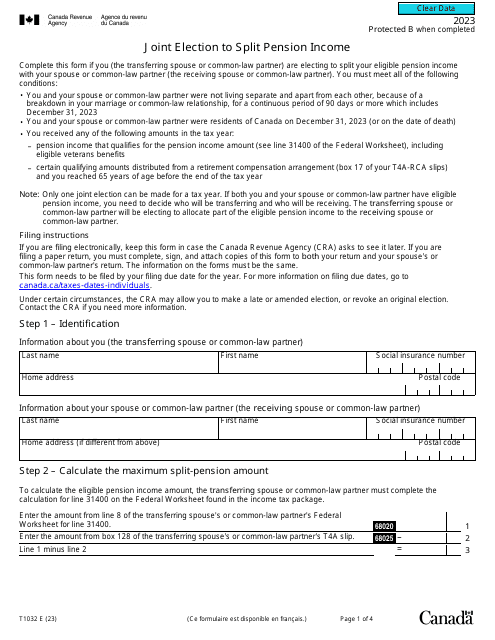

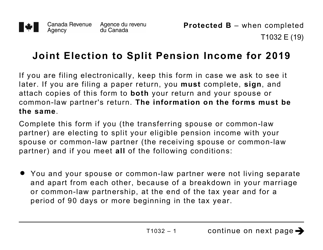

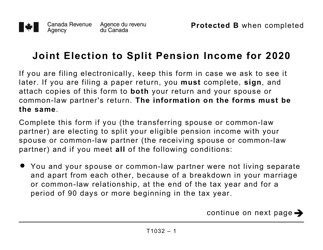

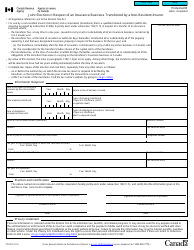

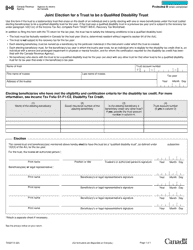

Form T1032 Joint Election to Split Pension Income - Canada

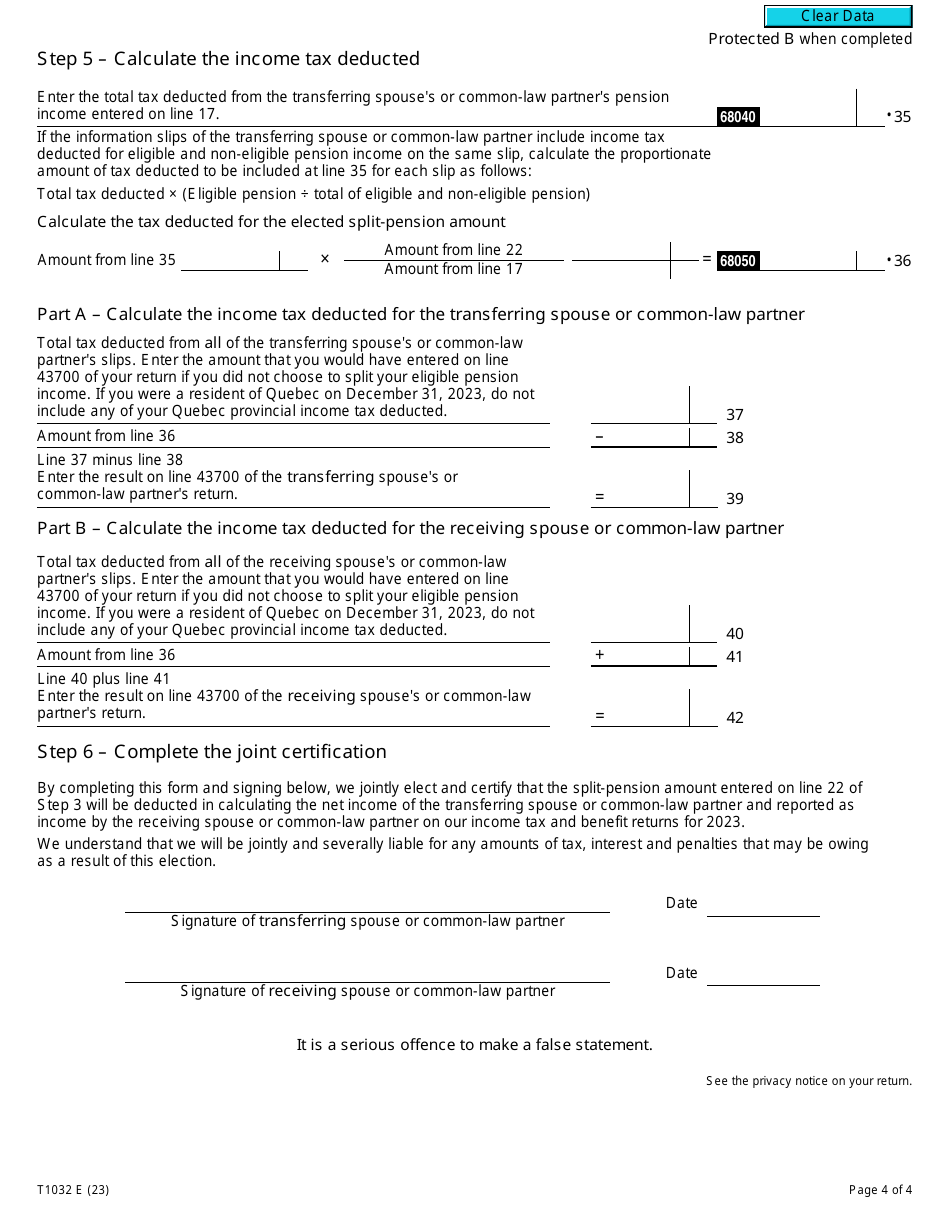

Form T1032 Joint Election to Split Pension Income - Canada is used by eligible individuals who want