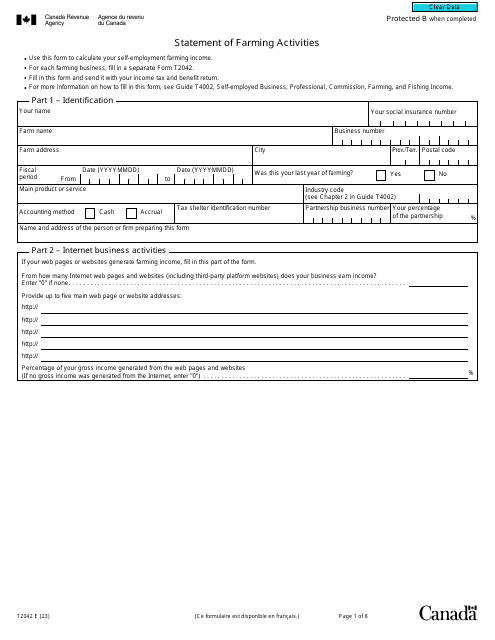

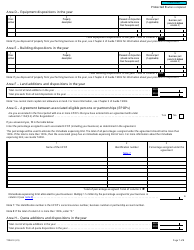

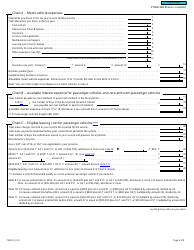

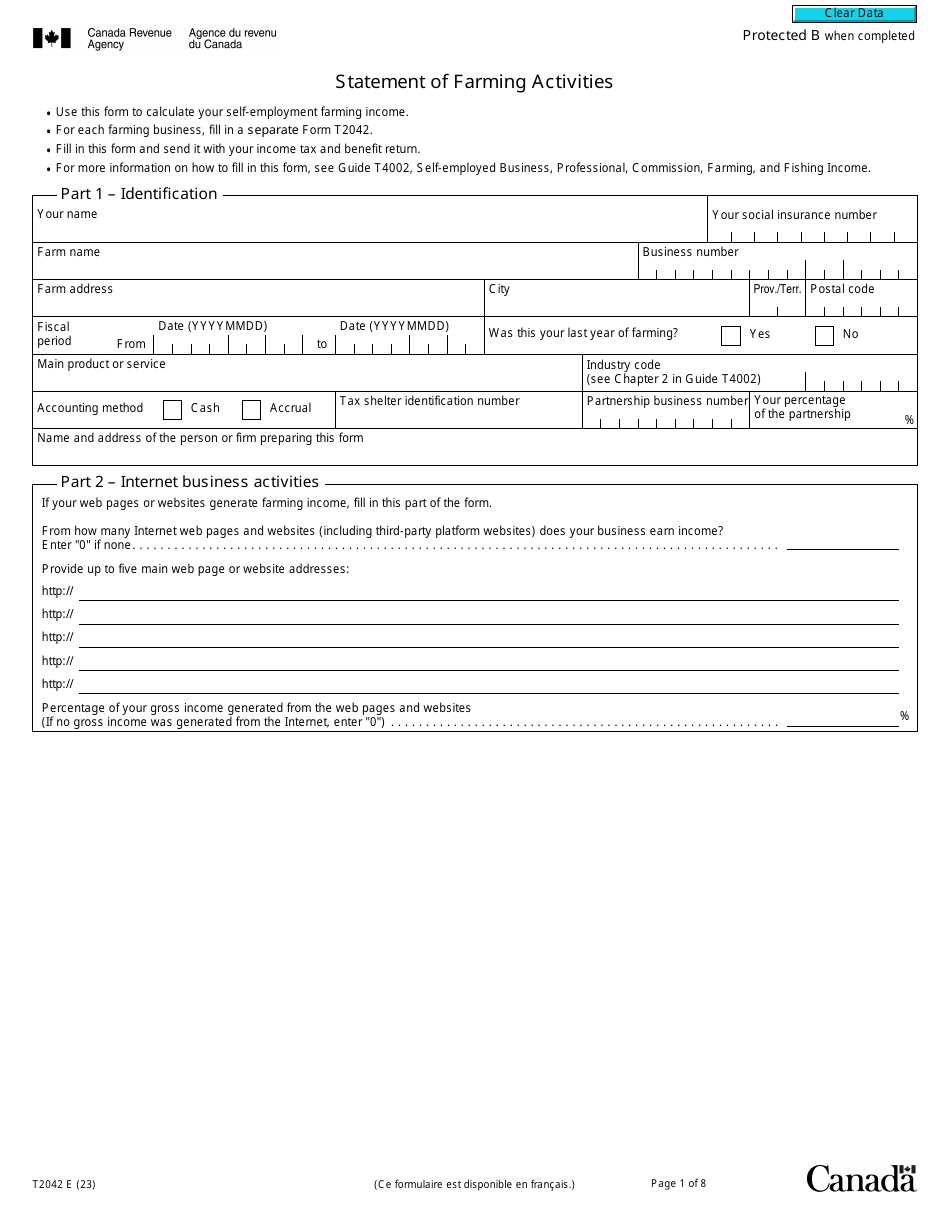

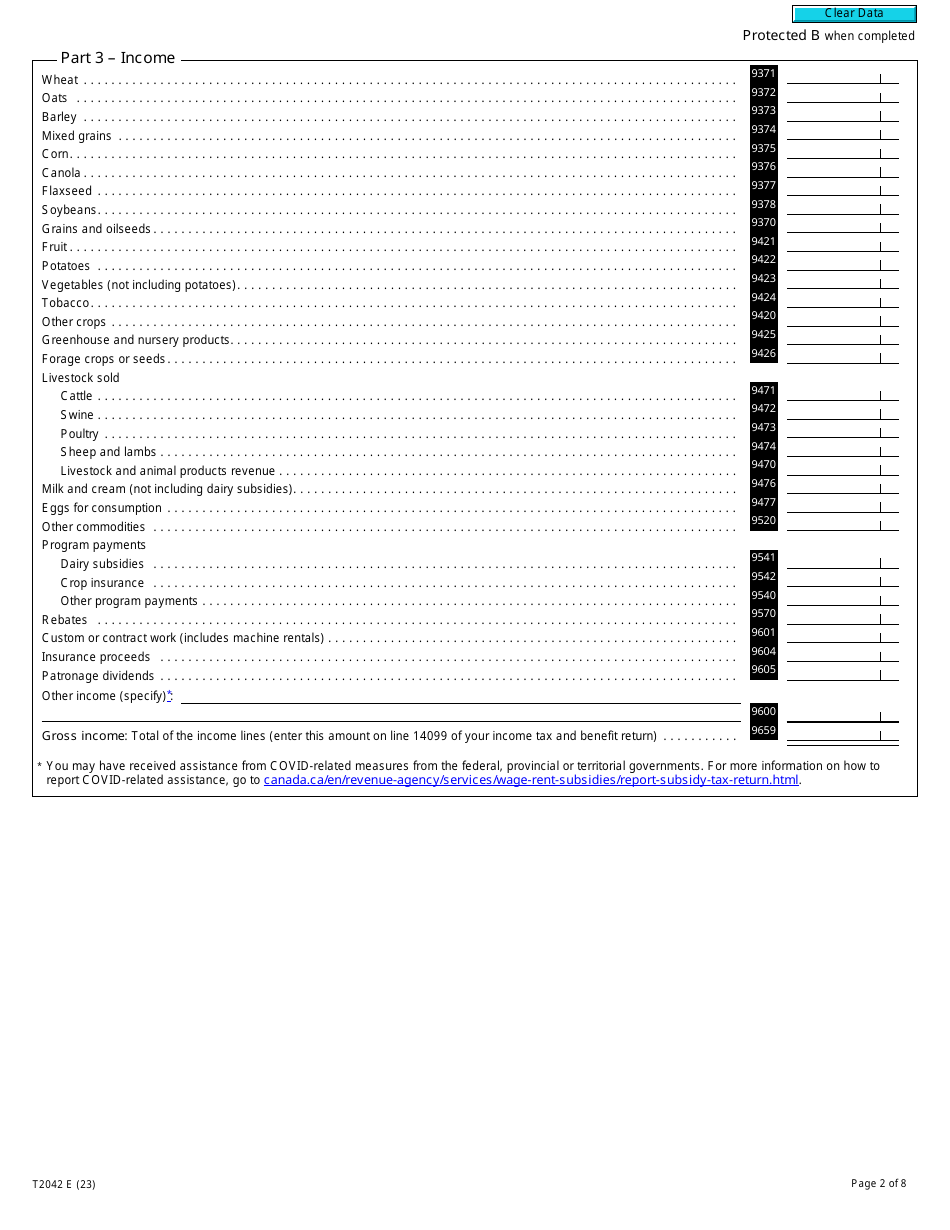

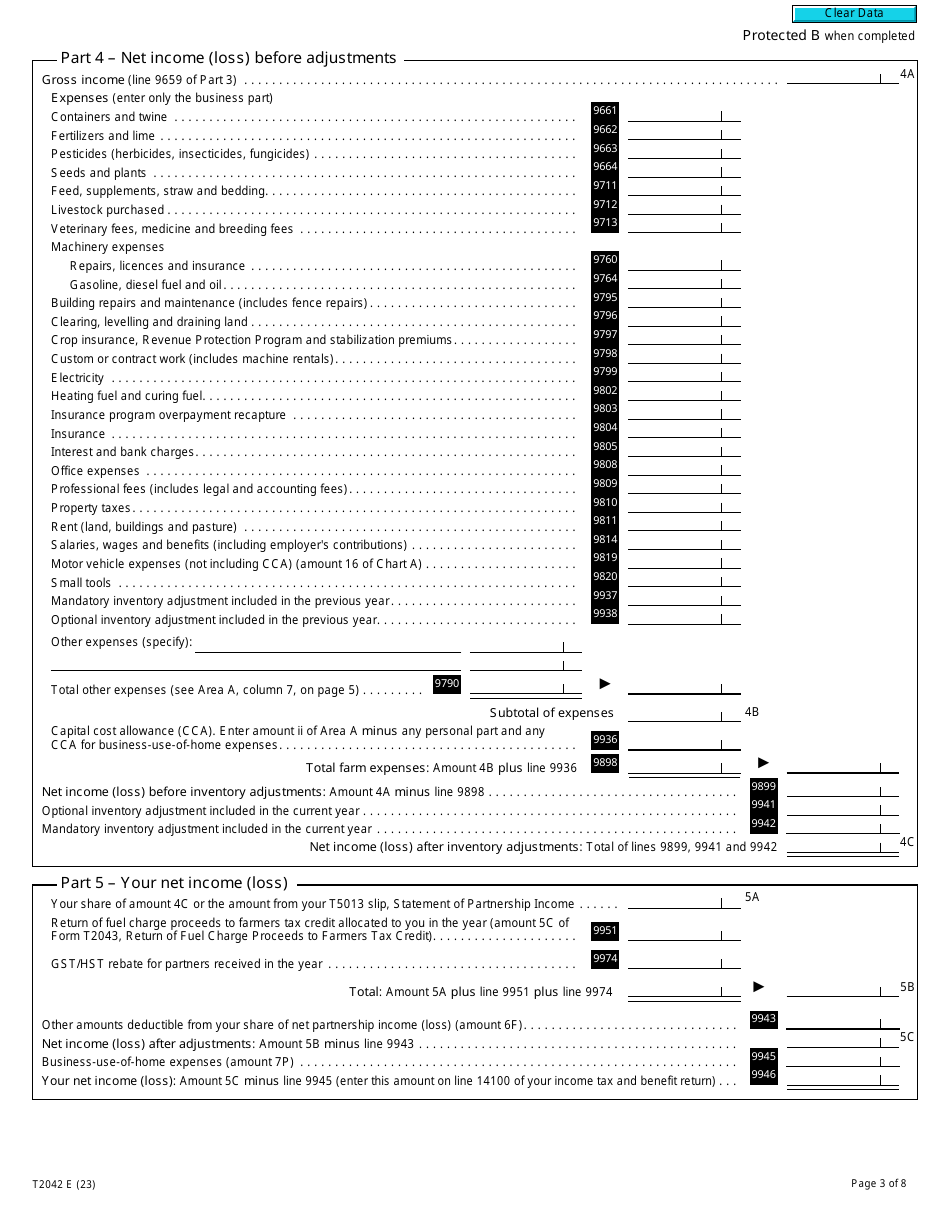

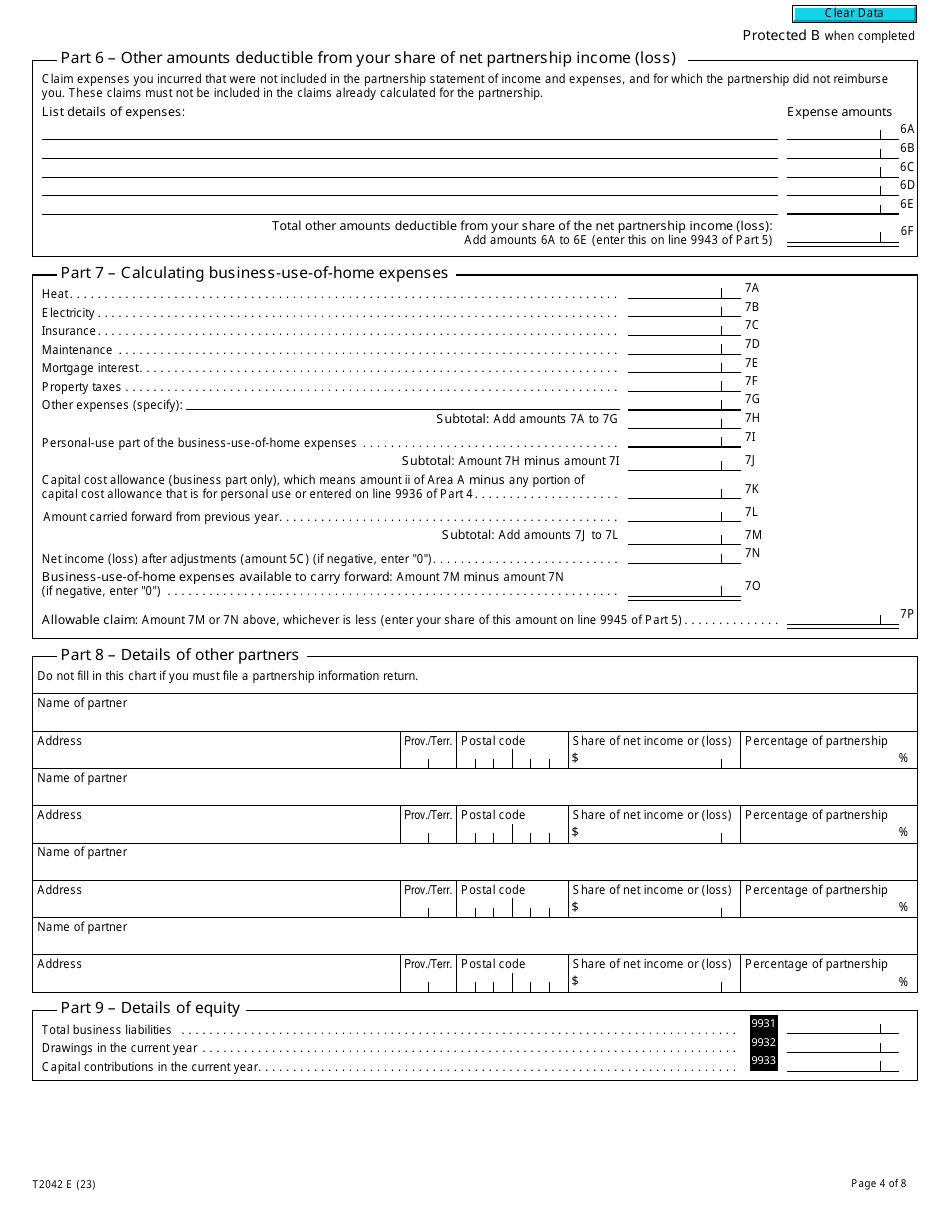

