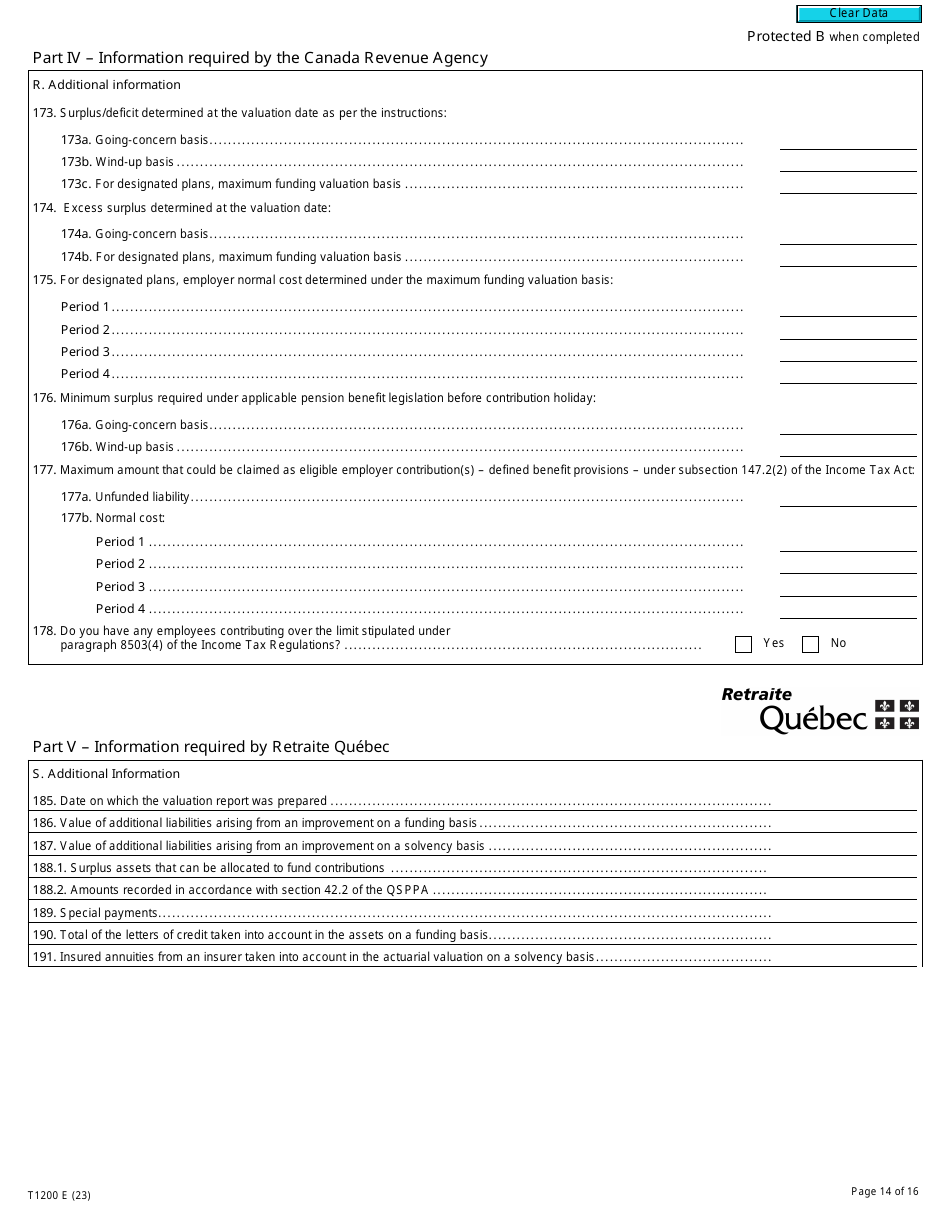

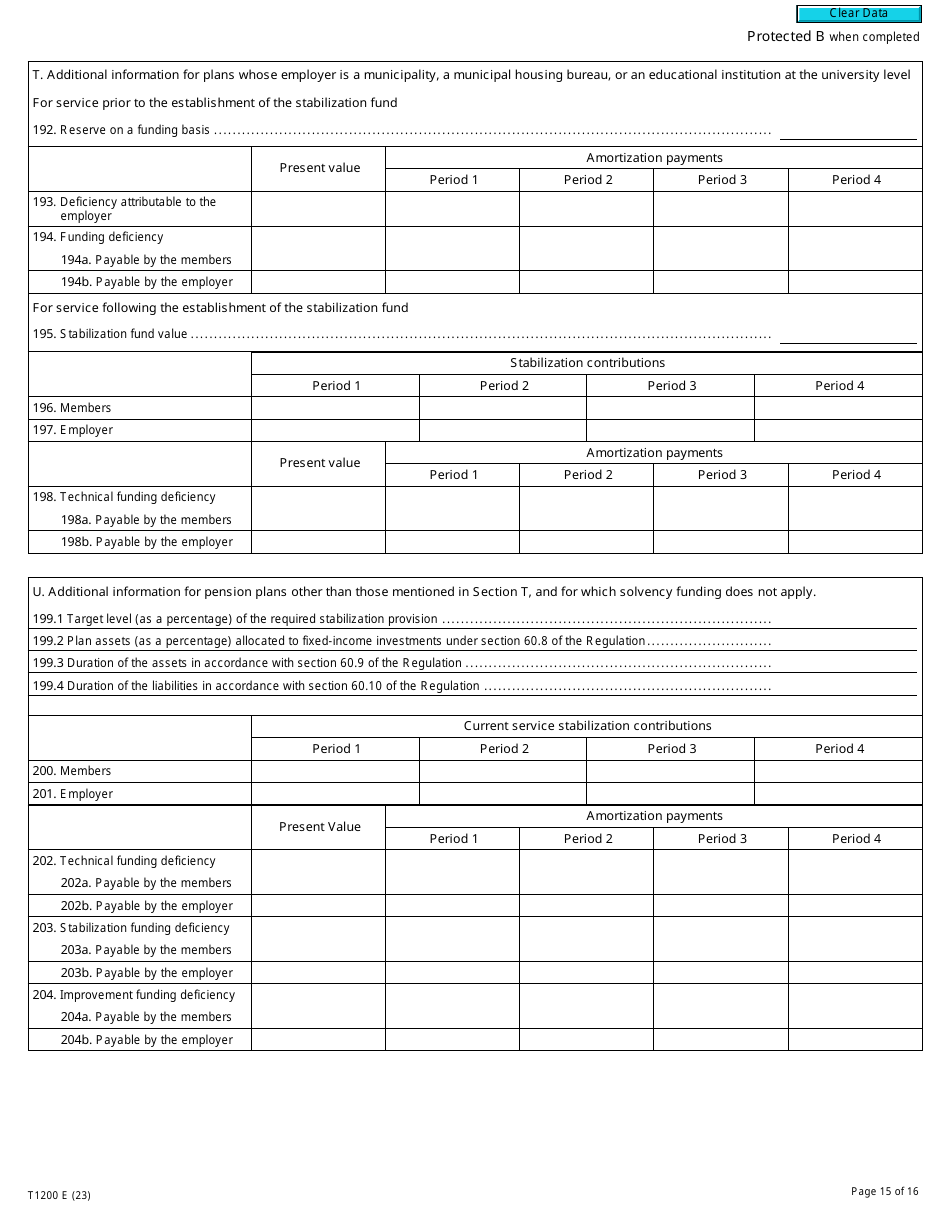

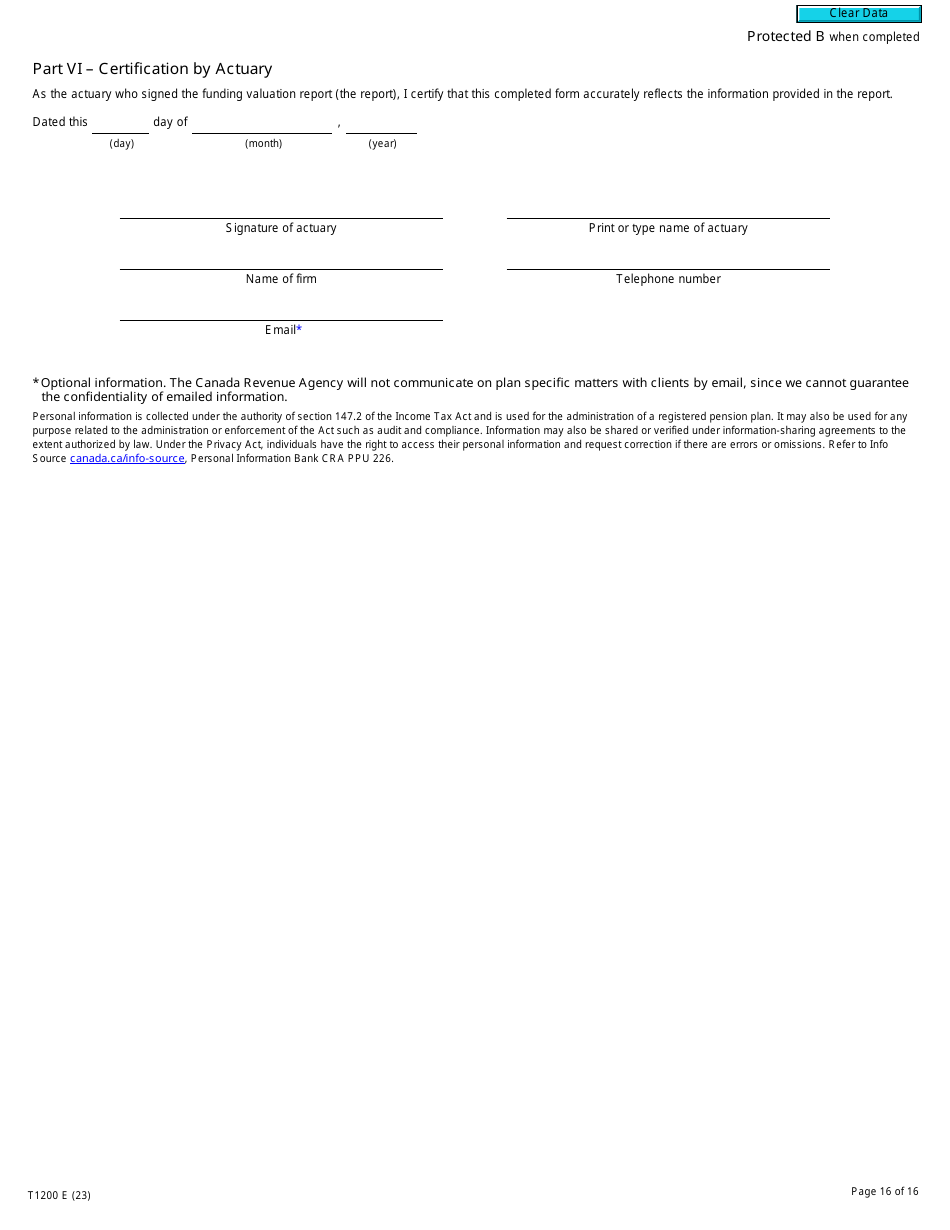

