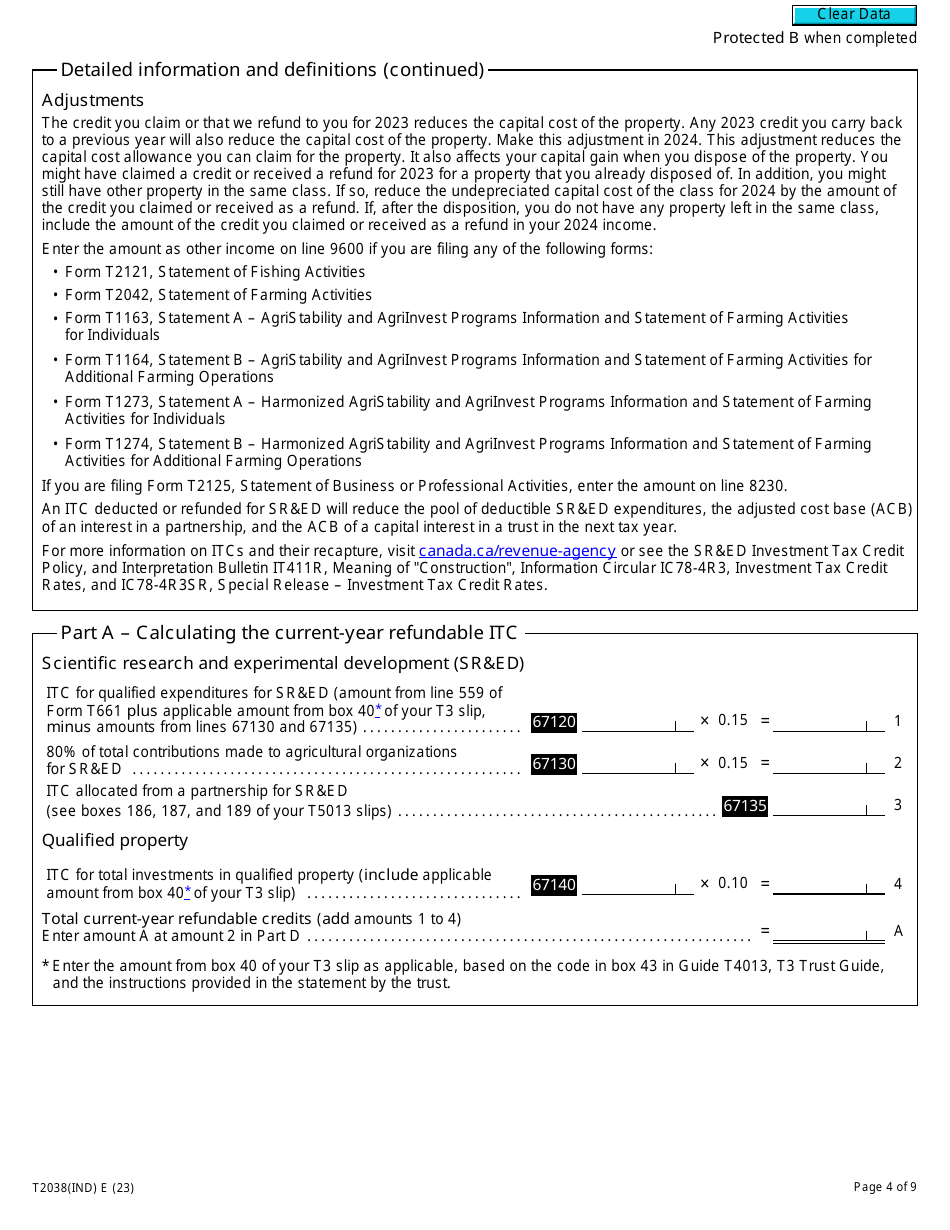

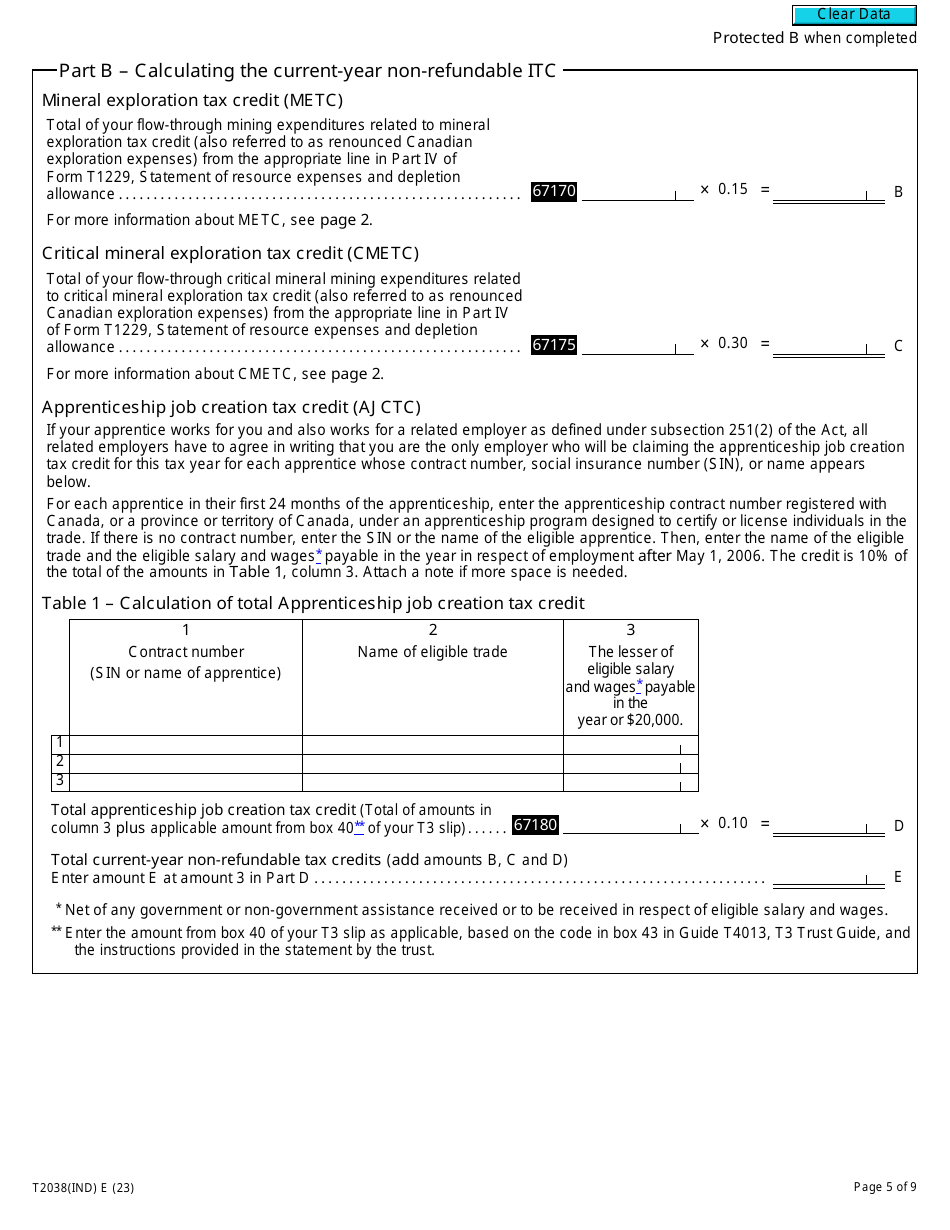

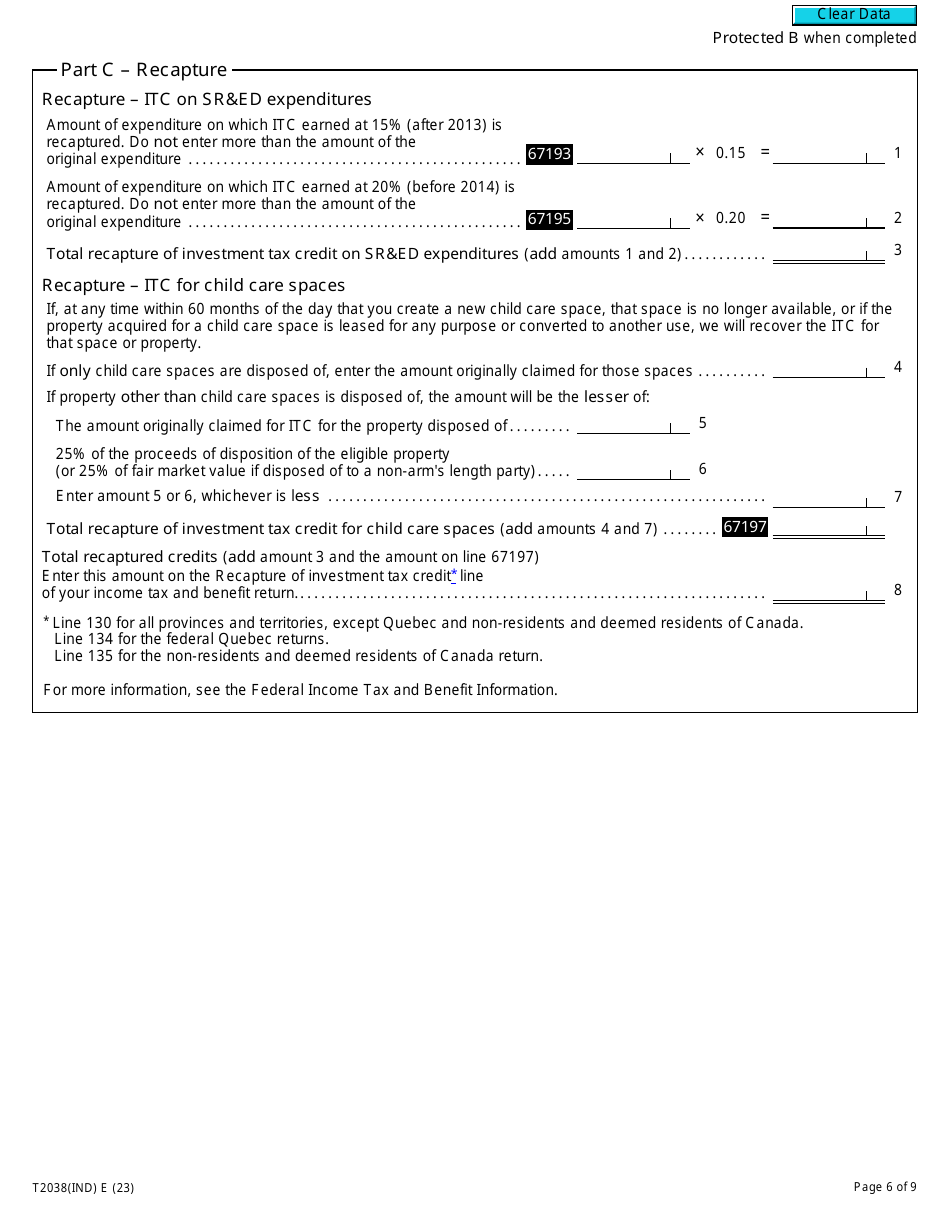

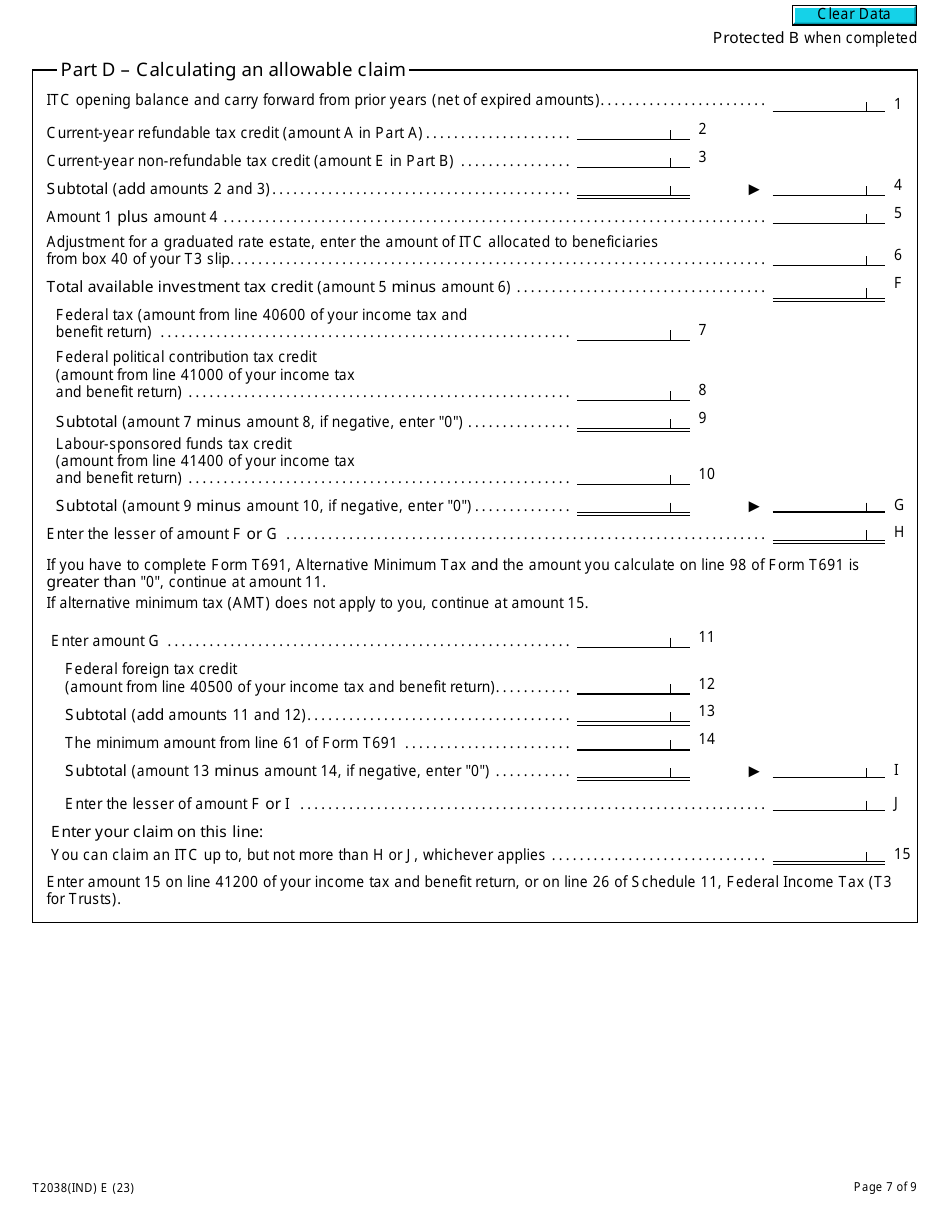

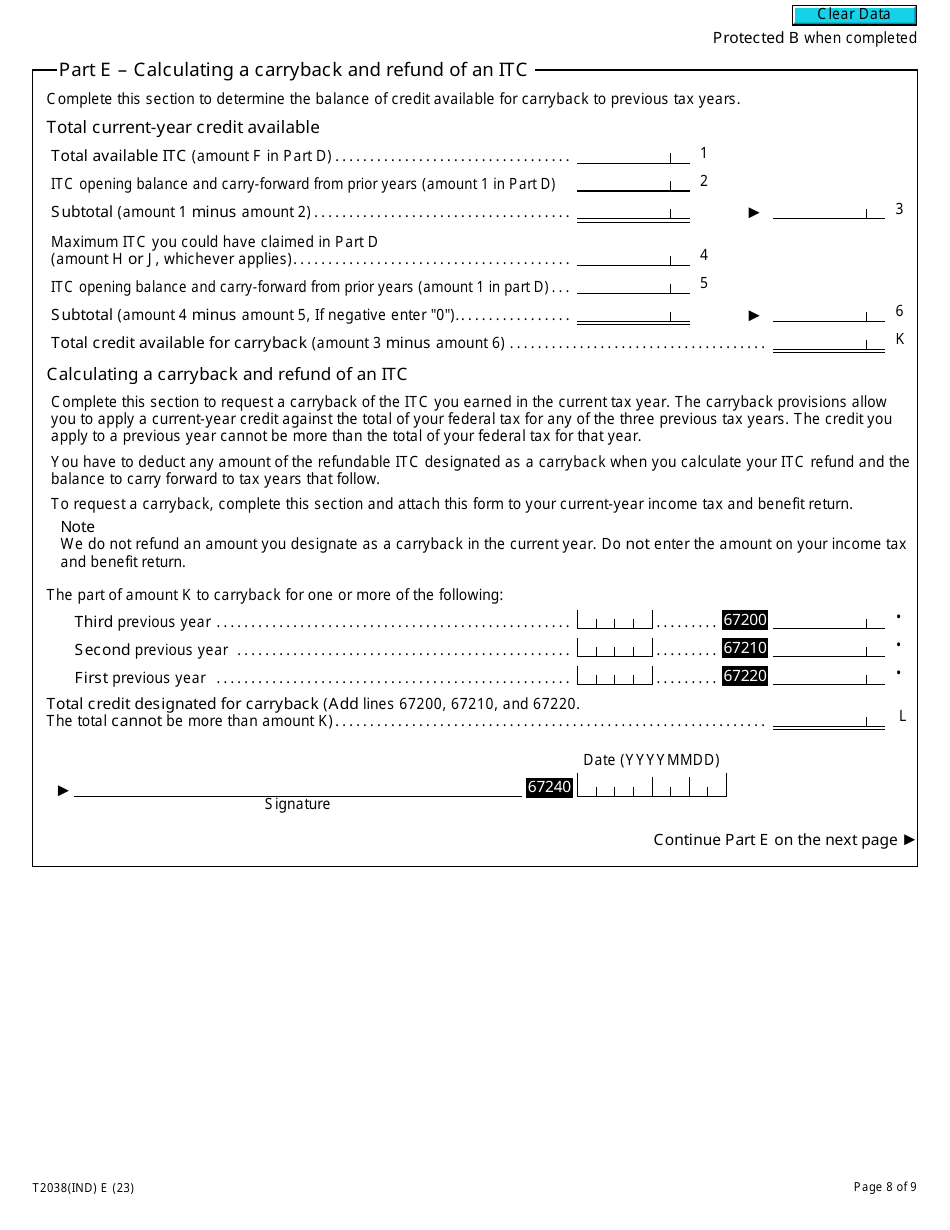

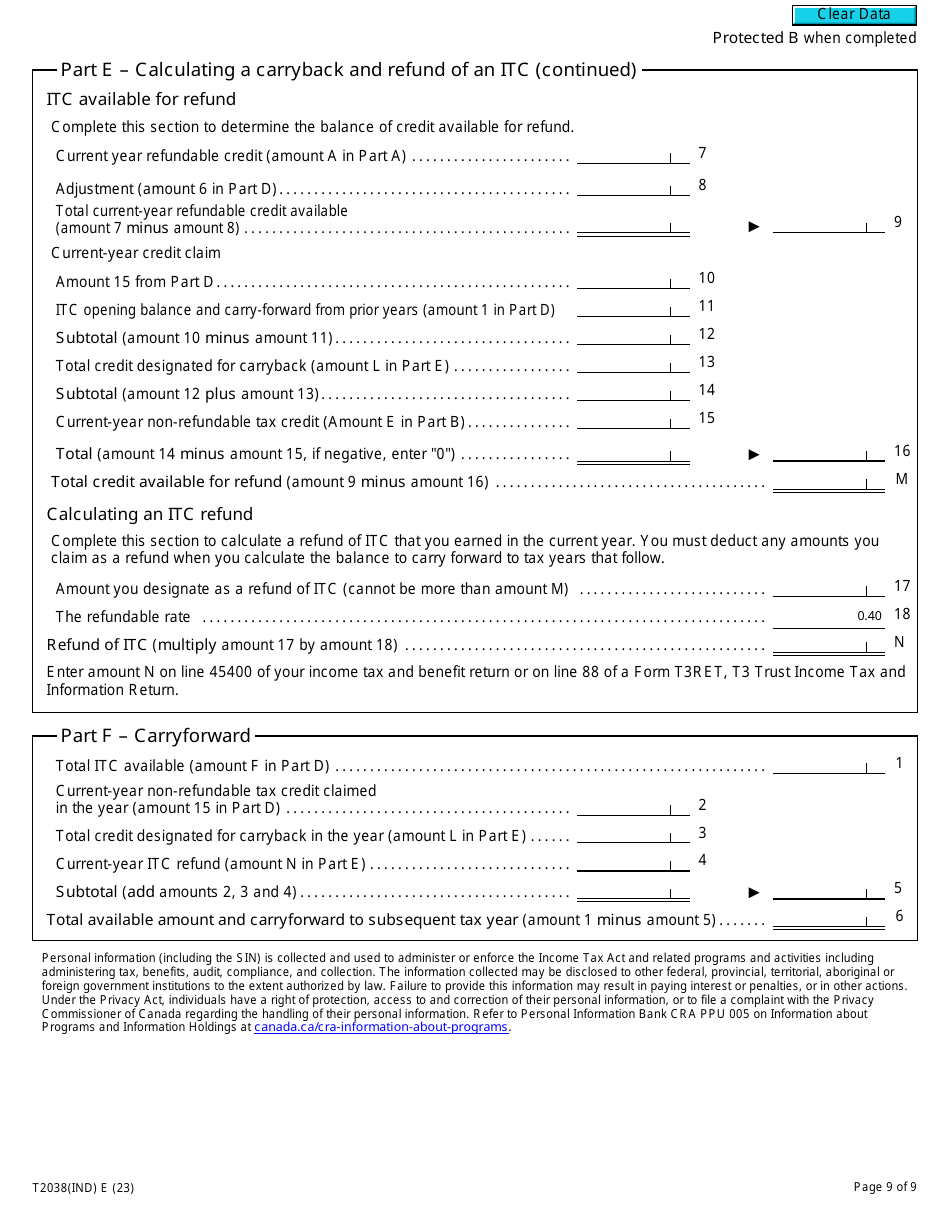

Form T2038(IND) Investment Tax Credit (Individuals) - Canada

Form T2038(IND) Investment Tax Credit (Individuals) in Canada is used for claiming the investment tax credit by