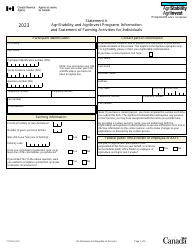

This version of the form is not currently in use and is provided for reference only. Download this version of

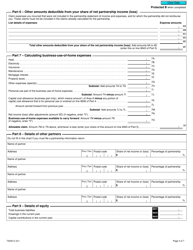

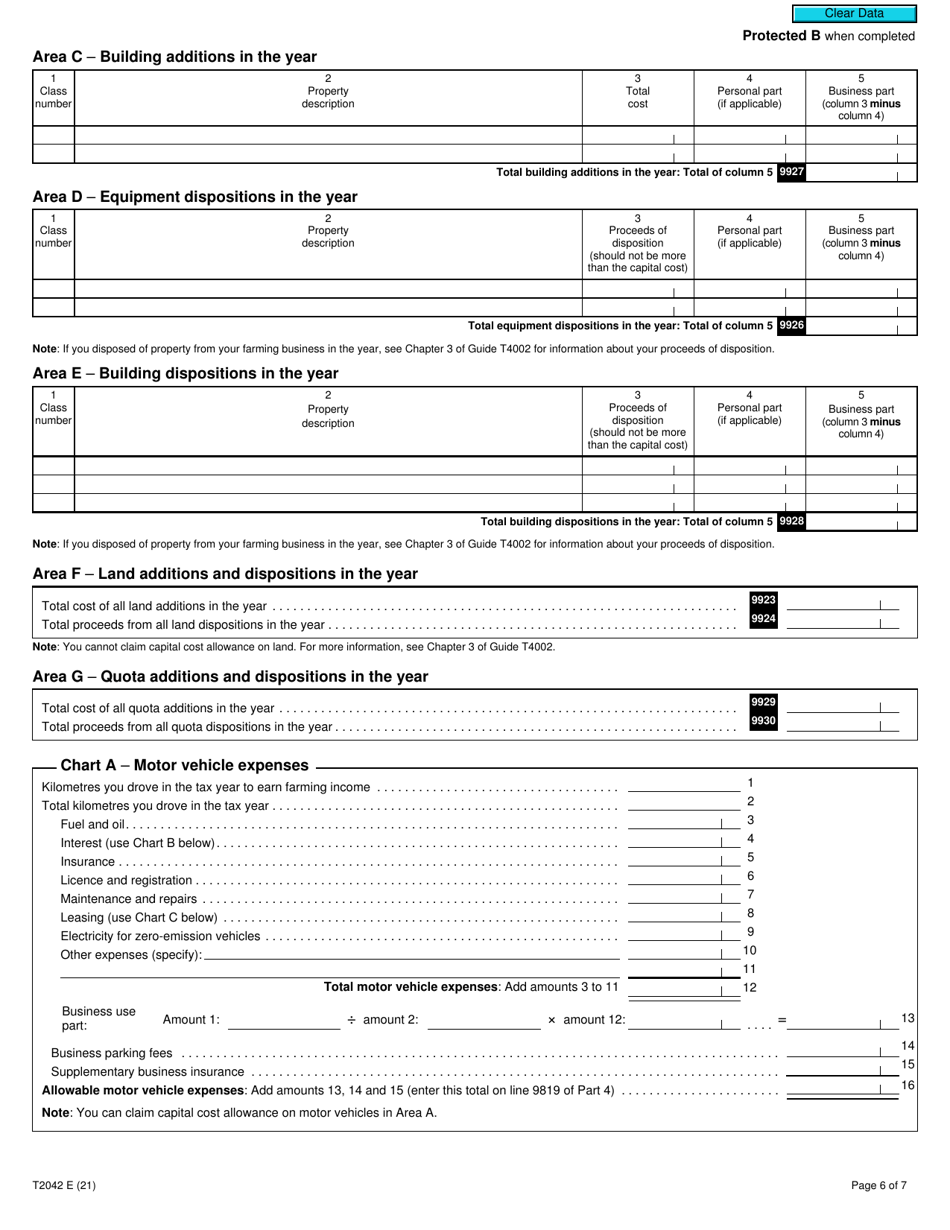

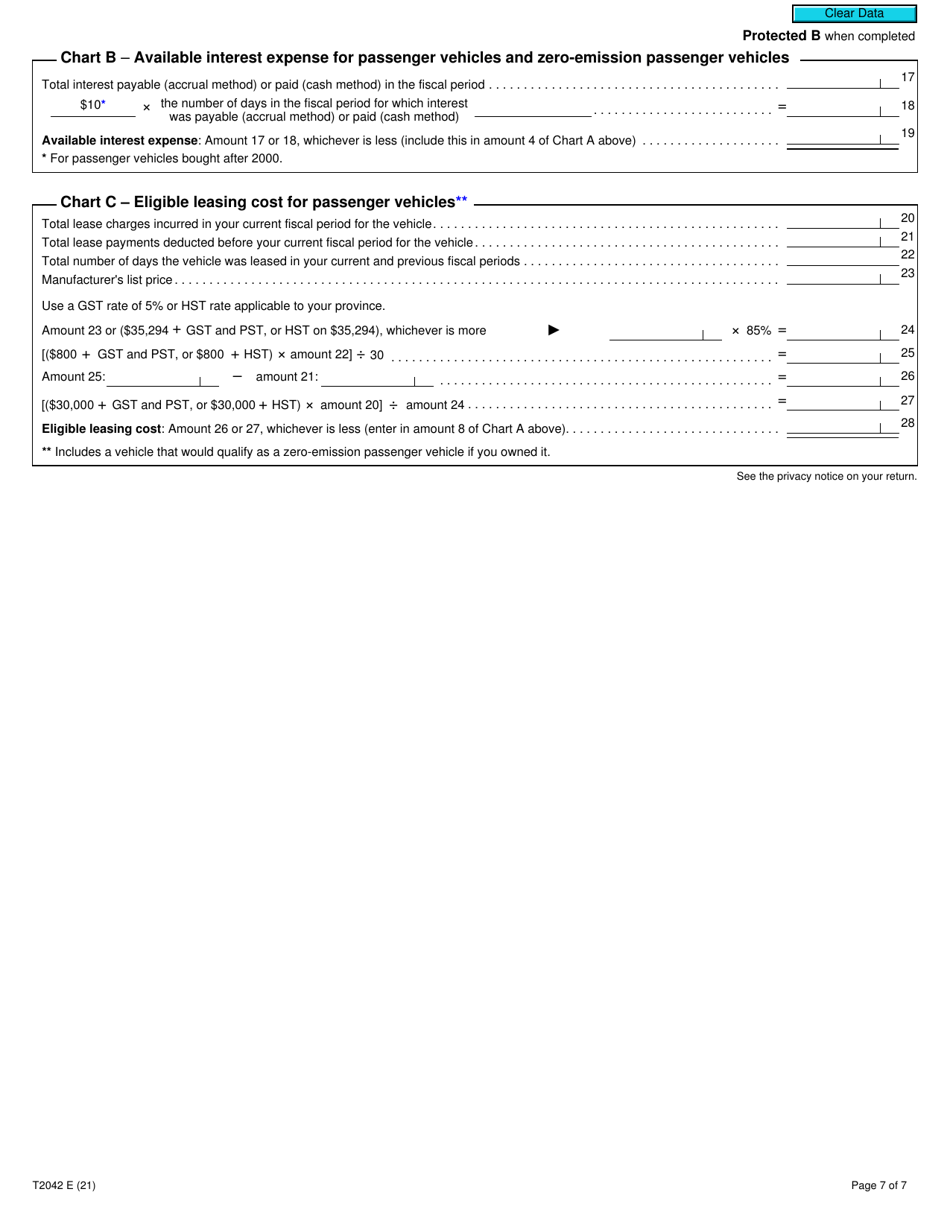

Form T2042

for the current year.

