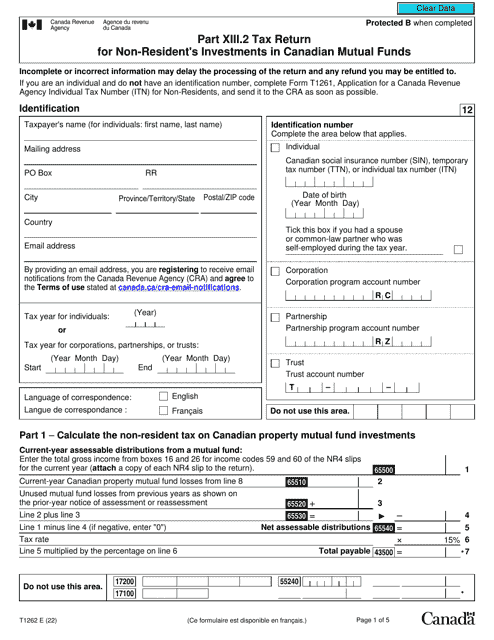

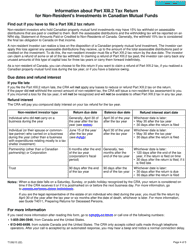

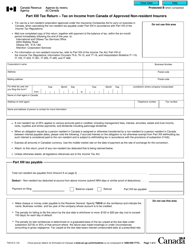

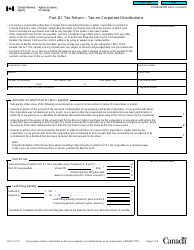

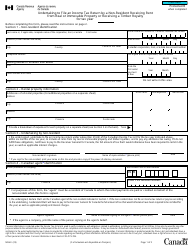

Form T1262 Part XIII.2 Tax Return for Non-resident's Investments in Canadian Mutual Funds - Canada

