This version of the form is not currently in use and is provided for reference only. Download this version of

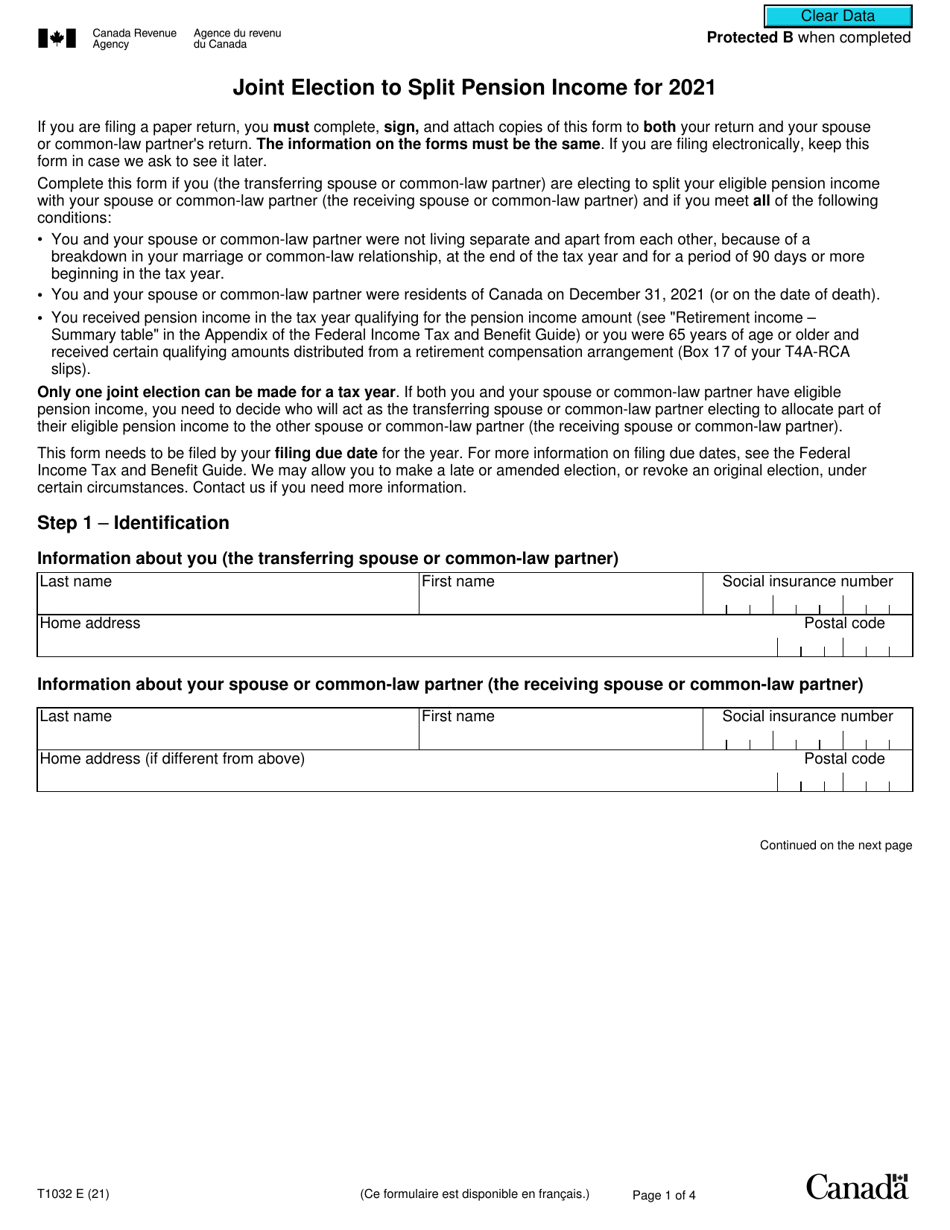

Form T1032

for the current year.