individuals. This credit allows individuals to reduce their tax liability by claiming a credit for certain investments made during the tax year. It is designed to promote investment and stimulate economic growth.

The Form T2038(IND) Investment Tax Credit (Individuals) in Canada is filed by individuals who want to claim the investment tax credit.

Form T2038(IND) Investment Tax Credit (Individuals) - Canada - Frequently Asked Questions (FAQ)

Q: What is Form T2038(IND)?

A: Form T2038(IND) is a tax form used by individuals in Canada to claim an investment tax credit.

Q: What is an investment tax credit?

A: An investment tax credit is a credit that can be claimed by individuals in Canada to reduce their taxable income.

Q: Who can use Form T2038(IND)?

A: Individuals in Canada who are eligible for an investment tax credit can use Form T2038(IND).

Q: What information is required on Form T2038(IND)?

A: Form T2038(IND) requires information such as the type of investment, the amount invested, and supporting documentation.

Q: When is the deadline to file Form T2038(IND)?

A: The deadline to file Form T2038(IND) is usually the same as the individual's income tax return deadline, which is April 30th for most individuals in Canada.

Q: What happens if I don't file Form T2038(IND)?

A: If you are eligible for an investment tax credit but do not file Form T2038(IND), you may miss out on potential tax savings.

Q: Can Form T2038(IND) be filed electronically?

A: Yes, Form T2038(IND) can be filed electronically through the CRA's My Account service or through certified tax software.

Q: Can I claim an investment tax credit for foreign investments?

A: Yes, you may be able to claim an investment tax credit for certain foreign investments, depending on the specific conditions outlined by the CRA.

Q: Is there a limit to the amount of investment tax credit I can claim?

A: Yes, there are specific limits to the amount of investment tax credit that can be claimed, depending on the type of investment and other factors. It is important to refer to the instructions provided with Form T2038(IND) for more information.