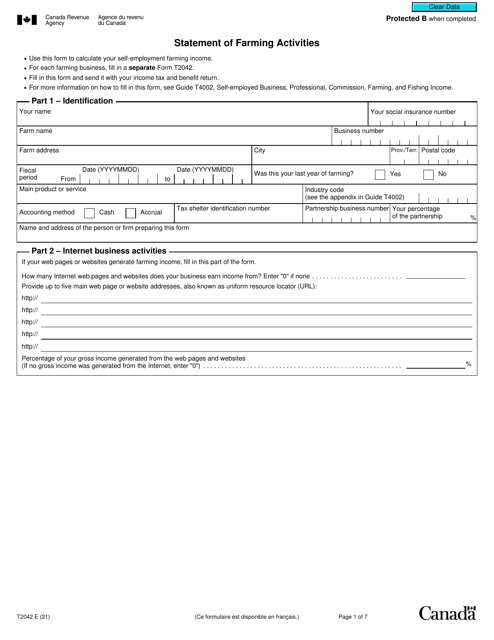

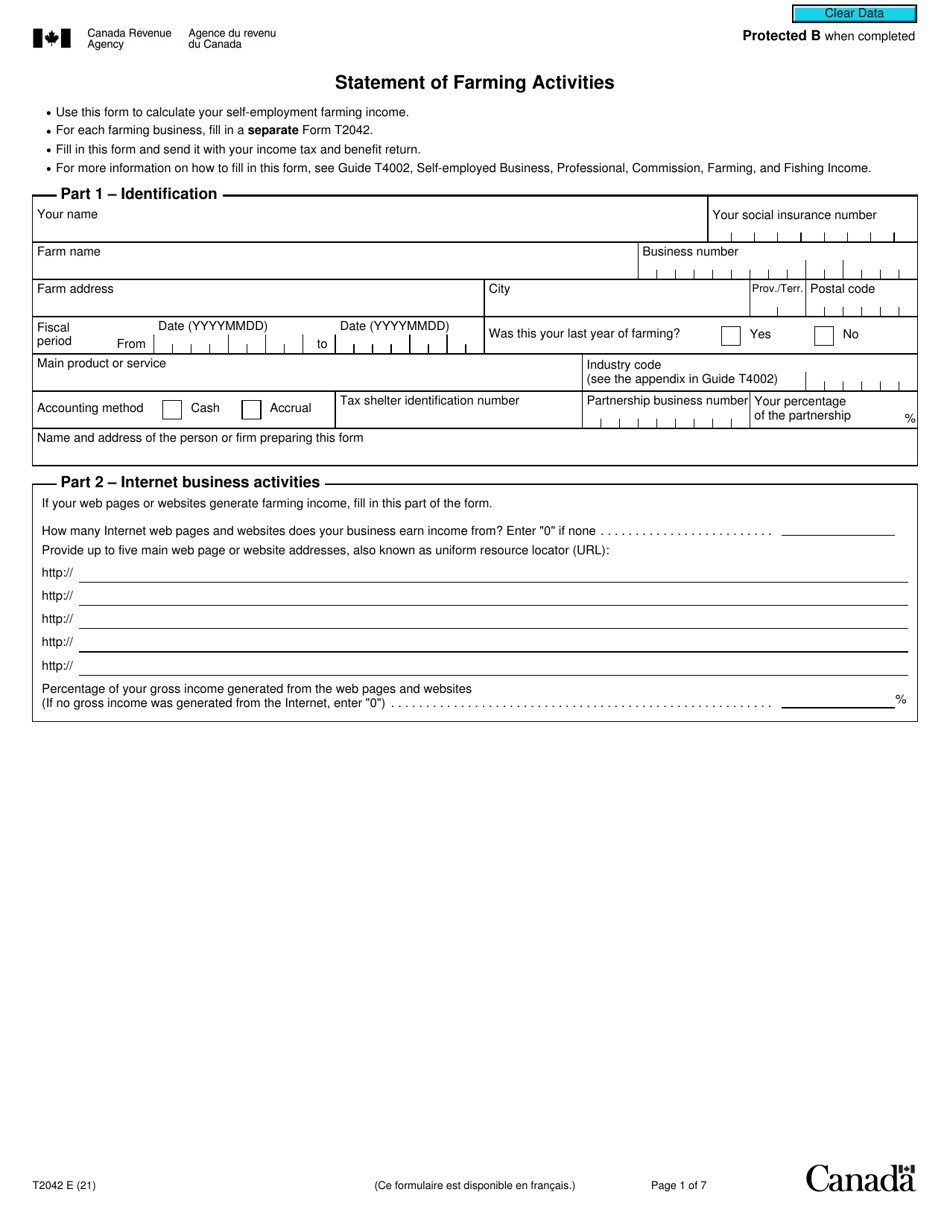

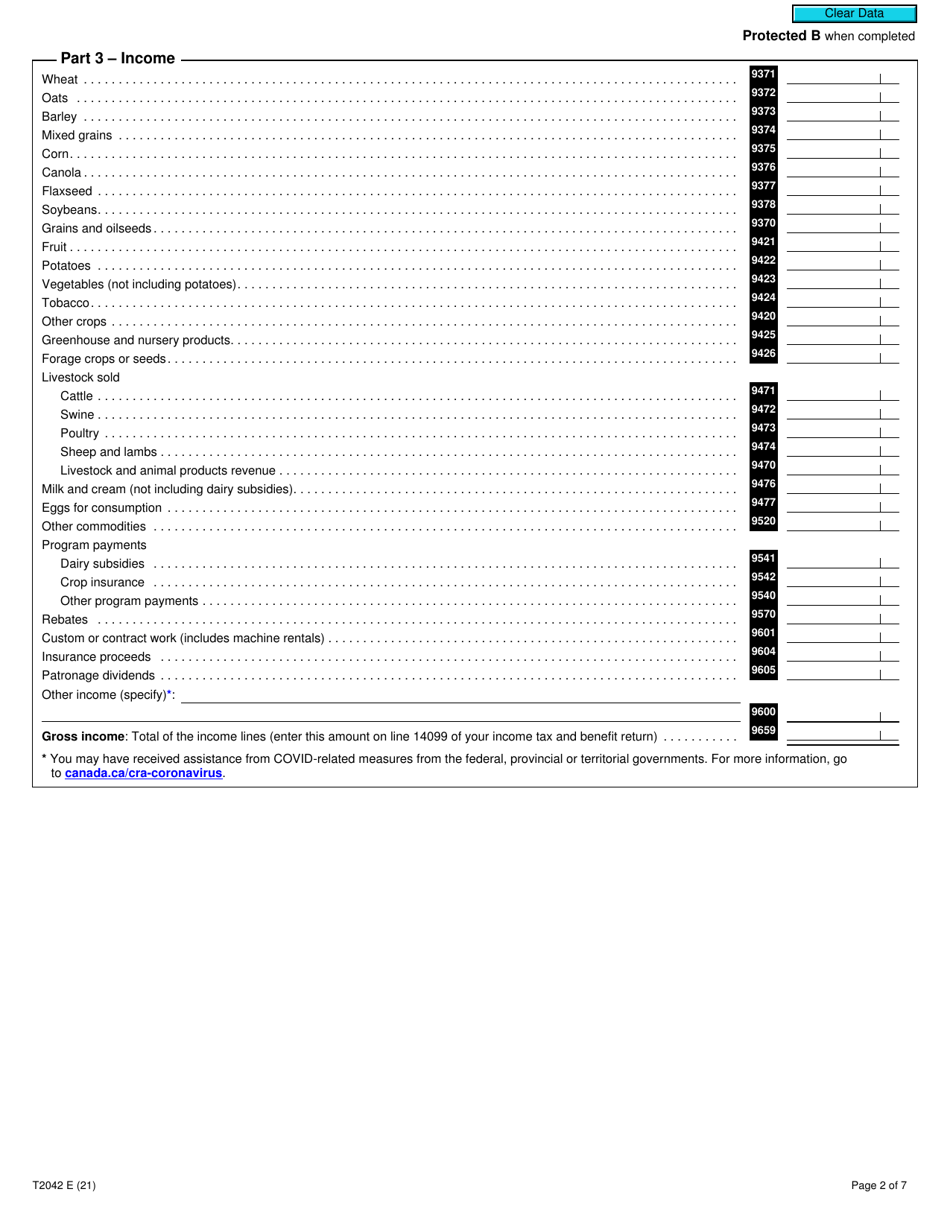

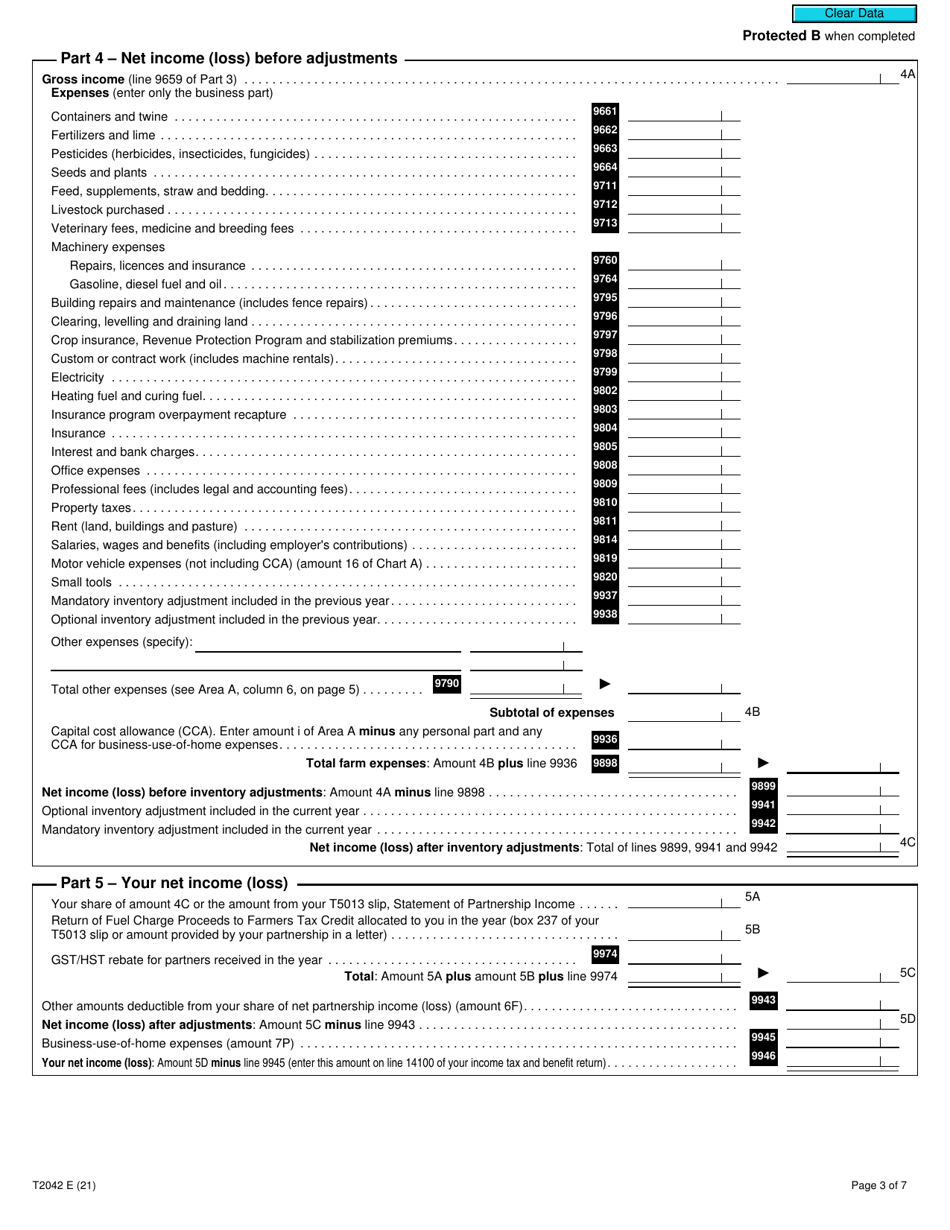

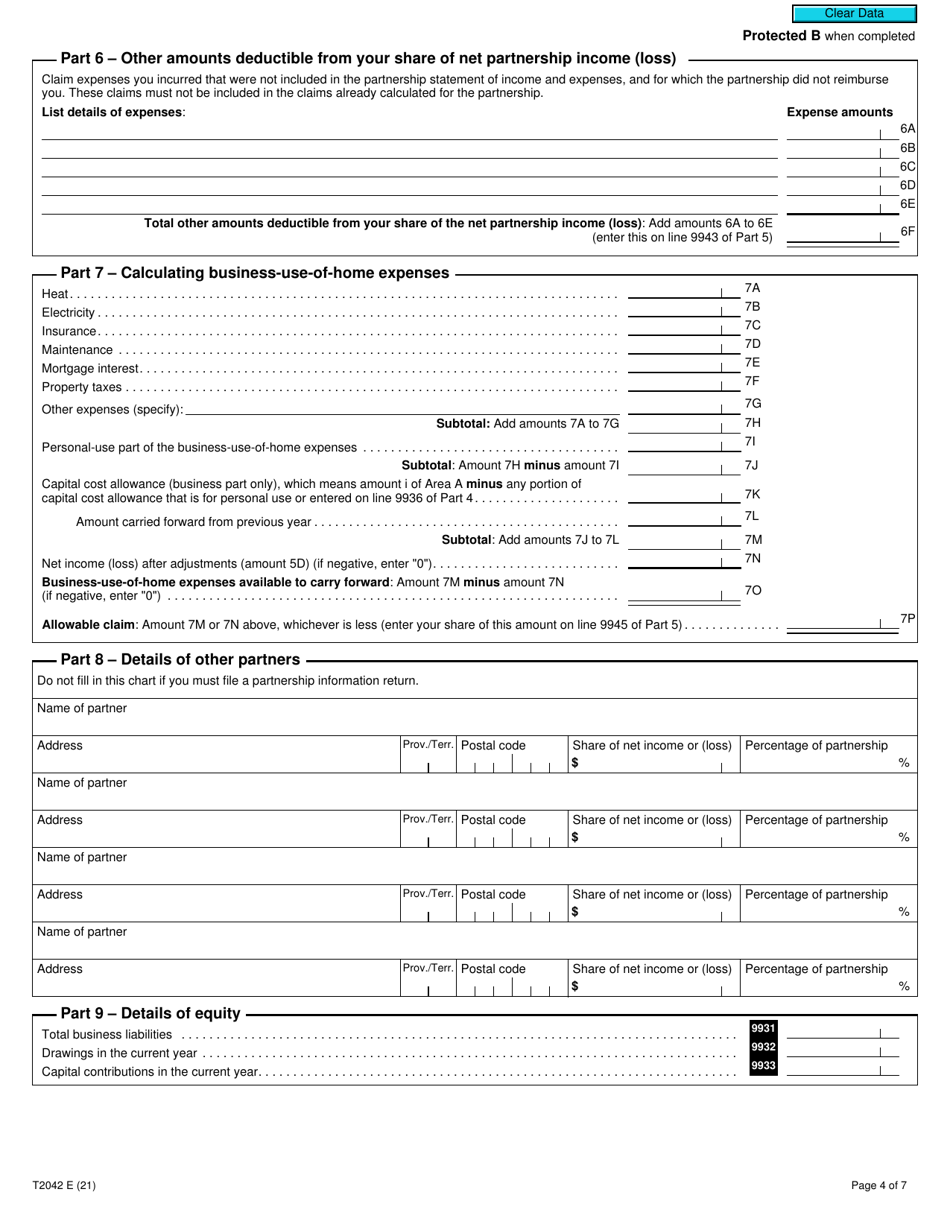

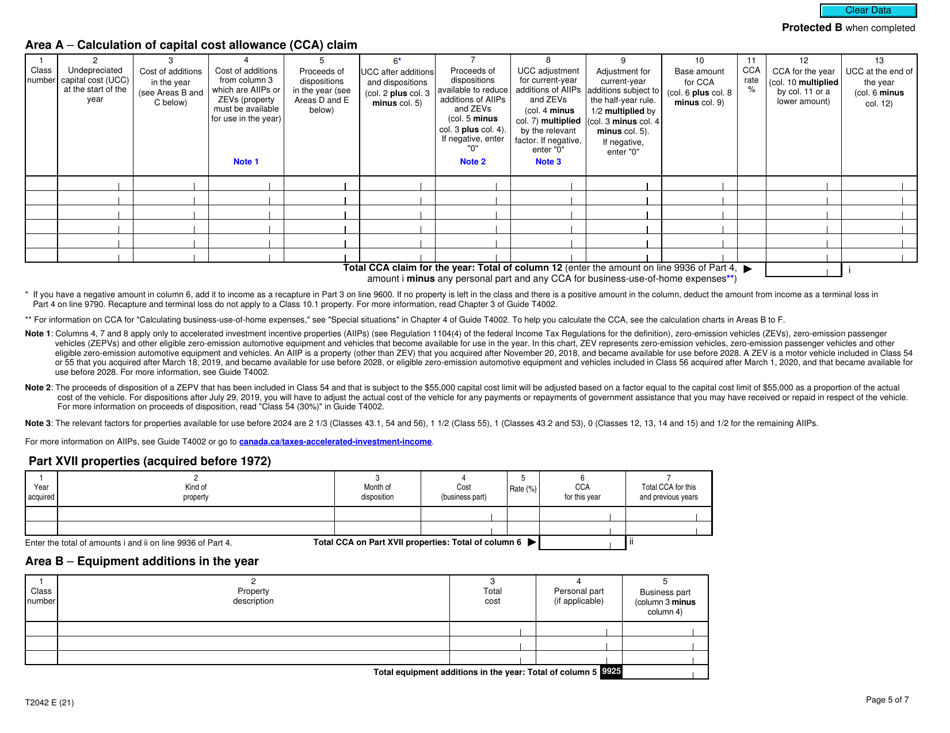

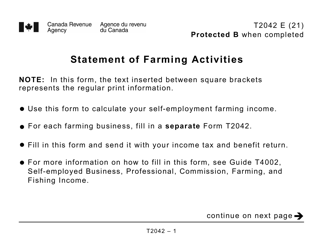

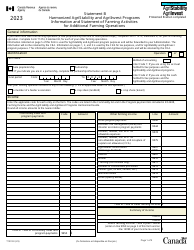