to split their eligible pension income with their spouse or common-law partner for tax purposes. This can help optimize their overall tax situation and potentially reduce their overall tax liability.

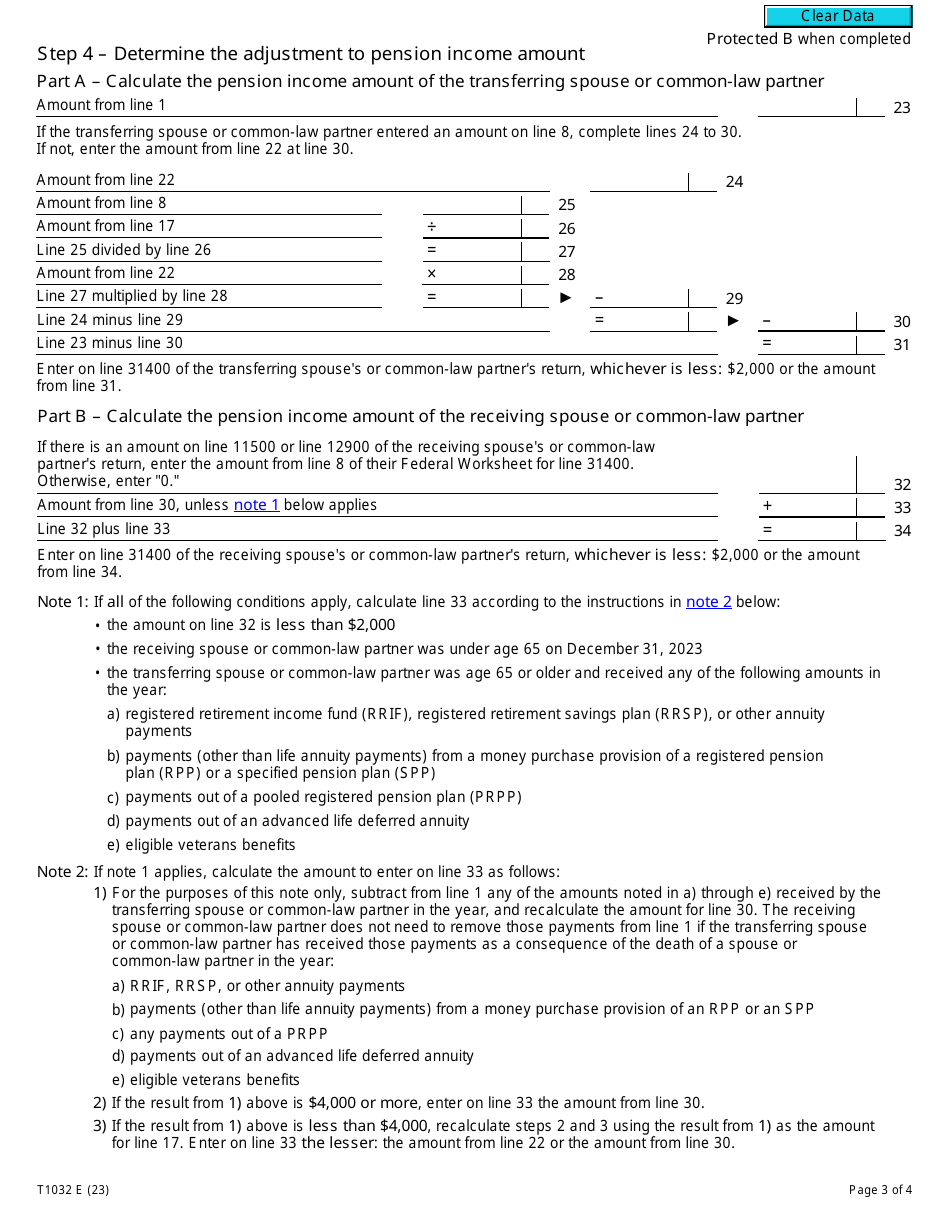

The Form T1032 Joint Election to Split Pension Income in Canada is filed by both the individual receiving the pension income and their spouse or common-law partner.