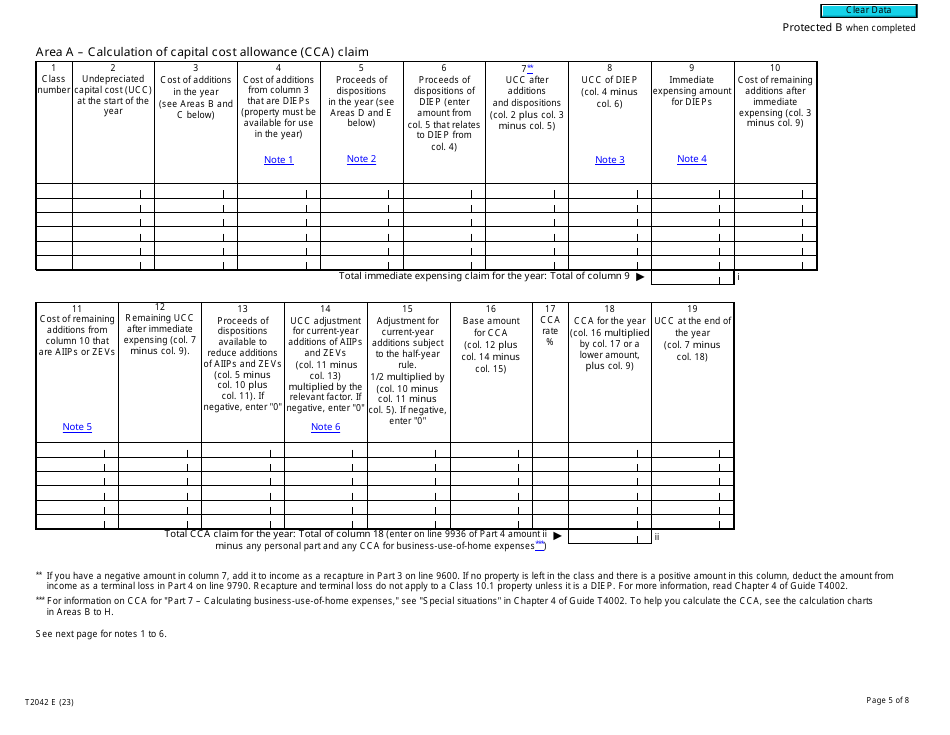

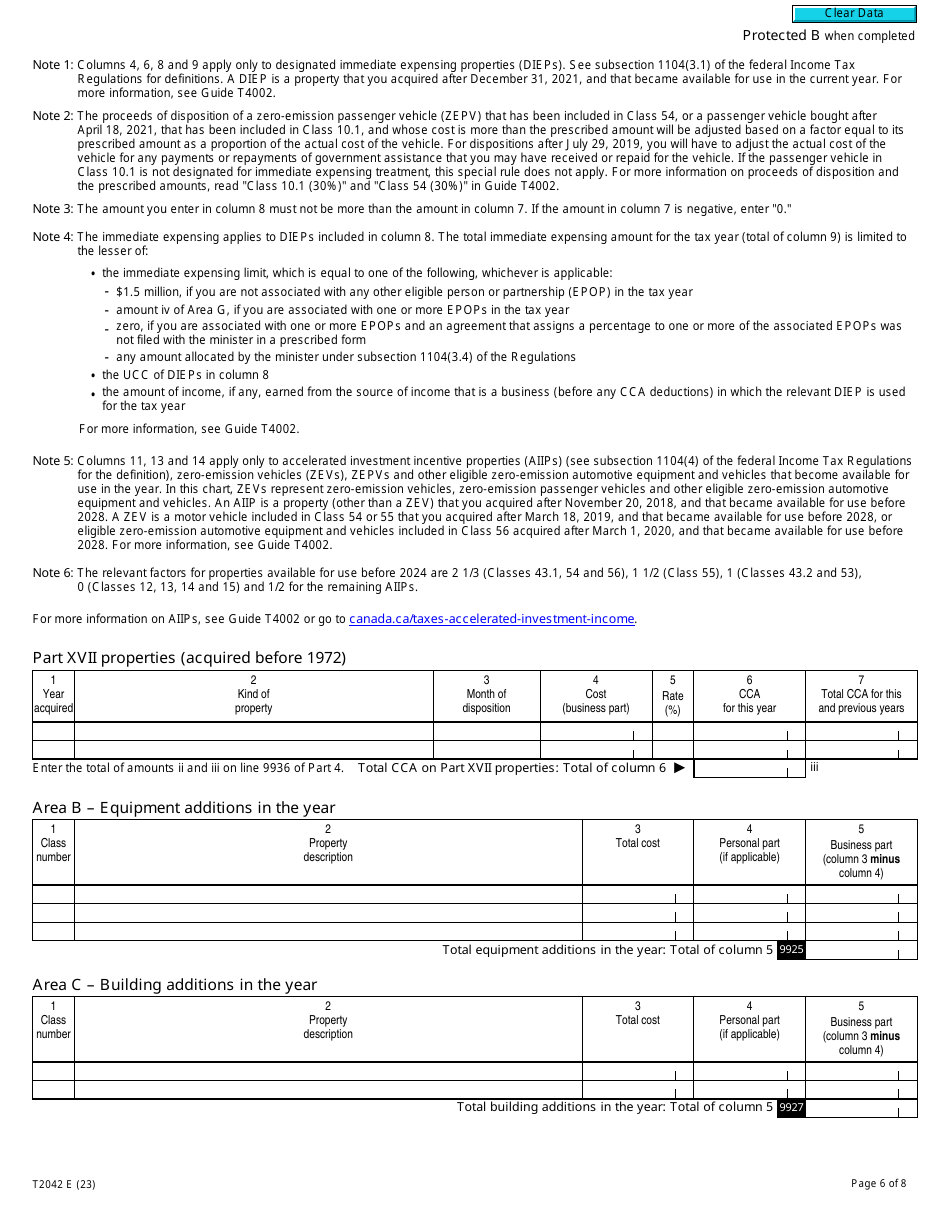

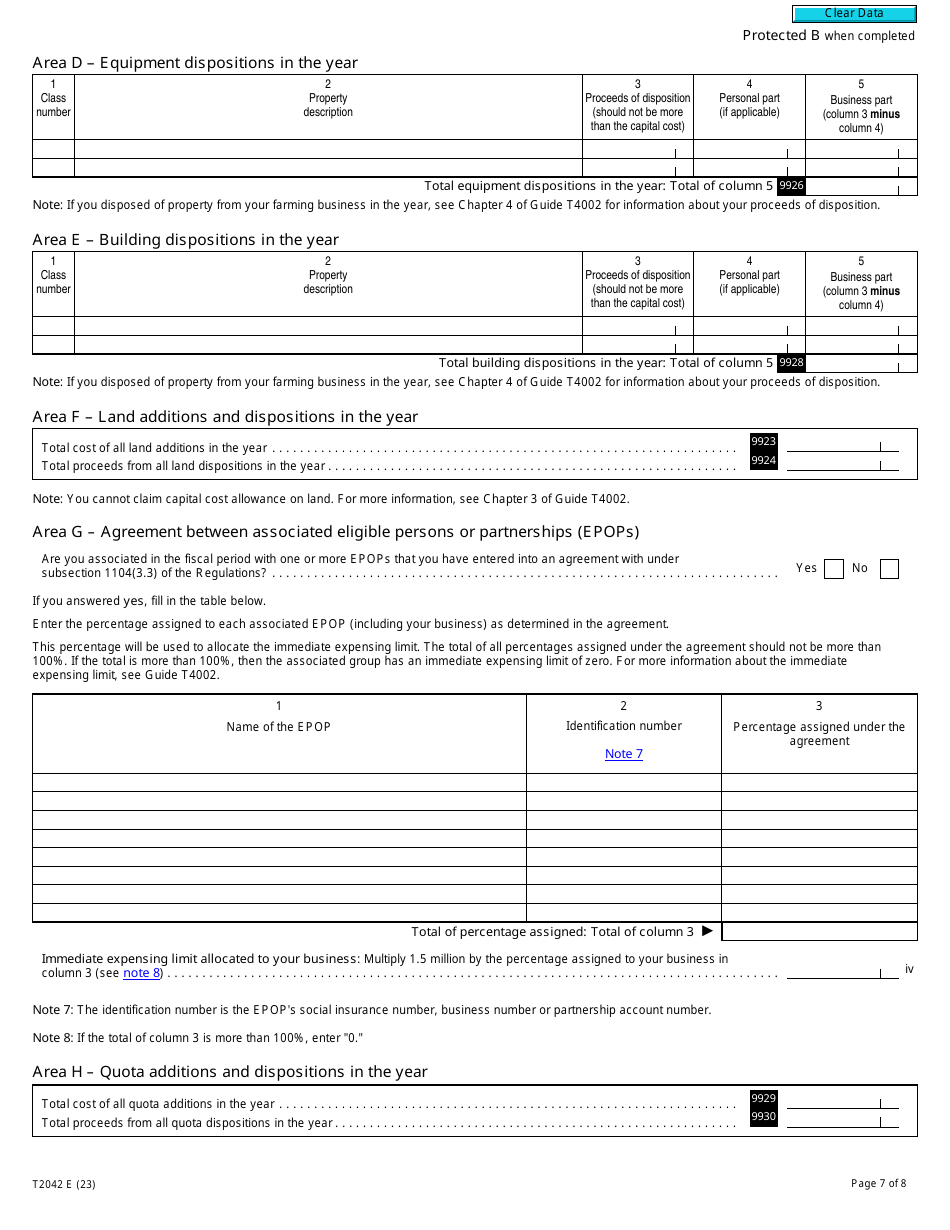

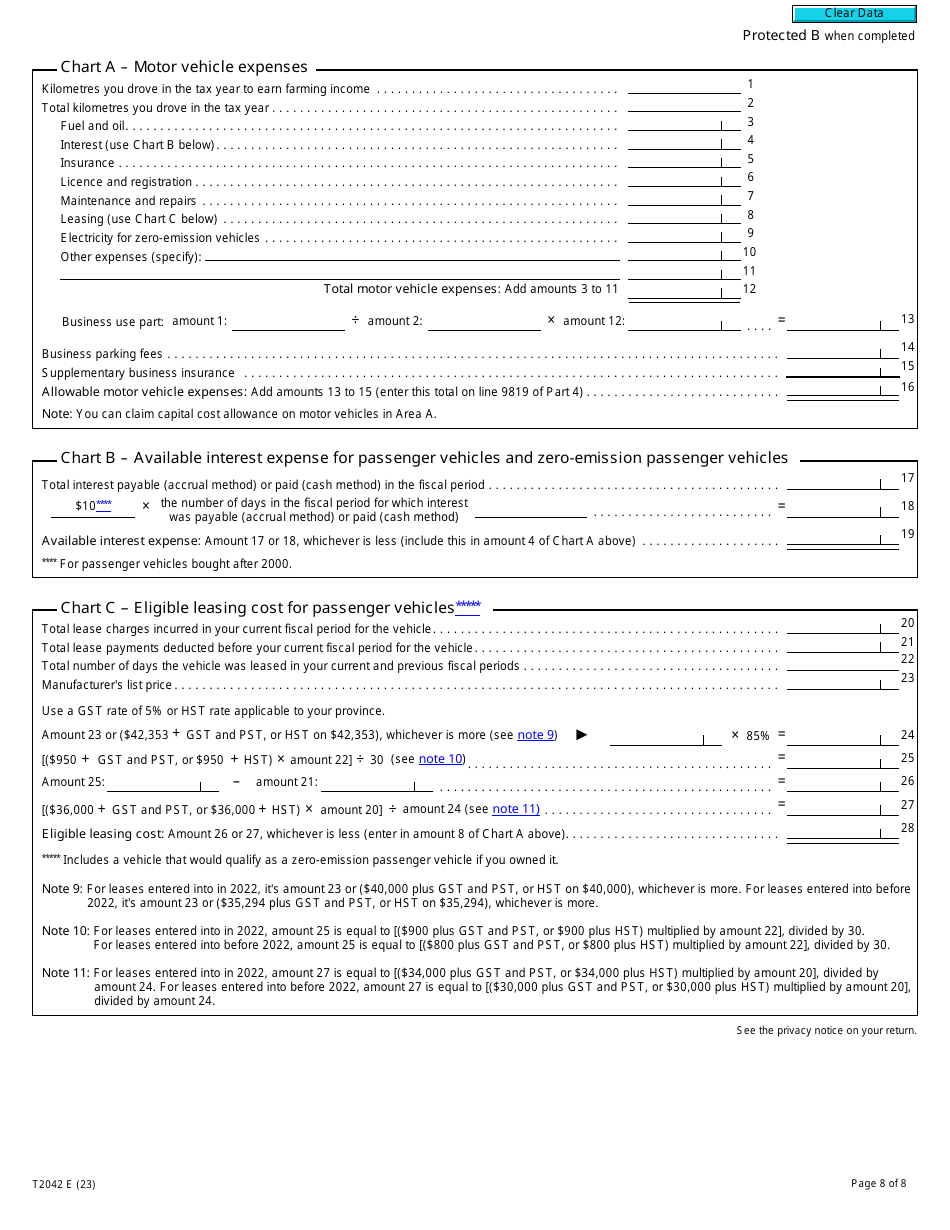

Form T2042 Statement of Farming Activities - Canada

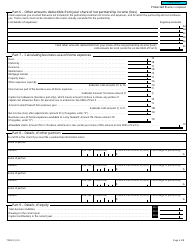

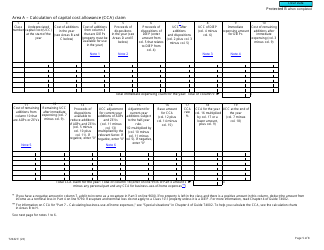