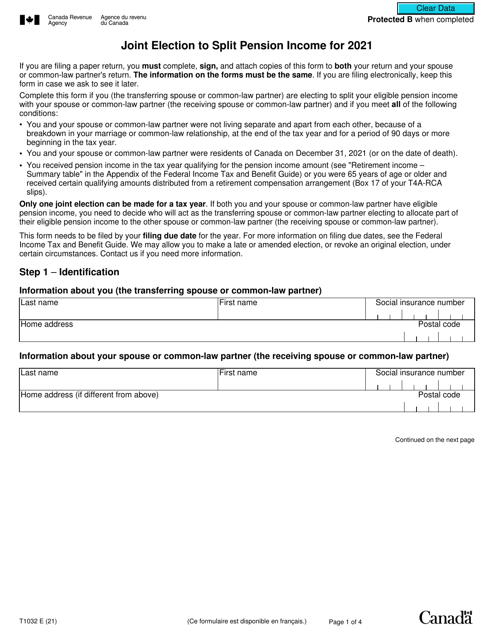

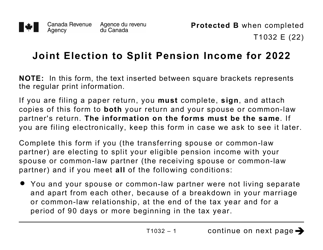

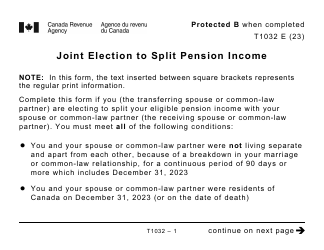

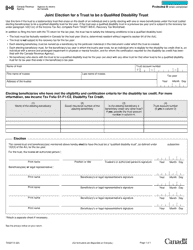

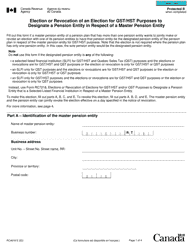

Form T1032 Joint Election to Split Pension Income - Canada

Form T1032 Joint Election to Split Pension Income - Canada is used by individuals who wish to split their pension income with their spouse or common-law partner. This can help reduce their overall tax liability and optimize their retirement income.

The Form T1032 Joint Election to Split Pension Income in Canada is typically filed by both the pension recipient and their spouse or common-law partner.

FAQ

Q: What is Form T1032?

A: Form T1032 is a Joint Election to Split Pension Income form in Canada.

Q: What is the purpose of Form T1032?

A: The purpose of Form T1032 is to allow eligible individuals to split their pension income with their spouse or common-law partner for tax purposes.

Q: Who can use Form T1032?

A: Form T1032 can be used by individuals who receive eligible pension income and want to split it with their spouse or common-law partner.

