This version of the form is not currently in use and is provided for reference only. Download this version of

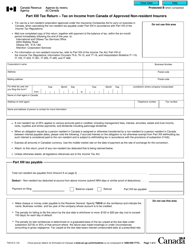

Form T1262 Part XIII.2

for the current year.

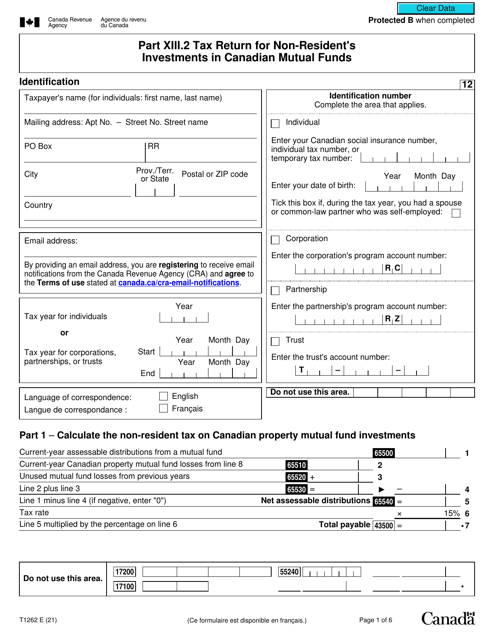

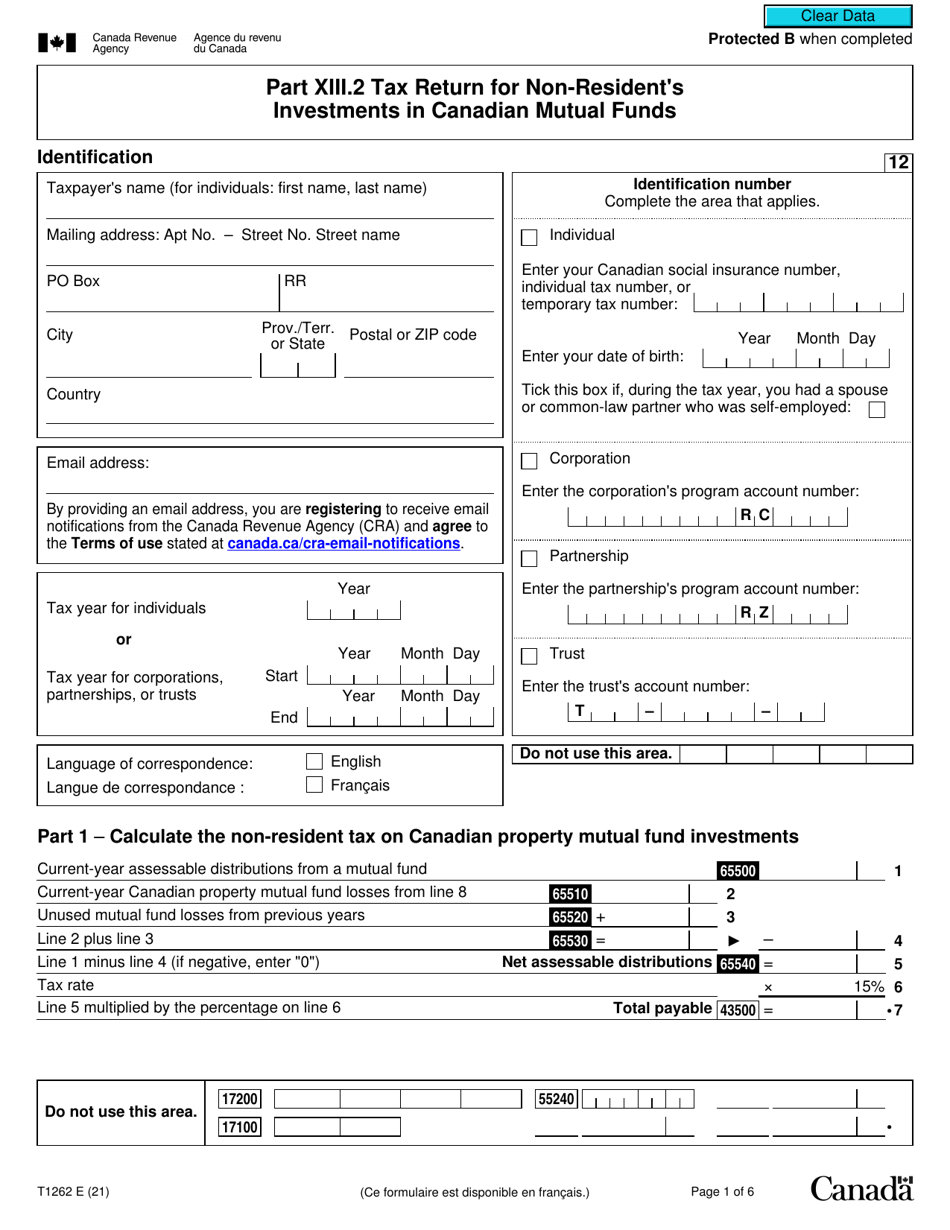

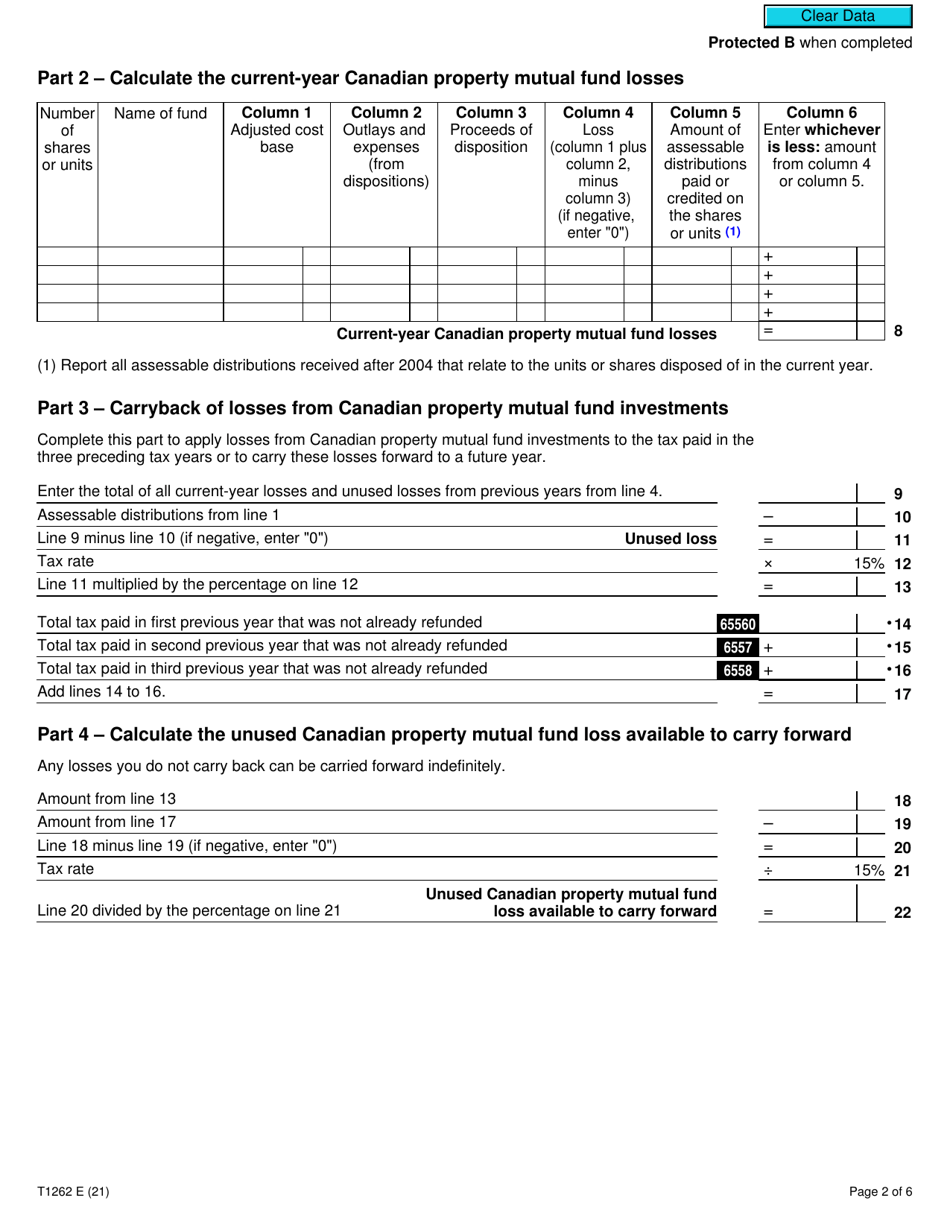

Form T1262 Part XIII.2 Tax Return for Non-resident's Investments in Canadian Mutual Funds - Canada

