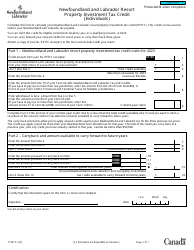

This version of the form is not currently in use and is provided for reference only. Download this version of

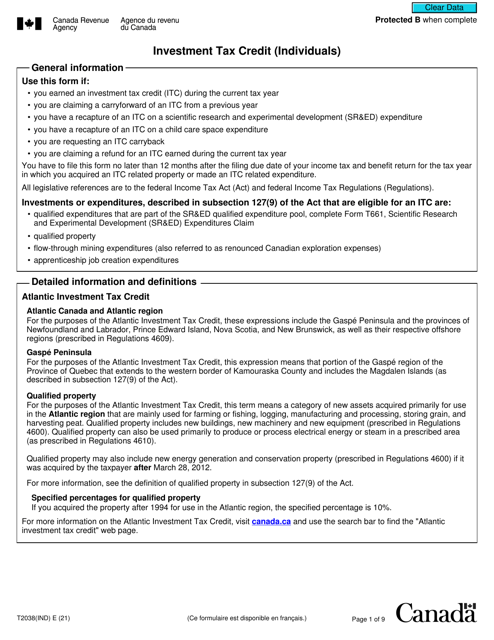

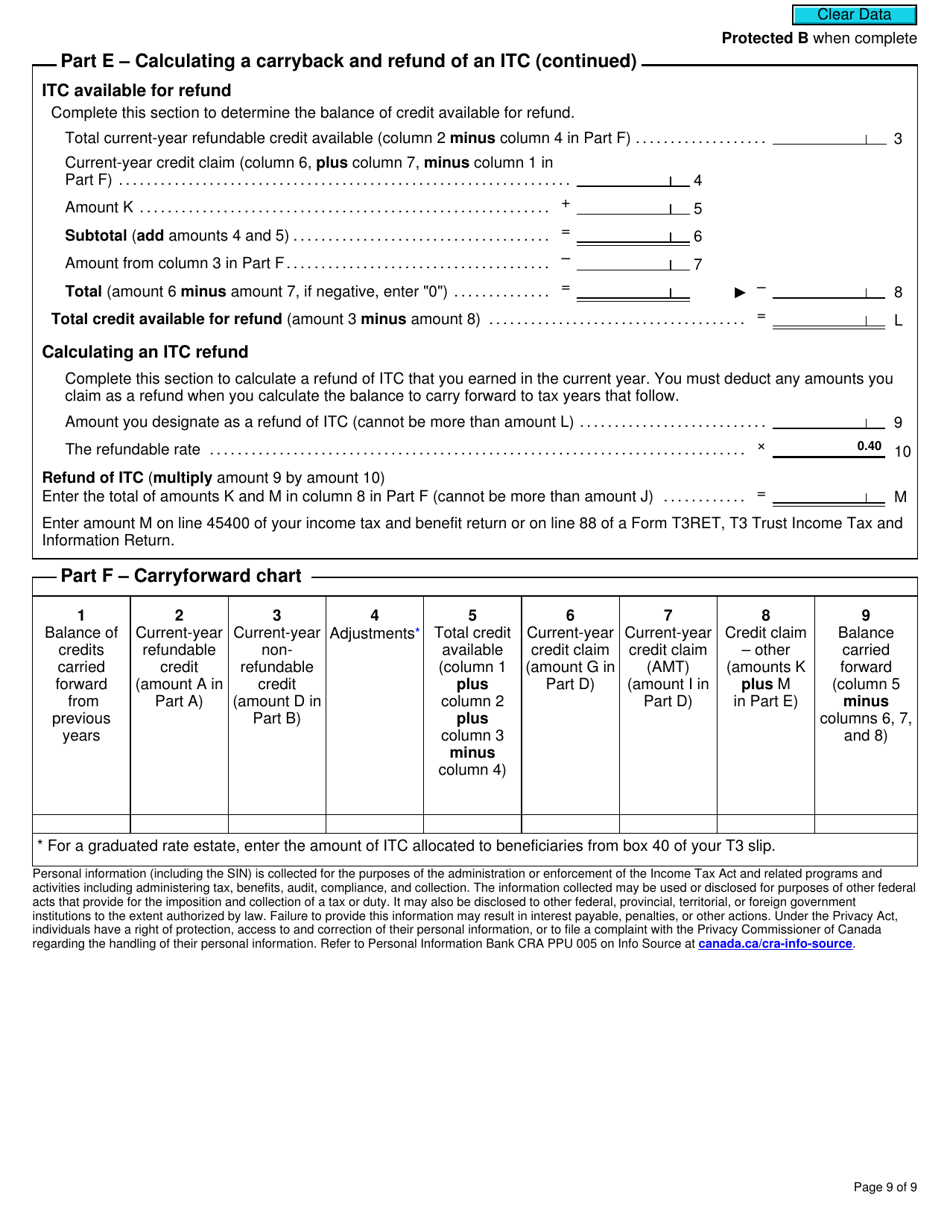

Form T2038(IND)

for the current year.