Form T1200 Actuarial Information Summary - Canada

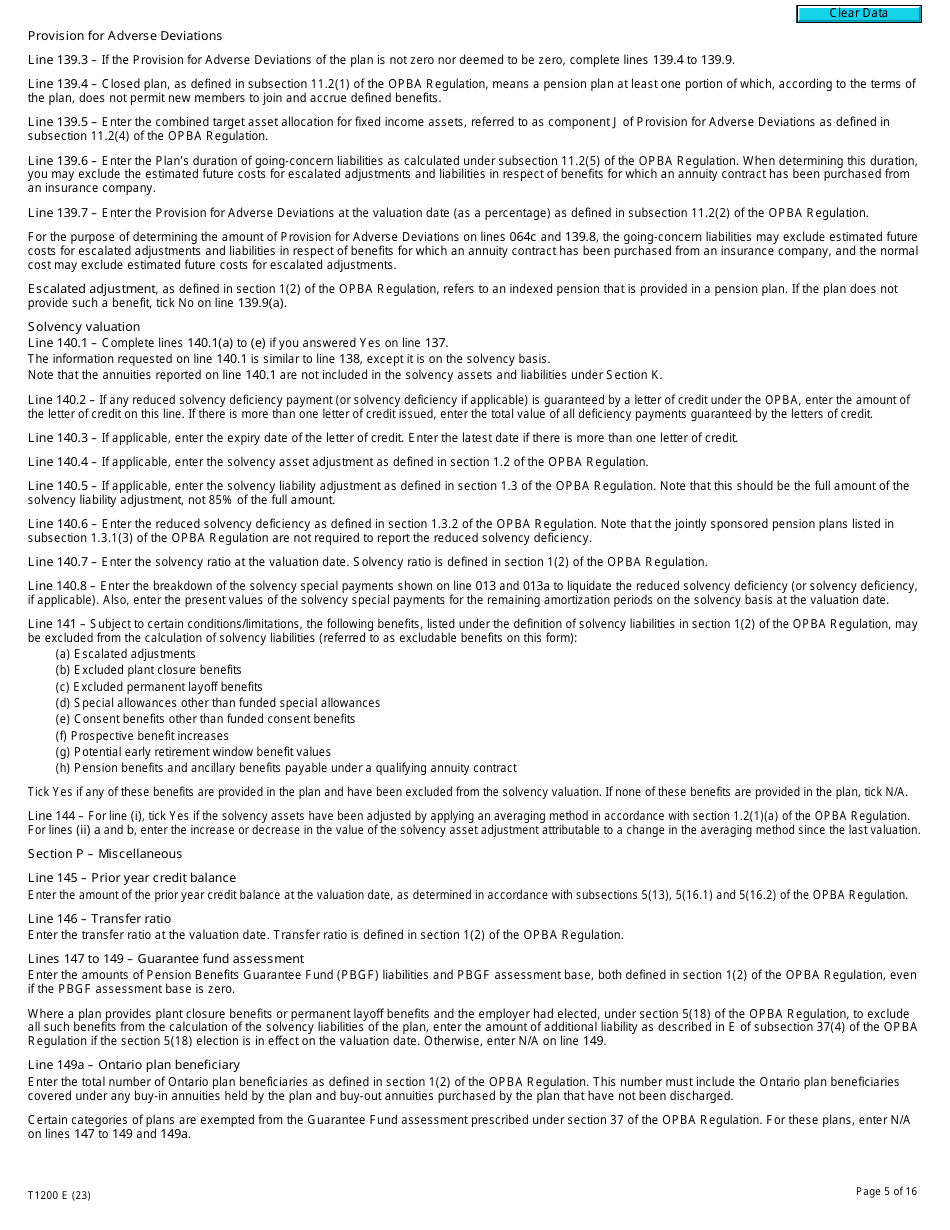

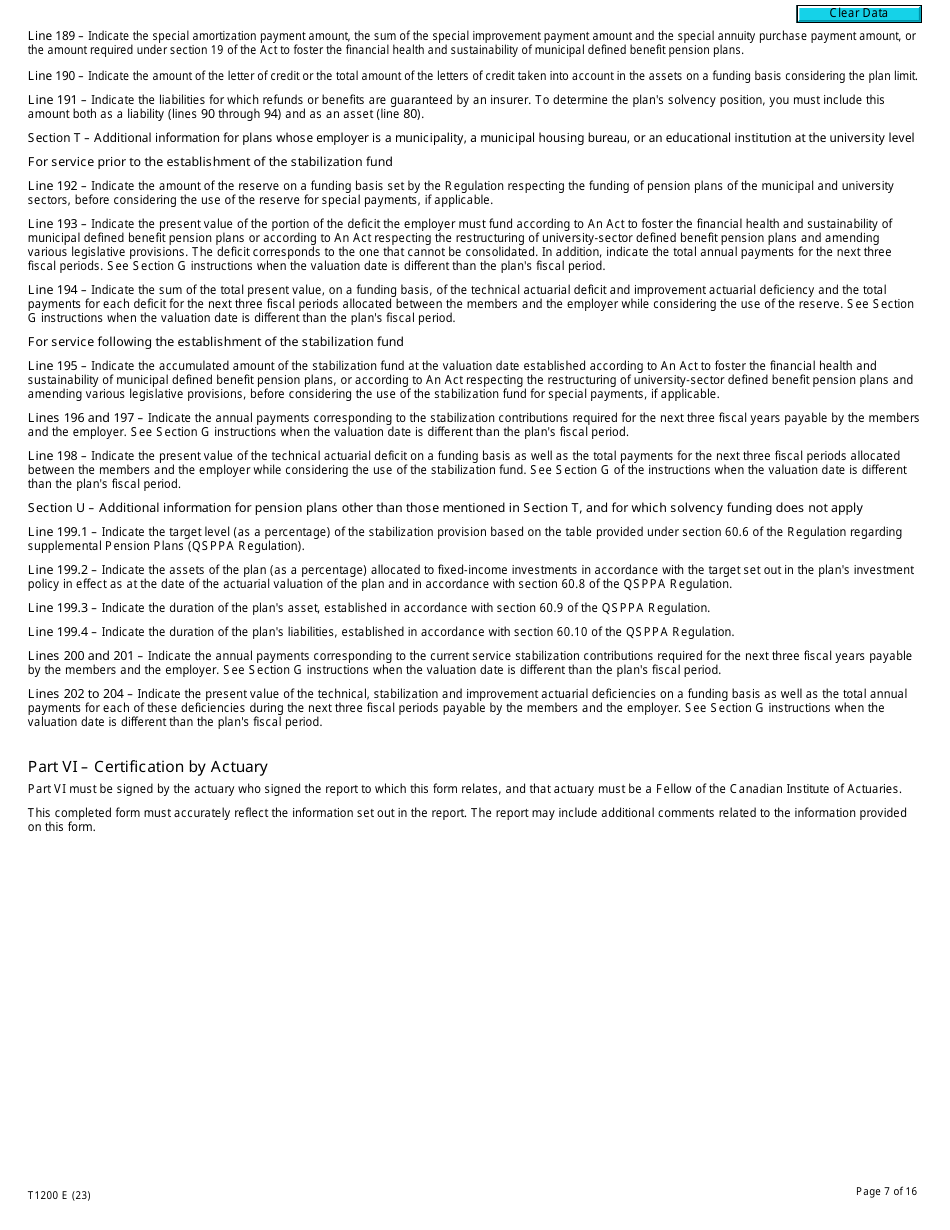

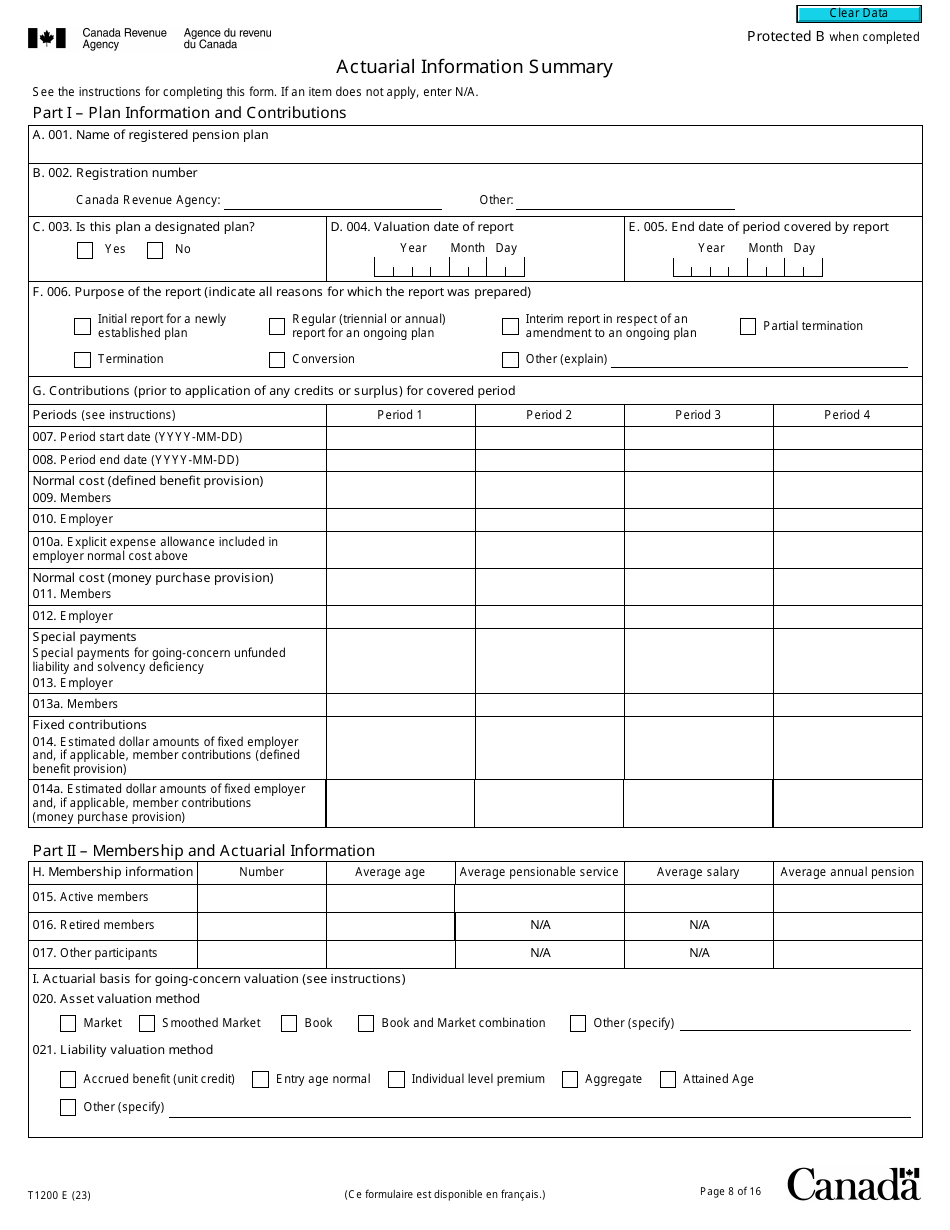