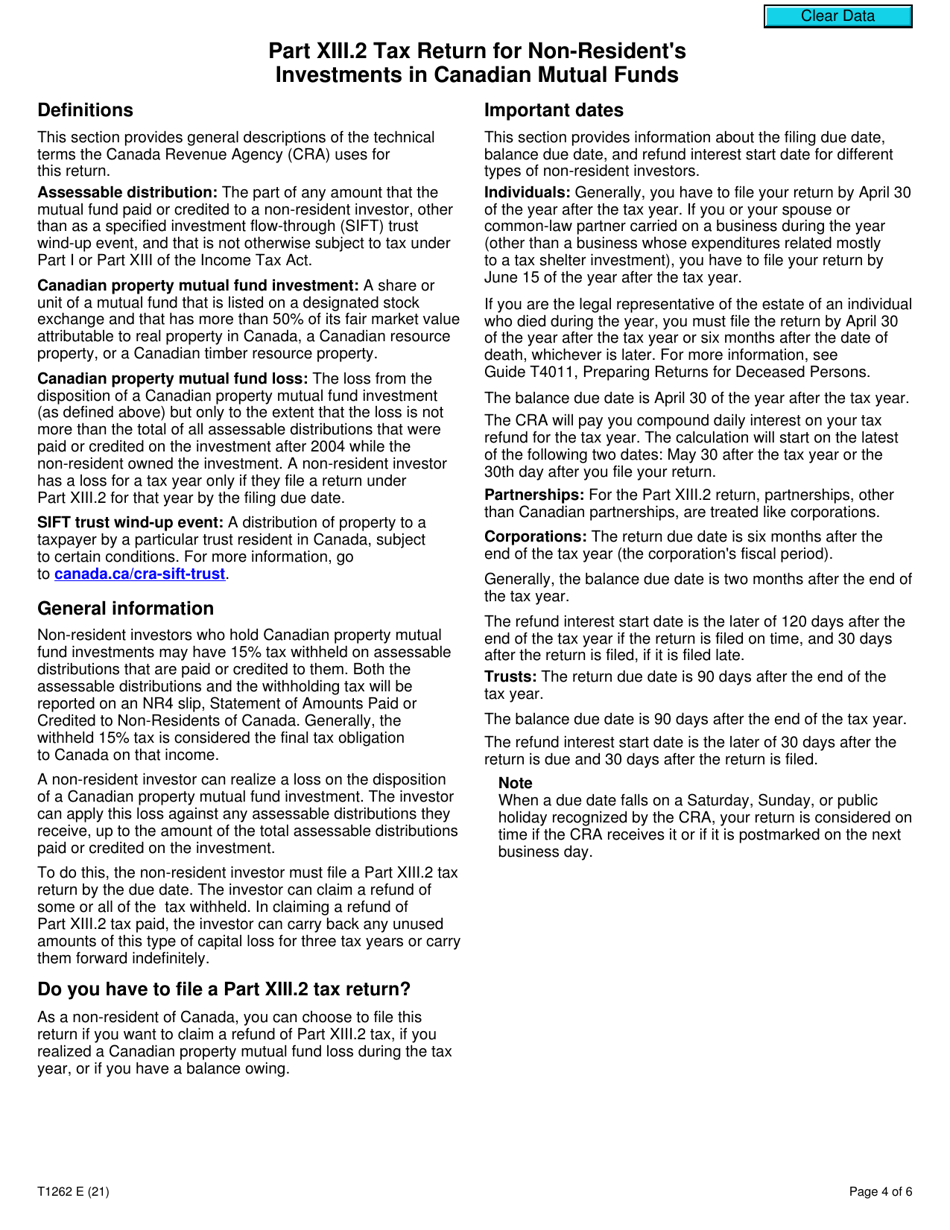

Form T1262 Part XIII.2 Tax Return for Non-resident's Investments in Canadian Mutual Funds in Canada is used by non-residents of Canada who have investments in Canadian mutual funds. This form is used to report income and calculate tax payable on these investments.

The Form T1262 Part XIII.2 Tax Return for Non-resident's Investments in Canadian Mutual Funds in Canada is filed by non-resident individuals who have investments in Canadian mutual funds.

FAQ

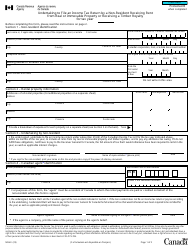

Q: What is Form T1262?

A: Form T1262 is a tax return for non-residents who have investments in Canadian mutual funds.

Q: Who needs to file Form T1262?

A: Non-residents with investments in Canadian mutual funds need to file Form T1262.

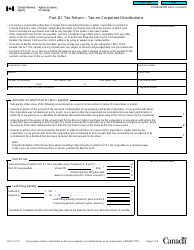

Q: What is Part XIII.2 of Form T1262?

A: Part XIII.2 of Form T1262 refers to the section of the form that deals with non-resident's investments in Canadian mutual funds.

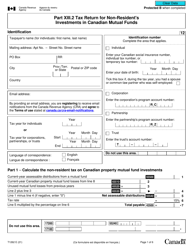

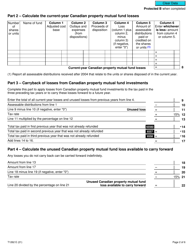

Q: What information is required in Part XIII.2 of Form T1262?

A: Part XIII.2 of Form T1262 requires information about the non-resident's investments in Canadian mutual funds, including income, gains, and withholding tax.

Q: Is Form T1262 specific to Canada?

A: Yes, Form T1262 is specific to Canada and is used to report non-resident's investments in Canadian mutual funds.