Form T1032 Joint Election to Split Pension Income - Canada - Frequently Asked Questions (FAQ)

Q: What is Form T1032?

A: Form T1032 is a Joint Election to Split Pension Income form in Canada.

Q: What is the purpose of Form T1032?

A: The purpose of Form T1032 is to allow eligible individuals to split their pension income with their spouse or common-law partner.

Q: Who can use Form T1032?

A: Any individual who is receiving eligible pension income and has a spouse or common-law partner can use Form T1032.

Q: What is eligible pension income?

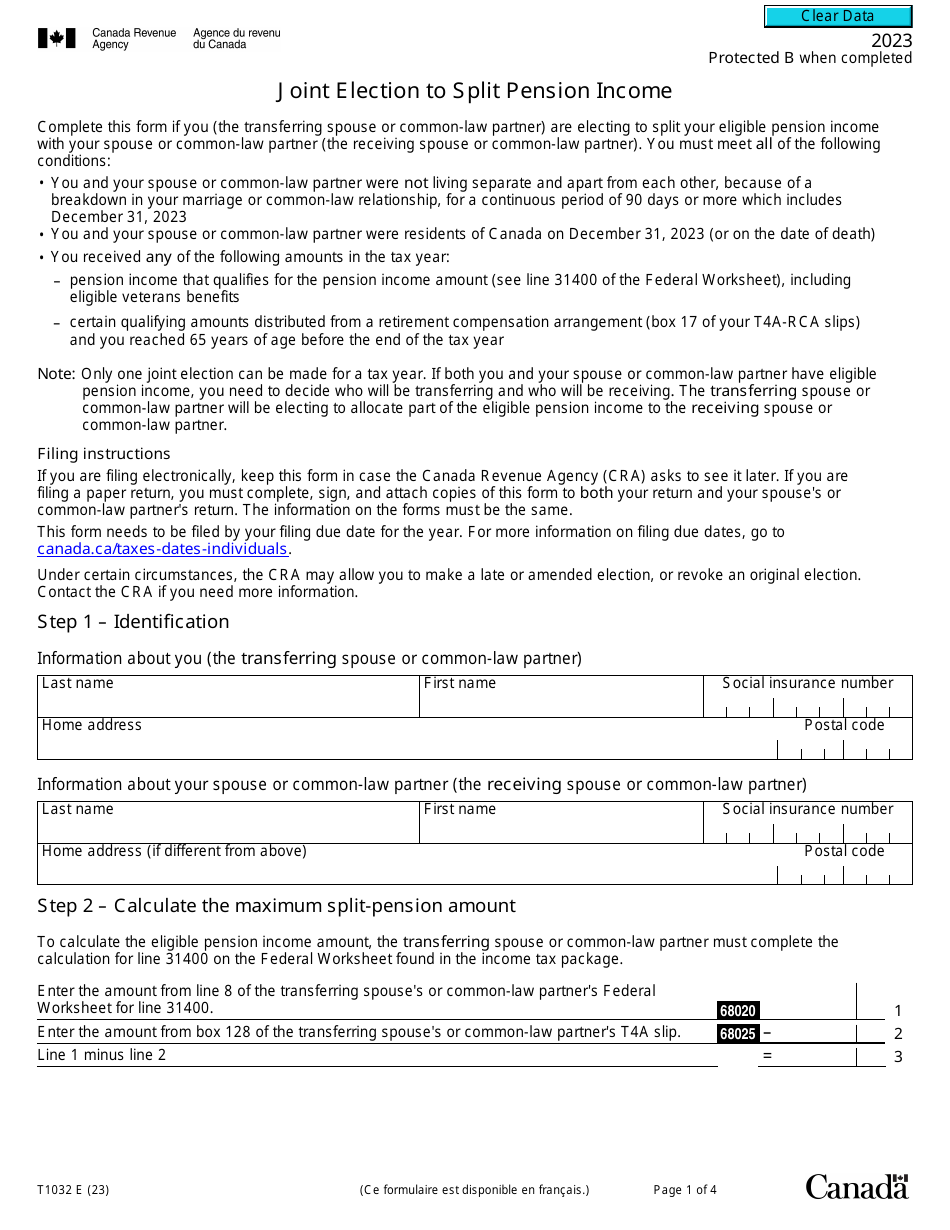

A: Eligible pension income includes certain types of retirement pensions, annuities, and superannuation or pension benefits.

