This version of the form is not currently in use and is provided for reference only. Download this version of

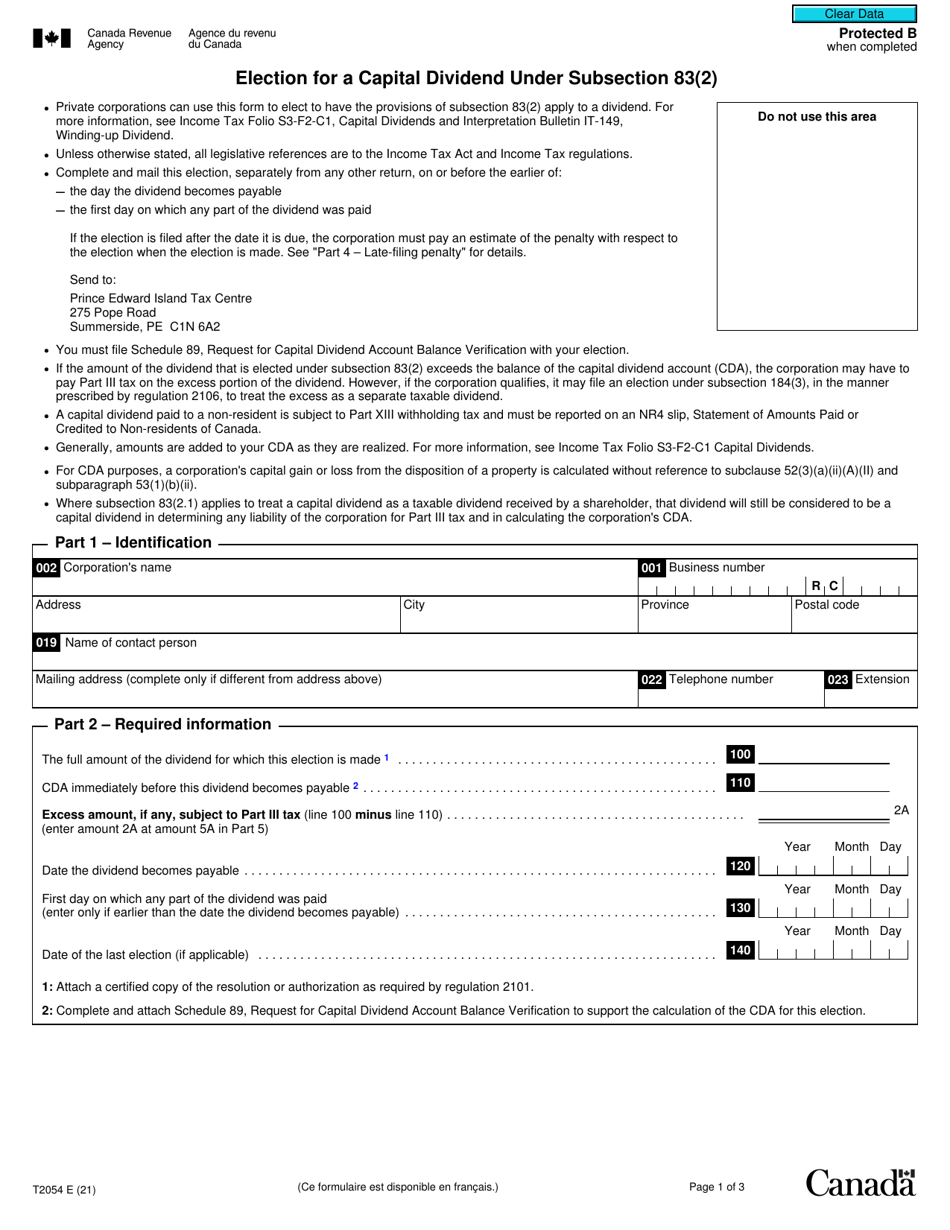

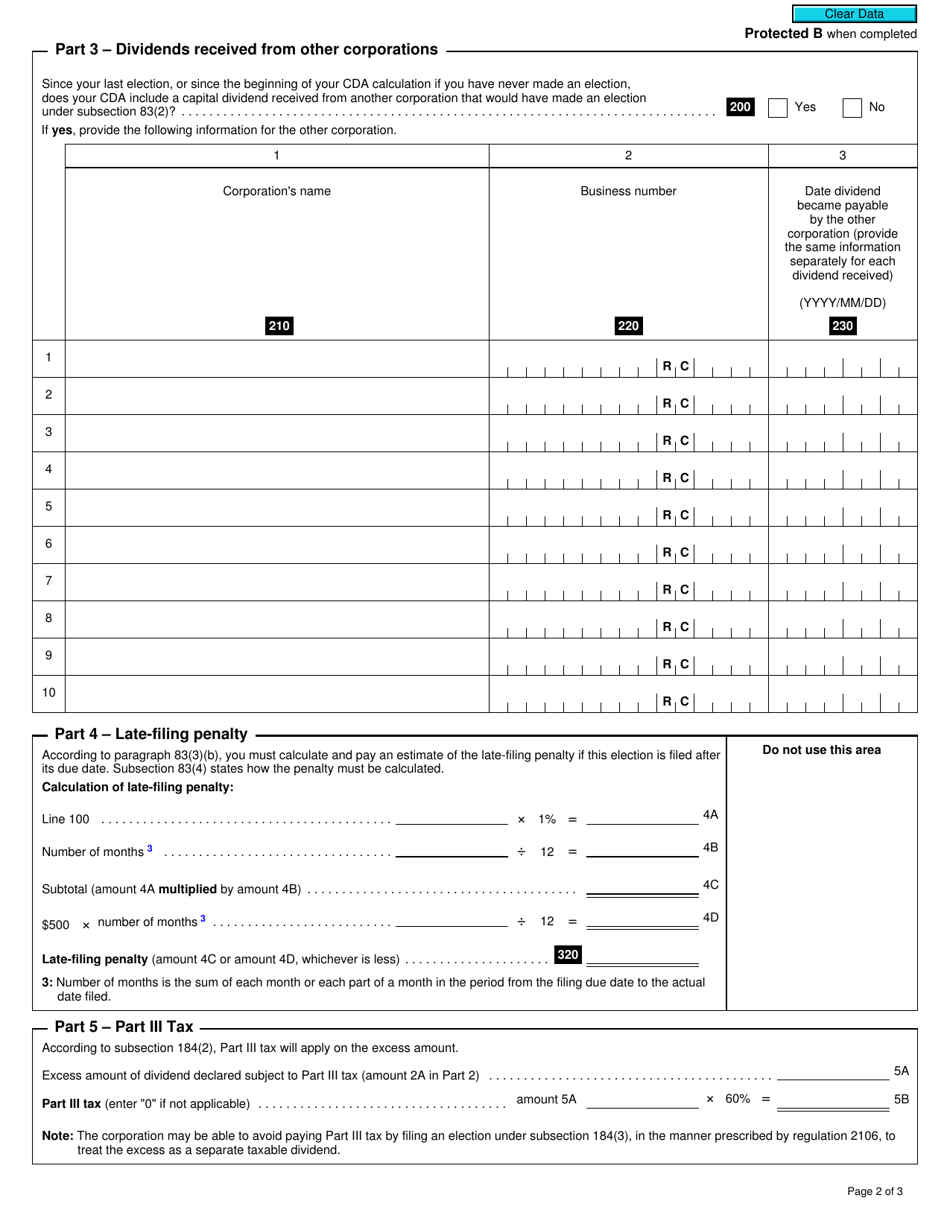

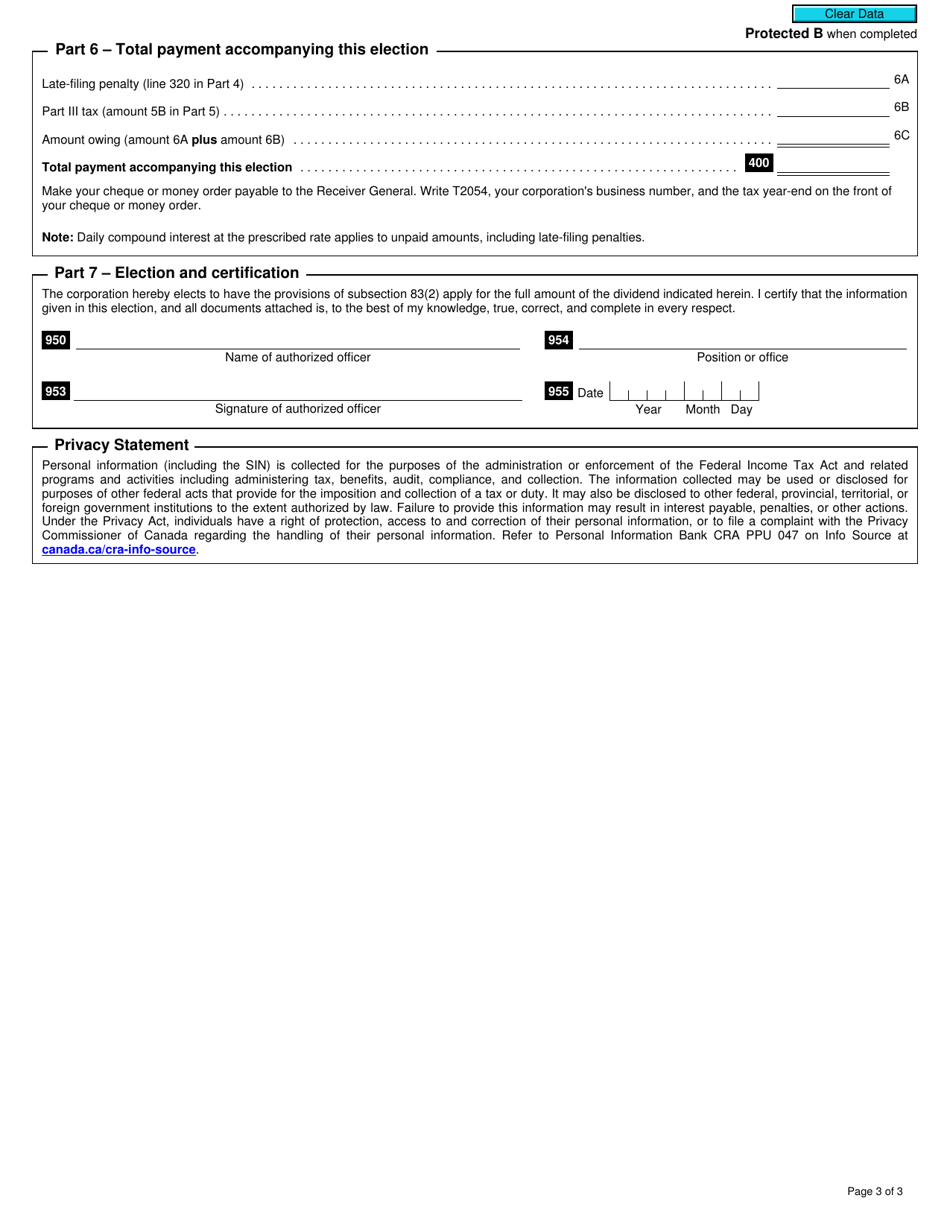

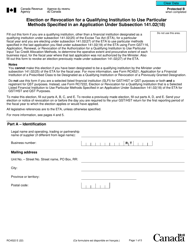

Form T2054

for the current year.

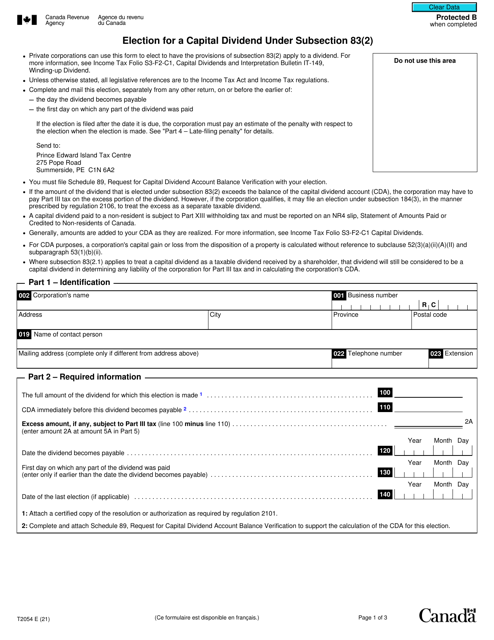

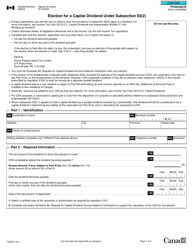

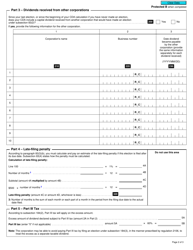

Form T2054 Election for a Capital Dividend Under Subsection 83(2) - Canada