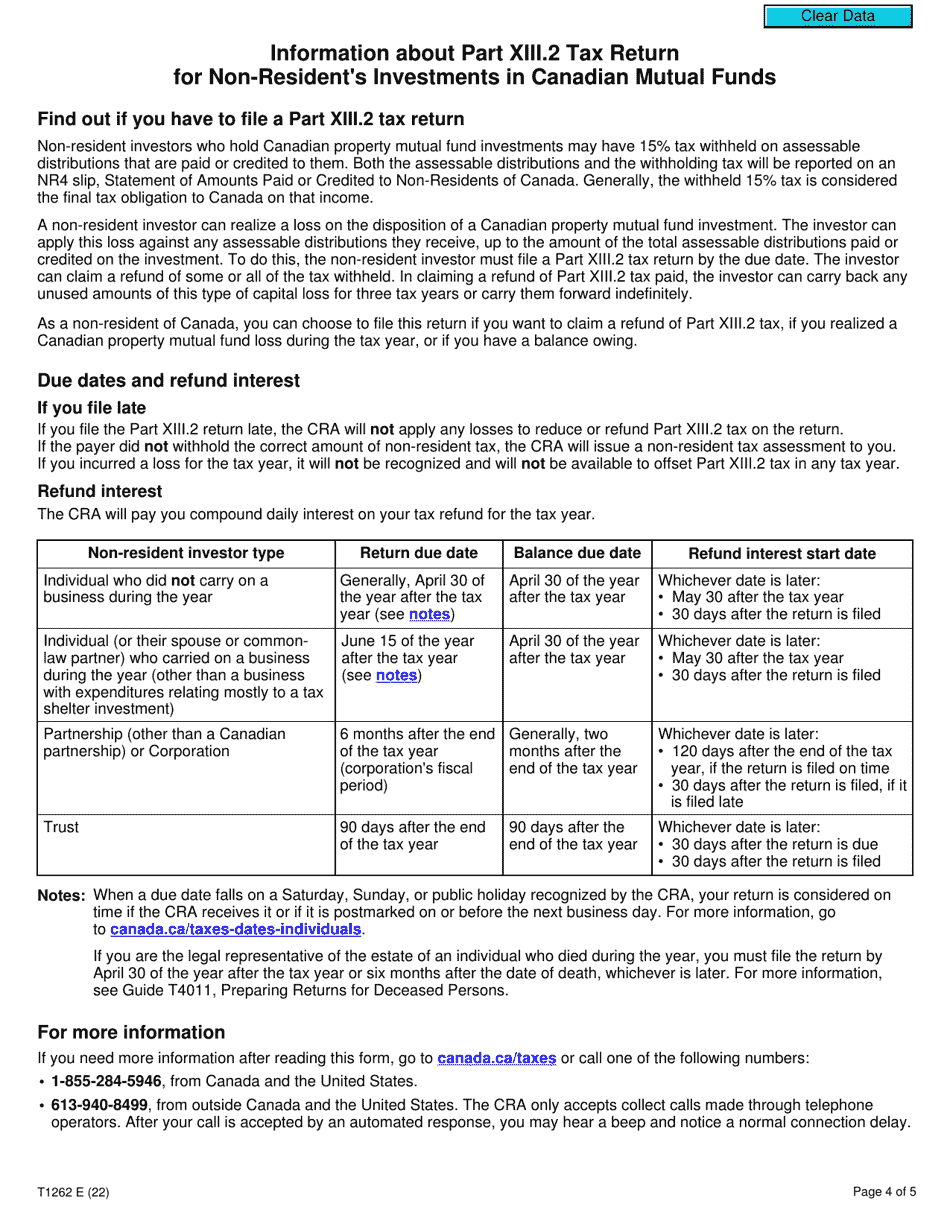

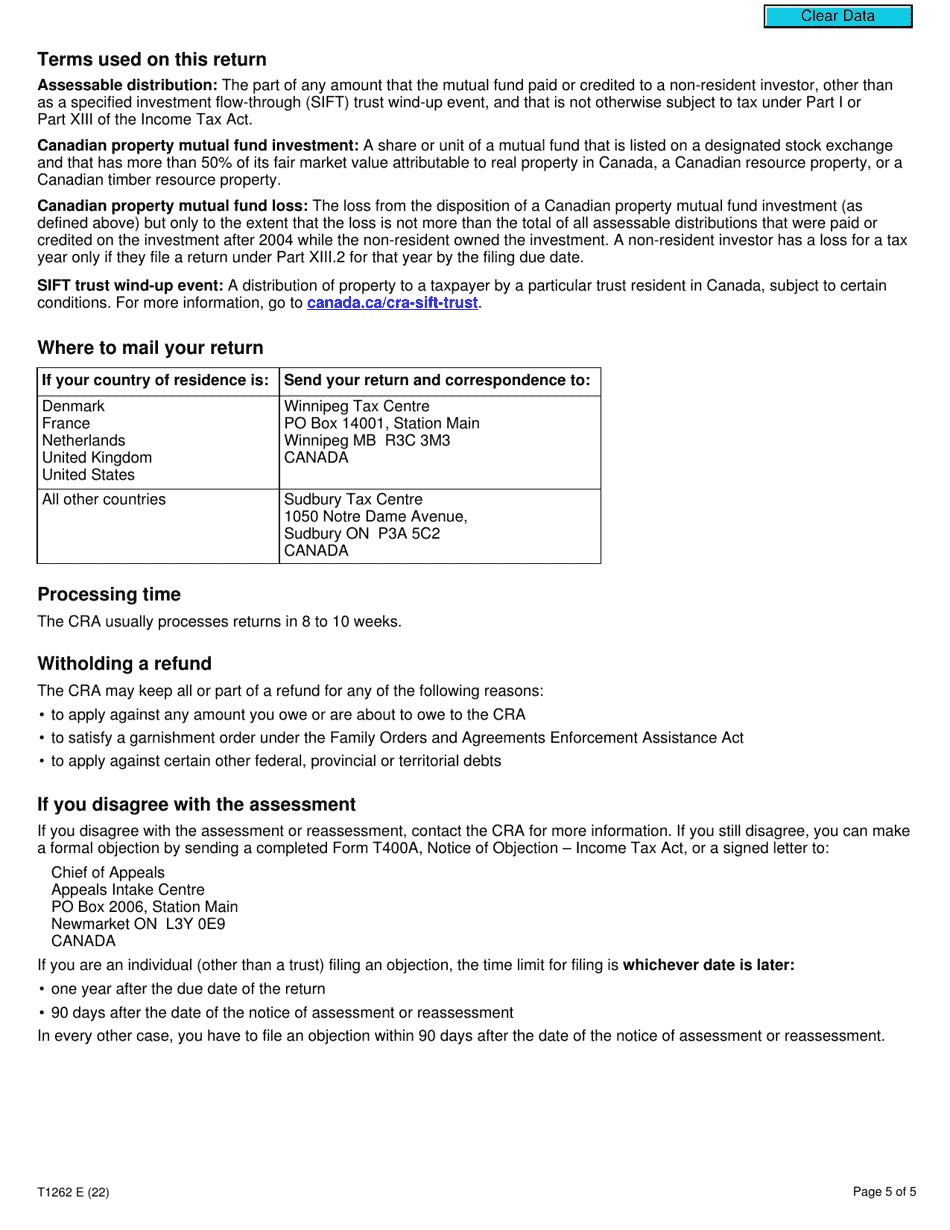

Form T1262 Part XIII.2 is a tax return specifically for non-residents who have investments in Canadian mutual funds. It is used to report income earned from these investments and to calculate the appropriate tax payable on that income.