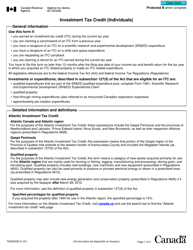

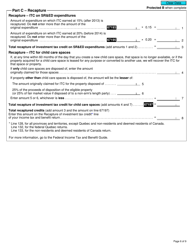

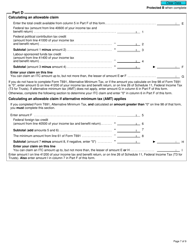

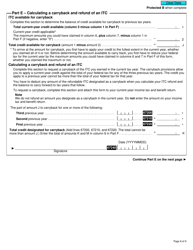

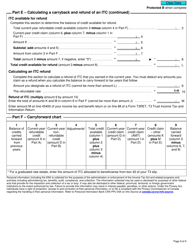

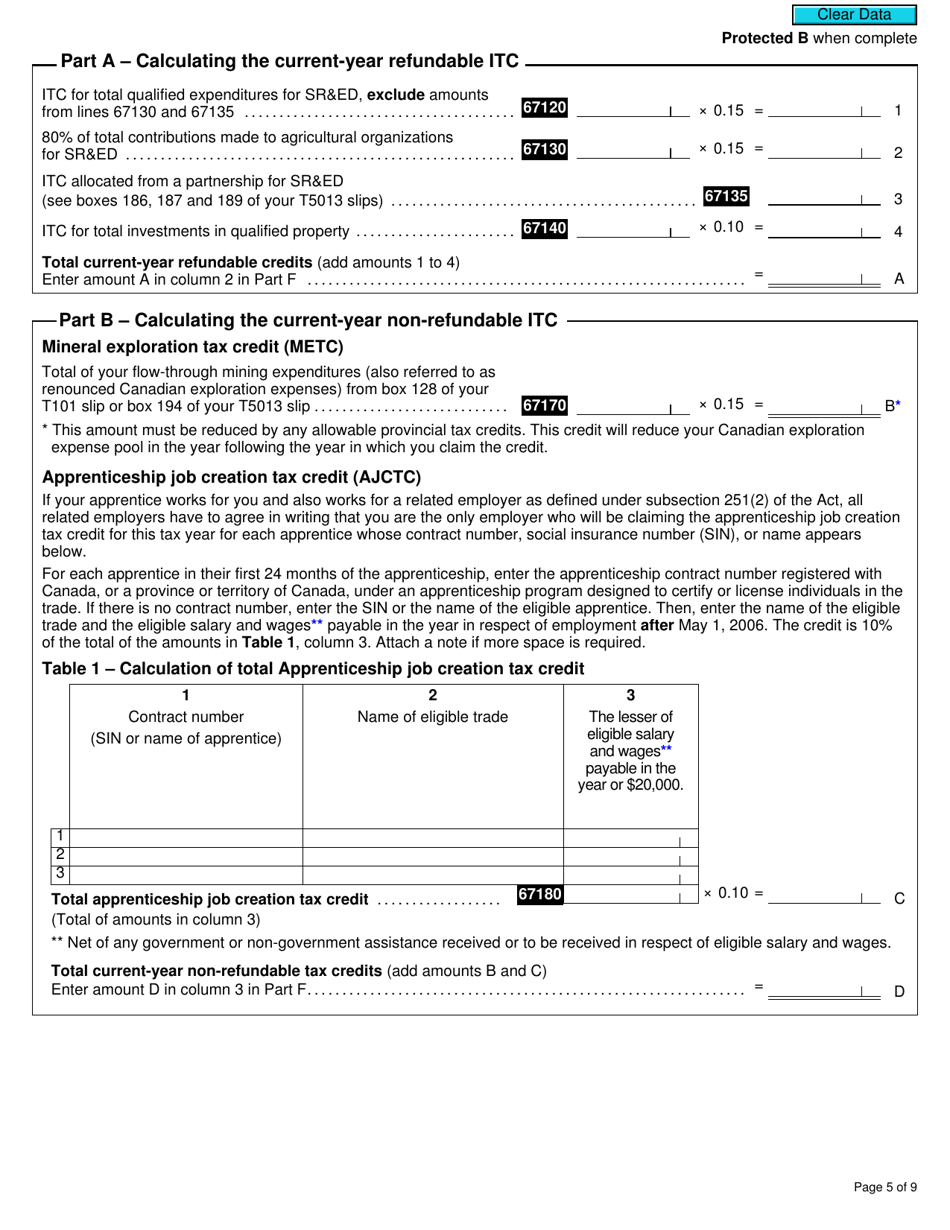

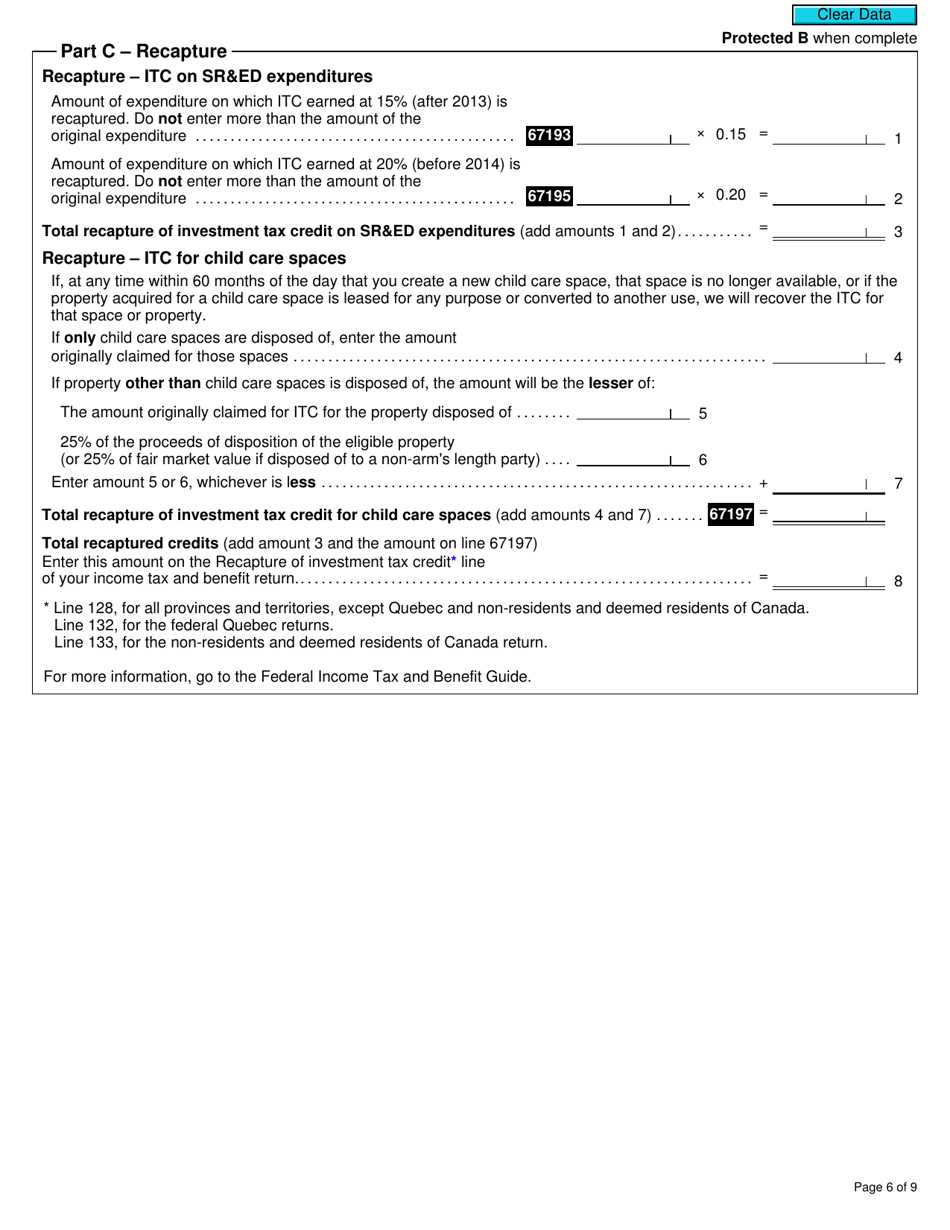

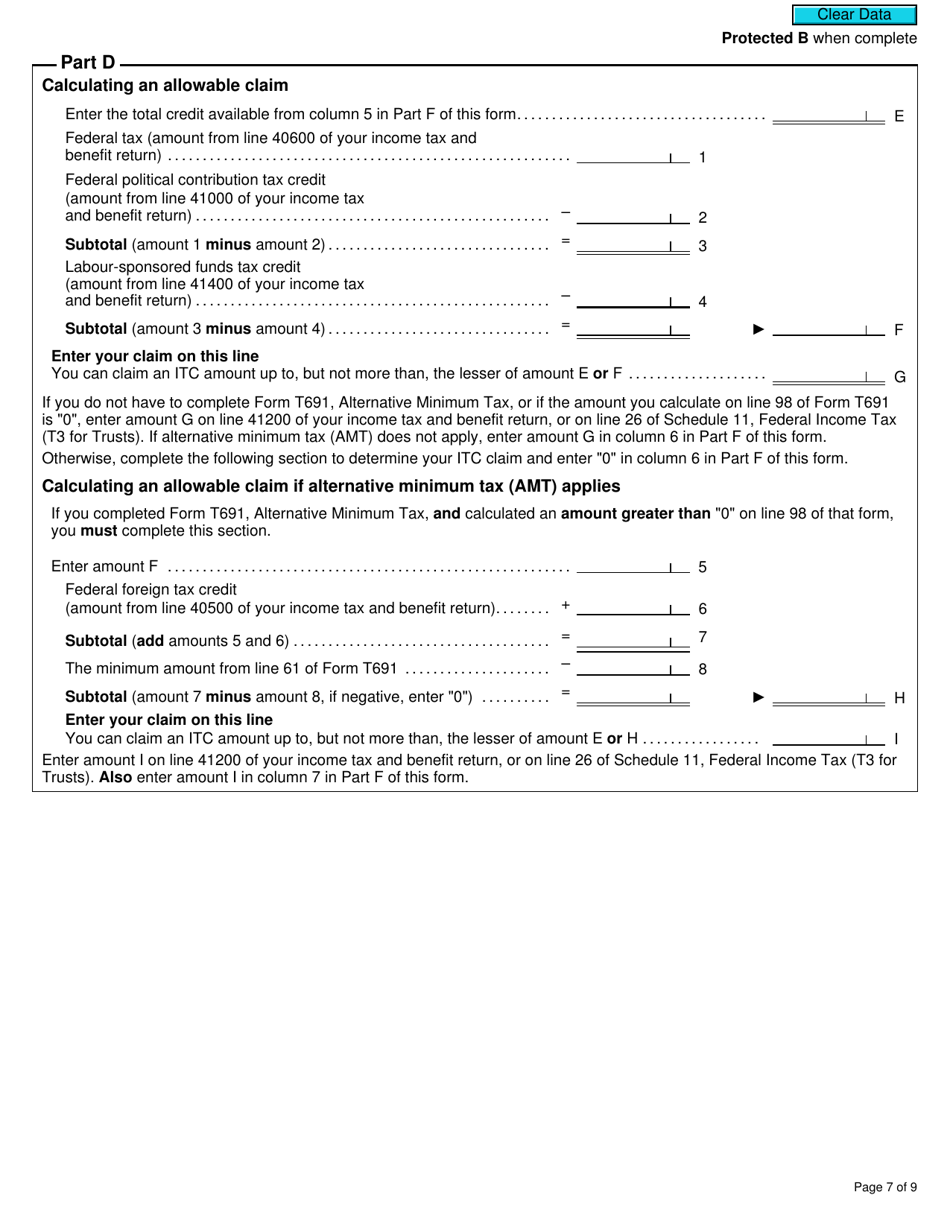

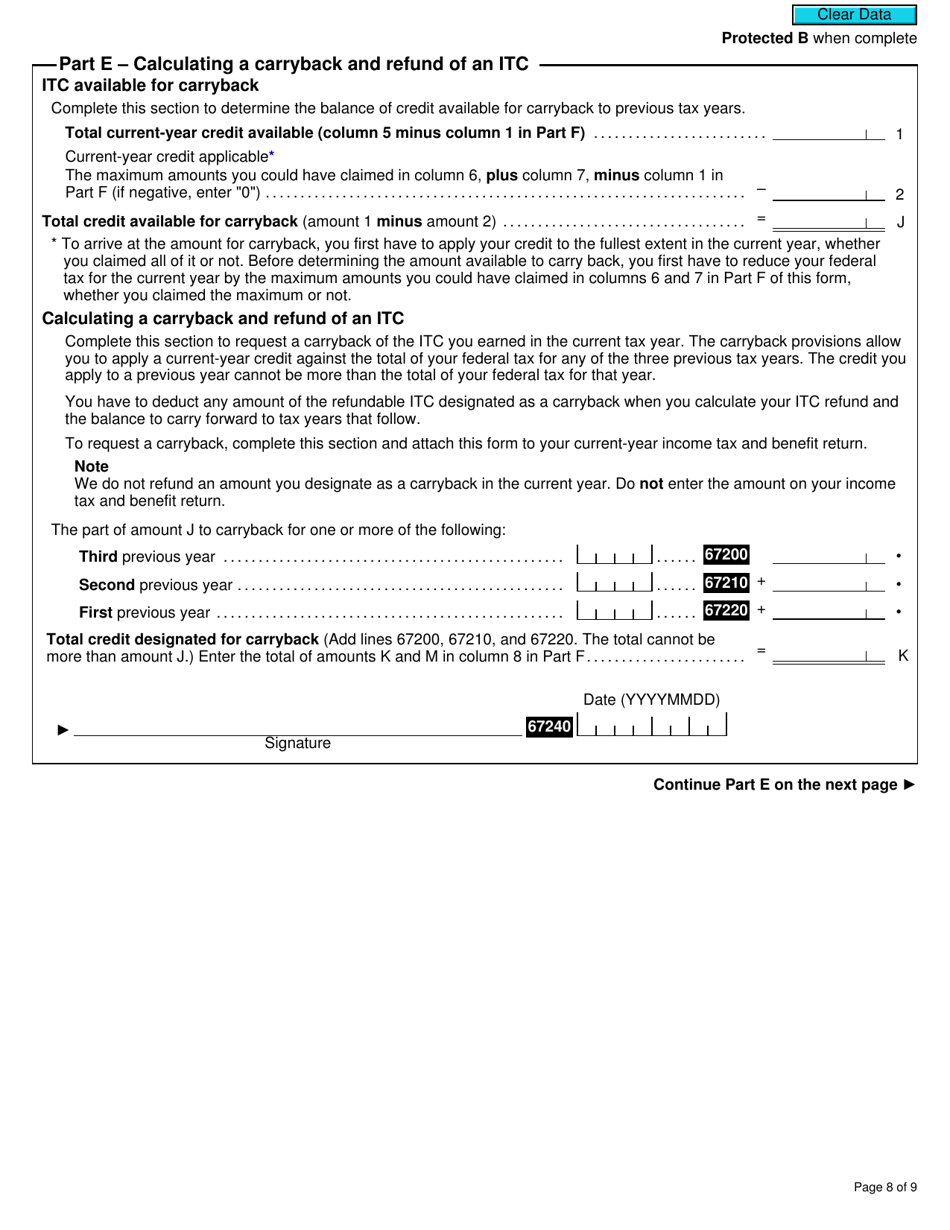

Form T2038(IND) Investment Tax Credit (Individuals) - Canada

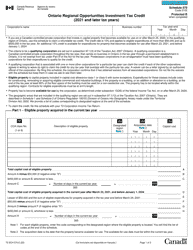

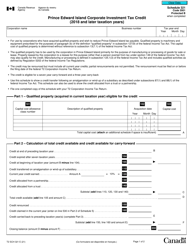

