This version of the form is not currently in use and is provided for reference only. Download this version of

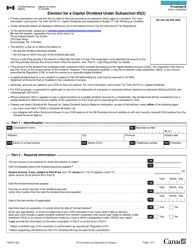

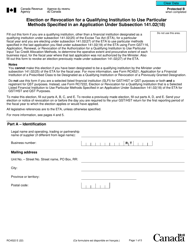

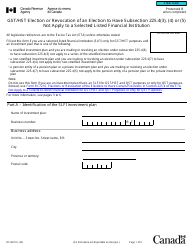

Form T1244

for the current year.

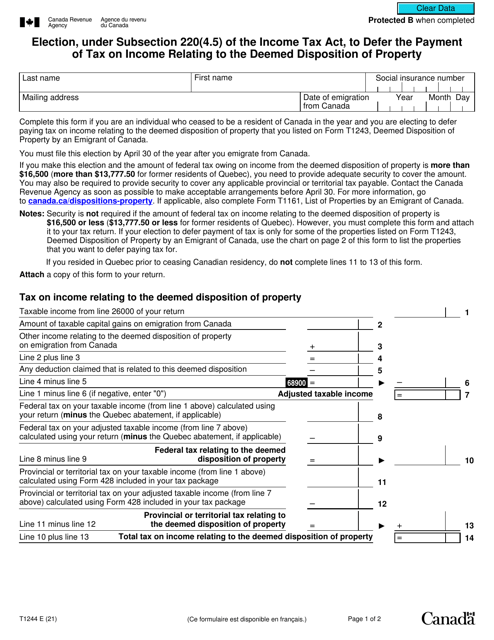

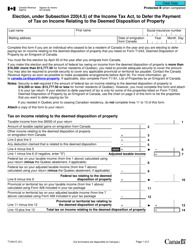

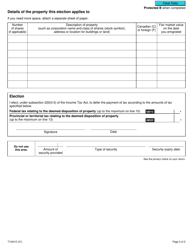

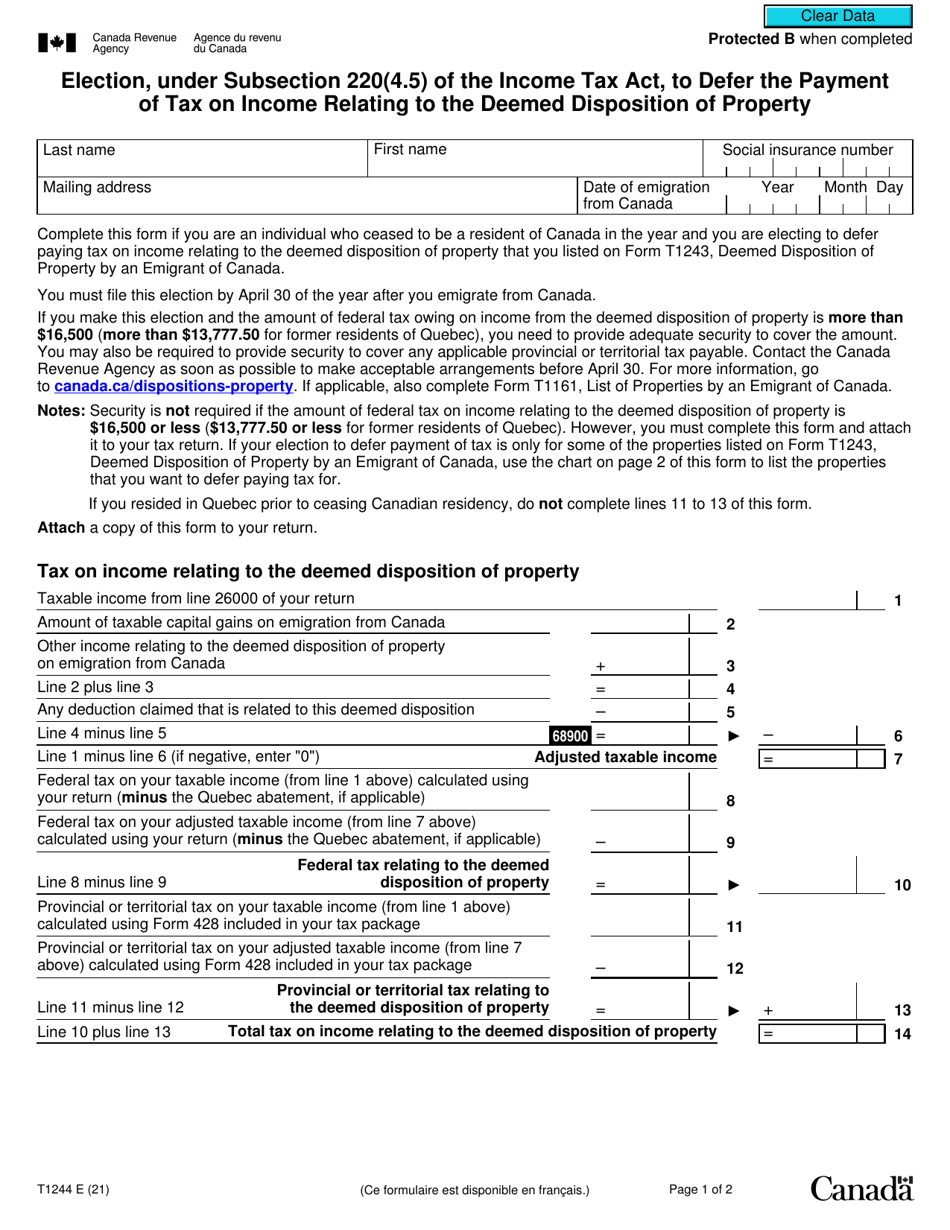

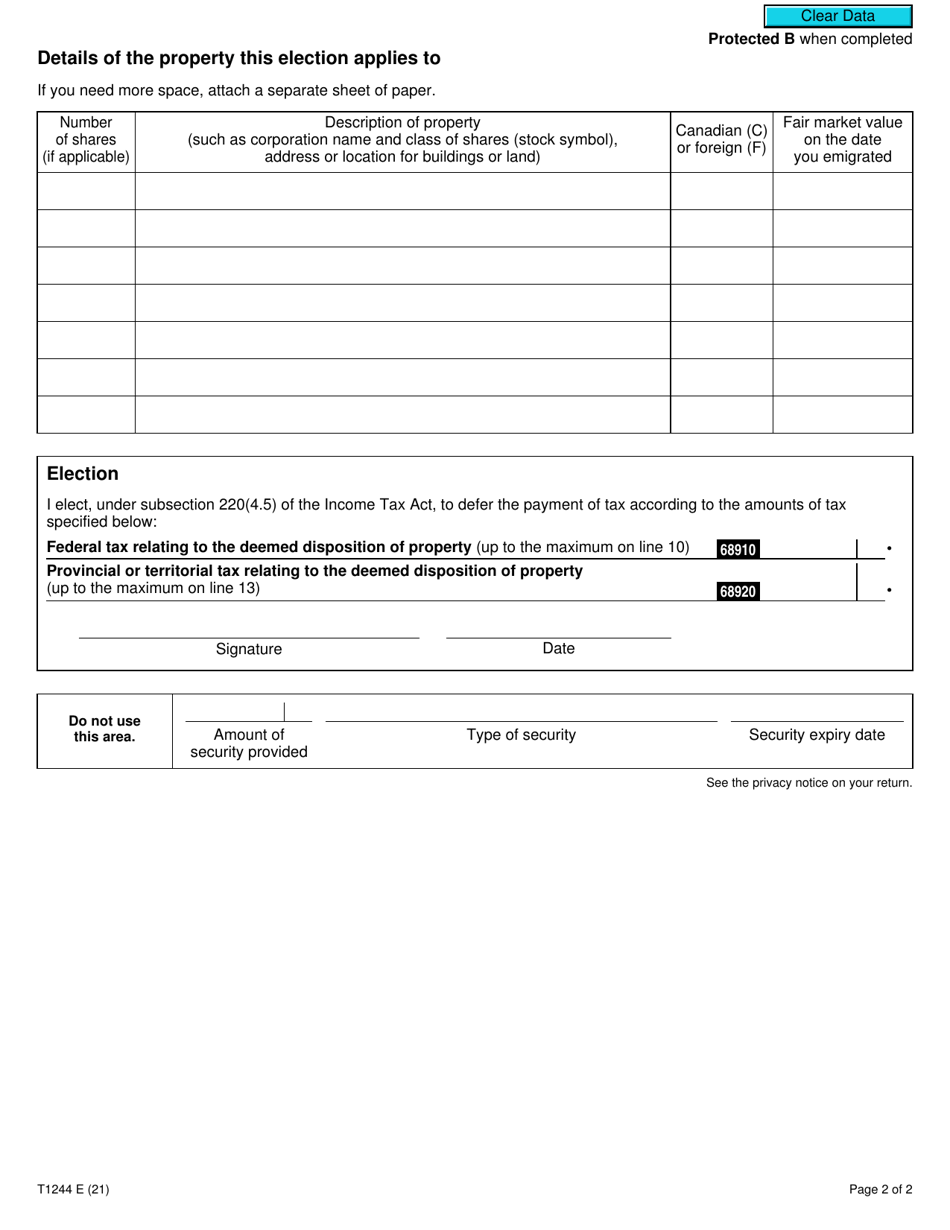

Form T1244 Election, Under Subsection 220(4.5) of the Income Tax Act, to Defer the Payment of Tax on Income Relating to the Deemed Disposition of Property - Canada

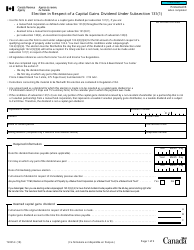

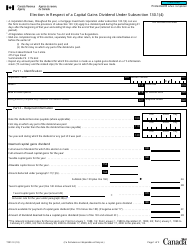

Form T1244 is used in Canada to make an election under subsection 220(4.5) of the Income Tax Act. This election allows taxpayers to defer the payment of tax on the income relating to the deemed disposition of property.

The taxpayer files the Form T1244 Election to defer the payment of tax on income relating to the deemed disposition of property in Canada.

FAQ

Q: What is Form T1244?

A: Form T1244 is an election form under Subsection 220(4.5) of the Income Tax Act in Canada.

Q: What is the purpose of Form T1244?

A: The purpose of Form T1244 is to defer the payment of tax on income relating to the deemed disposition of property.

Q: Who can use Form T1244?

A: Individuals and certain trusts can use Form T1244 to defer the payment of tax.

Q: What is meant by deemed disposition of property?

A: Deemed disposition of property refers to the situation where you are considered to have disposed of property, even if you haven't sold it.

Q: How does Form T1244 help in deferring tax payment?

A: By submitting Form T1244, you can defer the payment of tax on the income from deemed disposition of property until a later date.

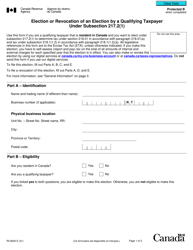

Q: Are there any conditions for using Form T1244?

A: Yes, there are certain conditions that must be met to use Form T1244, such as being a Canadian resident and the property being eligible.