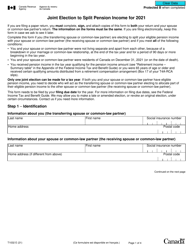

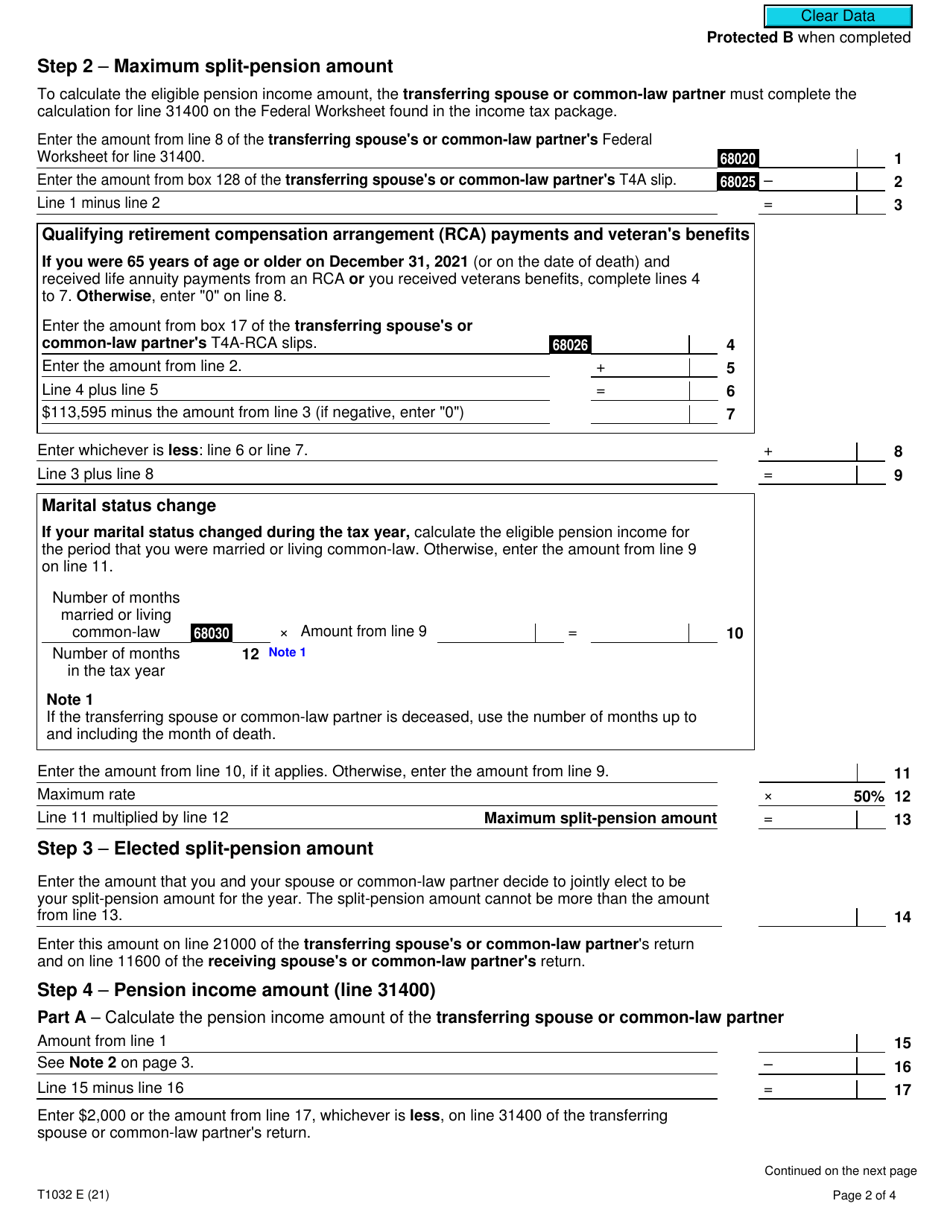

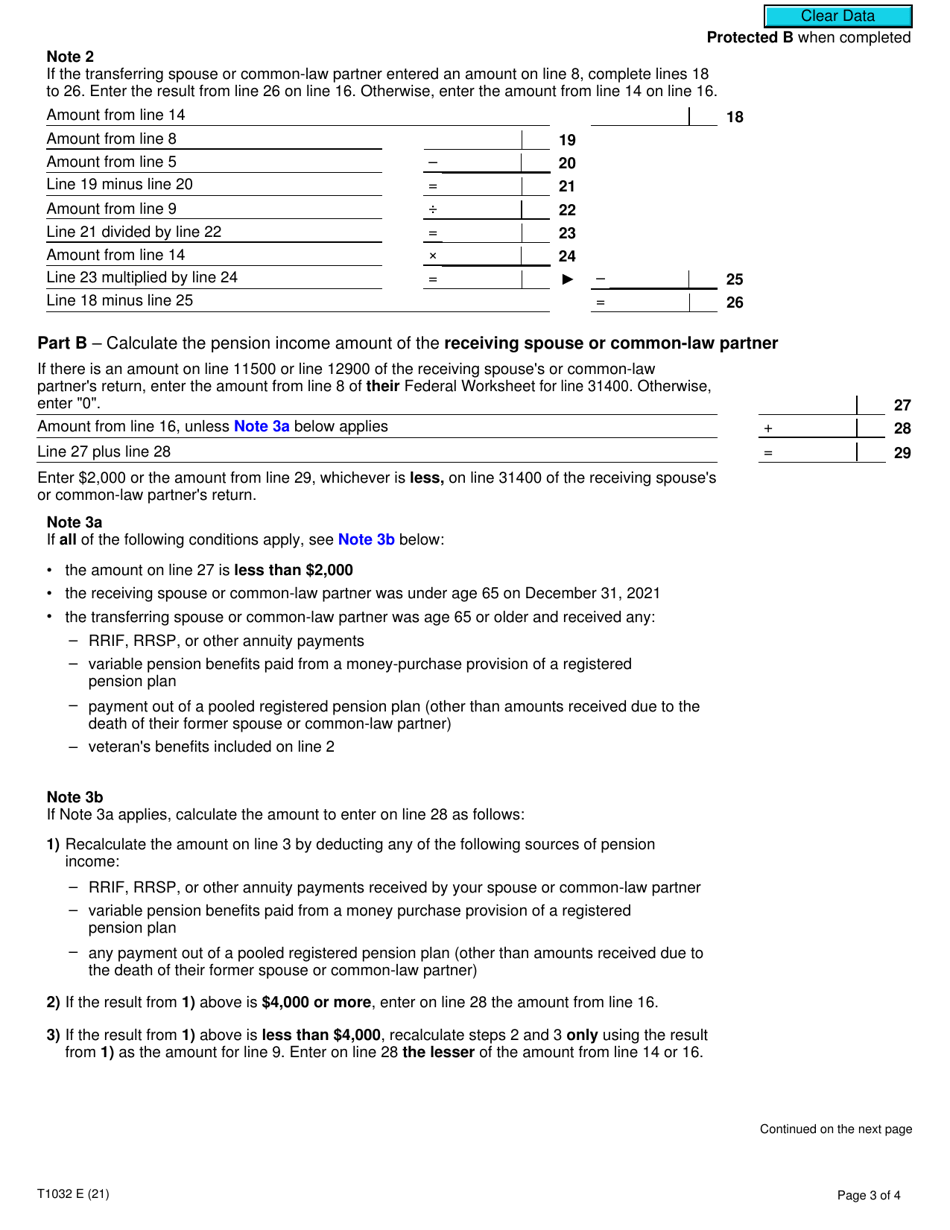

Q: What is considered eligible pension income?

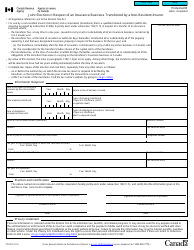

A: Eligible pension income can include lifetime annuity payments, registered retirement income fund (RRIF) payments, and other eligible periodic payments.

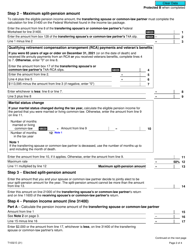

Q: How does pension income splitting work?

A: Pension income splitting allows individuals to allocate a portion of their eligible pension income to their spouse or common-law partner for tax purposes, potentially reducing their overall tax liability.

Q: Is pension income splitting mandatory?

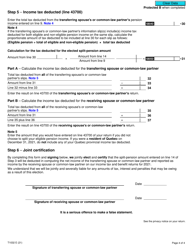

A: No, pension income splitting is optional. It is up to the individuals to decide whether they want to split their eligible pension income.