The Form T2042 Statement of Farming Activities in Canada is used to report farming income and expenses for tax purposes. It is used by individuals or partnerships engaged in farming activities to calculate their net income from farming.

Farmers in Canada are required to file the Form T2042 Statement of Farming Activities.

Form T2042 Statement of Farming Activities - Canada - Frequently Asked Questions (FAQ)

Q: What is Form T2042? A: Form T2042 is a statement of farming activities for individuals in Canada who are engaged in farming.

Q: Who needs to file Form T2042? A: Individuals in Canada who are engaged in farming activities, including farming for profit, must file Form T2042.

Q: What information is required on Form T2042? A: Form T2042 requires information about the farming activities, income, expenses, and deductions related to farming.

Q: When is Form T2042 due? A: Form T2042 is generally due on or before April 30 of the year following the tax year in which the farming activities took place.

Q: What if I have income from both farming and another source? A: If you have income from both farming and another source, you may need to complete additional forms, such as Form T2125, Statement of Business or Professional Activities.

Q: Can I claim expenses related to my farming activities? A: Yes, you can claim expenses related to your farming activities, such as seeds, fertilizers, equipment rentals, and maintenance costs.

Q: What records should I keep for my farming activities? A: You should keep records of your farming activities, including receipts, invoices, and financial statements, to support the information reported on Form T2042.

Q: Can I carry forward any farming losses? A: Yes, you may be able to carry forward farming losses to future years to offset farming income.