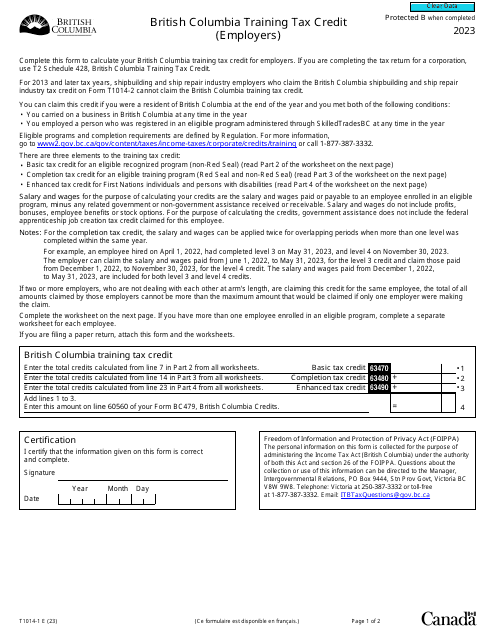

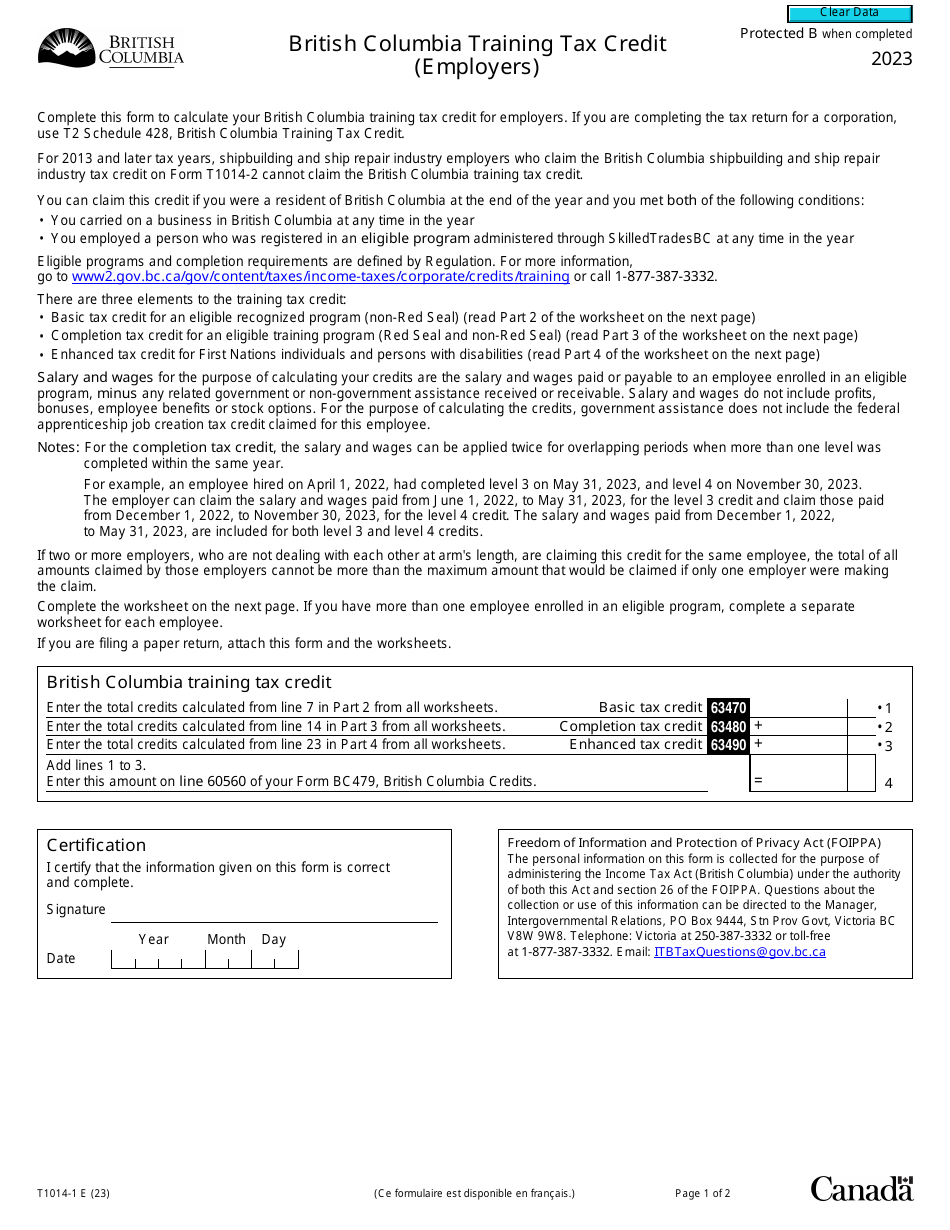

Form T1014-1 British Columbia Training Tax Credit (Employers) - Canada

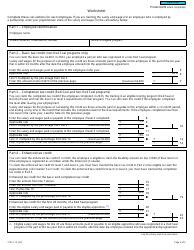

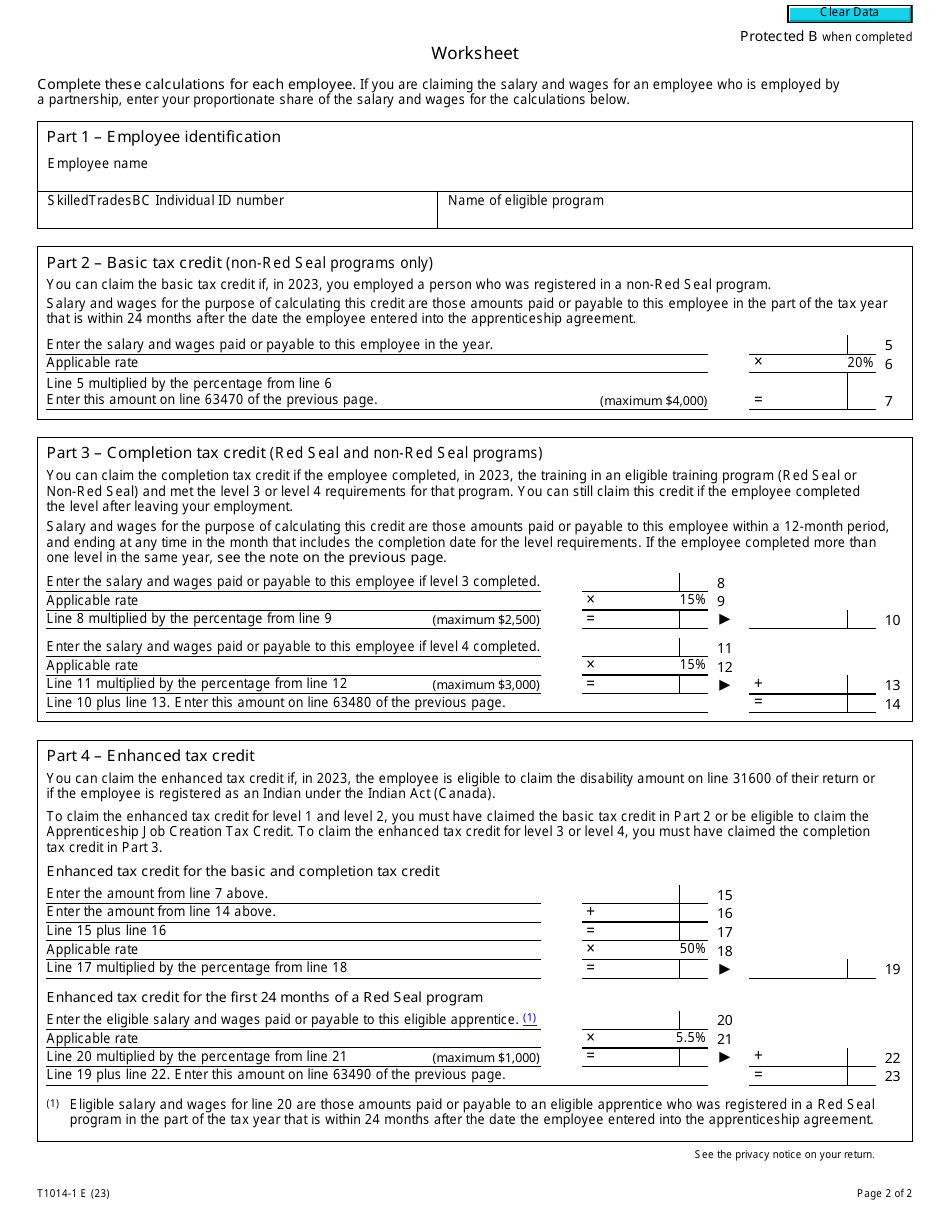

The Form T1014-1 British Columbia Training Tax Credit (Employers) in Canada is used to claim tax credits for eligible training expenses incurred by employers in British Columbia.

The employer files the Form T1014-1 British Columbia Training Tax Credit in Canada.

Form T1014-1 British Columbia Training Tax Credit (Employers) - Canada - Frequently Asked Questions (FAQ)

Q: What is Form T1014-1?

A: Form T1014-1 is a tax form used in British Columbia, Canada for claiming the Training Tax Credit for Employers.

Q: What is the Training Tax Credit for Employers?

A: The Training Tax Credit for Employers is a tax credit available in British Columbia, Canada that helps employers recover a portion of the costs incurred in providing eligible employee training.

Q: Who is eligible to claim the Training Tax Credit for Employers?

A: Employers in British Columbia, Canada who have incurred eligible training expenses for their employees are eligible to claim the Training Tax Credit for Employers.

Q: What are eligible training expenses?

A: Eligible training expenses include costs related to the training and development of employees, such as tuition fees, course materials, and instructor fees.

Q: How much is the Training Tax Credit for Employers?

A: The Training Tax Credit for Employers is calculated as 35% of eligible training expenses incurred during the taxation year.

Q: Is there a maximum limit for the Training Tax Credit?

A: Yes, the Training Tax Credit for Employers is subject to a maximum limit. For the 2021 tax year, the maximum limit is $40,000 per employer.

Q: How do I claim the Training Tax Credit for Employers?

A: To claim the Training Tax Credit for Employers, you must complete and file Form T1014-1 with your British Columbia income tax return.

Q: Is there a deadline for claiming the Training Tax Credit?

A: Yes, the deadline for claiming the Training Tax Credit for Employers is generally the same as the deadline for filing your British Columbia income tax return, which is usually April 30th of the following year.