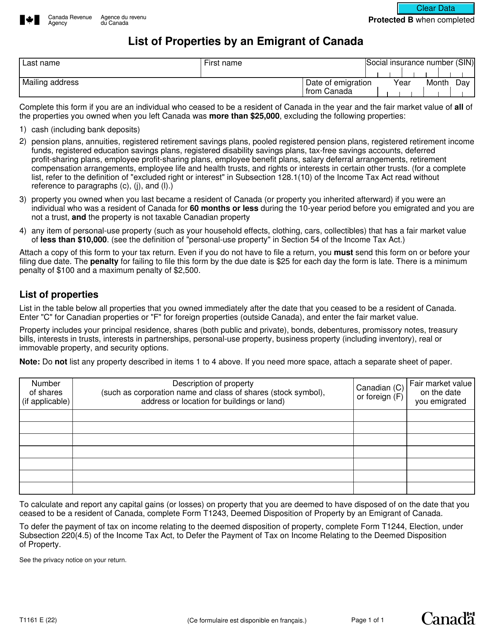

Form T1161 List of Properties by an Emigrant of Canada - Canada

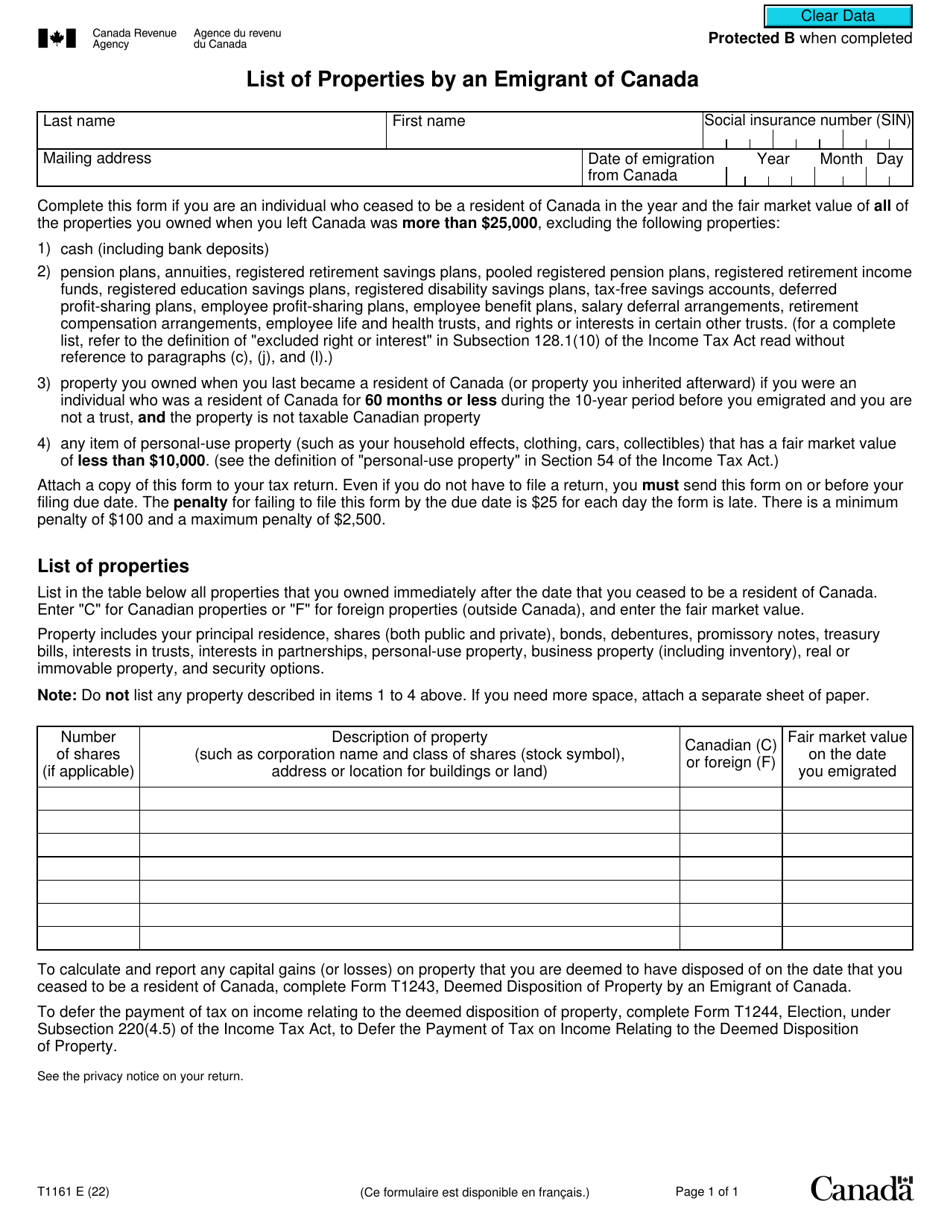

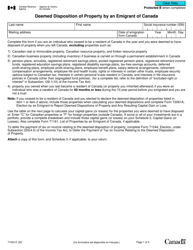

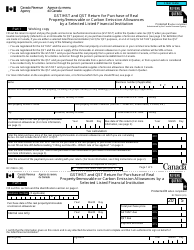

Form T1161, also known as the List of Properties by an Emigrant of Canada, is used by individuals who are emigrating from Canada for tax purposes. This form is used to report all their assets that they own or have an interest in at the time of emigration. It helps the Canadian government to track any potential tax liabilities associated with the emigration process.

The Form T1161 List of Properties by an Emigrant of Canada is filed by individuals who are emigrating from Canada.

Form T1161 List of Properties by an Emigrant of Canada - Canada - Frequently Asked Questions (FAQ)

Q: What is Form T1161?

A: Form T1161 is a form that must be filed by individuals who are emigrating from Canada and who own certain properties.

Q: Who needs to file Form T1161?

A: Individuals who are emigrating from Canada and who own certain properties need to file Form T1161.

Q: What is the purpose of Form T1161?

A: The purpose of Form T1161 is to report the list of properties owned by an individual who is emigrating from Canada.

Q: Which properties need to be reported on Form T1161?

A: Certain types of properties, such as real estate, investments, and certain other assets, need to be reported on Form T1161.

Q: When should Form T1161 be filed?

A: Form T1161 should be filed within 90 days after the date of emigration from Canada.