The non-resident investor files the Form T1262 Part XIII.2 Tax Return for Non-resident's Investments in Canadian Mutual Funds in Canada.

Form T1262 Part XIII.2 Tax Return for Non-resident's Investments in Canadian Mutual Funds - Canada - Frequently Asked Questions (FAQ)

Q: What is Form T1262?

A: Form T1262 is the tax return form for non-residents who have investments in Canadian mutual funds.

Q: Who needs to file Form T1262?

A: Non-residents who have investments in Canadian mutual funds need to file Form T1262.

Q: What is Part XIII.2 of Form T1262?

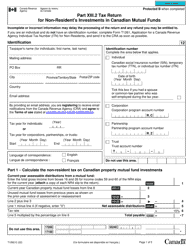

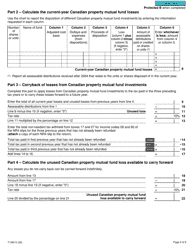

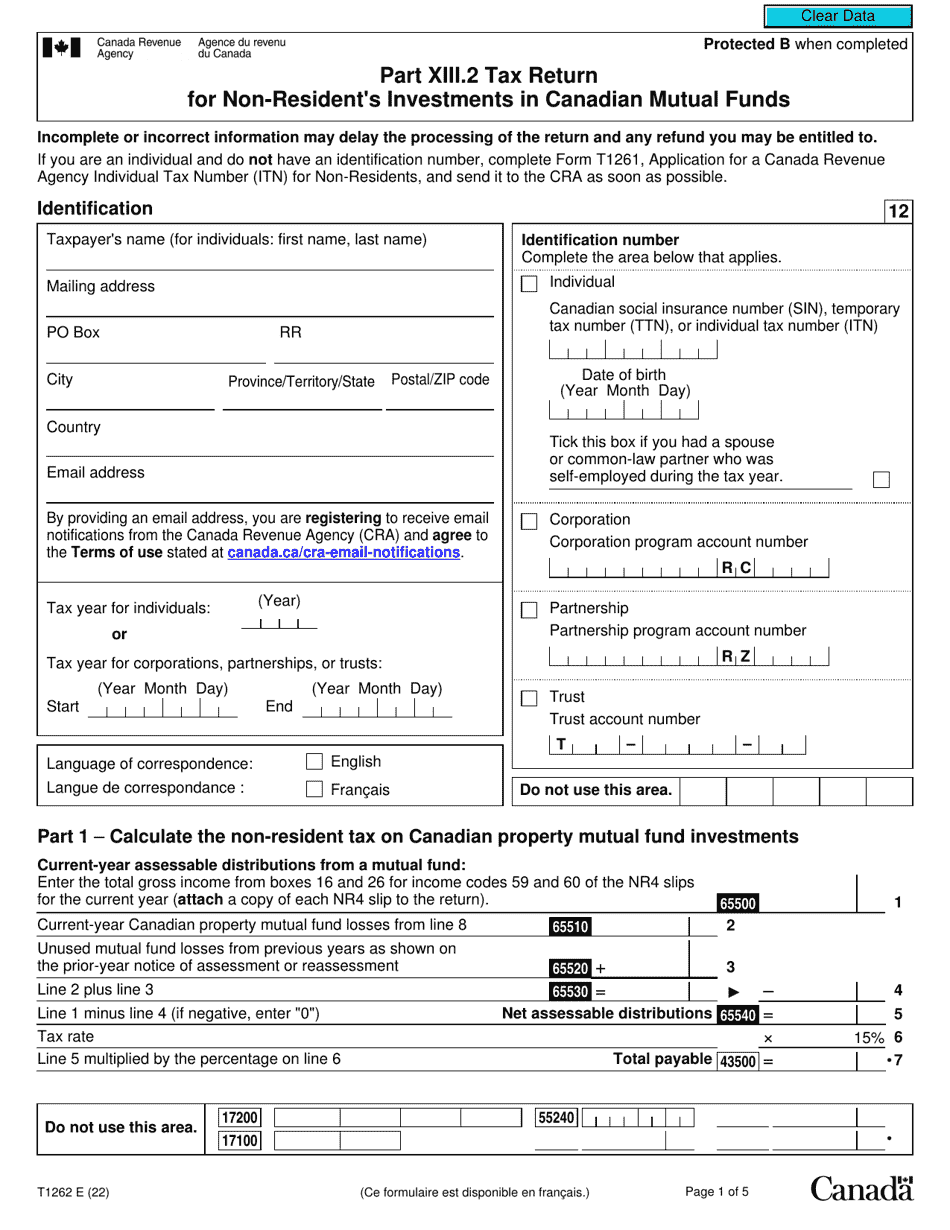

A: Part XIII.2 of Form T1262 is the section where you report your income and claim any applicable deductions for your investments in Canadian mutual funds.