Q: How does the pension income splitting work?

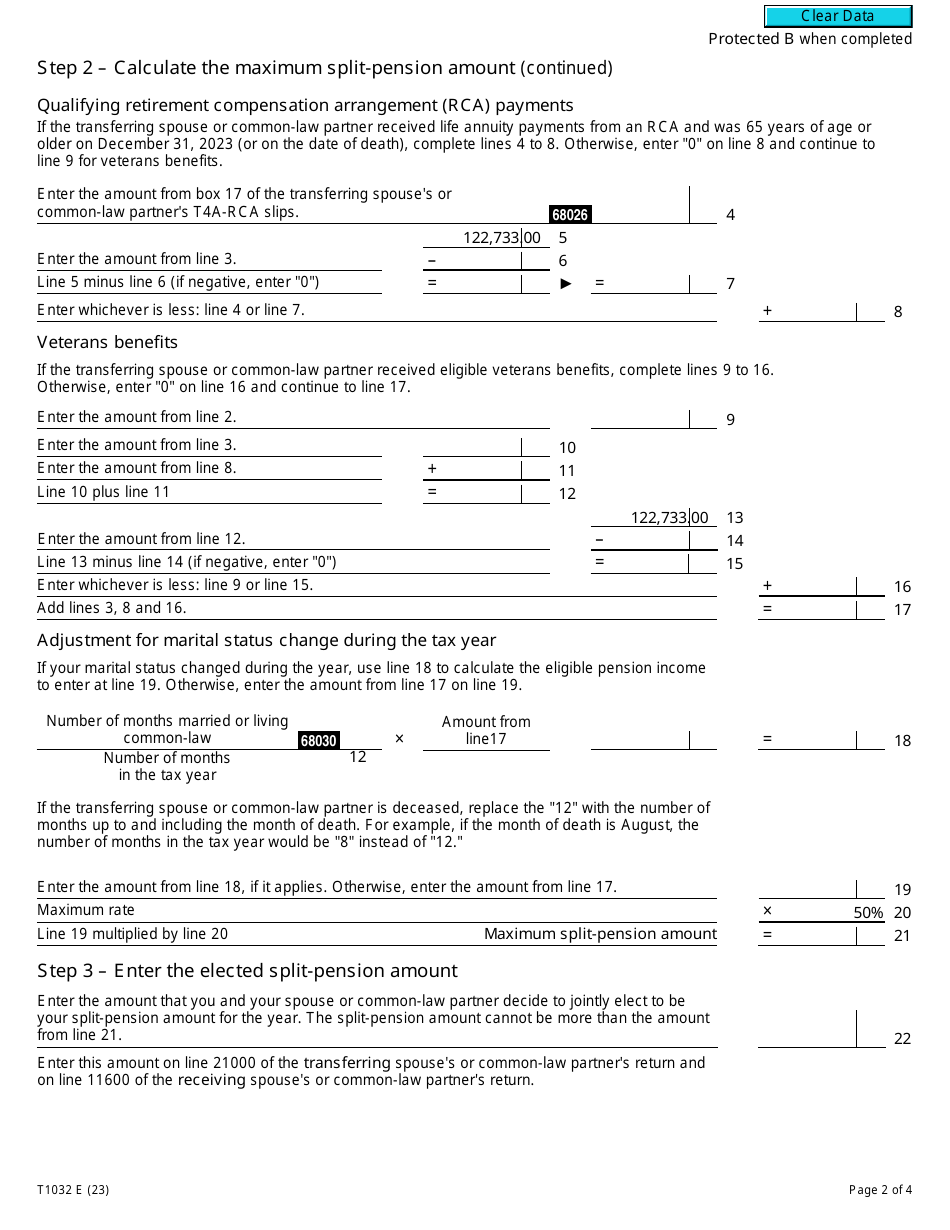

A: By completing and filing Form T1032, eligible individuals can allocate a portion of their pension income to their spouse or common-law partner, which can result in potential tax savings.

Q: Are there any limitations to pension income splitting?

A: Yes, there are limitations, such as the maximum amount that can be transferred and the requirement to use the same income year for both individuals.

Q: When should Form T1032 be filed?

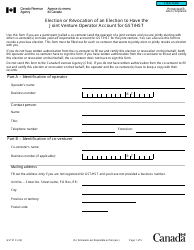

A: Form T1032 should be filed by both individuals as part of their annual income tax returns.

Q: Is the pension income splitting mandatory?

A: No, the pension income splitting is optional; it is up to the individuals to decide whether they want to split their pension income or not.

Q: Can pension income splitting be done retroactively?

A: No, pension income splitting cannot be done retroactively; it must be elected for the current tax year.