This version of the form is not currently in use and is provided for reference only. Download this version of

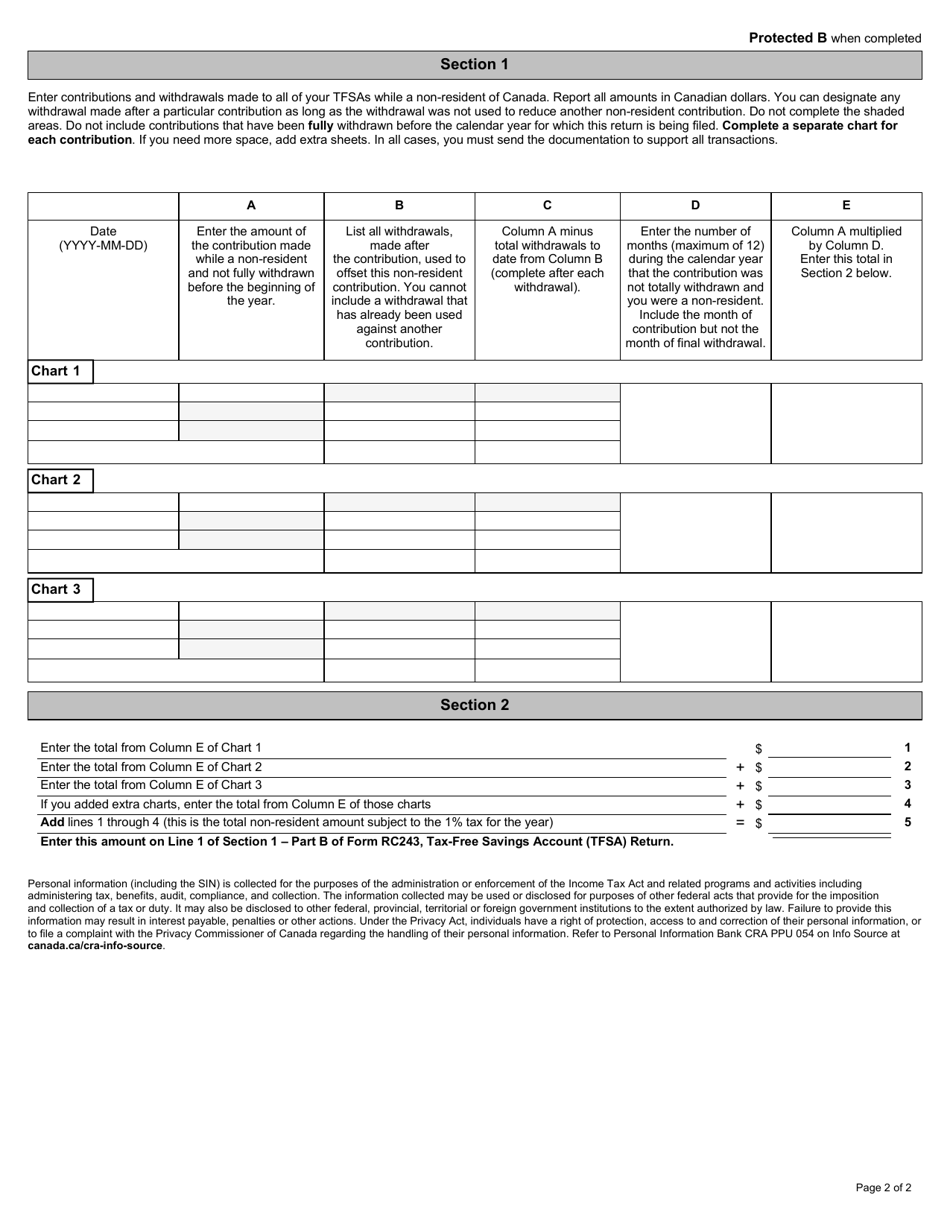

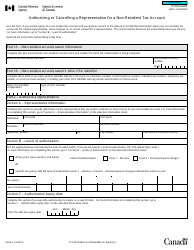

Form RC243 Schedule B

for the current year.

