This version of the form is not currently in use and is provided for reference only. Download this version of

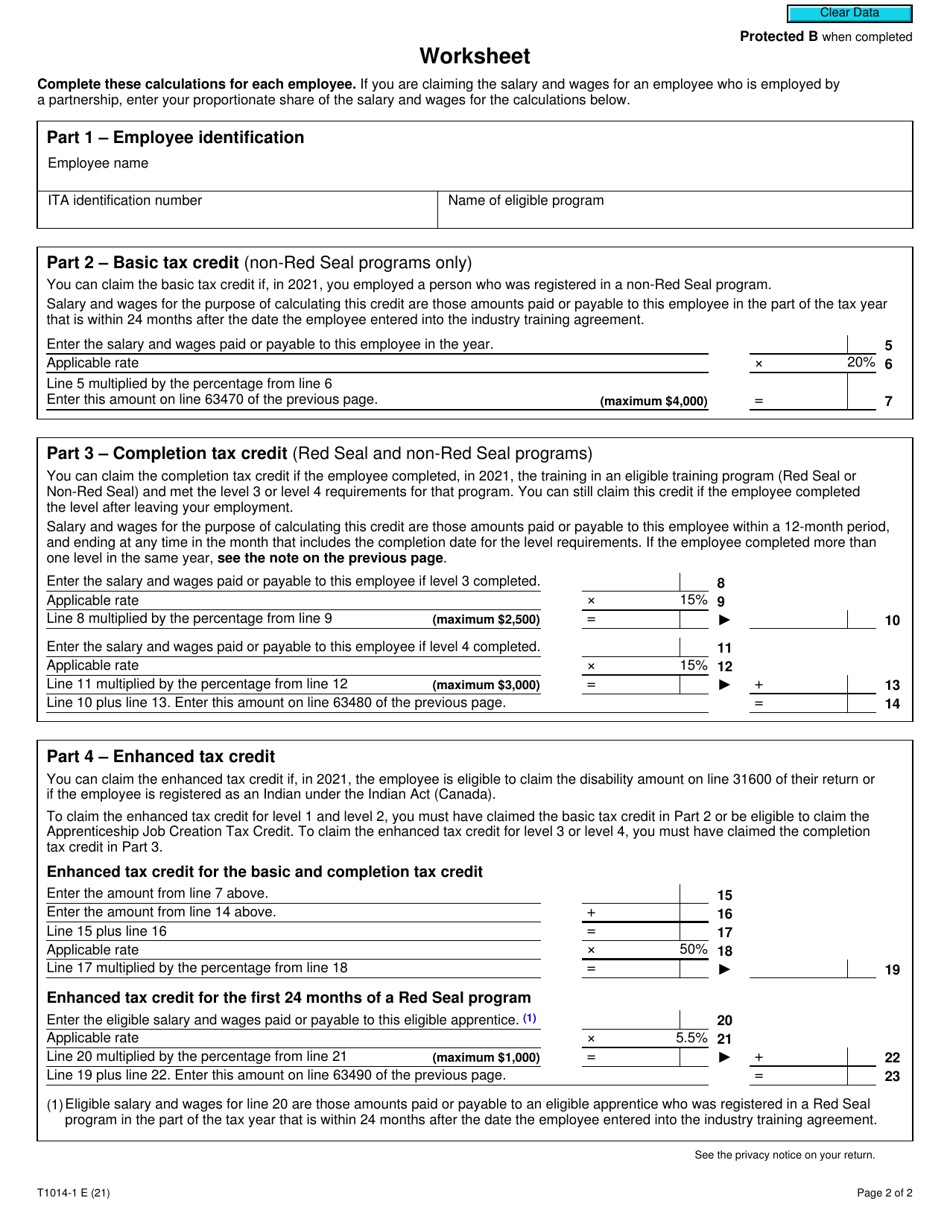

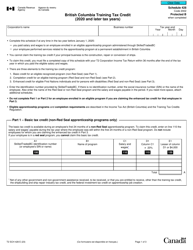

Form T1014-1

for the current year.

