This version of the form is not currently in use and is provided for reference only. Download this version of

Form T1A

for the current year.

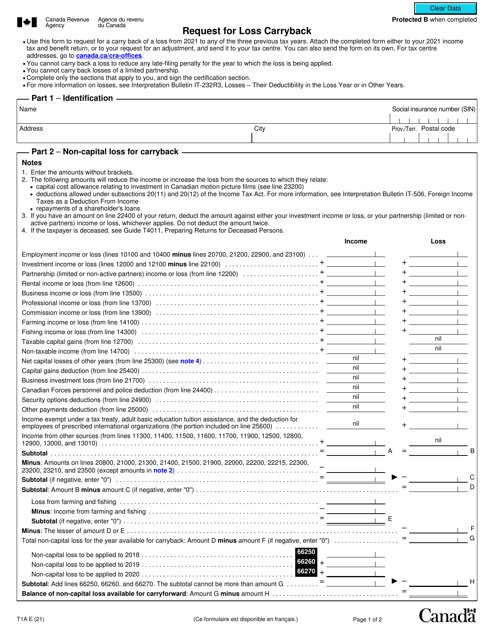

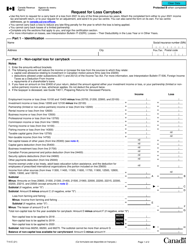

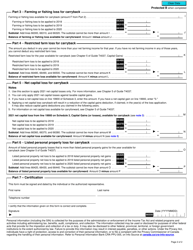

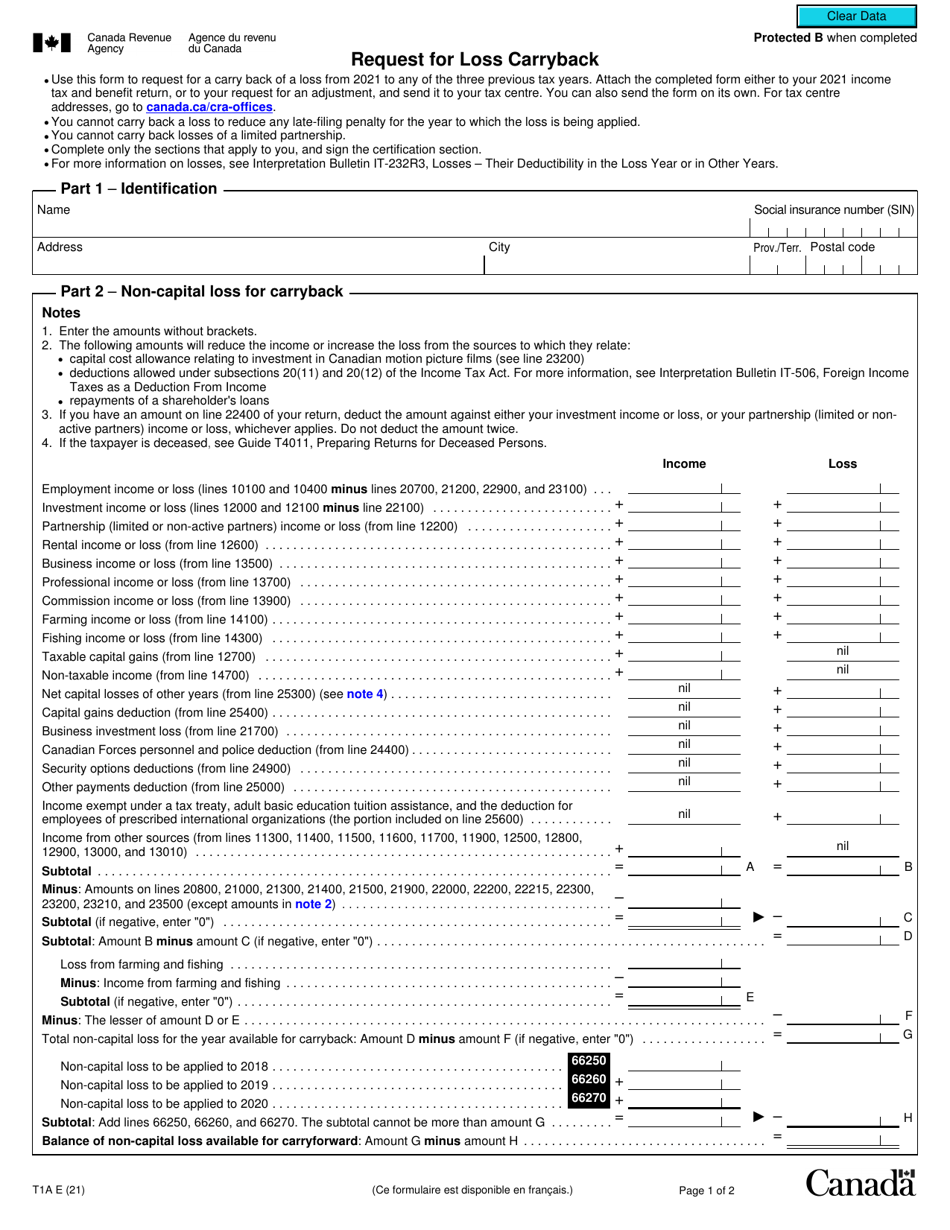

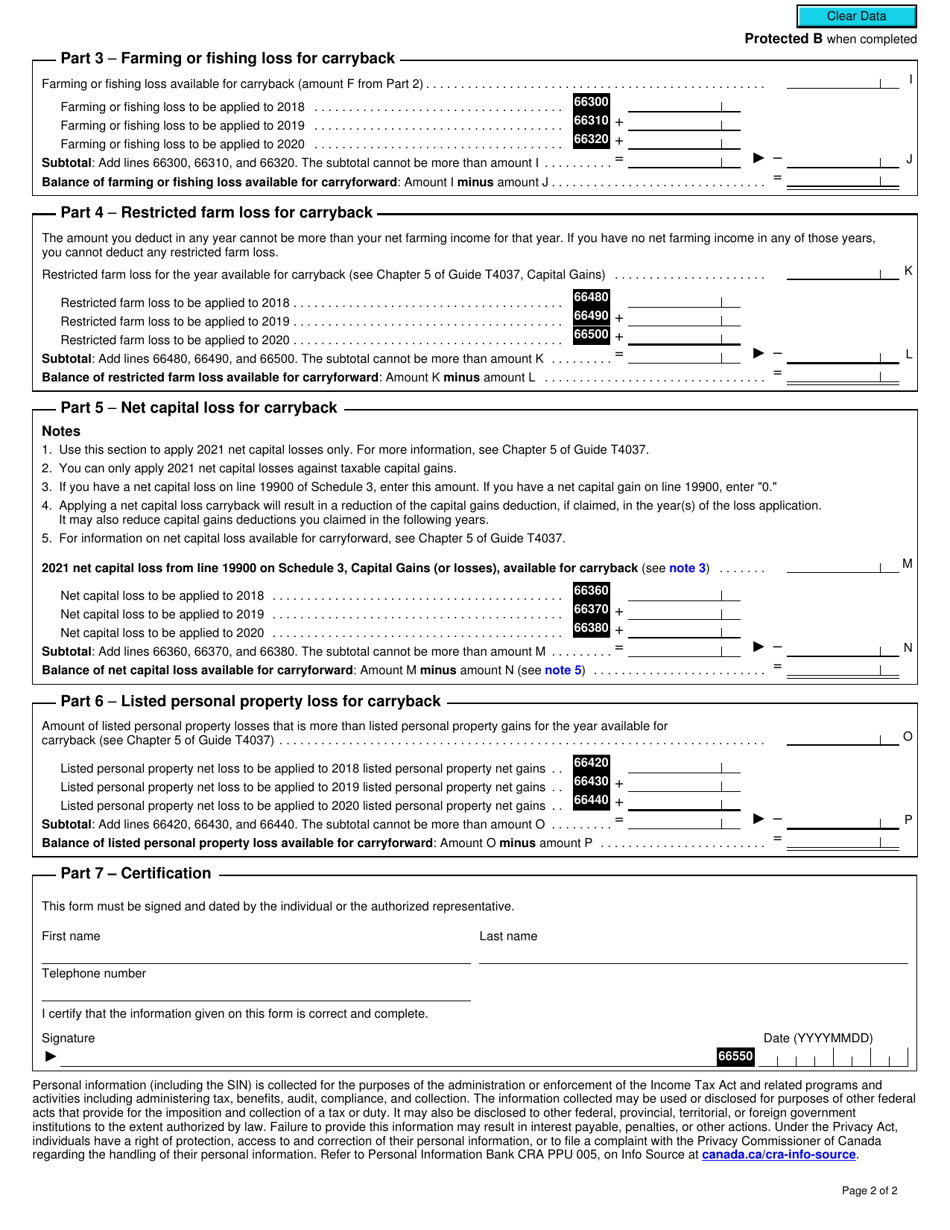

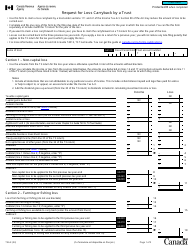

Form T1A Request for Loss Carryback - Canada

Form T1A Request forLoss Carryback in Canada is used to apply for the carryback of business or property losses to a previous tax year. This allows individuals or corporations to offset their current year's income with losses incurred in previous years, potentially resulting in a tax refund or reduction.

Individuals and corporations in Canada who want to apply for a loss carryback can file the Form T1A.

FAQ

Q: What is Form T1A?

A: Form T1A is a tax form used in Canada to request a loss carryback.

Q: What is a loss carryback?

A: A loss carryback allows a taxpayer to apply a current year loss to a previous year's income tax return in order to receive a refund.

Q: How do I request a loss carryback using Form T1A?

A: To request a loss carryback, you need to complete and submit Form T1A to the Canada Revenue Agency (CRA), along with any required supporting documents.

Q: Are there any deadlines for submitting Form T1A?

A: Yes, the deadline for requesting a loss carryback using Form T1A is generally within three years from the end of the tax year in which the loss was incurred.