This version of the form is not currently in use and is provided for reference only. Download this version of

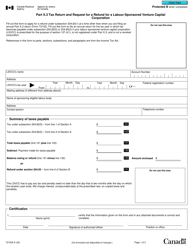

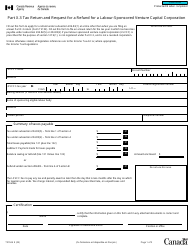

Form T1256-1

for the current year.

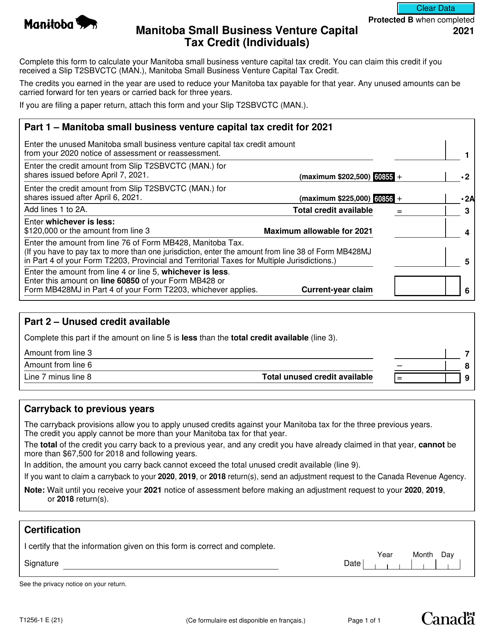

Form T1256-1 Manitoba Small Business Venture Capital Tax Credit (Individuals) - Canada

Form T1256-1 "Manitoba Small Business Venture Capital Tax Credit (Individuals)" is used by individuals in Canada to claim the Small Business Venture Capital Tax Credit in the province of Manitoba. This tax credit is available to individuals who invest in eligible small business ventures in Manitoba and allows them to offset a portion of their tax payable.

The form T1256-1 is filed by individuals in Canada who are claiming the Manitoba Small Business Venture Capital Tax Credit.

FAQ

Q: What is Form T1256-1?

A: Form T1256-1 is the Manitoba Small Business Venture Capital Tax Credit form that individuals in Canada can use.

Q: What is the purpose of the form?

A: The purpose of Form T1256-1 is to claim the Manitoba Small Business Venture Capital Tax Credit for individuals.

Q: Who can use Form T1256-1?

A: Individuals in Manitoba, Canada, who want to claim the Small Business Venture Capital Tax Credit can use this form.

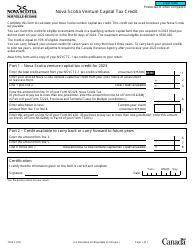

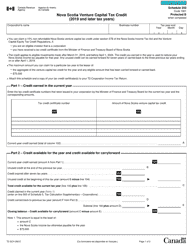

Q: What is the Small Business Venture Capital Tax Credit?

A: The Small Business Venture Capital Tax Credit is a tax credit offered by the government of Manitoba to encourage individuals to invest in small businesses.

Q: Is there a deadline for submitting Form T1256-1?

A: Yes, the form must be submitted by the deadline specified by the Canada Revenue Agency, usually in alignment with the annual tax returnfiling deadline.

Q: What are the benefits of claiming the tax credit?

A: By claiming the Small Business Venture Capital Tax Credit, individuals can reduce their tax liability and support the growth of small businesses in Manitoba.

Q: Can Form T1256-1 be used by businesses?

A: No, this form is specifically for individuals. Businesses may have separate forms and requirements to claim the Small Business Venture Capital Tax Credit.

Q: What if I have questions or need assistance with Form T1256-1?

A: If you have questions or need assistance with Form T1256-1, you can contact the Canada Revenue Agency or seek guidance from a tax professional.