Q: Do non-residents need to pay taxes on their investments in Canadian mutual funds?

A: Yes, non-residents are subject to taxes on their income from Canadian mutual funds.

Q: What information is required to complete Form T1262?

A: To complete Form T1262, you will need information such as the name and number of the mutual fund, the income earned, and any deductions claimed.

Q: When is the deadline to file Form T1262?

A: The deadline to file Form T1262 is typically June 30th of the following year.

Q: Are there any penalties for late filing of Form T1262?

A: Yes, there may be penalties for late filing of Form T1262. It is important to file your tax return on time to avoid any penalties.

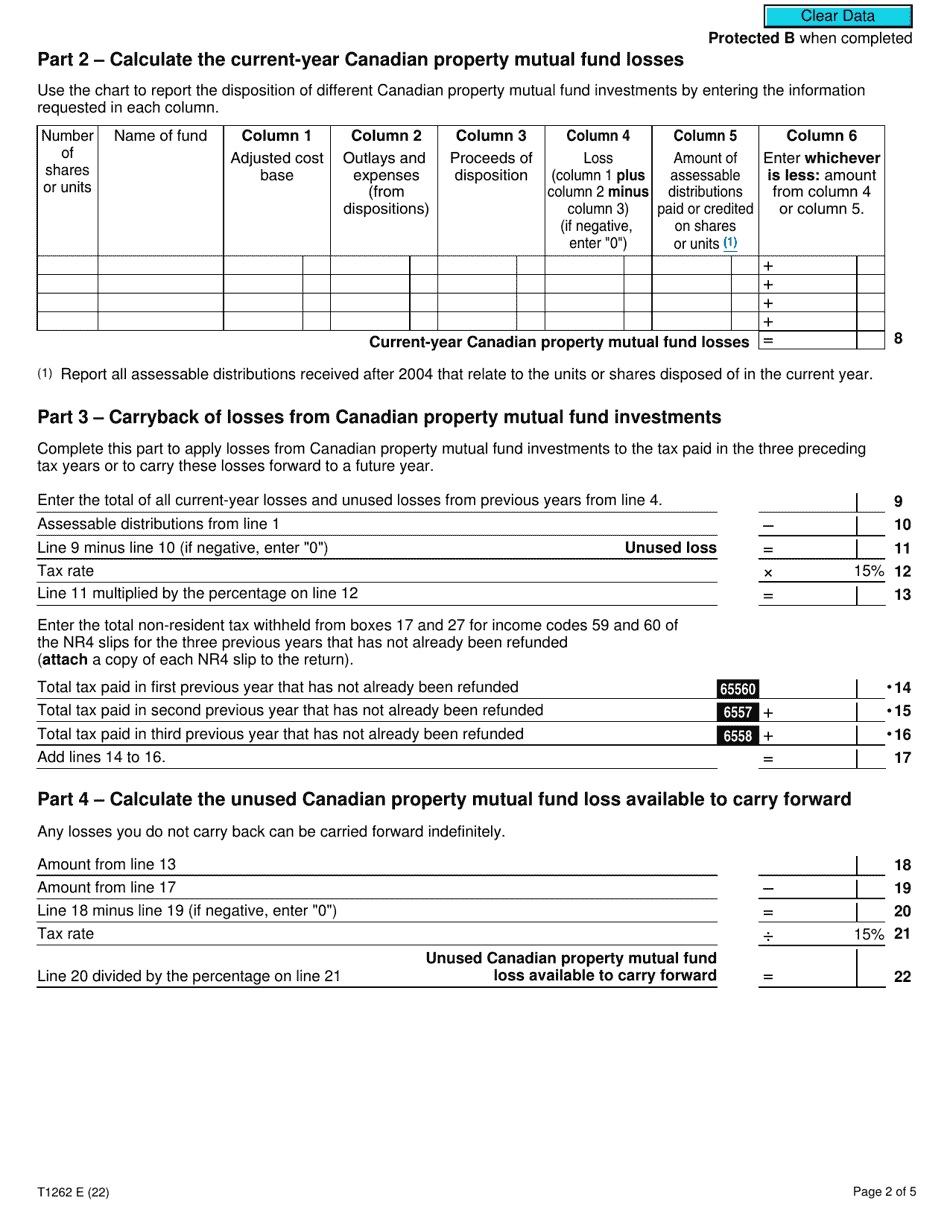

Q: Can I get a refund if I overpaid taxes on my investments in Canadian mutual funds?

A: Yes, if you overpaid taxes on your investments in Canadian mutual funds, you may be eligible for a refund. The amount of the refund will depend on various factors.

Q: Do non-residents need to report their investments in Canadian mutual funds to the IRS?

A: Yes, non-residents are required to report their investments in Canadian mutual funds to the Internal Revenue Service (IRS) in the United States.