This version of the form is not currently in use and is provided for reference only. Download this version of

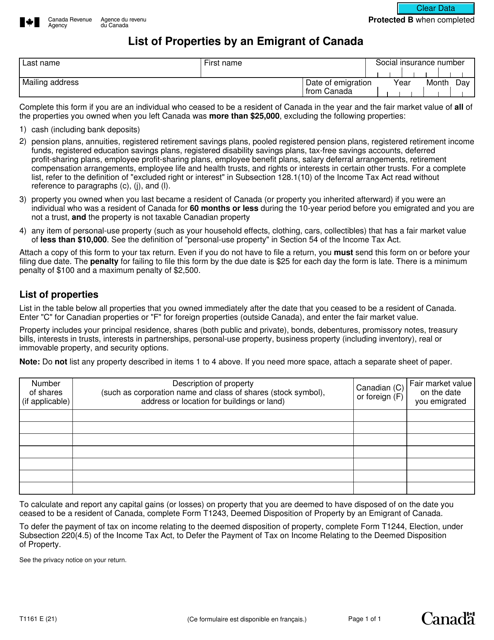

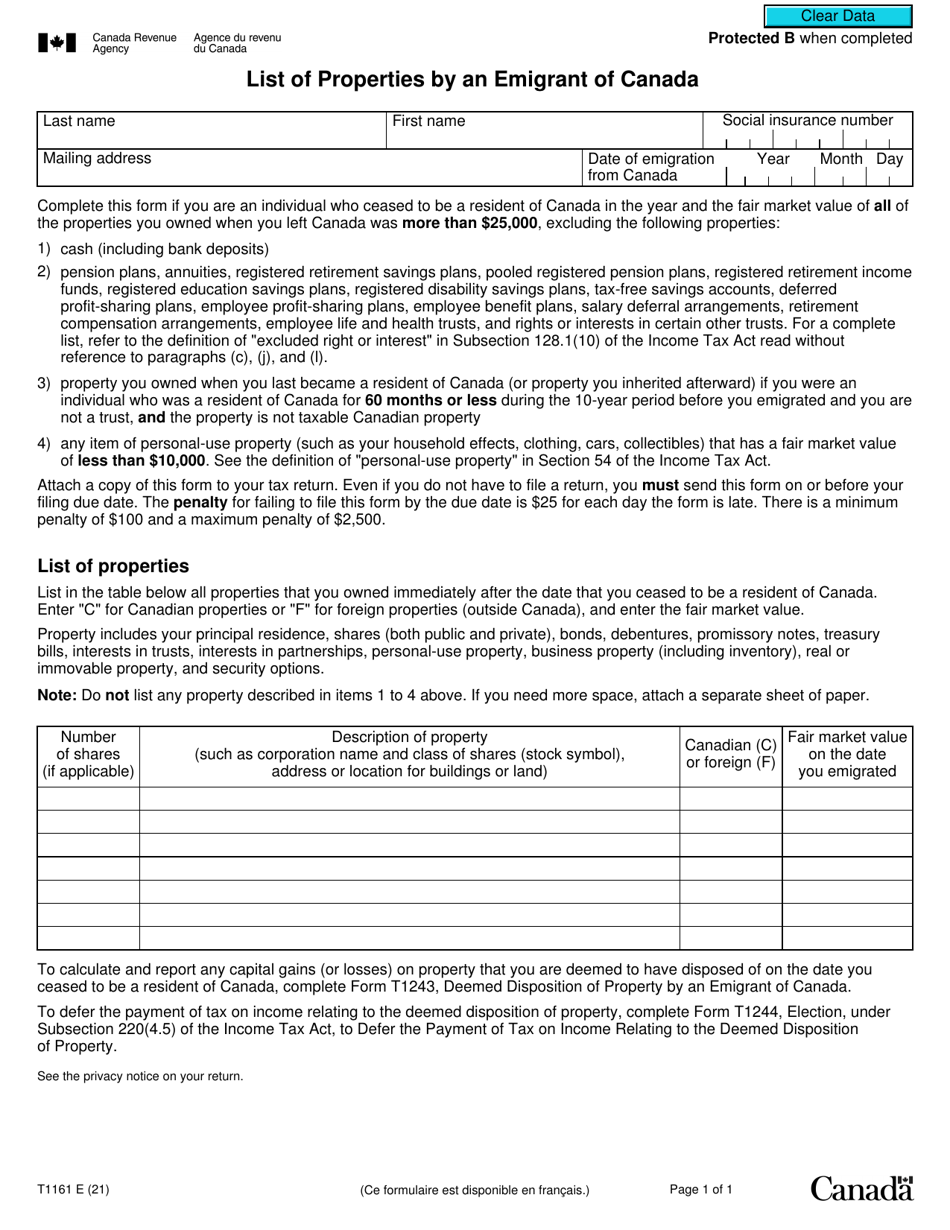

Form T1161

for the current year.

Form T1161 List of Properties by an Emigrant of Canada - Canada

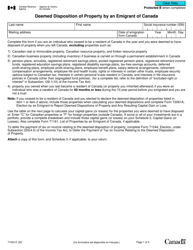

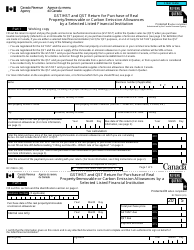

Form T1161 List of Properties by an Emigrant of Canada is used to report certain properties when an individual emigrates from Canada. It provides important information to the Canadian government about the assets owned by the emigrant.

The emigrant of Canada is responsible for filing Form T1161 List of Properties.

FAQ

Q: What is Form T1161?

A: Form T1161 is a document used by an individual who is emigrating from Canada to report their property holdings.

Q: Who is required to file Form T1161?

A: Any individual who is emigrating from Canada and has certain property holdings must file Form T1161.

Q: What information is required on Form T1161?

A: Form T1161 requires information about the property holdings of the emigrant, including their description, value, and date of acquisition.

Q: When should Form T1161 be filed?

A: Form T1161 should be filed within 90 days of the emigrant becoming a non-resident of Canada.

Q: Are there any penalties for not filing Form T1161?

A: Yes, failure to file Form T1161 or providing false or misleading information can result in penalties.