Form T2054 Election for a Capital Dividend Under Subsection 83(2) in Canada allows a Canadian corporation to elect to pay a tax-free capital dividend to its shareholders.

The shareholder of a Canadian corporation files Form T2054 Election for a Capital Dividend under Subsection 83(2) in Canada.

FAQ

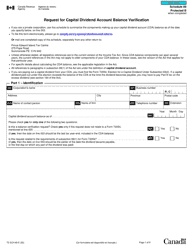

Q: What is Form T2054?

A: Form T2054 is a tax form used in Canada.

Q: What is the purpose of Form T2054?

A: The purpose of Form T2054 is to make an election for a capital dividend under Subsection 83(2) of the Canadian tax law.

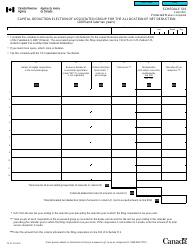

Q: What is a capital dividend?

A: A capital dividend is a tax benefit that allows a Canadian corporation to pay out tax-free dividends to its shareholders.

Q: What does Subsection 83(2) refer to?

A: Subsection 83(2) is a specific provision in the Canadian tax law that allows for the election of a capital dividend.

Q: Who should fill out Form T2054?

A: Form T2054 should be filled out by Canadian corporations that want to make an election for a capital dividend under Subsection 83(2).

Q: What should I do if I have questions about Form T2054?

A: If you have questions about Form T2054, you should contact the Canada Revenue Agency (CRA) for assistance.