This version of the form is not currently in use and is provided for reference only. Download this version of

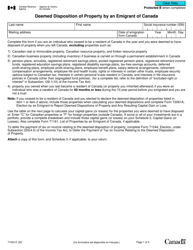

Form T1055

for the current year.

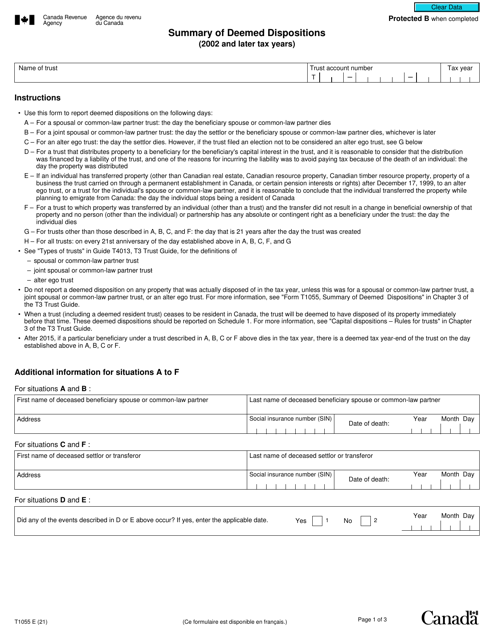

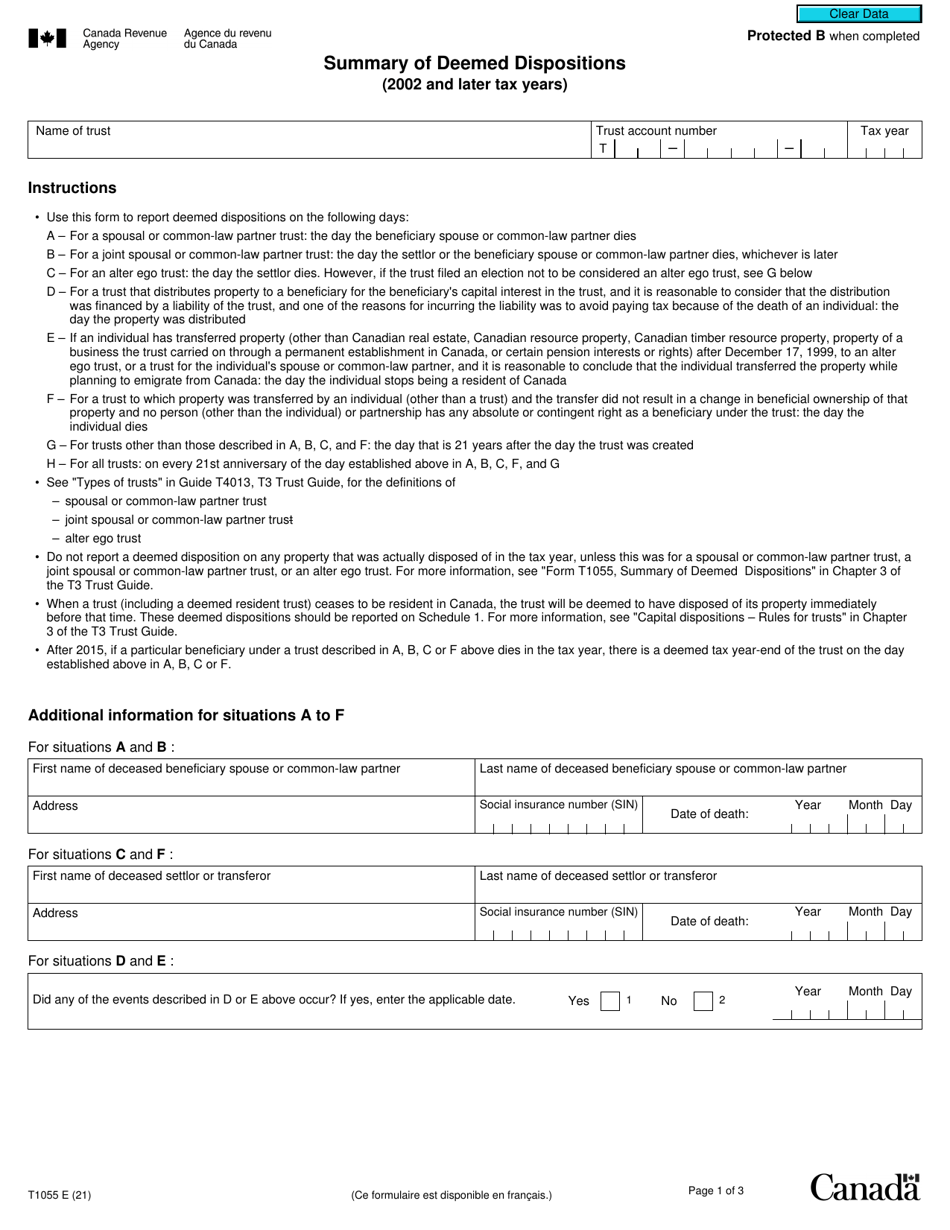

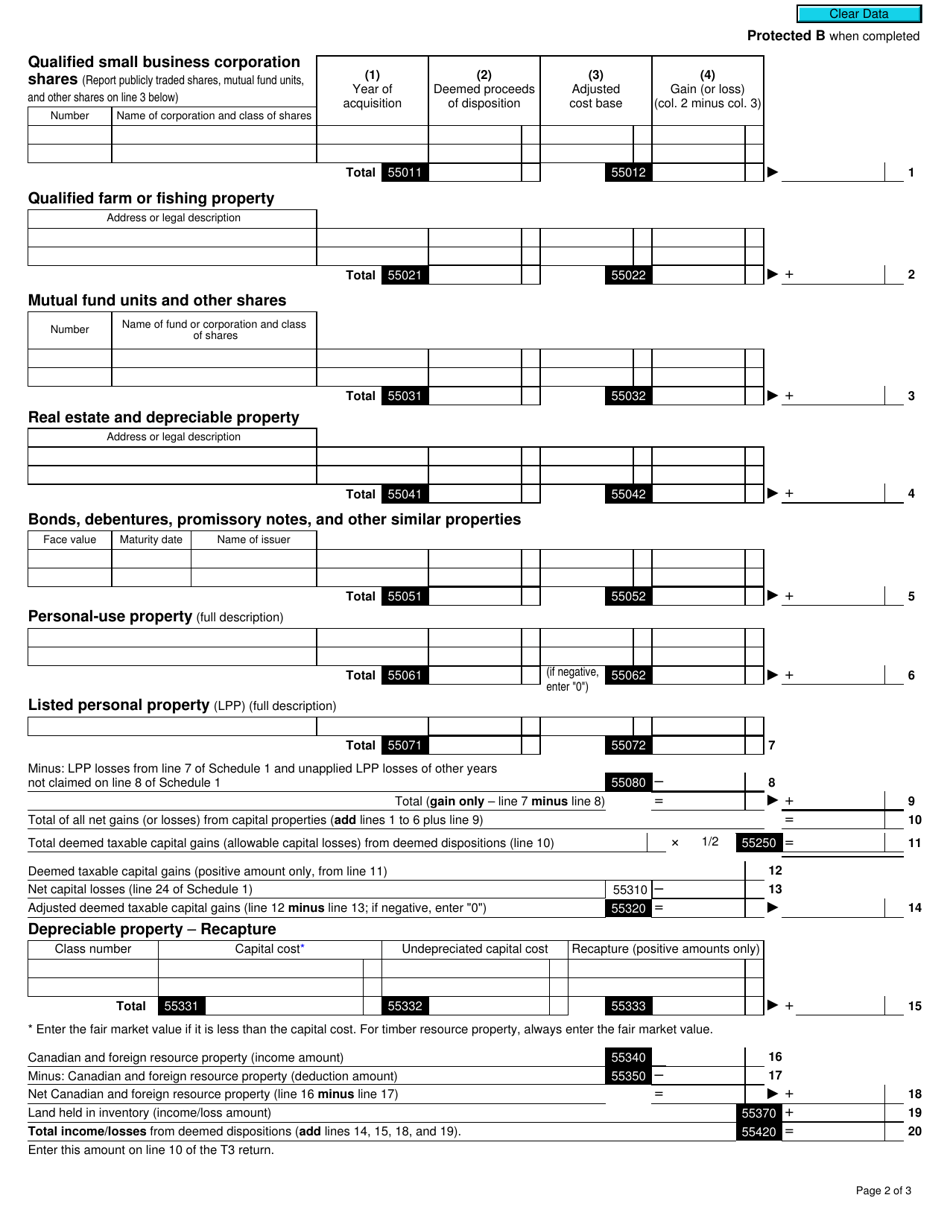

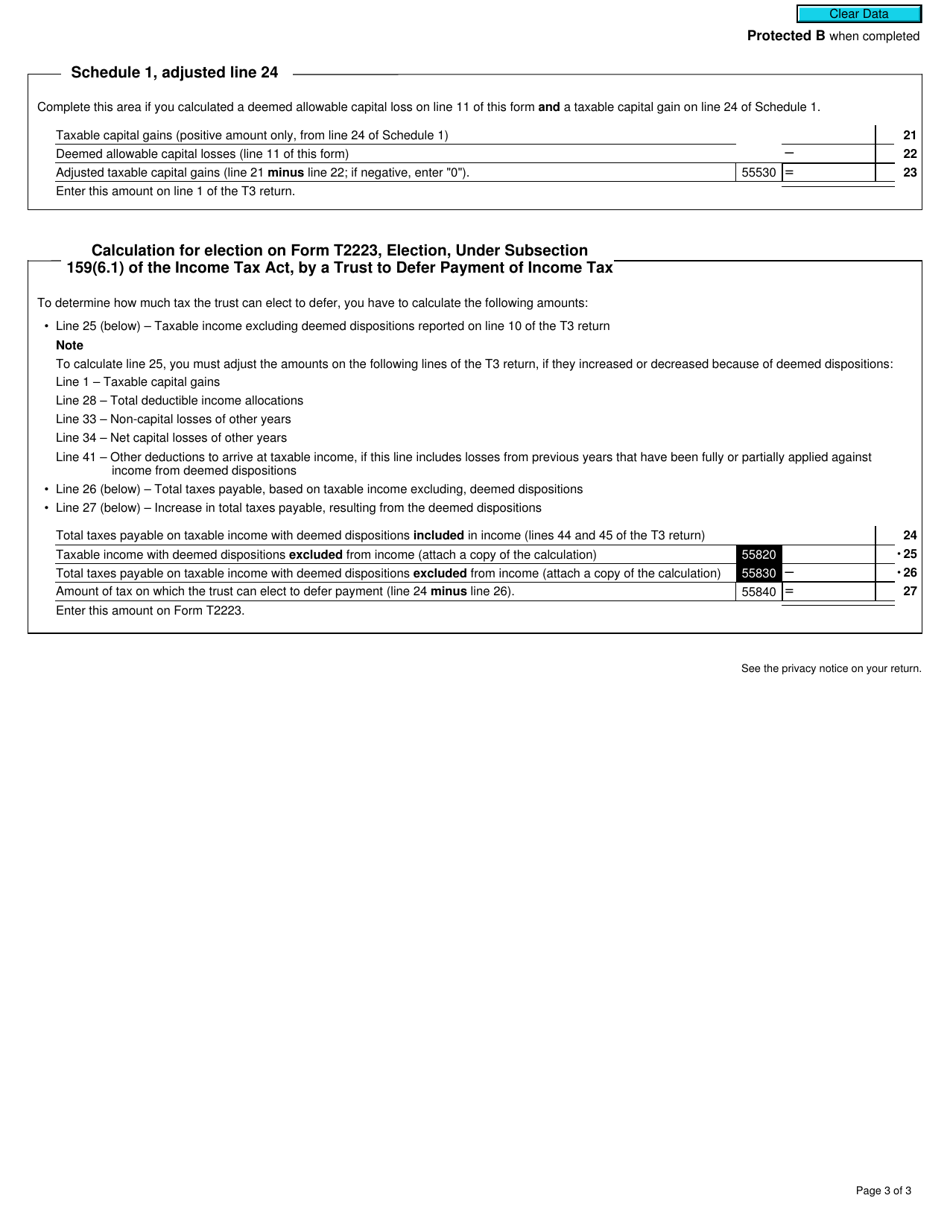

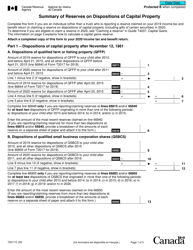

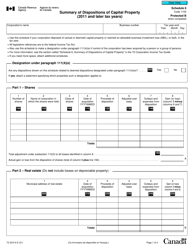

Form T1055 Summary of Deemed Dispositions (2002 and Later Tax Years) - Canada