The Form T2038(IND) Investment Tax Credit (Individuals) in Canada is used to claim a tax credit on certain investments made by individuals. It allows individuals to reduce their income tax payable by claiming a credit for eligible investments.

Form T2038(IND) Investment Tax Credit (Individuals) in Canada is typically filed by individuals who are claiming an investment tax credit.

FAQ

Q: What is Form T2038(IND)?

A: Form T2038(IND) is a tax form used in Canada to claim an investment tax credit for individuals.

Q: What is an investment tax credit?

A: An investment tax credit is a credit that can be applied against your income taxes to reduce the amount you owe.

Q: Who is eligible to use Form T2038(IND)?

A: Individuals in Canada who want to claim an investment tax credit are eligible to use Form T2038(IND).

Q: What can the investment tax credit be claimed for?

A: The investment tax credit can be claimed for certain types of investments, such as scientific research and experimental development.

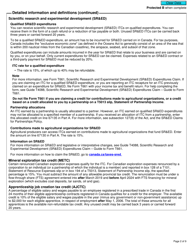

Q: How do I fill out Form T2038(IND)?

A: You will need to provide information about your investments and calculate the amount of the tax credit you are claiming.

Q: When is the deadline to file Form T2038(IND)?

A: The deadline to file Form T2038(IND) is the same as the deadline for your income tax return, which is usually April 30th.

Q: What should I do if I need help with Form T2038(IND)?

A: If you need help with Form T2038(IND), you can contact the Canada Revenue Agency (CRA) or consult a tax professional.