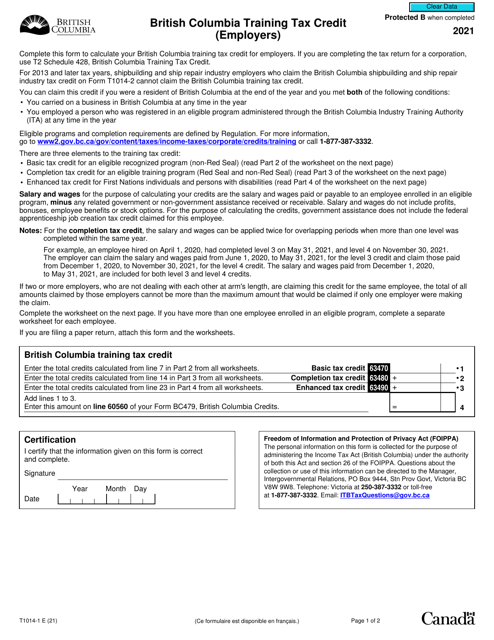

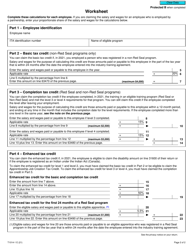

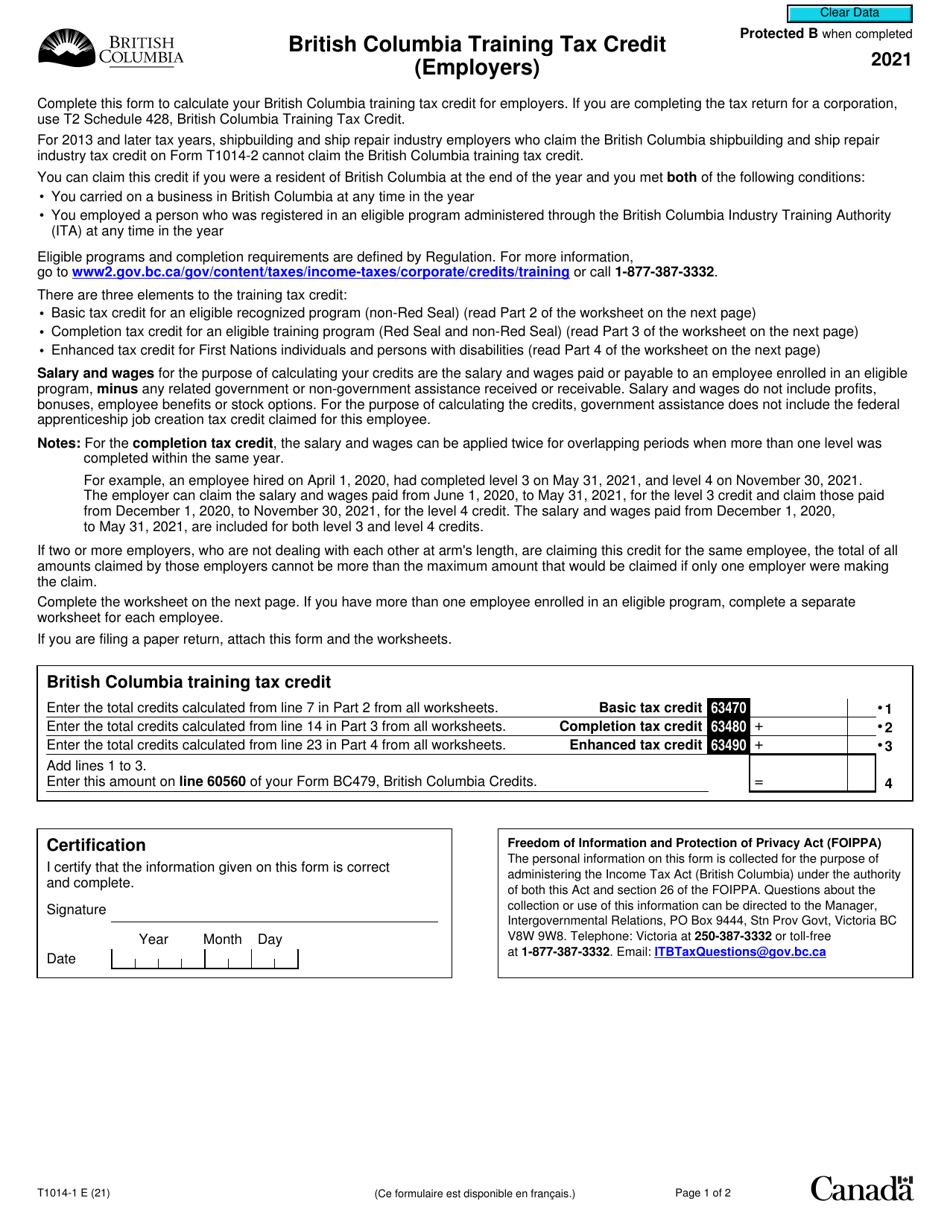

Form T1014-1 British Columbia Training Tax Credit (Employers) - Canada

The employer files the Form T1014-1 British Columbia Training Tax Credit in Canada.

FAQ

Q: What is Form T1014-1?

A: Form T1014-1 is a tax form used in British Columbia, Canada.

Q: What is the purpose of Form T1014-1?

A: Form T1014-1 is used to claim the British Columbia Training Tax Credit for Employers.

Q: Who can use Form T1014-1?

A: Employers in British Columbia can use Form T1014-1 to claim the training tax credit.

Q: What is the British Columbia Training Tax Credit?

A: The British Columbia Training Tax Credit is a tax credit available to employers who have eligible training expenses.

Q: How do I qualify for the British Columbia Training Tax Credit?

A: To qualify for the credit, your business must have eligible training expenditures for employees in British Columbia.