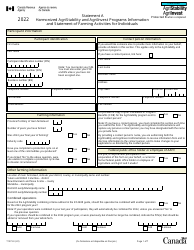

Form T2042 Statement of Farming Activities - Canada

Form T2042 Statement of Farming Activities is used by Canadian residents who earn income from farming activities. It is used to report farming income, expenses, and other details related to the farming business for taxation purposes in Canada.

The form T2042 Statement of Farming Activities in Canada is typically filed by individuals who are engaged in farming activities.

FAQ

Q: What is Form T2042?

A: Form T2042 is the Statement of Farming Activities in Canada.

Q: Who needs to complete Form T2042?

A: Anyone who operates a farm in Canada needs to complete Form T2042.

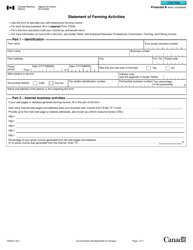

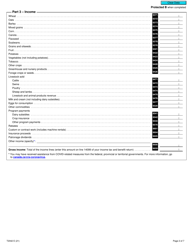

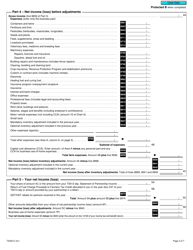

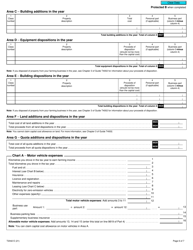

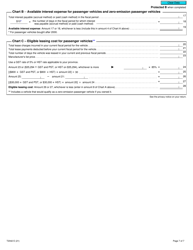

Q: What information is required on Form T2042?

A: Form T2042 requires information about your farming activities, income, expenses, and other details related to your farm.

Q: When is Form T2042 due?

A: Form T2042 is usually due on or before June 15th of the following year.

Q: What happens if I don't file Form T2042?

A: Failing to file Form T2042 or providing inaccurate information can result in penalties and interest charges from the CRA.