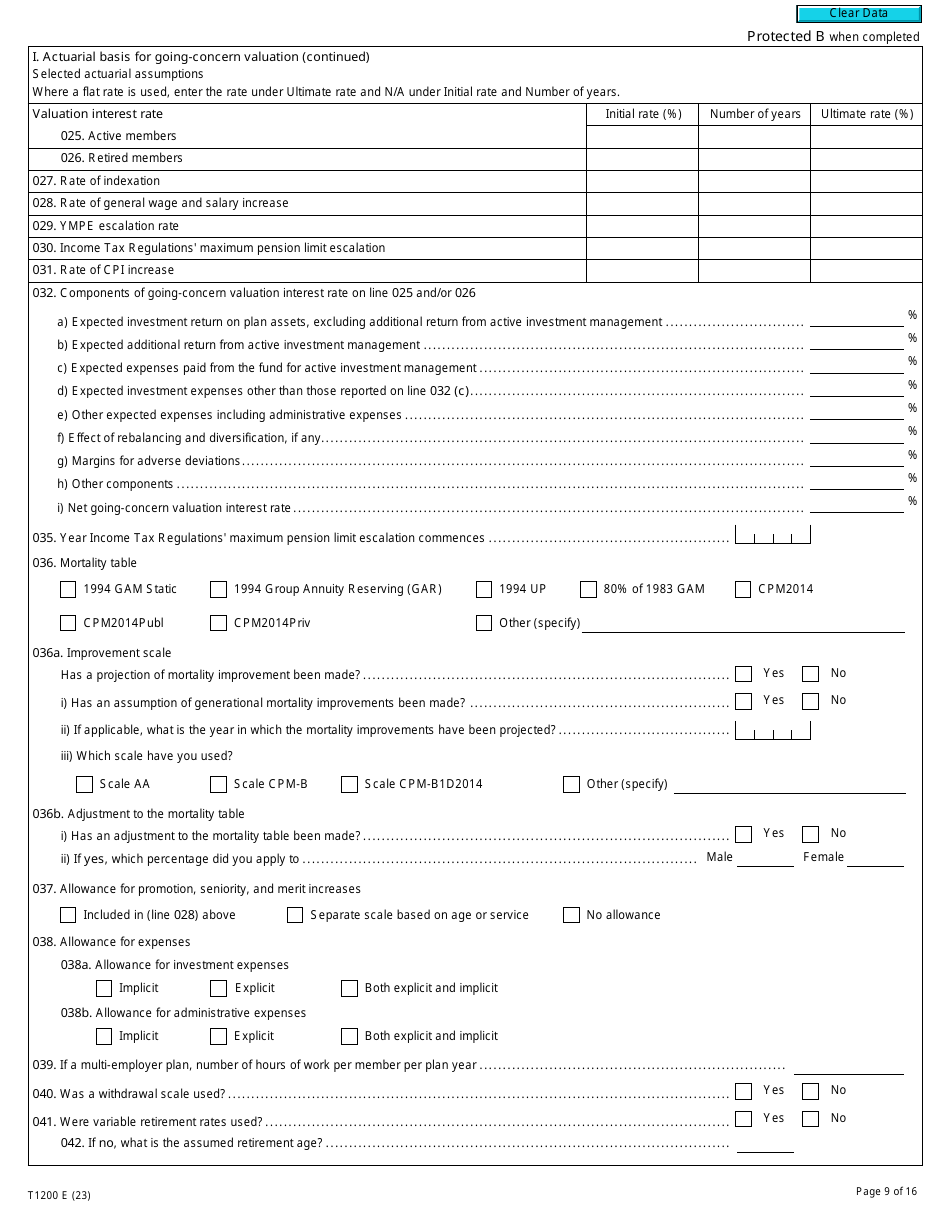

Form T1200 Actuarial Information Summary is a form used in Canada for reporting actuarial information related to registered pension plans. It provides a summary of the assumptions and calculations made by the plan's actuary.

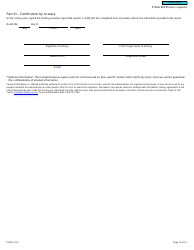

The Form T1200 Actuarial Information Summary in Canada is filed by the actuary.

Form T1200 Actuarial Information Summary - Canada - Frequently Asked Questions (FAQ)

Q: What is Form T1200?

A: Form T1200 is an Actuarial Information Summary form used in Canada.

Q: Who needs to file Form T1200?

A: Individuals and businesses with registered pension plans in Canada that have more than 50 members need to file Form T1200.