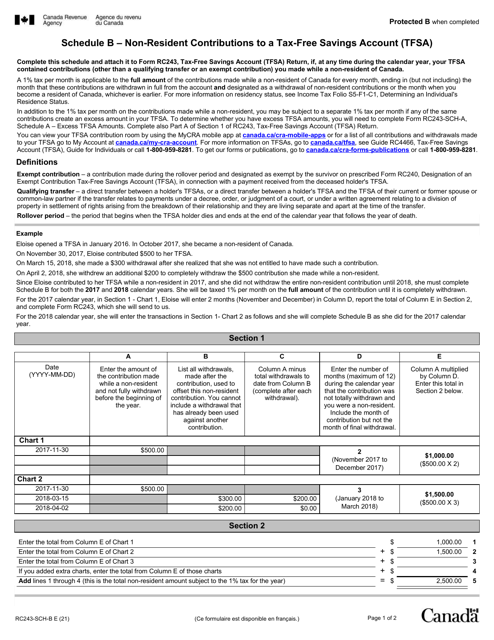

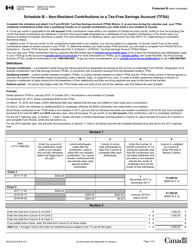

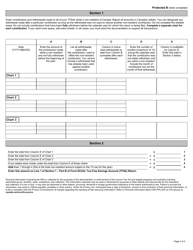

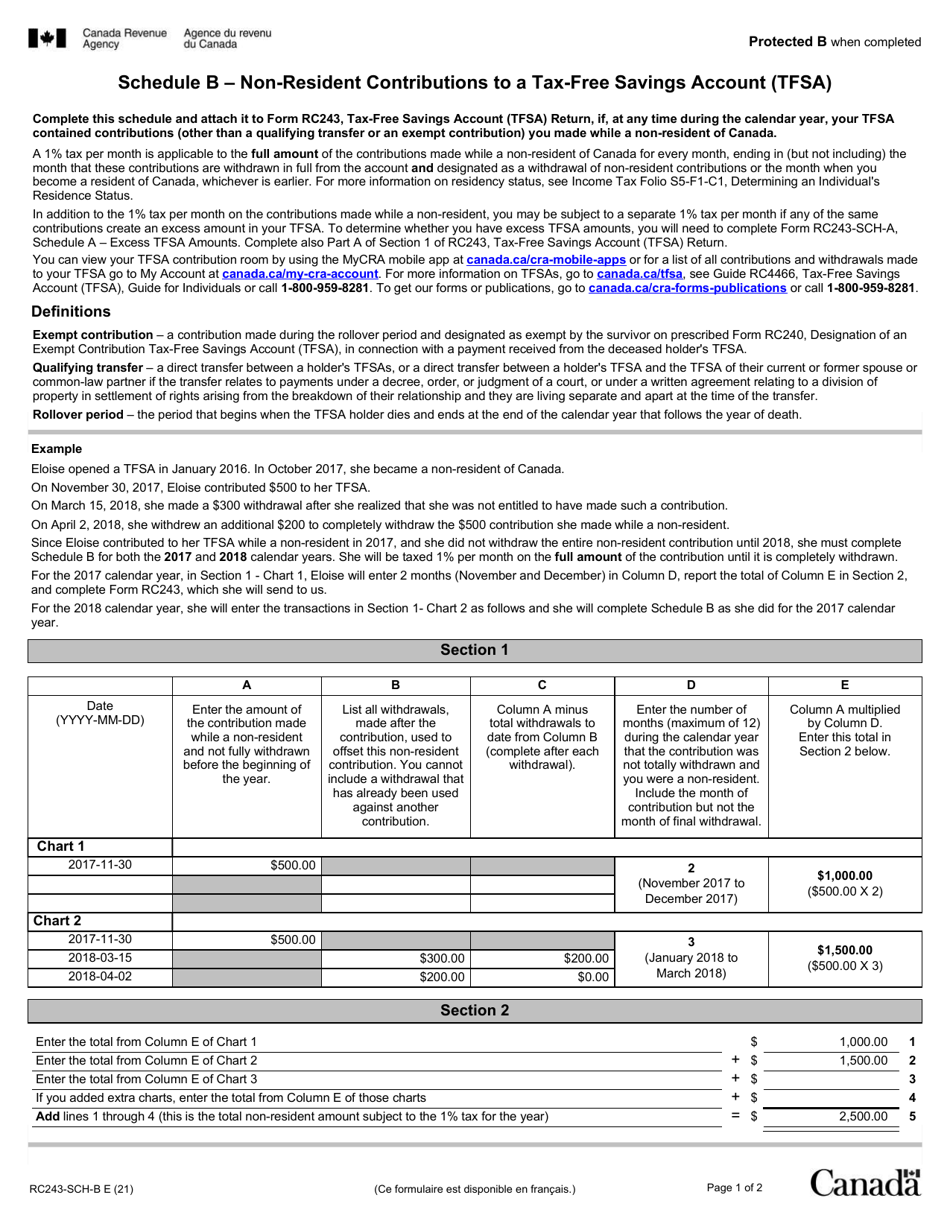

Form RC243 Schedule B Non-resident Contributions to a Tax-Free Savings Account (Tfsa) - Canada

Form RC243 Schedule B Non-resident Contributions to a Tax-Free Savings Account (TFSA) in Canada is used to report contributions made by non-residents to a TFSA. It helps the Canadian government keep track of contributions made by individuals who are not residents of Canada for tax purposes.

FAQ

Q: What is Form RC243 Schedule B?

A: Form RC243 Schedule B is a tax form used in Canada for reporting non-resident contributions to a Tax-Free Savings Account (TFSA).

Q: Who needs to file Form RC243 Schedule B?

A: Non-residents of Canada who have made contributions to a TFSA need to file Form RC243 Schedule B.

Q: What is a Tax-Free Savings Account (TFSA)?

A: A Tax-Free Savings Account (TFSA) is a registered savings account in Canada that allows individuals to earn tax-free investment income.

Q: Why do non-residents need to report contributions to a TFSA?

A: Non-residents are subject to certain tax rules in Canada, and reporting TFSA contributions ensures compliance with these rules.