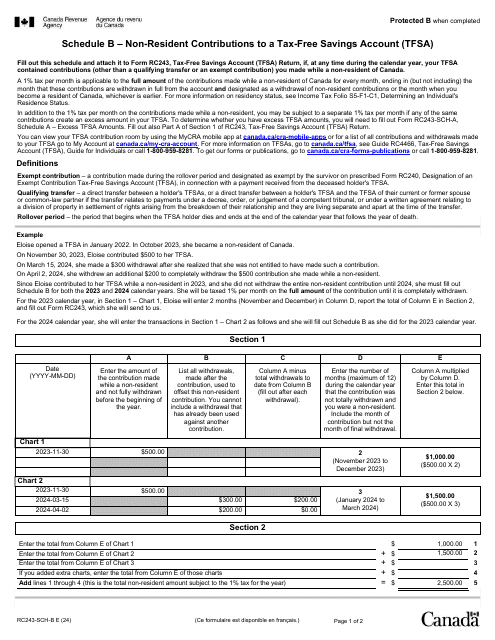

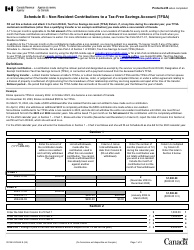

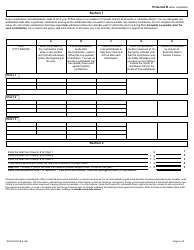

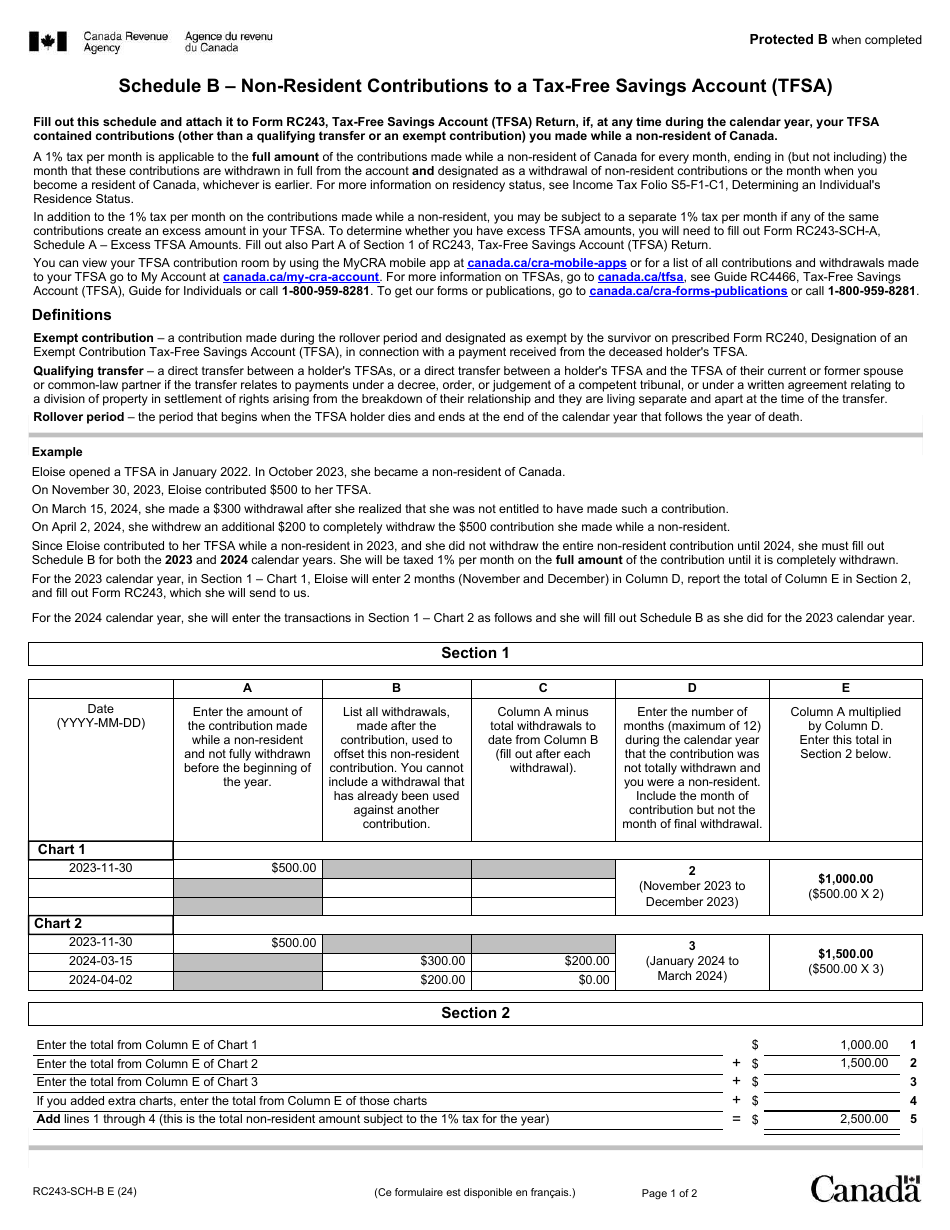

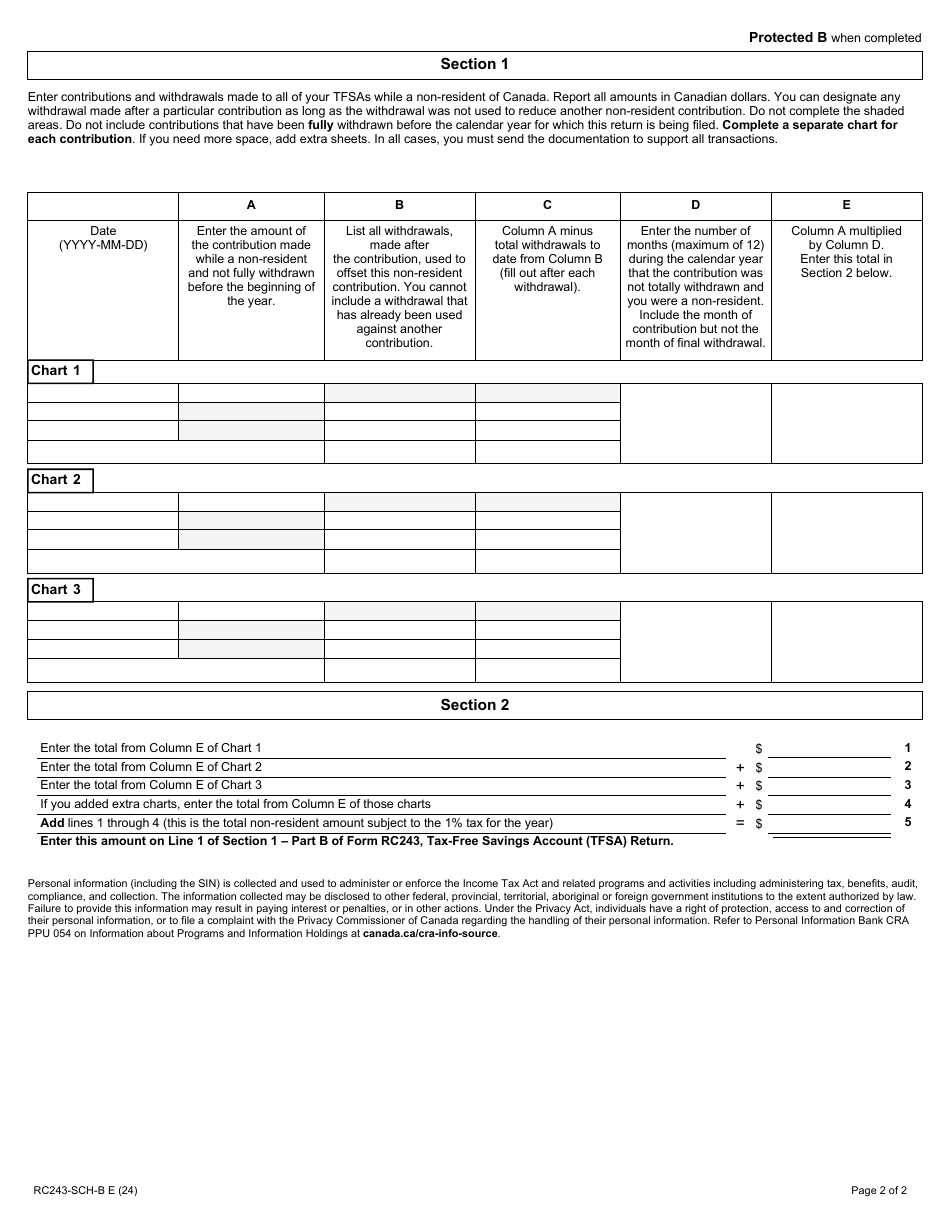

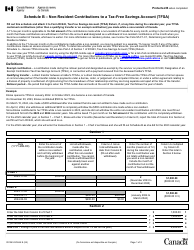

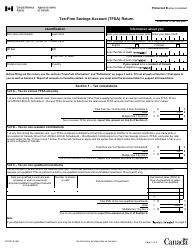

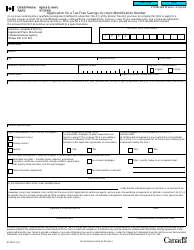

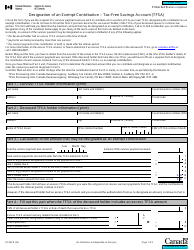

Form RC243 Schedule B Non-resident Contributions to a Tax-Free Savings Account (Tfsa) - Canada

Form RC243 Schedule B is used to report contributions made to a Tax-Free Savings Account (TFSA) in Canada by non-residents.

Form RC243 Schedule B Non-resident Contributions to a Tax-Free Savings Account (Tfsa) - Canada - Frequently Asked Questions (FAQ)

Q: What is Form RC243 Schedule B?

A: Form RC243 Schedule B is a tax form in Canada used to report non-resident contributions to a Tax-Free Savings Account (TFSA).

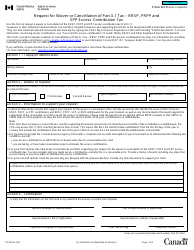

Q: Who should use Form RC243 Schedule B?

A: Non-residents of Canada who have contributed to a TFSA should use Form RC243 Schedule B.

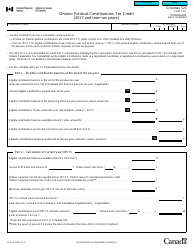

Q: What is a Tax-Free Savings Account (TFSA)?

A: A Tax-Free Savings Account (TFSA) is a Canadian investment account that allows individuals to save and invest money without paying taxes on the income generated.

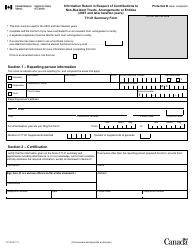

Q: Why do non-residents need to report contributions to a TFSA?

A: Non-residents need to report contributions to a TFSA to ensure compliance with Canadian tax regulations.