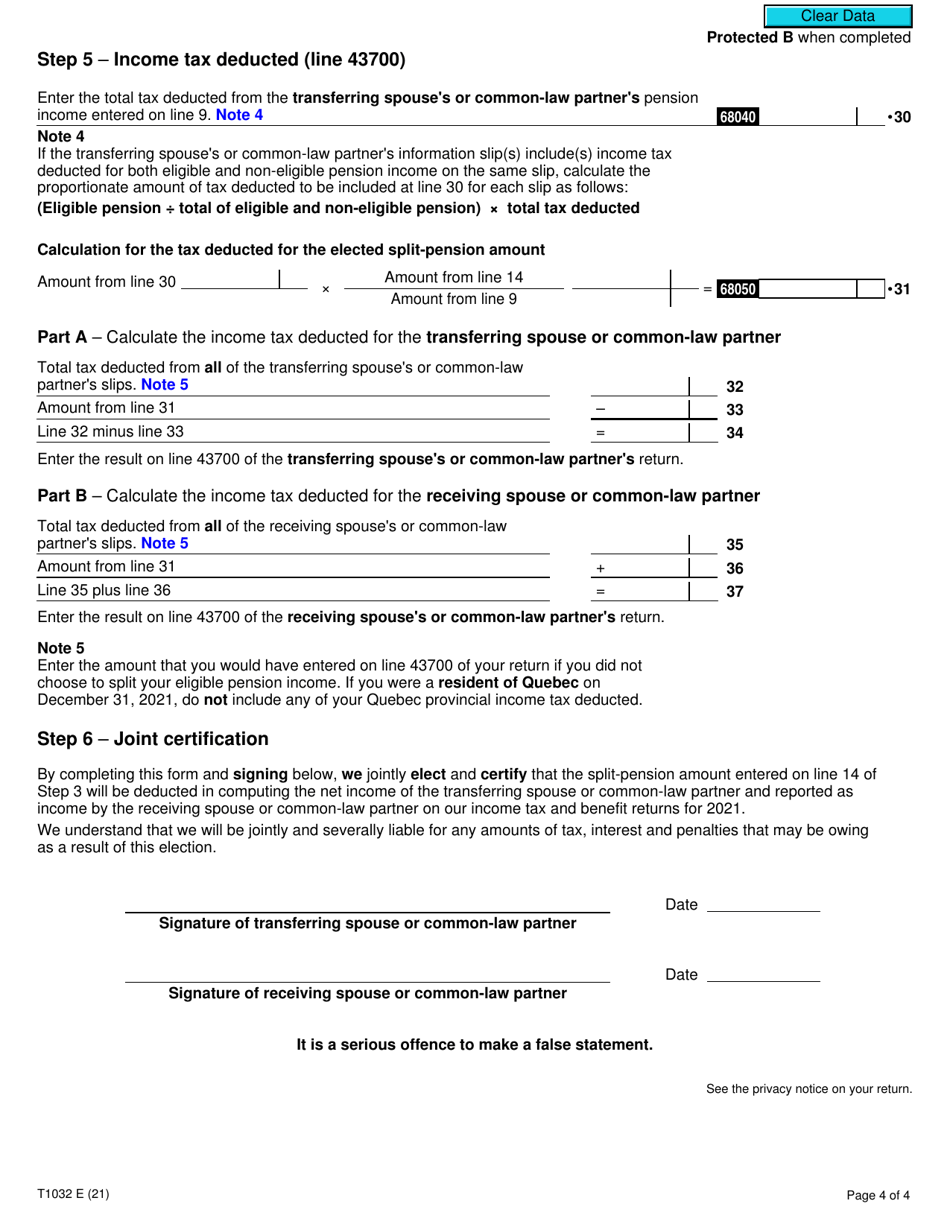

Q: When should I submit Form T1032?

A: Form T1032 should be submitted along with your annual income tax return.

Q: Can I use Form T1032 if I am not married?

A: Yes, you can use Form T1032 if you have a common-law partner. It is not necessary to be legally married.

Q: Are there any restrictions on pension income splitting?

A: Yes, there are specific rules and limitations on pension income splitting. It is important to review the instructions and guidelines provided with Form T1032 to ensure eligibility and compliance.