Form T1055 Summary of Deemed Dispositions (2002 and Later Tax Years) - Canada is used to report any deemed dispositions of property for tax purposes in Canada.

The taxpayer (individual or corporation) files the Form T1055 Summary of Deemed Dispositions in Canada.

FAQ

Q: What is Form T1055?

A: Form T1055 is a summary of deemed dispositions for Canadian taxpayers in tax years 2002 and later.

Q: What is a deemed disposition?

A: A deemed disposition is a taxable event where an asset is considered to have been sold even if no actual sale has occurred.

Q: Who needs to file Form T1055?

A: Canadian taxpayers who have had deemed dispositions in tax years 2002 and later need to file Form T1055.

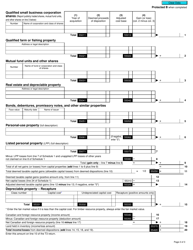

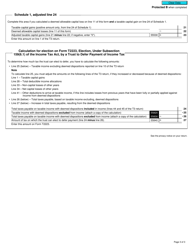

Q: What information is included in Form T1055?

A: Form T1055 includes details about the deemed dispositions, such as the type of asset, the date of disposition, and the proceeds of disposition.

Q: Is Form T1055 optional or mandatory?

A: Form T1055 is mandatory for taxpayers who have had deemed dispositions in tax years 2002 and later.