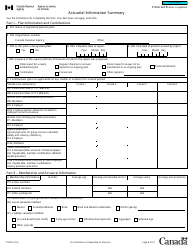

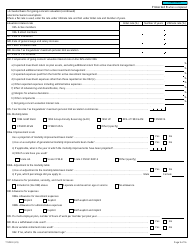

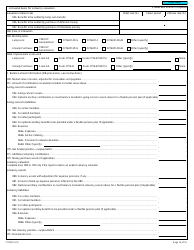

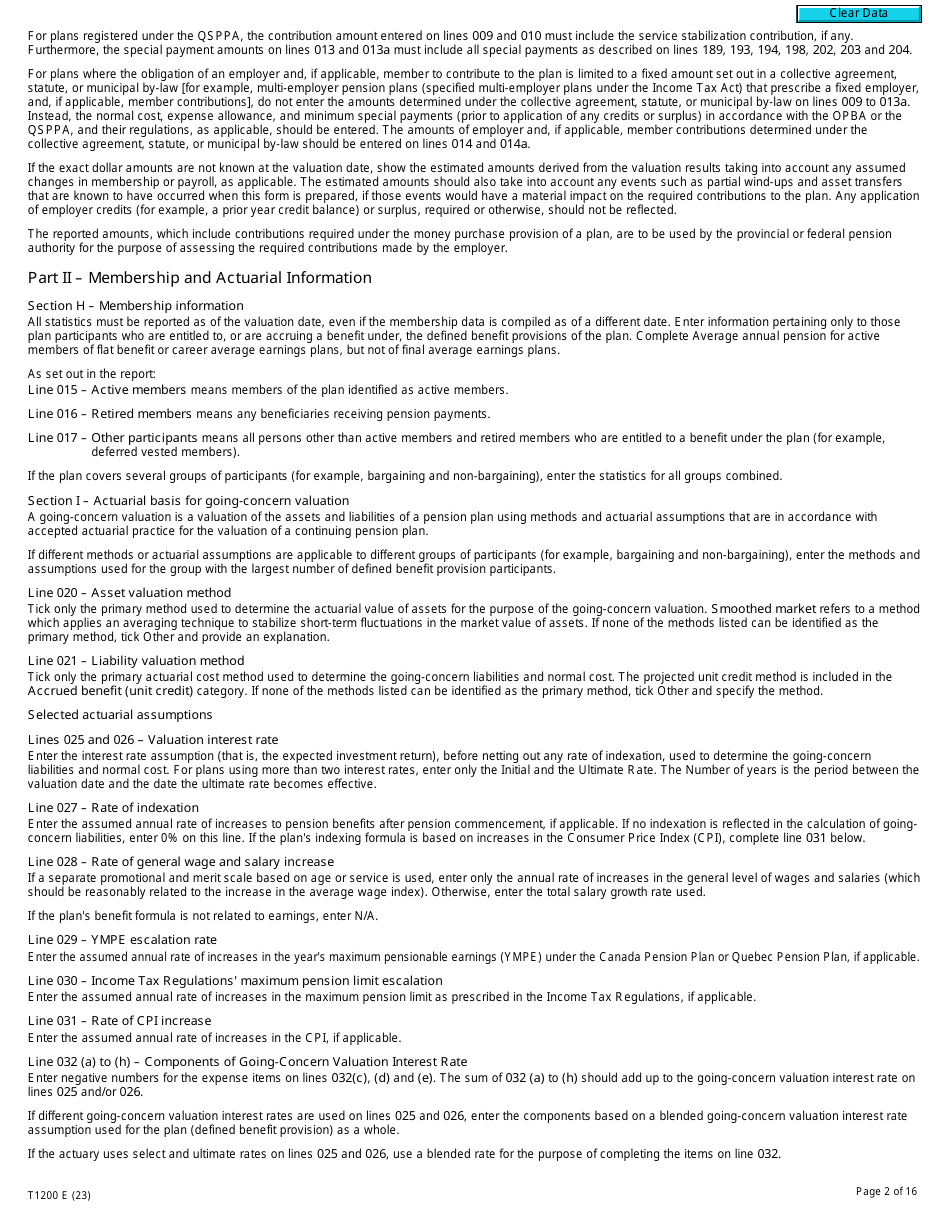

Q: What information does Form T1200 include?

A: Form T1200 includes actuarial information such as the plan's funding status, benefit obligations, and actuarial assumptions.

Q: When is Form T1200 due?

A: Form T1200 is generally due within 9 months after the end of the pension plan's fiscal year.

Q: Are there any penalties for not filing Form T1200?

A: Yes, there are penalties for not filing Form T1200, including financial penalties imposed by the CRA.

Q: Do I need to keep a copy of Form T1200?

A: Yes, it is recommended to keep a copy of Form T1200 for record-keeping purposes.

Q: What should I do if I have questions about Form T1200?

A: If you have questions about Form T1200, you can contact the CRA or consult with a qualified actuary or tax professional.